0001045609false0001045610false0001045609pld:PrologisLPMember2023-10-172023-10-170001045609us-gaap:CommonStockMember2023-10-172023-10-170001045609pld:Note3000PercentDue2026Memberpld:PrologisLPMember2023-10-172023-10-170001045609pld:Notes2250PercentDue2029Memberpld:PrologisLPMember2023-10-172023-10-1700010456092023-10-172023-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

--------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 17, 2023

Prologis, Inc.

Prologis, L.P.

(Exact name of registrant as specified in charter)

|

|

|

|

|

|

|

|

|

|

Maryland (Prologis, Inc.)

Delaware (Prologis, L.P.)

(State or other jurisdiction

of Incorporation) |

|

001-13545 (Prologis, Inc.)

001-14245 (Prologis, L.P.)

(Commission File Number) |

|

94-3281941 (Prologis, Inc.)

94-3285362 (Prologis, L.P.)

(I.R.S. Employer Identification

No.) |

|

|

|

|

|

|

Pier 1, Bay 1, San Francisco, California |

|

94111 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrants’ Telephone Number, including Area Code: (415) 394-9000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

Prologis, Inc. |

|

Common Stock, $0.01 par value |

|

PLD |

|

New York Stock Exchange |

Prologis, L.P. |

|

3.000% Notes due 2026 |

|

PLD/26 |

|

New York Stock Exchange |

Prologis, L.P. |

|

2.250% Notes due 2029 |

|

PLD/29 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition (Prologis, Inc.) and

Item 7.01. Regulation FD Disclosure (Prologis, Inc. and Prologis, L.P.).

On October 17, 2023, Prologis, Inc., the general partner of Prologis, L.P., issued a press release announcing third quarter 2023 financial results. A copy of the supplemental information as well as the press release is furnished with this report as Exhibit 99.1 and Exhibit 99.2, respectively, and incorporated herein by reference.

The information in this report and the exhibits attached hereto is being furnished, not filed, for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and pursuant to Items 2.02 and 7.01 of Form 8-K will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

99.1 Supplemental information, dated October 17, 2023.

99.2 Press release, dated October 17, 2023.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

PROLOGIS, INC. |

|

|

|

|

October 17, 2023 |

|

By: |

/s/ Timothy D. Arndt |

|

|

|

Name: Timothy D. Arndt |

|

|

|

Title: Chief Financial Officer |

|

|

|

|

|

|

PROLOGIS, L.P., |

October 17, 2023 |

|

By: Prologis, Inc., its general partner |

|

|

|

|

|

|

By: |

/s/ Timothy D. Arndt |

|

|

|

Name: Timothy D. Arndt |

|

|

|

Title: Chief Financial Officer |

Prologis Supplemental Information third quarter 2023 Unaudited

Highlights 1 Company Profile 2 Company Performance 4 Prologis Leading Indicators and Proprietary Metrics 5 Guidance Financial Information 6 Consolidated Balance Sheets 7 Consolidated Statements of Income 8 Reconciliations of Net Earnings to FFO 9 Reconciliations of Net Earnings to Adjusted EBITDA Operations 10 Overview 11 Operating Metrics 13 Operating Portfolio 16 Customer Information Capital Deployment 17 Overview 18 Development Stabilizations 19 Development Starts 20 Development Portfolio 21 Third-Party Acquisitions 22 Dispositions and Contributions 23 Land Portfolio Strategic Capital 25 Overview 26 Summary and Financial Highlights 27 Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures 28 Non-GAAP Pro-Rata Financial Information Capitalization 29 Overview 30 Debt Components - Consolidated 31 Debt Components - Noncontrolling Interests and Unconsolidated Net Asset Value 32 Components Notes and Definitions 34 Notes and Definitions Contents 3Q 2023 Supplemental

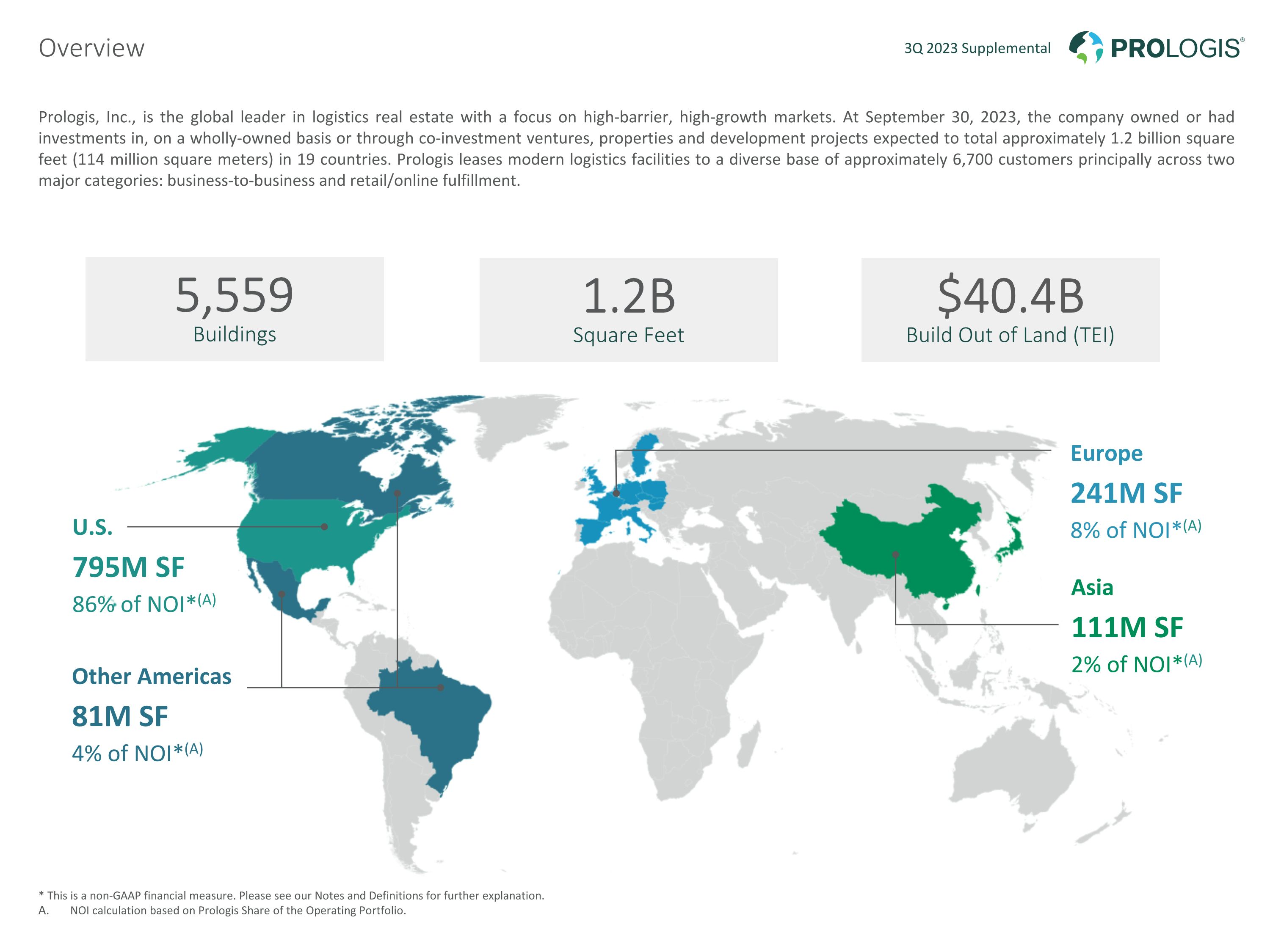

* This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. NOI calculation based on Prologis Share of the Operating Portfolio. 3Q 2023 Supplemental Overview Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At September 30, 2023, the company owned or had investments in, on a wholly-owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (114 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 6,700 customers principally across two major categories: business-to-business and retail/online fulfillment. 5,559 Buildings 1.2B Square Feet $40.4B Build Out of Land (TEI) U.S. 795M SF 86% of NOI*(A) Other Americas 81M SF 4% of NOI*(A) Europe 241M SF 8% of NOI*(A) Asia 111M SF 2% of NOI*(A)

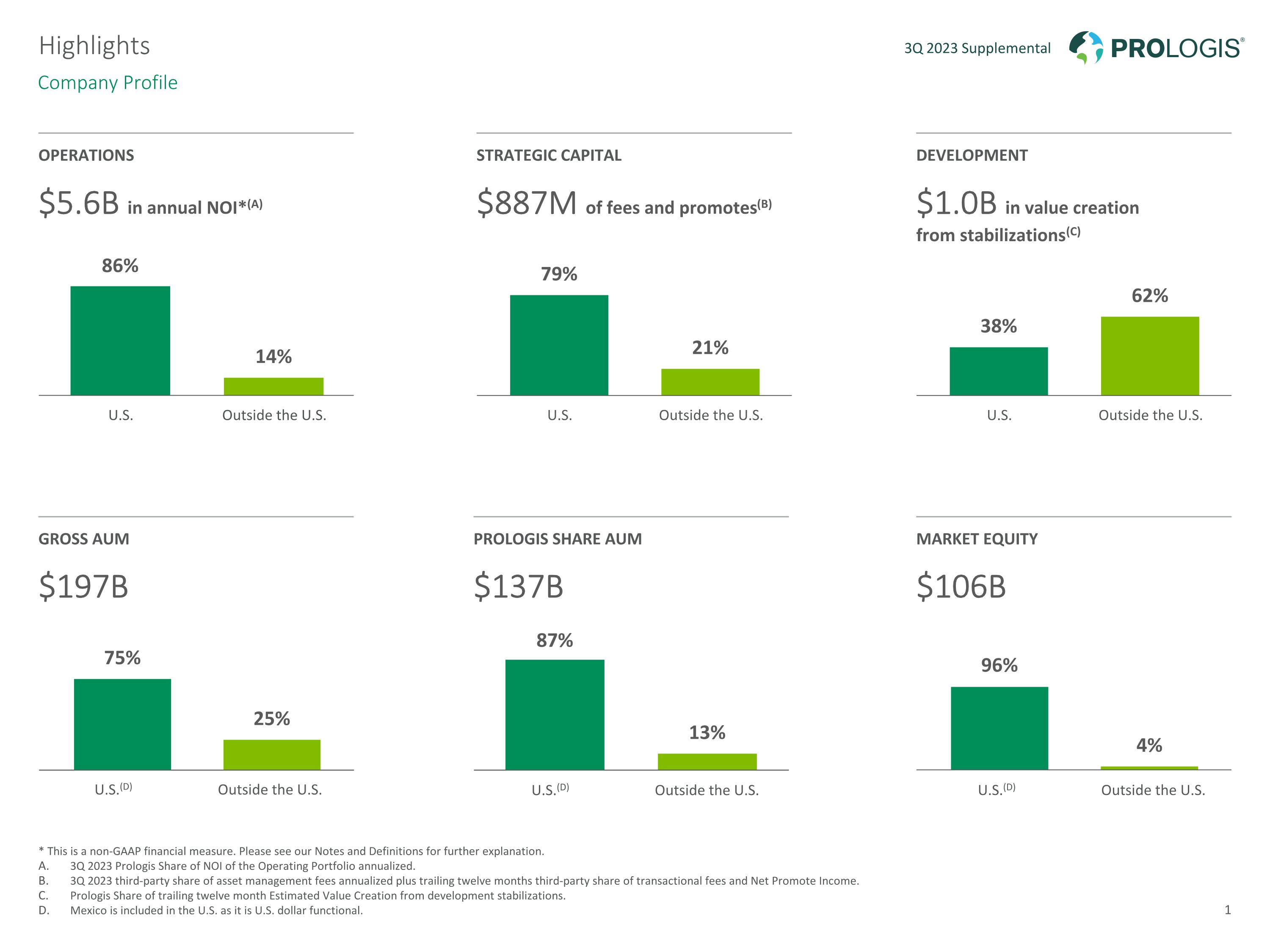

Company Profile * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 3Q 2023 Prologis Share of NOI of the Operating Portfolio annualized. 3Q 2023 third-party share of asset management fees annualized plus trailing twelve months third-party share of transactional fees and Net Promote Income. Prologis Share of trailing twelve month Estimated Value Creation from development stabilizations. Mexico is included in the U.S. as it is U.S. dollar functional. 3Q 2023 Supplemental Highlights Operations $5.6B in annual NOI*(A) Development $1.0B in value creation�from stabilizations(C) Gross AUM $197B Prologis Share AUM $137B Market Equity $106B Strategic capital $887M of fees and promotes(B) 1 U.S.(D) Outside the U.S. U.S.(D) Outside the U.S. U.S.(D) Outside the U.S.

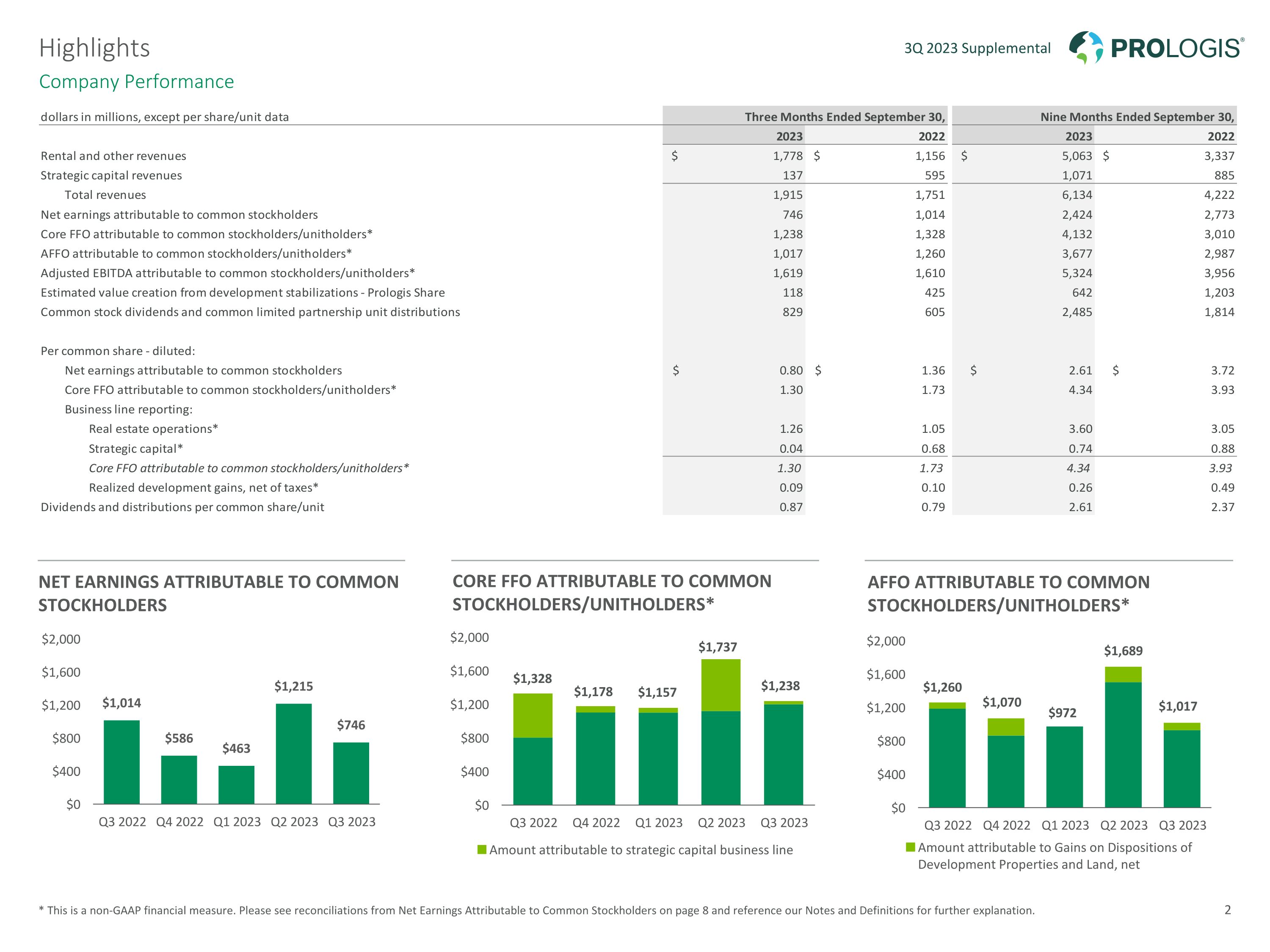

Company Performance * This is a non-GAAP financial measure. Please see reconciliations from Net Earnings Attributable to Common Stockholders on page 8 and reference our Notes and Definitions for further explanation. 3Q 2023 Supplemental Highlights Net earnings attributable to common stockholders Core FFO attributable to common stockholders/unitholders* AFFO attributable to common stockholders/unitholders* 2

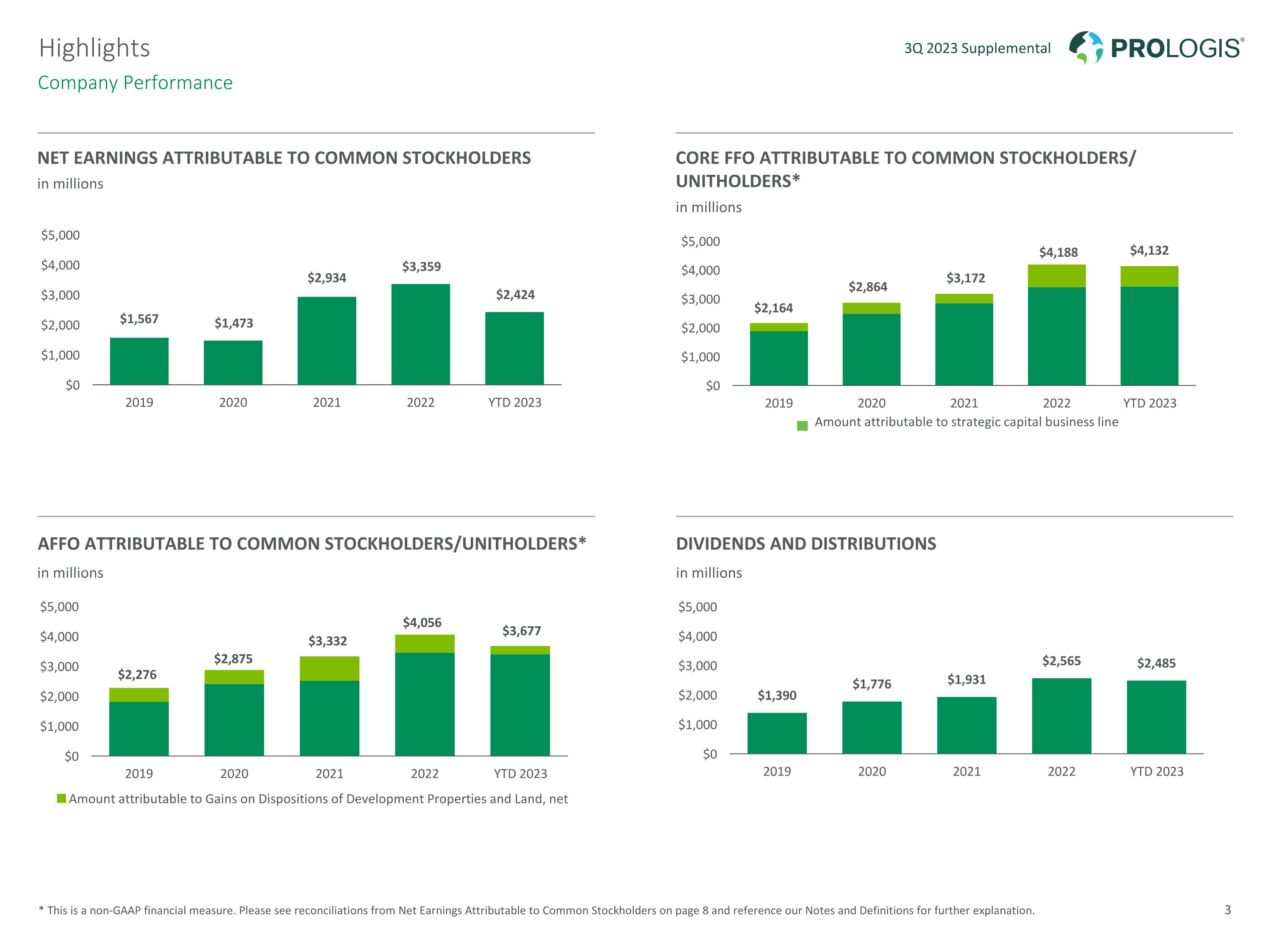

Net earnings attributable to common stockholders in millions Core ffo attributable to common stockholders/ unitholders* in millions affO attributable to common stockholders/unitholders* in millions Dividends and distributions in millions * This is a non-GAAP financial measure. Please see reconciliations from Net Earnings Attributable to Common Stockholders on page 8 and reference our Notes and Definitions for further explanation. Highlights Company Performance 3Q 2023 Supplemental 3

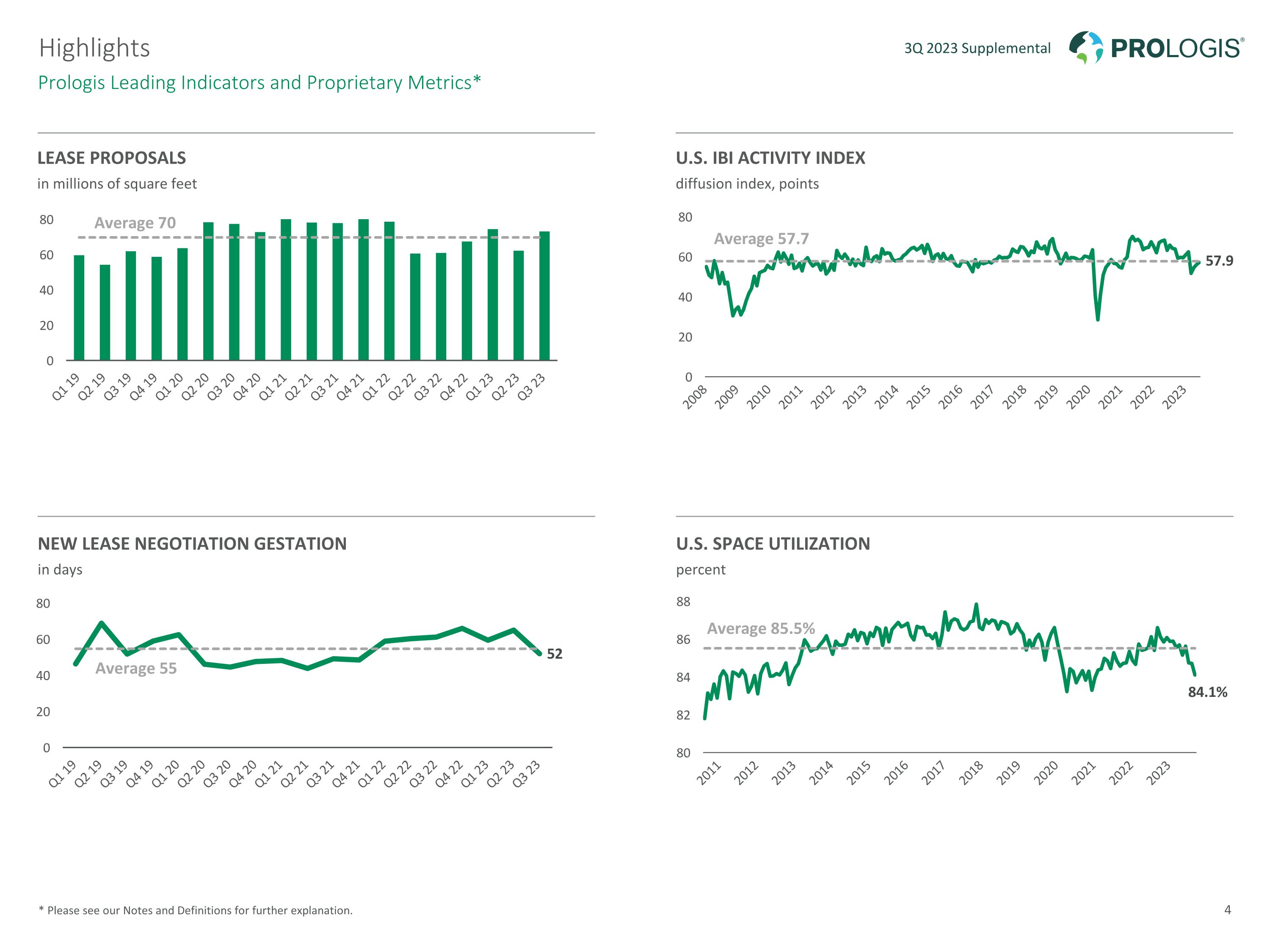

Average 57.7 Average 55 Average 85.5% Lease Proposals in millions of square feet U.s. IBI activity index diffusion index, points New Lease negotiation Gestation in days U.S. space utilization * Please see our Notes and Definitions for further explanation. Prologis Leading Indicators and Proprietary Metrics* 3Q 2023 Supplemental Average 70 4 percent Highlights

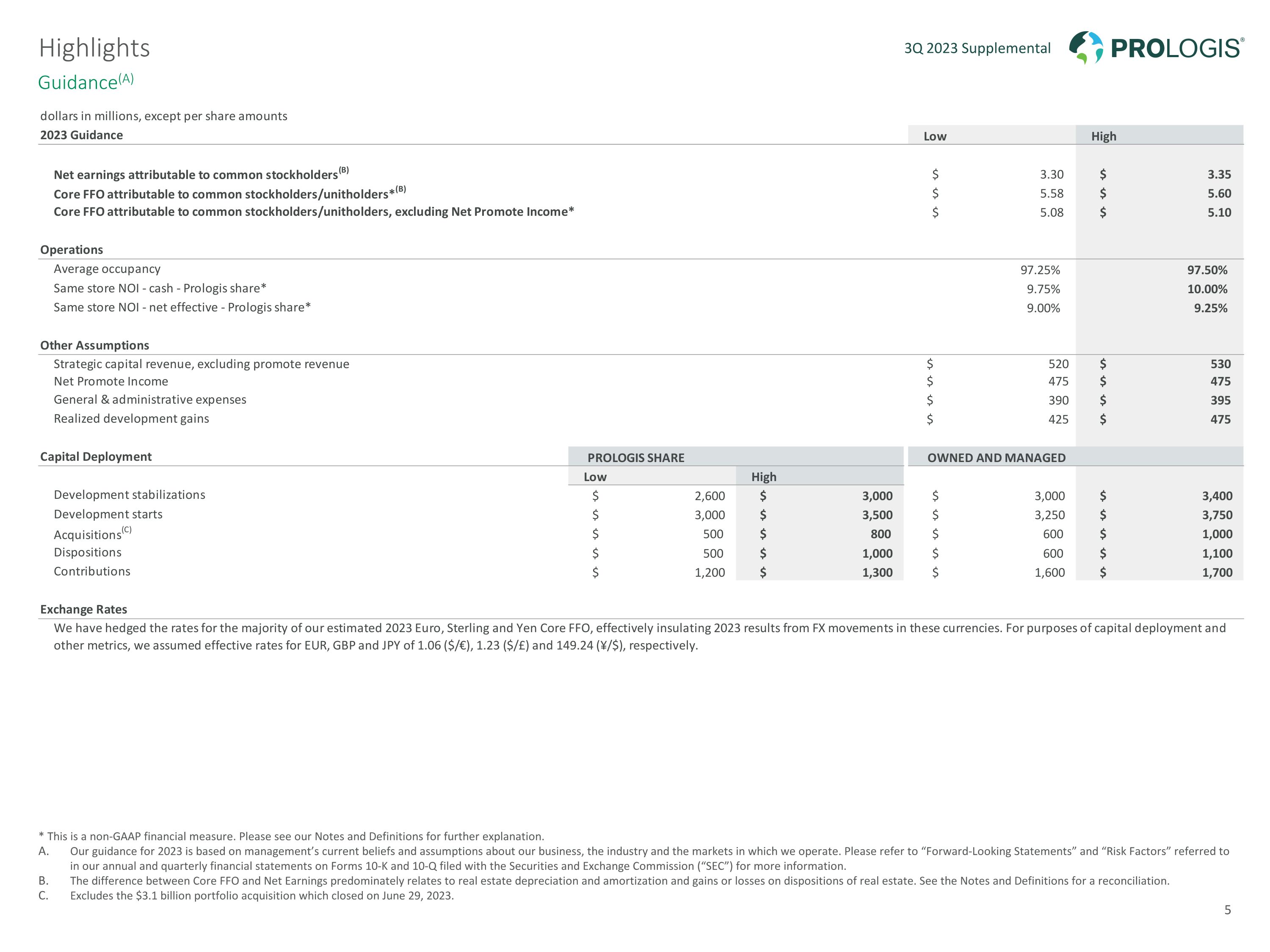

Guidance(A) * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Our guidance for 2023 is based on management’s current beliefs and assumptions about our business, the industry and the markets in which we operate. Please refer to “Forward-Looking Statements” and “Risk Factors” referred to in our annual and quarterly financial statements on Forms 10-K and 10-Q filed with the Securities and Exchange Commission (“SEC”) for more information. The difference between Core FFO and Net Earnings predominately relates to real estate depreciation and amortization and gains or losses on dispositions of real estate. See the Notes and Definitions for a reconciliation. Excludes the $3.1 billion portfolio acquisition which closed on June 29, 2023. 3Q 2023 Supplemental Highlights 5

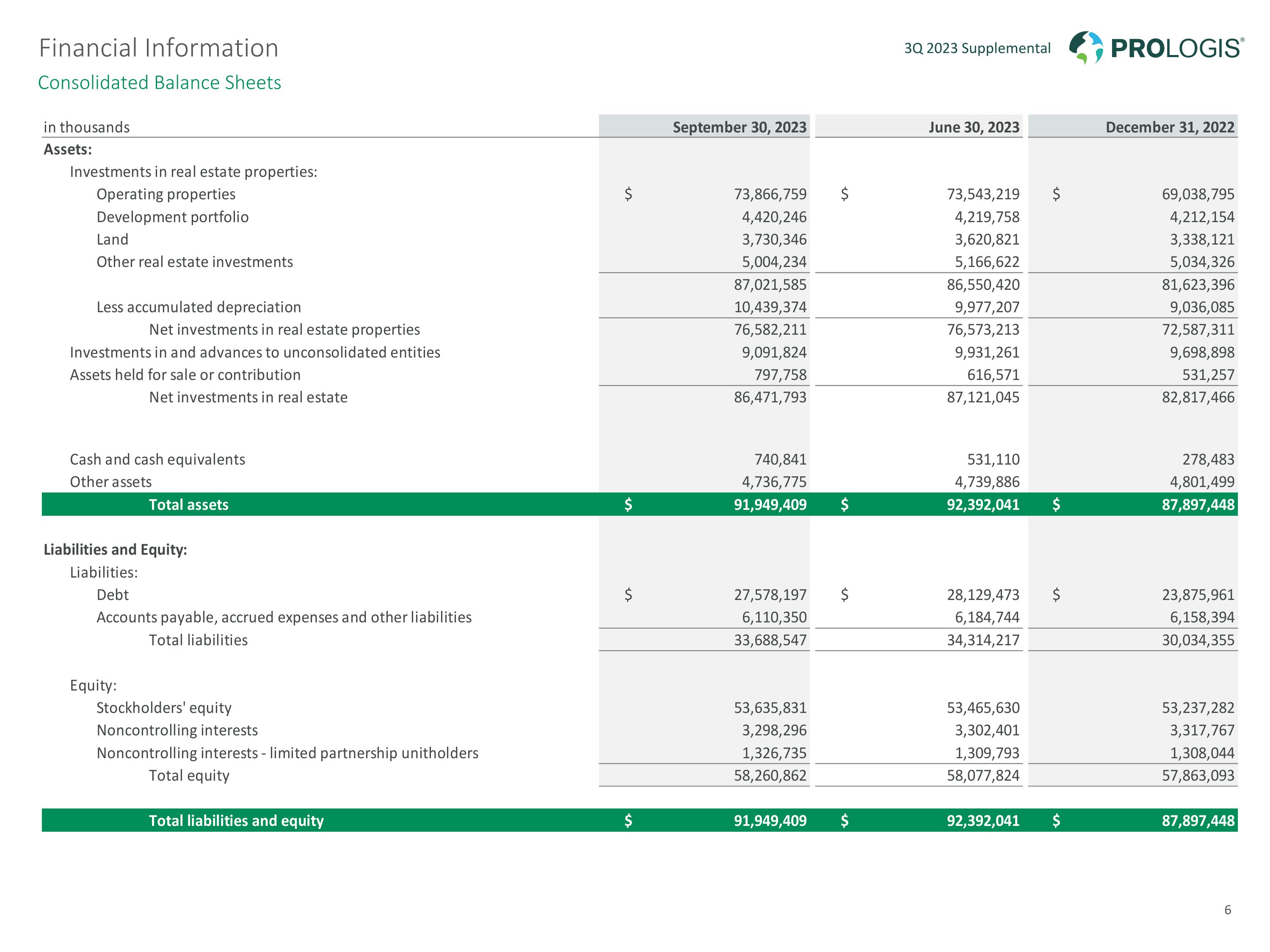

Consolidated Balance Sheets 3Q 2023 Supplemental Financial Information 6

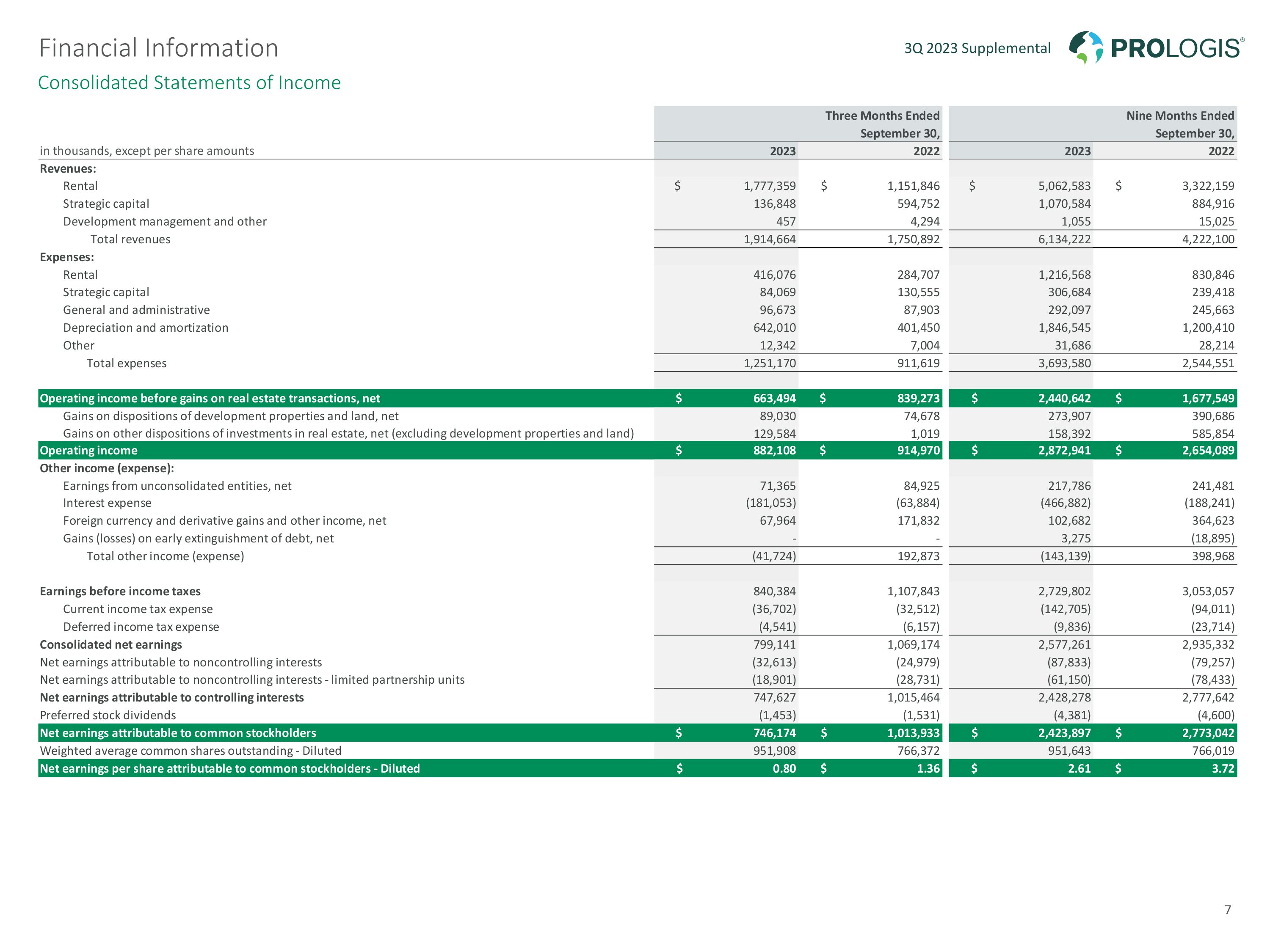

Consolidated Statements of Income 3Q 2023 Supplemental Financial Information 7

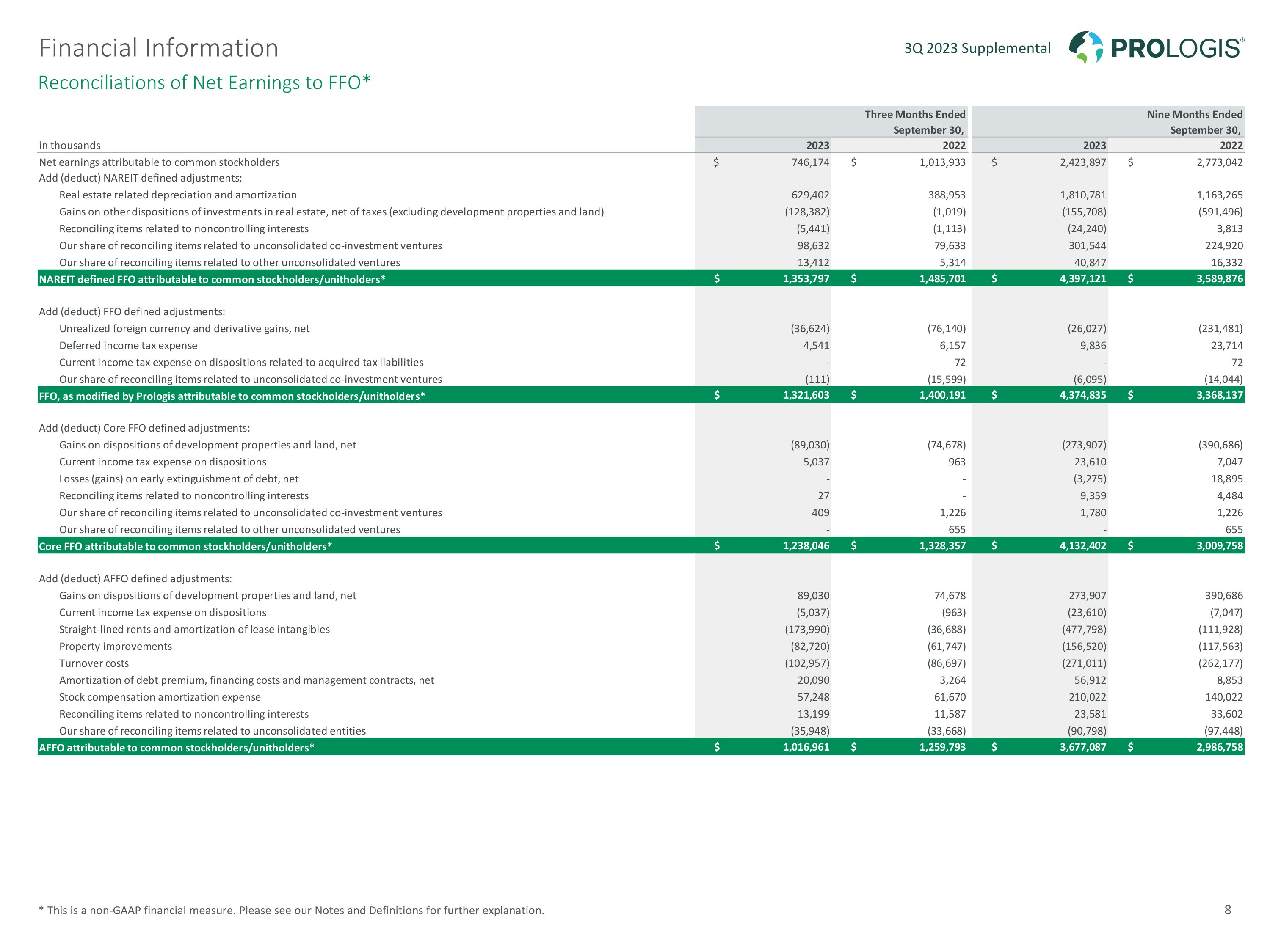

Reconciliations of Net Earnings to FFO* * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 3Q 2023 Supplemental Financial Information 8

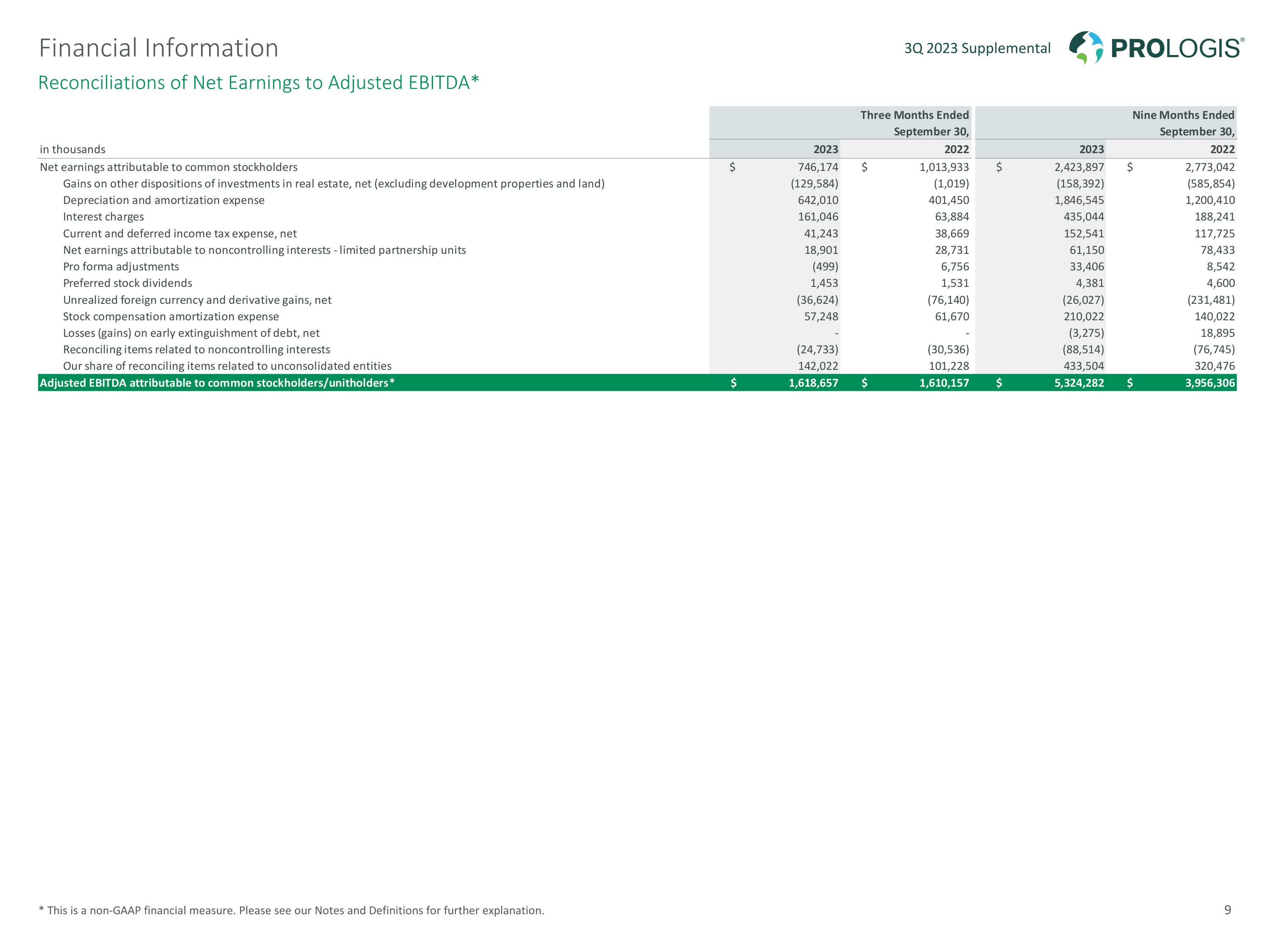

Reconciliations of Net Earnings to Adjusted EBITDA* * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 3Q 2023 Supplemental Financial Information 9

43.8% 48.0% 56.3% 64.0% 70.6% Occupancy Customer Retention Same Store Change Over Prior Year - Prologis Share* Rent Change - Prologis Share * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operations Overview 3Q 2023 Supplemental Trailing four quarters – net effective 10

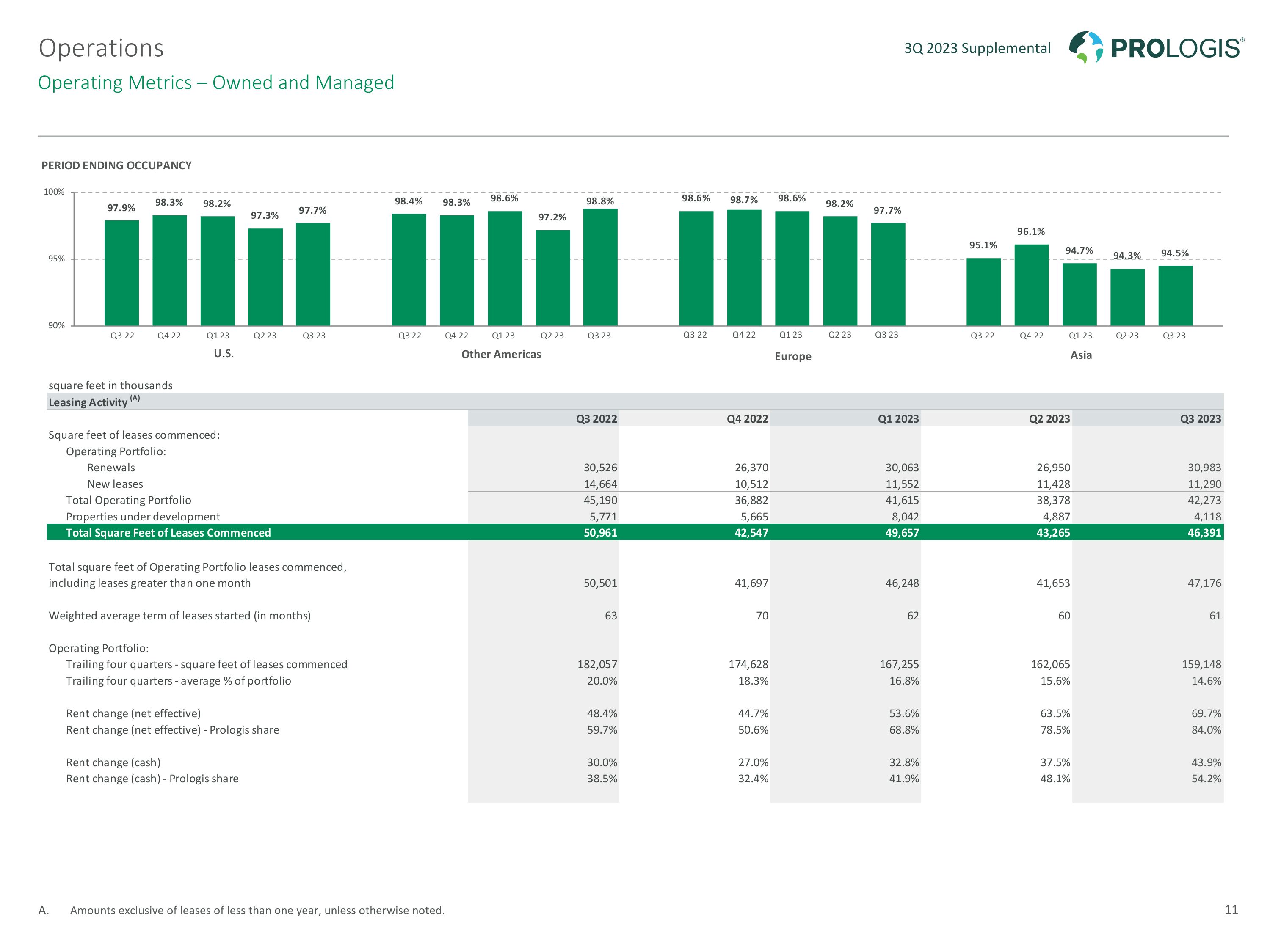

Operating Metrics – Owned and Managed Amounts exclusive of leases of less than one year, unless otherwise noted. 3Q 2023 Supplemental Operations 11

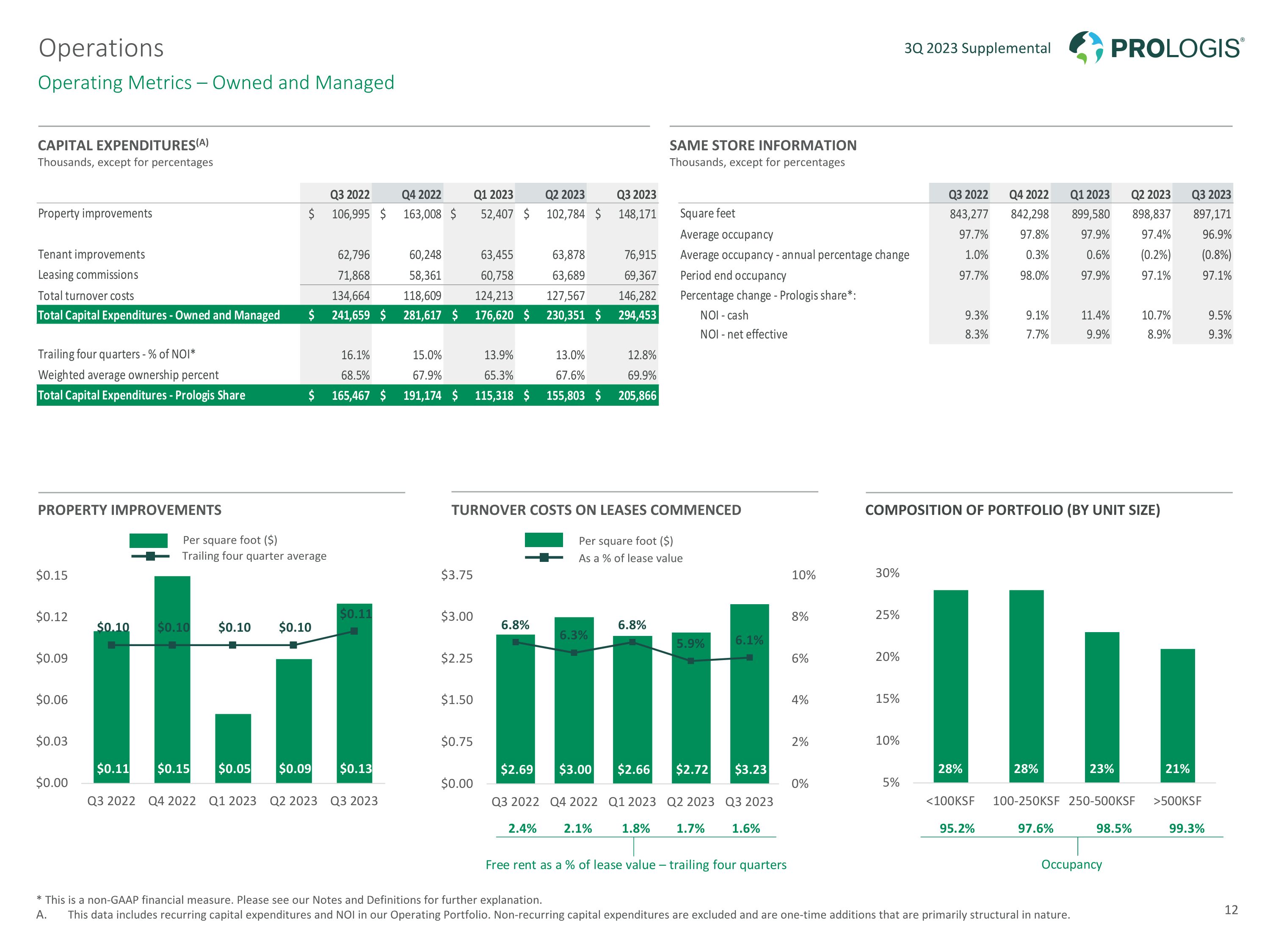

Operating Metrics – Owned and Managed * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. This data includes recurring capital expenditures and NOI in our Operating Portfolio. Non-recurring capital expenditures are excluded and are one-time additions that are primarily structural in nature. 3Q 2023 Supplemental Operations CAPITAL EXPENDITURES(A) Thousands, except for percentages SAME STORE INFORMATION Thousands, except for percentages PROPERTY IMPROVEMENTS TURNOVER COSTS ON LEASES COMMENCED COMPOSITION OF PORTFOLIO (BY UNIT SIZE) Trailing four quarter average Per square foot ($) As a % of lease value Per square foot ($) 12

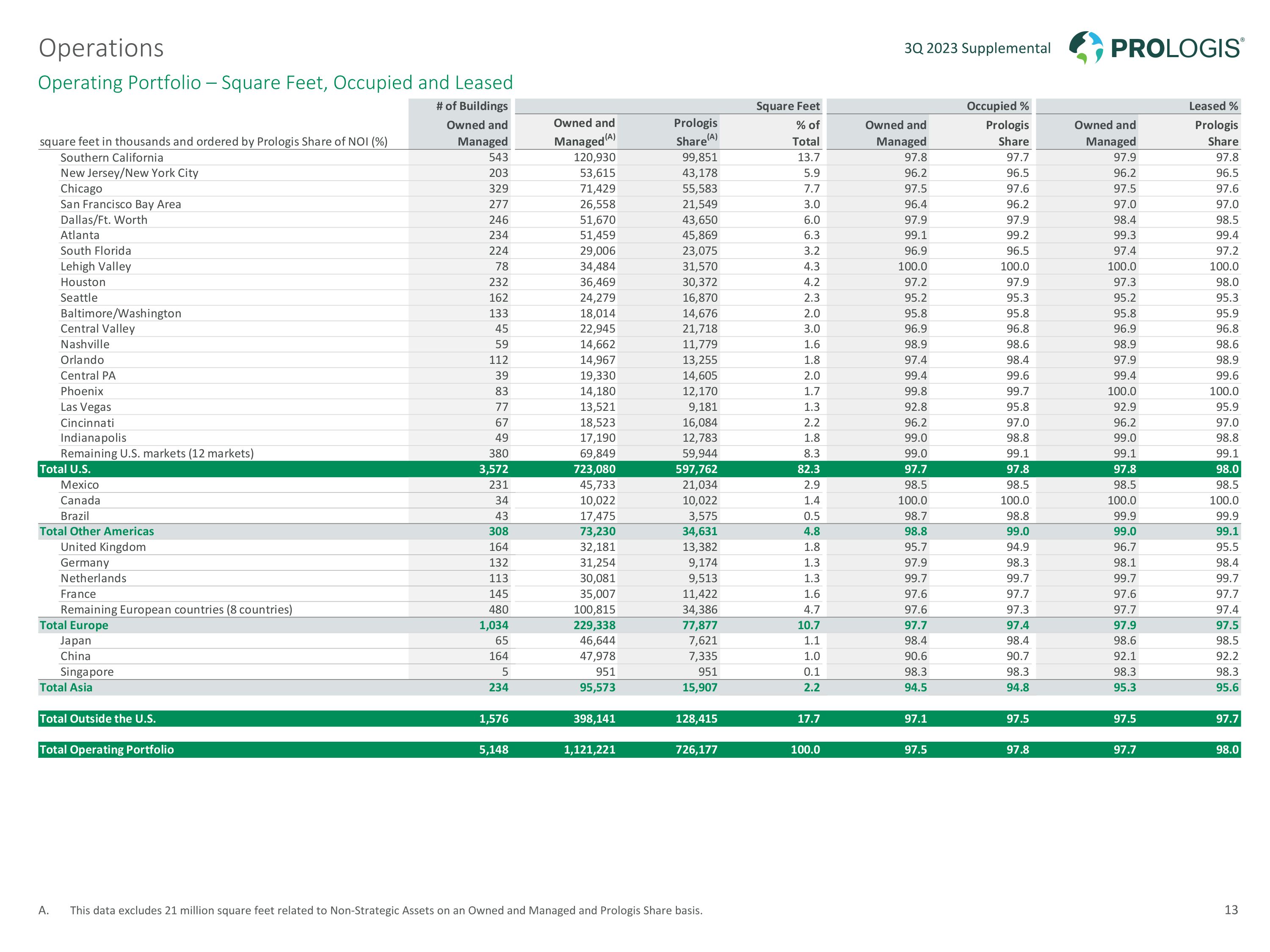

Operating Portfolio – Square Feet, Occupied and Leased This data excludes 21 million square feet related to Non-Strategic Assets on an Owned and Managed and Prologis Share basis. 3Q 2023 Supplemental Operations 13

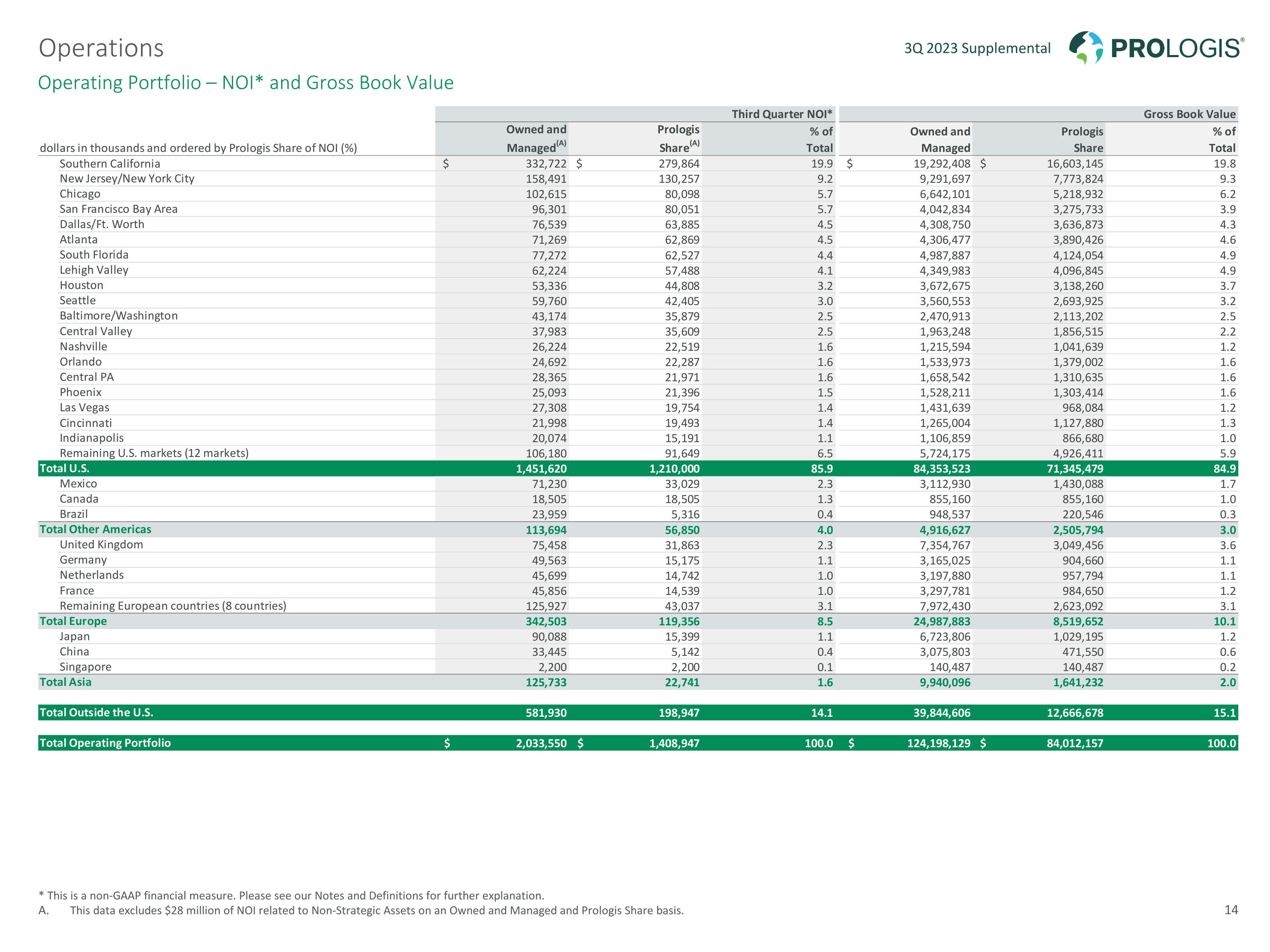

Operating Portfolio – NOI* and Gross Book Value * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. This data excludes $28 million of NOI related to Non-Strategic Assets on an Owned and Managed and Prologis Share basis. 3Q 2023 Supplemental Operations 14

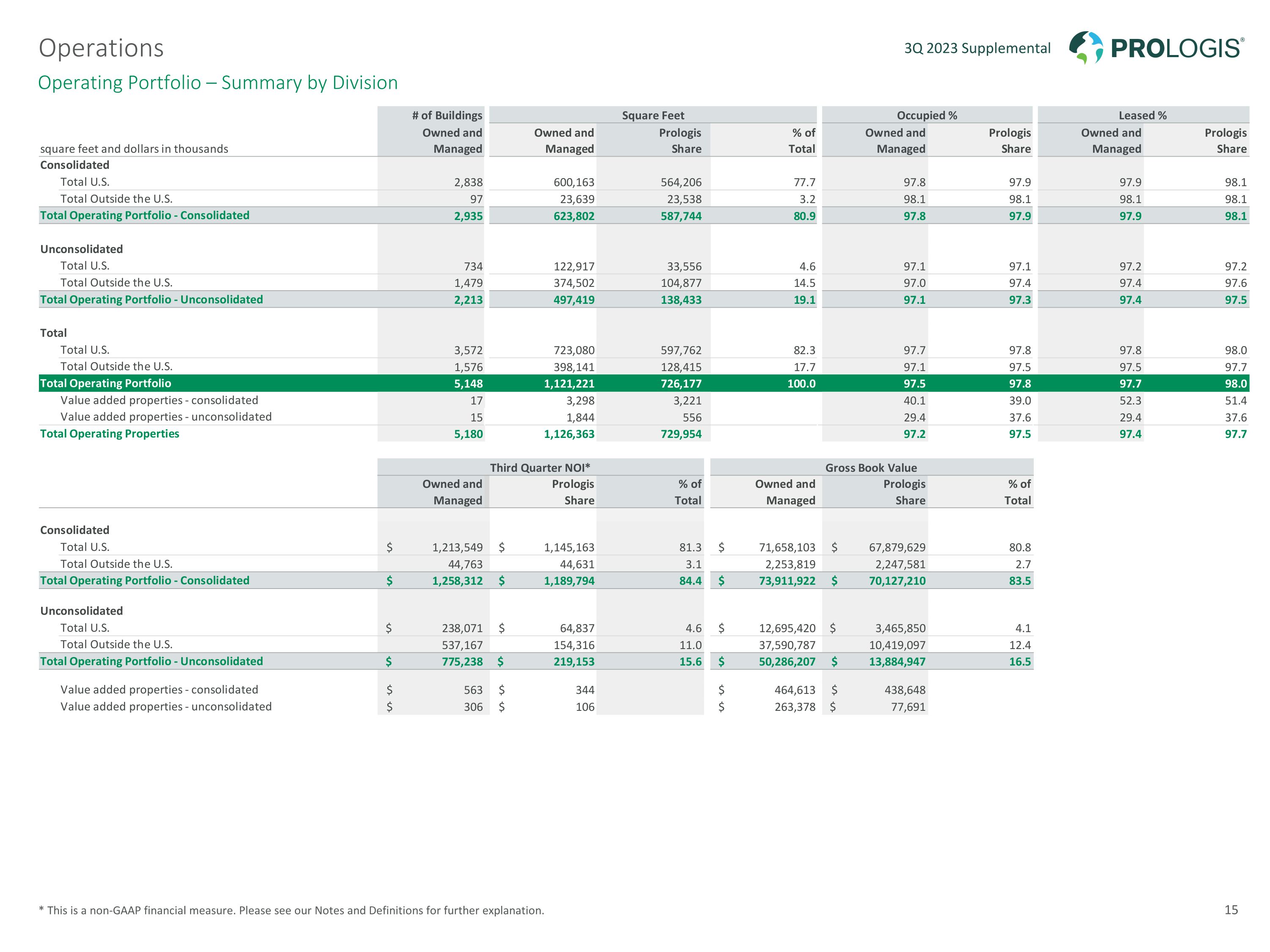

Operating Portfolio – Summary by Division * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 3Q 2023 Supplemental Operations 15

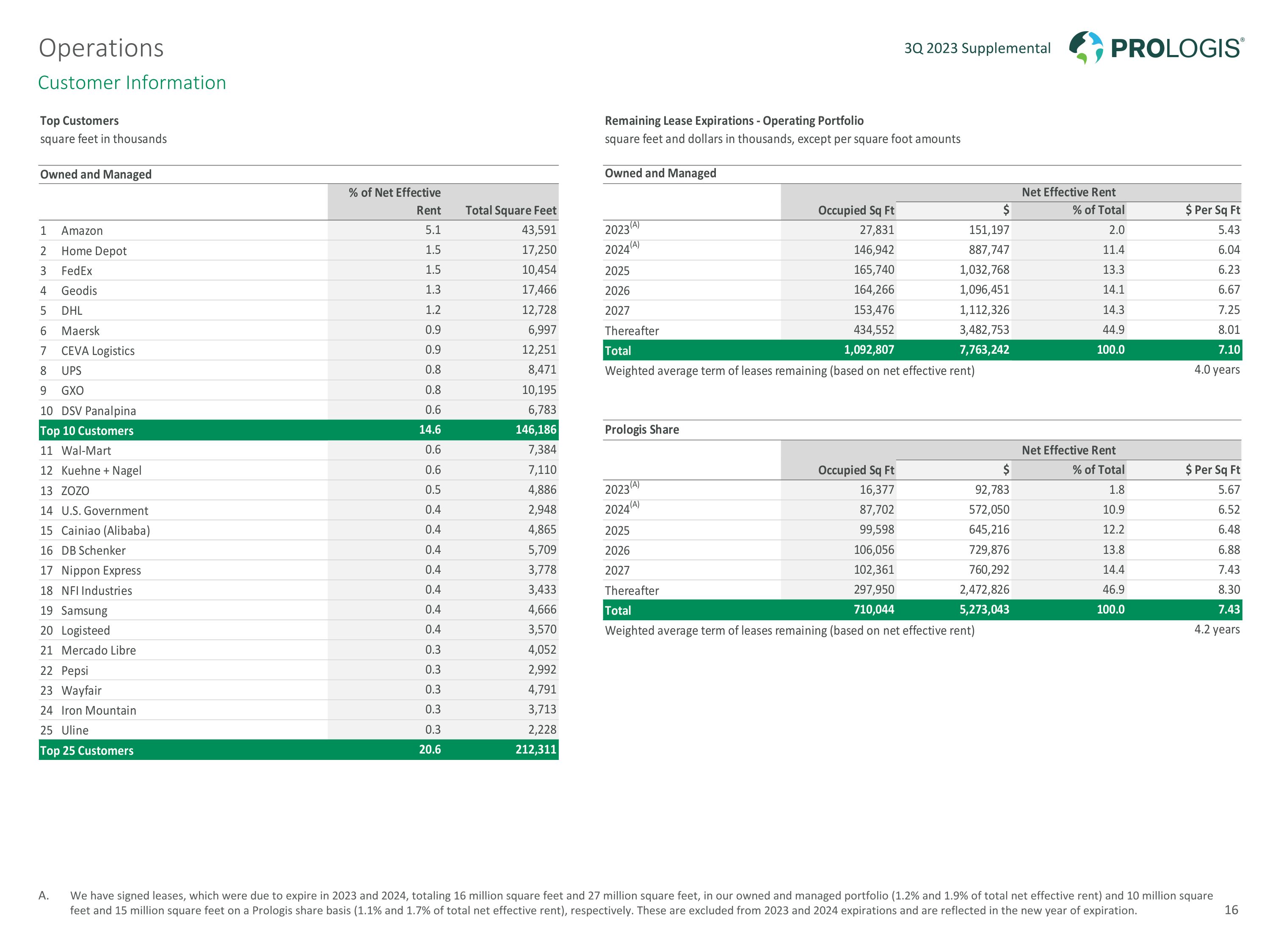

Customer Information We have signed leases, which were due to expire in 2023 and 2024, totaling 16 million square feet and 27 million square feet, in our owned and managed portfolio (1.2% and 1.9% of total net effective rent) and 10 million square feet and 15 million square feet on a Prologis share basis (1.1% and 1.7% of total net effective rent), respectively. These are excluded from 2023 and 2024 expirations and are reflected in the new year of expiration. 3Q 2023 Supplemental Operations 16

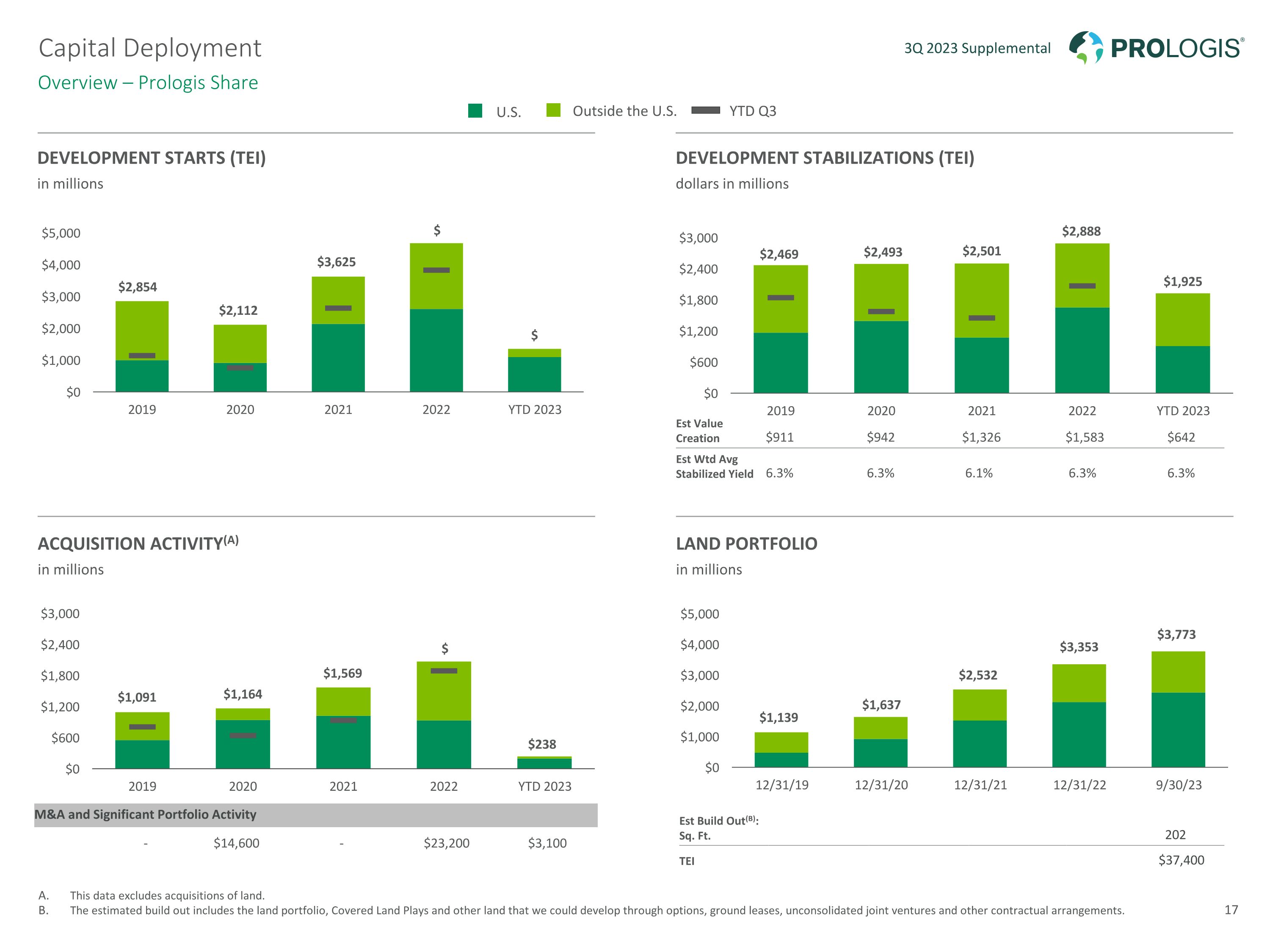

M&A and Significant Portfolio Activity - $14,600 - $23,200 $3,100 Development Starts (TEI) in millions Development Stabilizations (TEI) dollars in millions Acquisition Activity(a) in millions Land Portfolio in millions This data excludes acquisitions of land. The estimated build out includes the land portfolio, Covered Land Plays and other land that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. Capital Deployment Overview – Prologis Share 3Q 2023 Supplemental Outside the U.S. U.S. Est Value Creation $911 $942 $1,326 $1,583 $642 Est Wtd Avg Stabilized Yield 6.3% 6.3% 6.1% 6.3% 6.3% Est Build Out(B): Sq. Ft. 202 TEI $37,400 17 YTD Q3

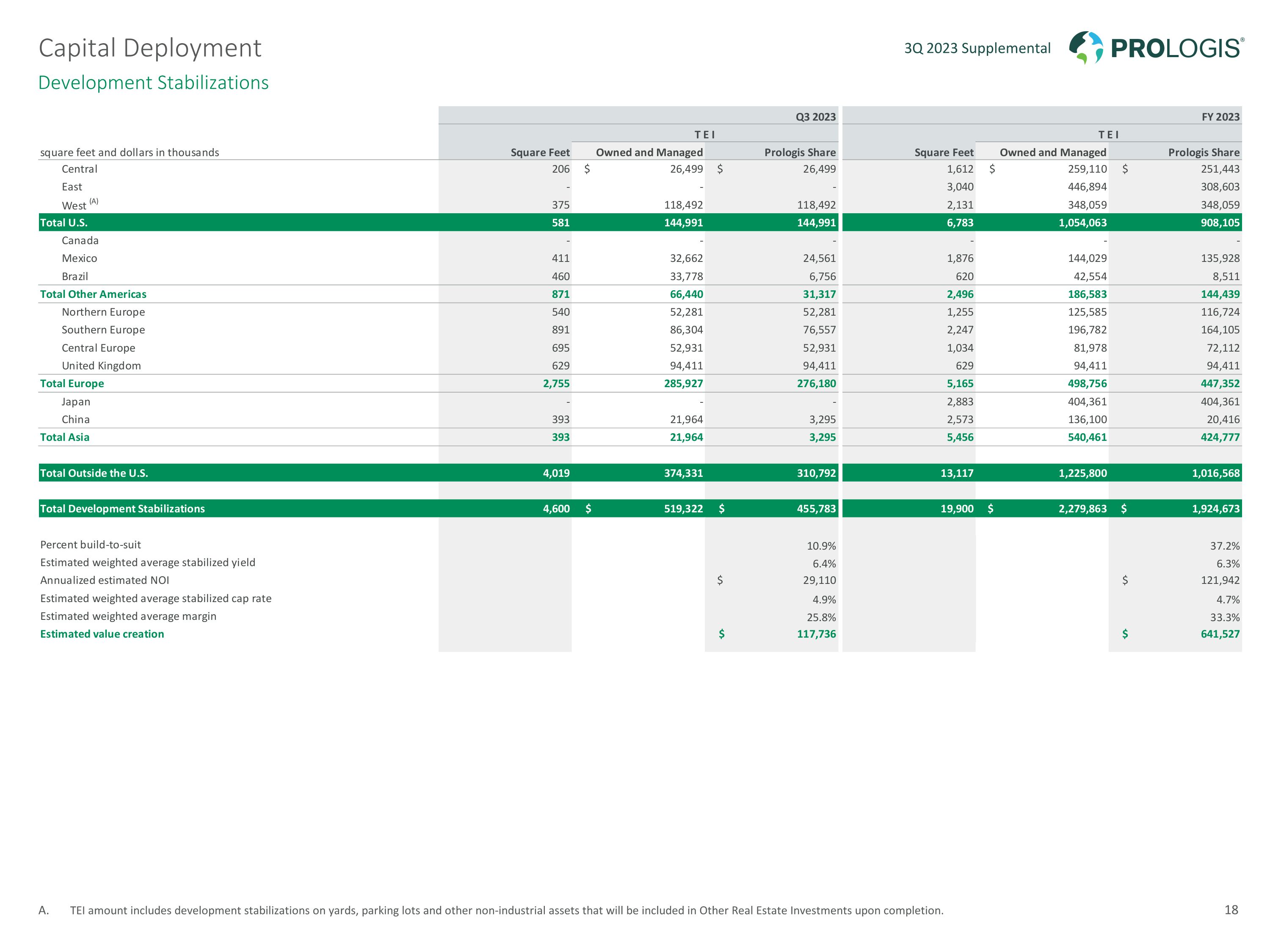

Development Stabilizations TEI amount includes development stabilizations on yards, parking lots and other non-industrial assets that will be included in Other Real Estate Investments upon completion. 3Q 2023 Supplemental Capital Deployment 18

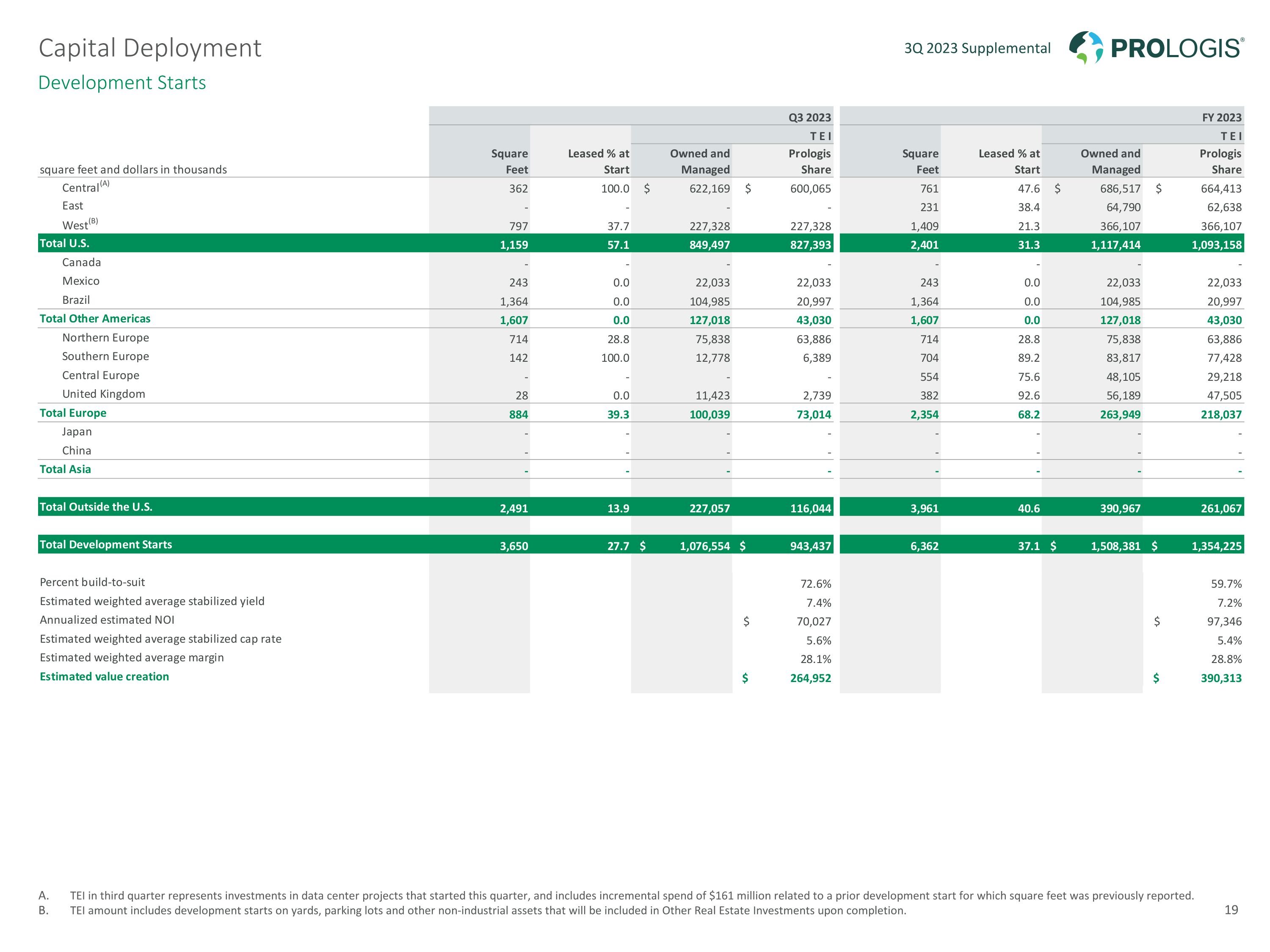

Development Starts TEI in third quarter represents investments in data center projects that started this quarter, and includes incremental spend of $161 million related to a prior development start for which square feet was previously reported. TEI amount includes development starts on yards, parking lots and other non-industrial assets that will be included in Other Real Estate Investments upon completion. 3Q 2023 Supplemental Capital Deployment 19

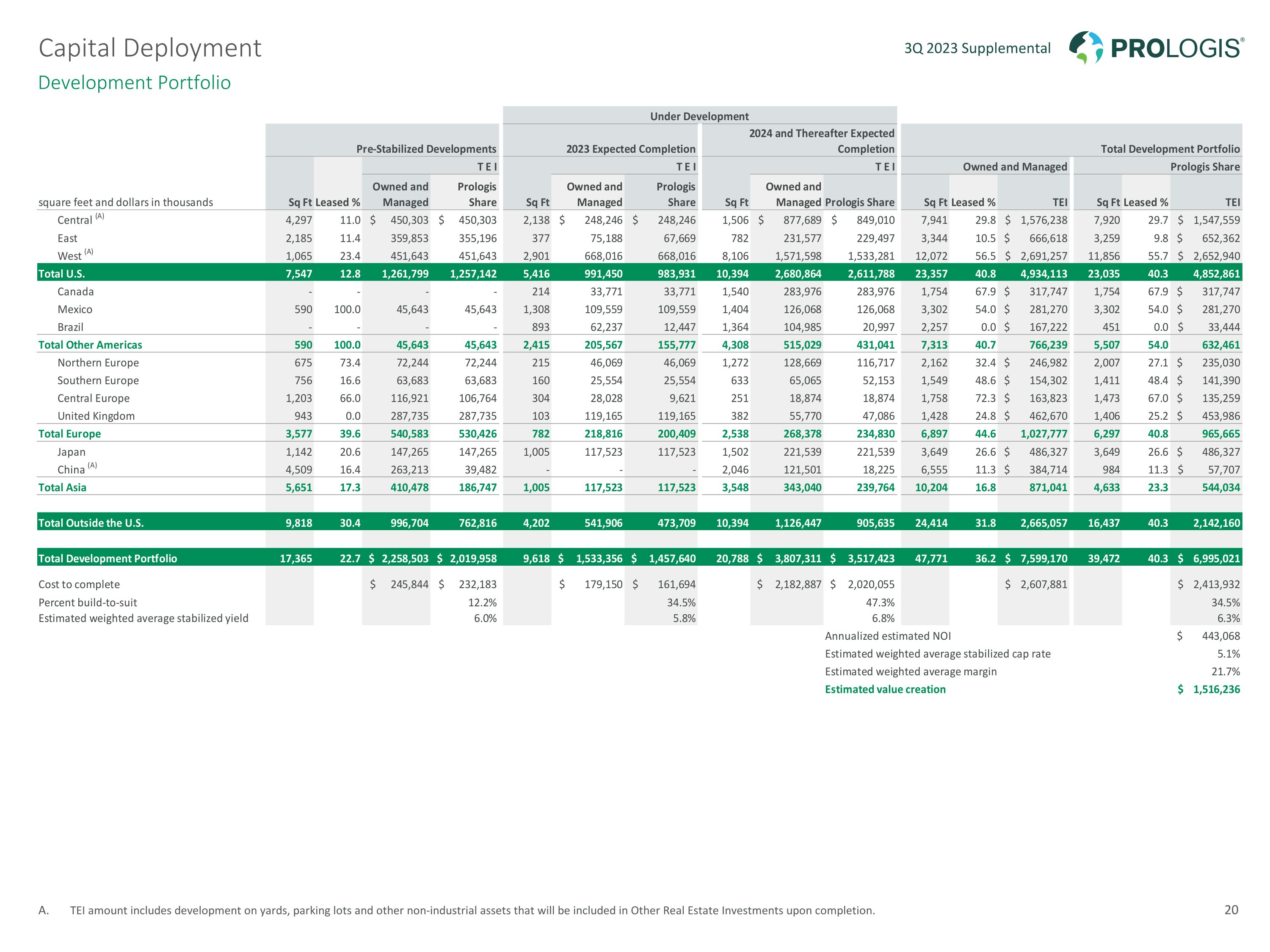

Development Portfolio TEI amount includes development on yards, parking lots and other non-industrial assets that will be included in Other Real Estate Investments upon completion. 3Q 2023 Supplemental Capital Deployment 20

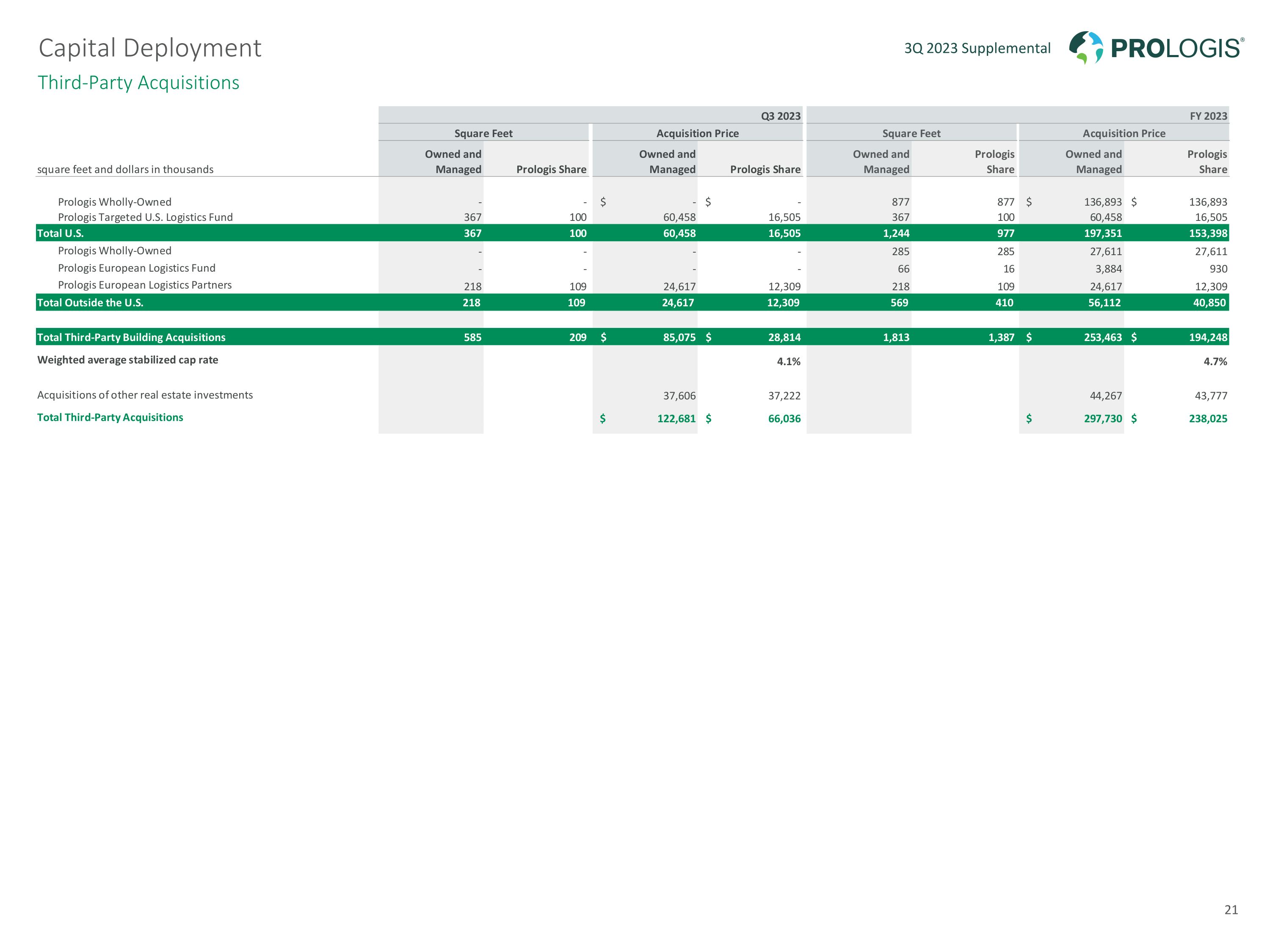

Third-Party Acquisitions 3Q 2023 Supplemental Capital Deployment 21

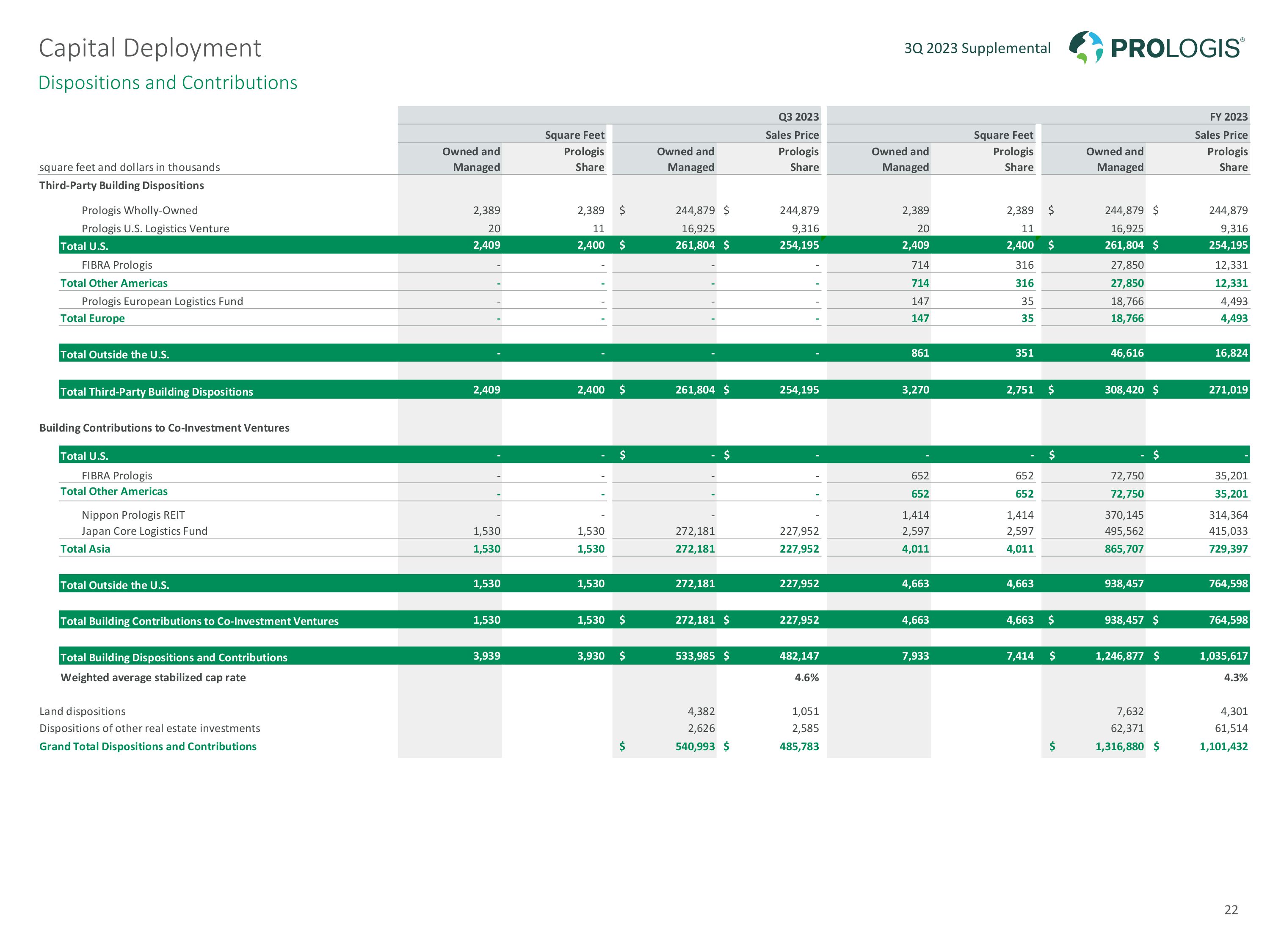

Dispositions and Contributions 3Q 2023 Supplemental Capital Deployment 22

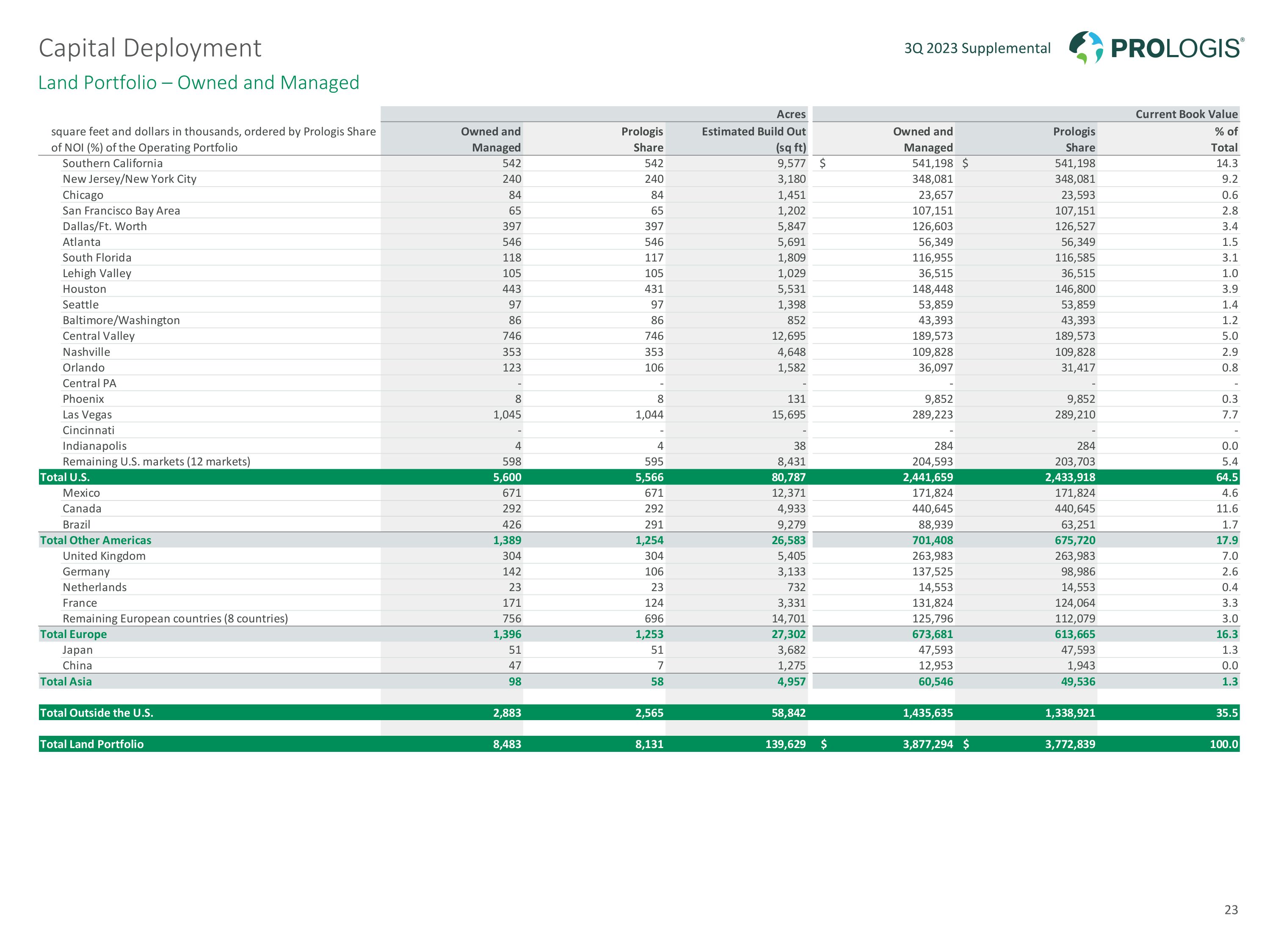

Land Portfolio – Owned and Managed 3Q 2023 Supplemental Capital Deployment 23

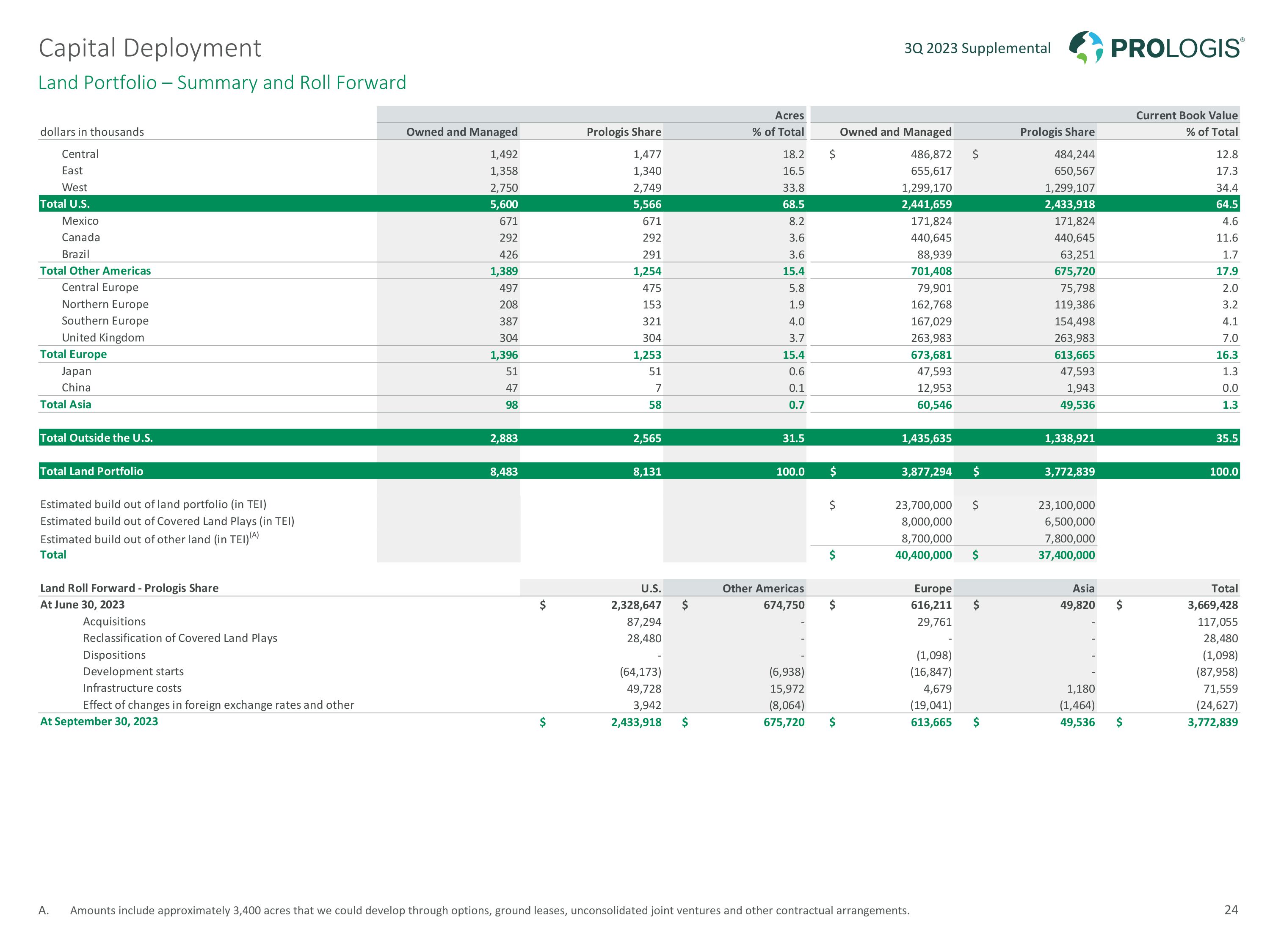

Land Portfolio – Summary and Roll Forward Amounts include approximately 3,400 acres that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. 3Q 2023 Supplemental Capital Deployment 24

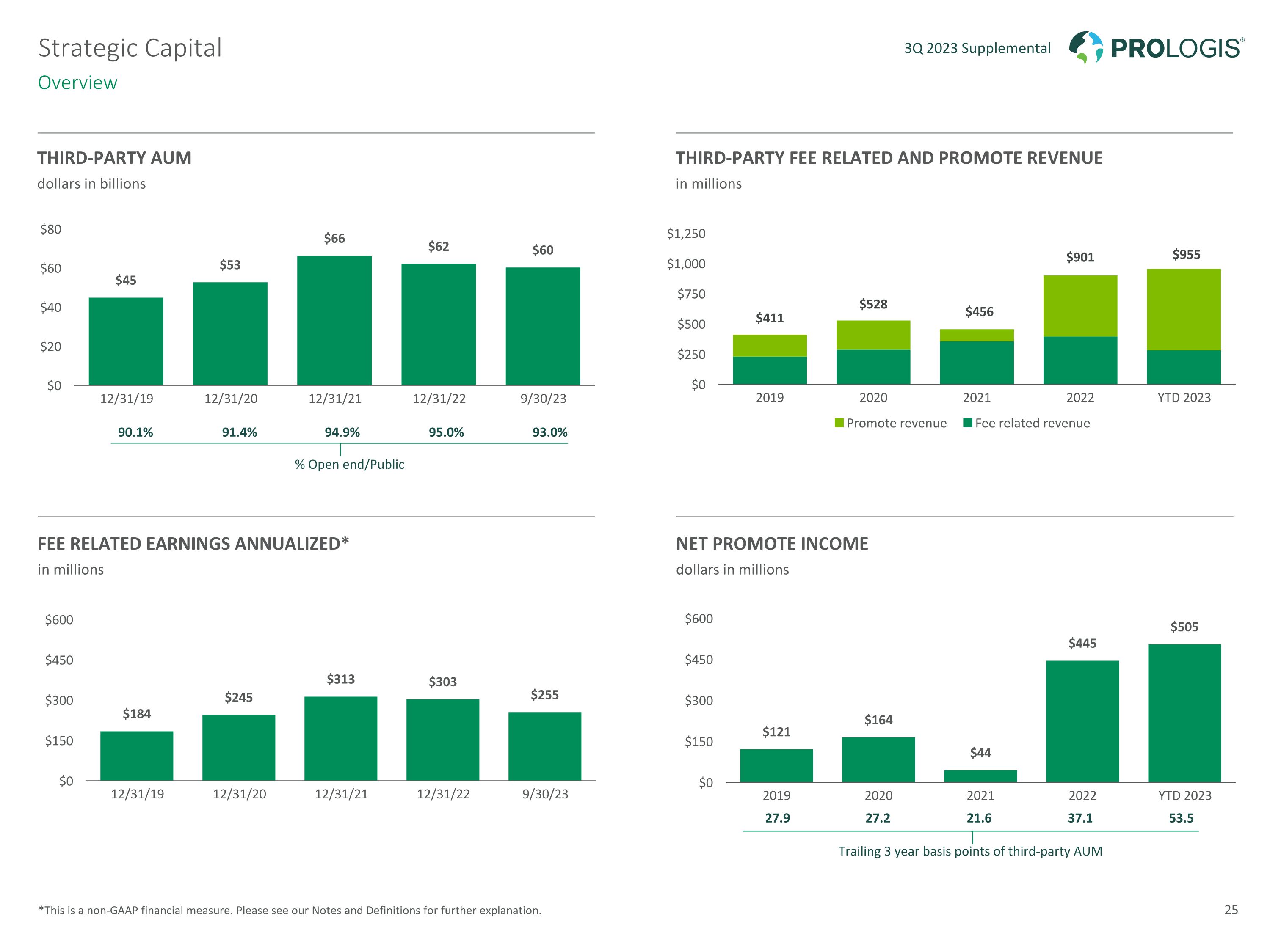

Third-party aum dollars in billions Third-Party Fee Related and promote revenue in millions Fee related earnings annualized* in millions Net Promote income dollars in millions *This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Strategic Capital Overview 3Q 2023 Supplemental 90.1% 91.4% 94.9% 95.0% 93.0% % Open end/Public 27.9 27.2 21.6 37.1 53.5 Trailing 3 year basis points of third-party AUM 25

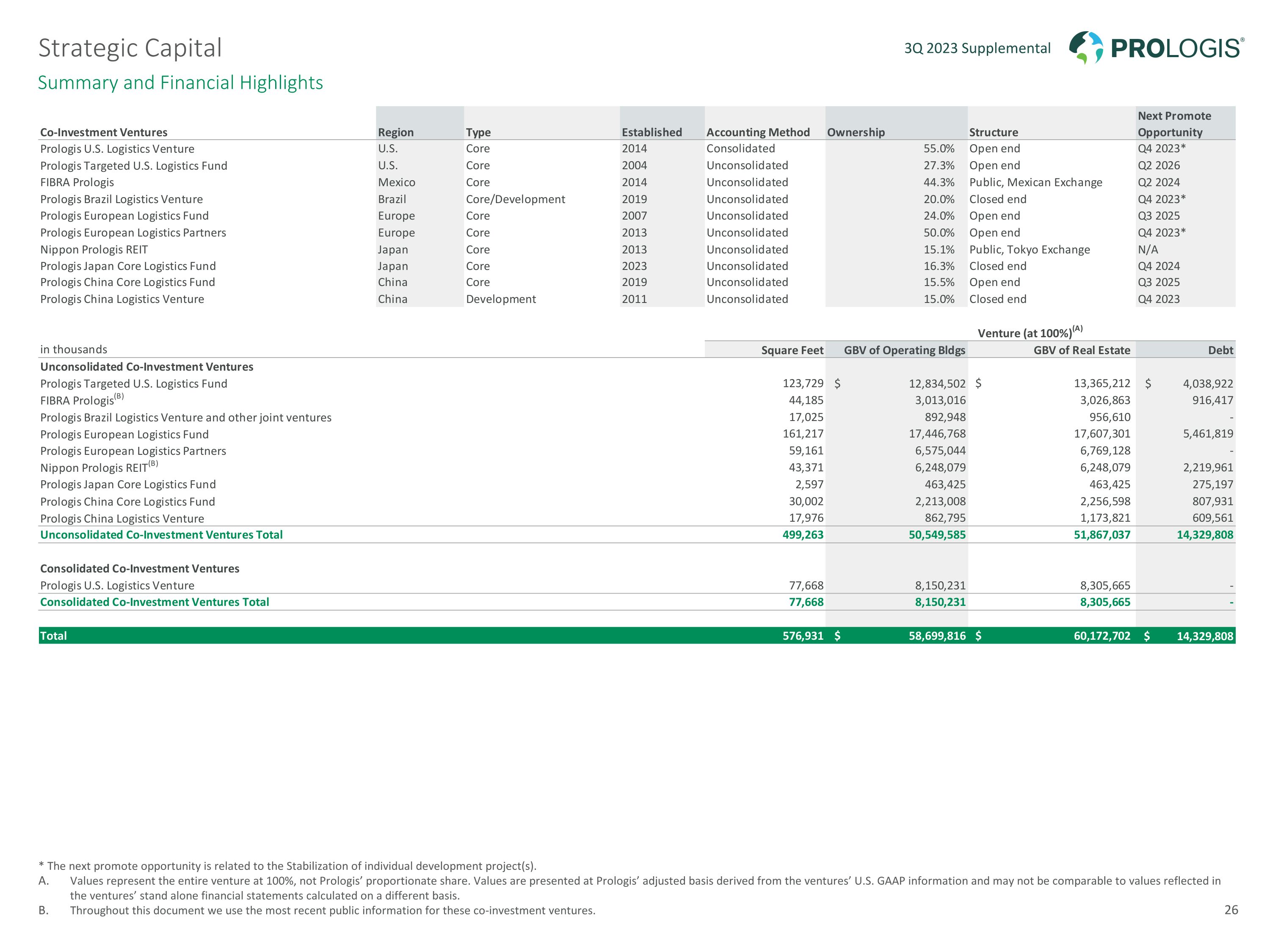

Summary and Financial Highlights * The next promote opportunity is related to the Stabilization of individual development project(s). Values represent the entire venture at 100%, not Prologis’ proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Throughout this document we use the most recent public information for these co-investment ventures. 3Q 2023 Supplemental Strategic Capital 26

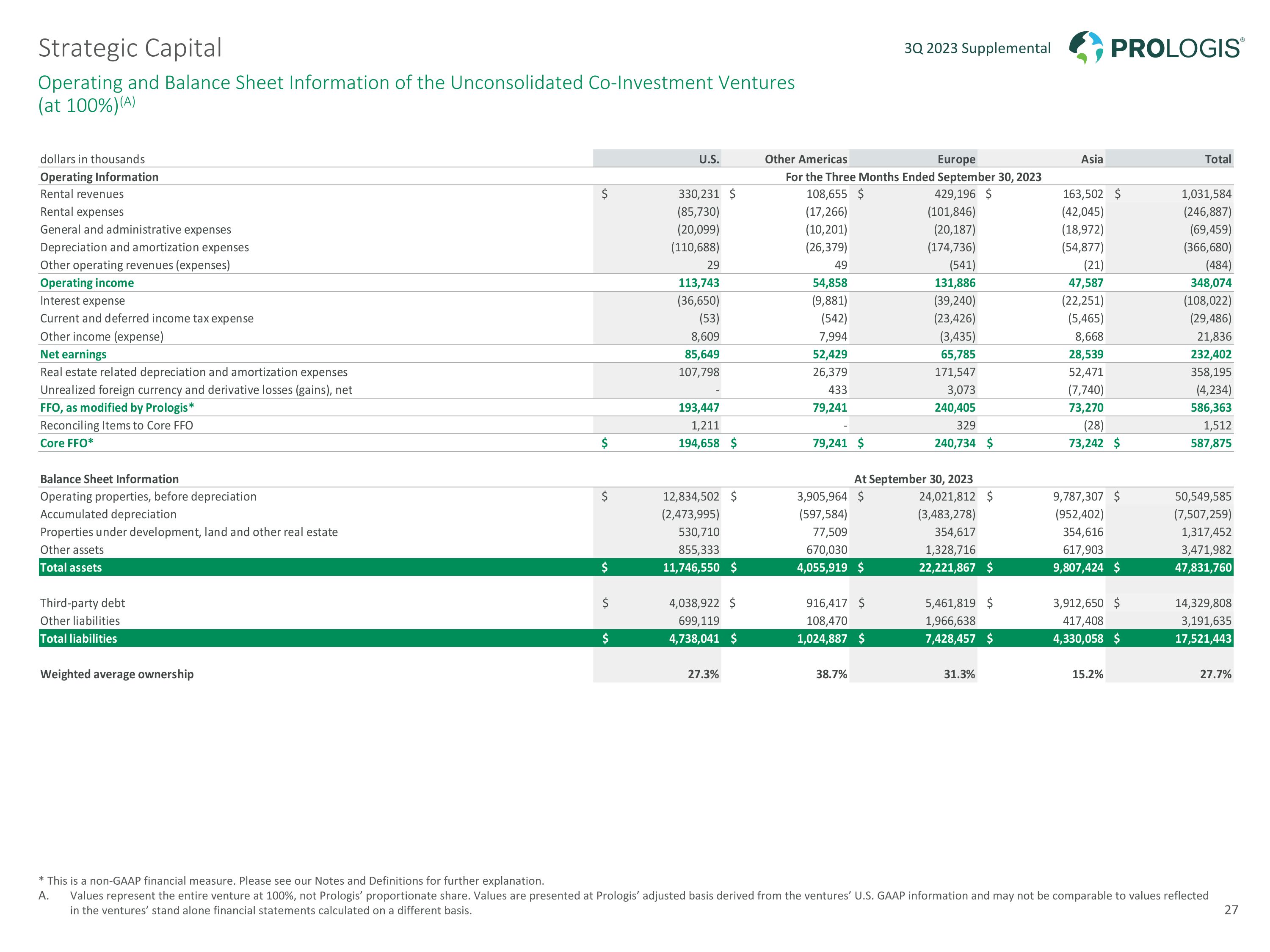

Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures �(at 100%)(A) * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Values represent the entire venture at 100%, not Prologis’ proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. 3Q 2023 Supplemental Strategic Capital 27

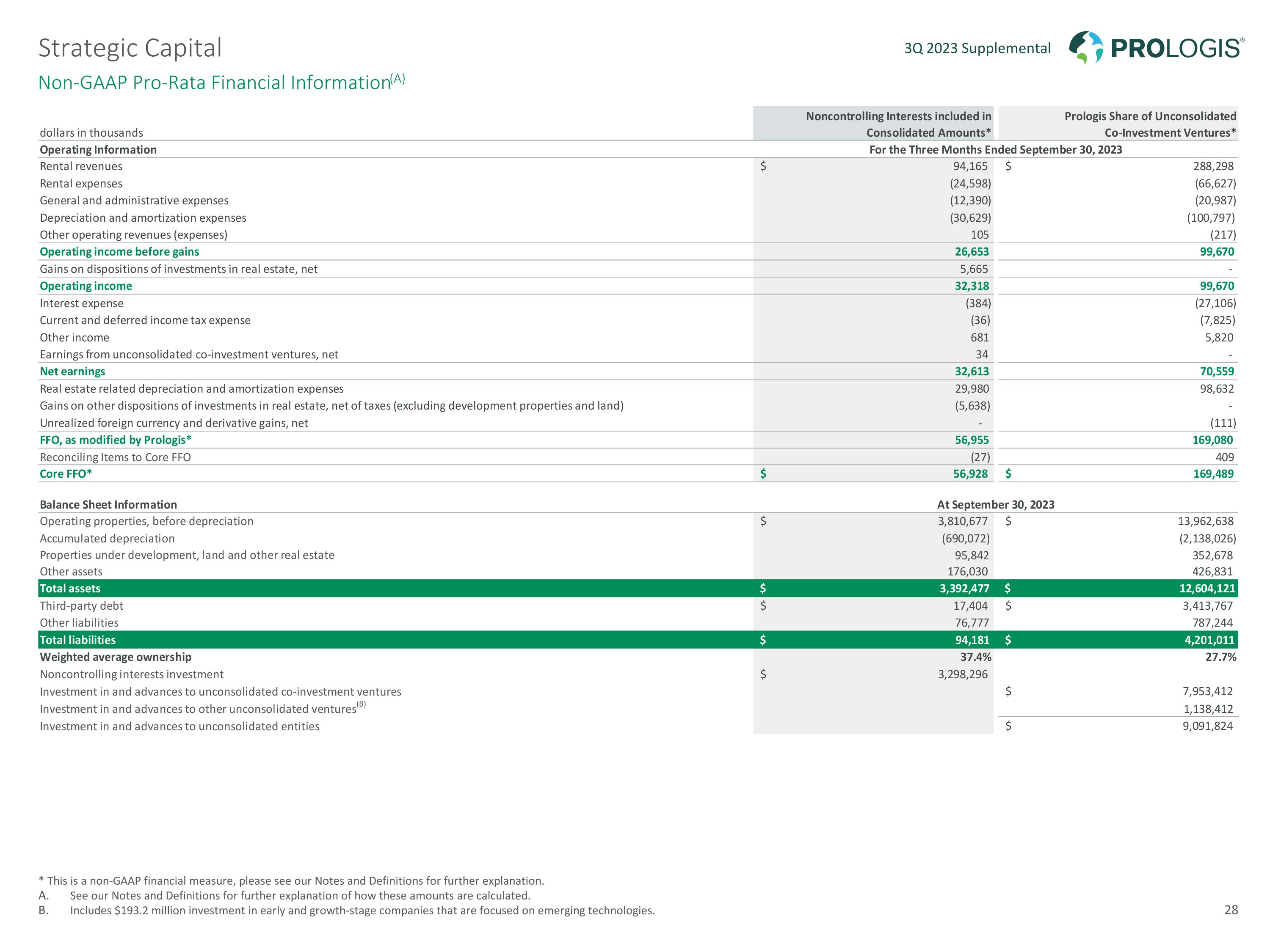

Non-GAAP Pro-Rata Financial Information(A) * This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. See our Notes and Definitions for further explanation of how these amounts are calculated. Includes $193.2 million investment in early and growth-stage companies that are focused on emerging technologies. 3Q 2023 Supplemental Strategic Capital 28

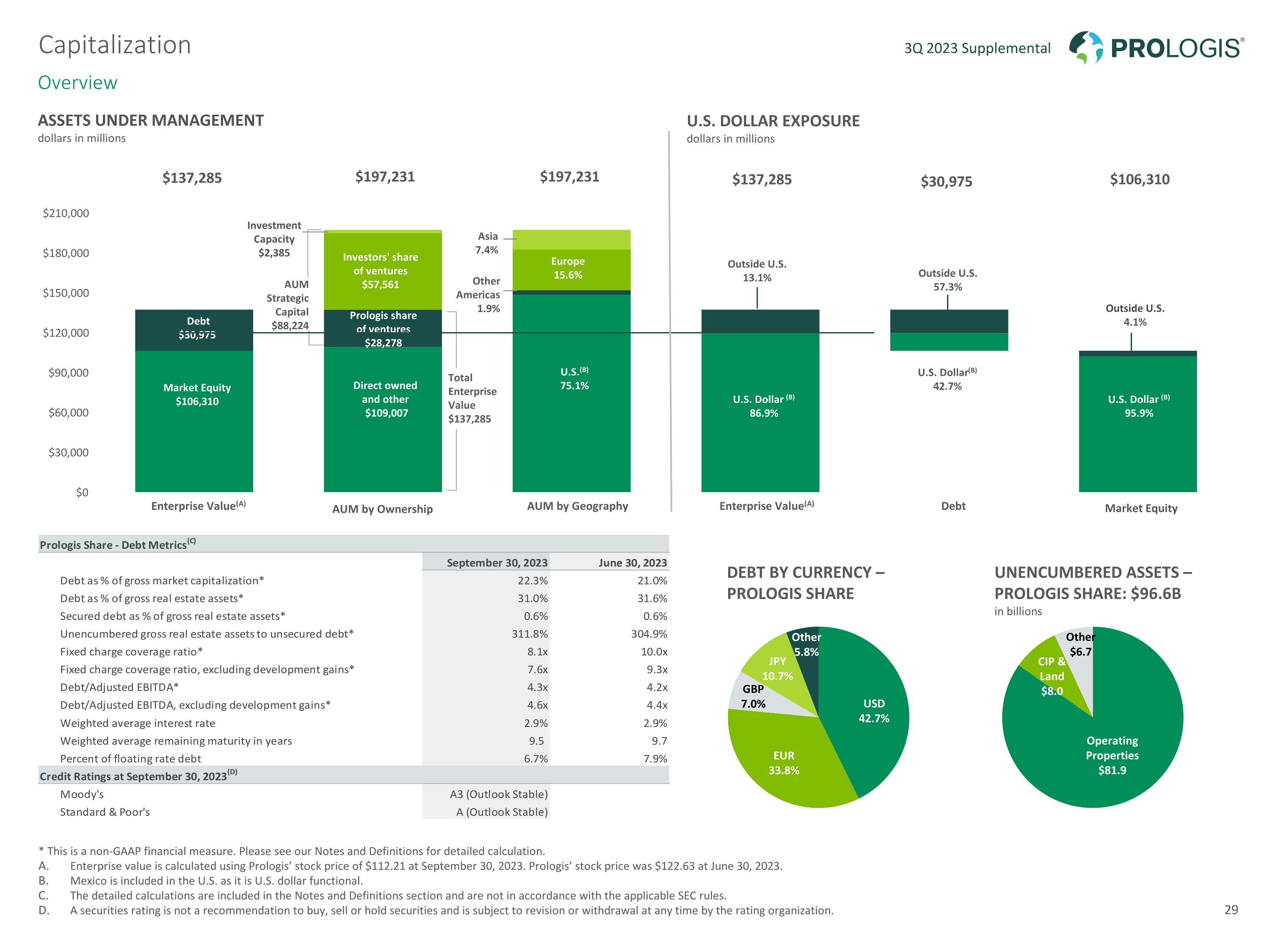

Europe 15.6% $137,285 $197,231 Debt $30,975 Investment Capacity $2,385 U.S.(B) 75.1% $197,231 Direct owned �and other $109,007 Market Equity $106,310 AUM Strategic Capital $88,224 Investors' share �of ventures $57,561 Prologis share �of ventures $28,278 Total Enterprise Value �$137,285 $137,285 U.S. Dollar (B) 95.9% Outside U.S. 4.1% Other Americas 1.9% $30,975 $106,310 Asia 7.4% Overview * This is a non-GAAP financial measure. Please see our Notes and Definitions for detailed calculation. Enterprise value is calculated using Prologis’ stock price of $112.21 at September 30, 2023. Prologis’ stock price was $122.63 at June 30, 2023. Mexico is included in the U.S. as it is U.S. dollar functional. The detailed calculations are included in the Notes and Definitions section and are not in accordance with the applicable SEC rules. A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time by the rating organization. 3Q 2023 Supplemental Capitalization ASSETS UNDER MANAGEMENT dollars in millions Enterprise Value(A) AUM by Geography Market Equity U.S. DOLLAR EXPOSURE dollars in millions Enterprise Value(A) Debt U.S. Dollar(B) 42.7% U.S. Dollar (B) 86.9% Outside U.S. 13.1% Outside U.S. 57.3% DEBT BY CURRENCY – PROLOGIS SHARE UNENCUMBERED ASSETS – PROLOGIS SHARE: $96.6B in billions 29 AUM by Ownership

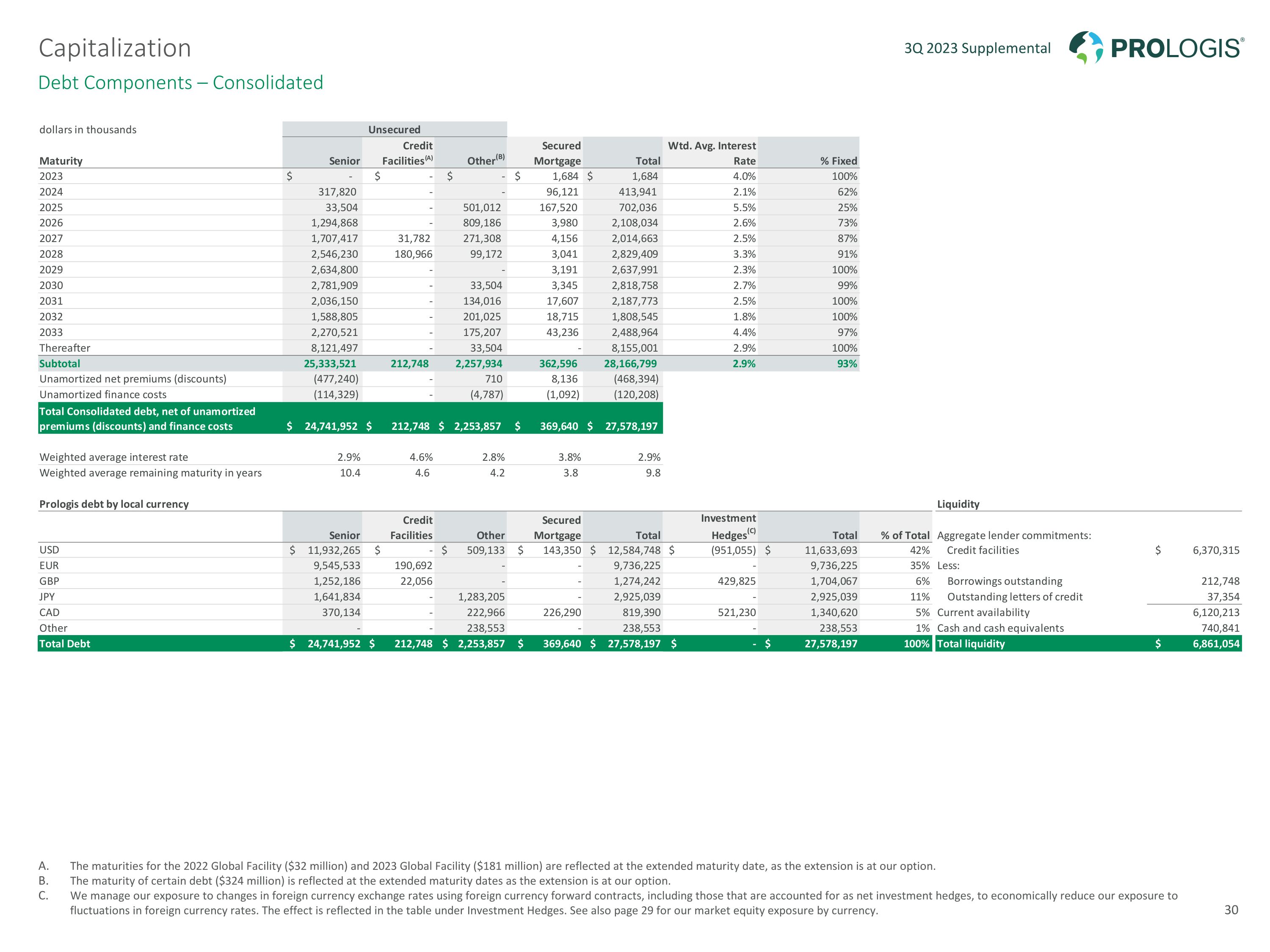

Debt Components – Consolidated The maturities for the 2022 Global Facility ($32 million) and 2023 Global Facility ($181 million) are reflected at the extended maturity date, as the extension is at our option. The maturity of certain debt ($324 million) is reflected at the extended maturity dates as the extension is at our option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 29 for our market equity exposure by currency. 3Q 2023 Supplemental Capitalization 30

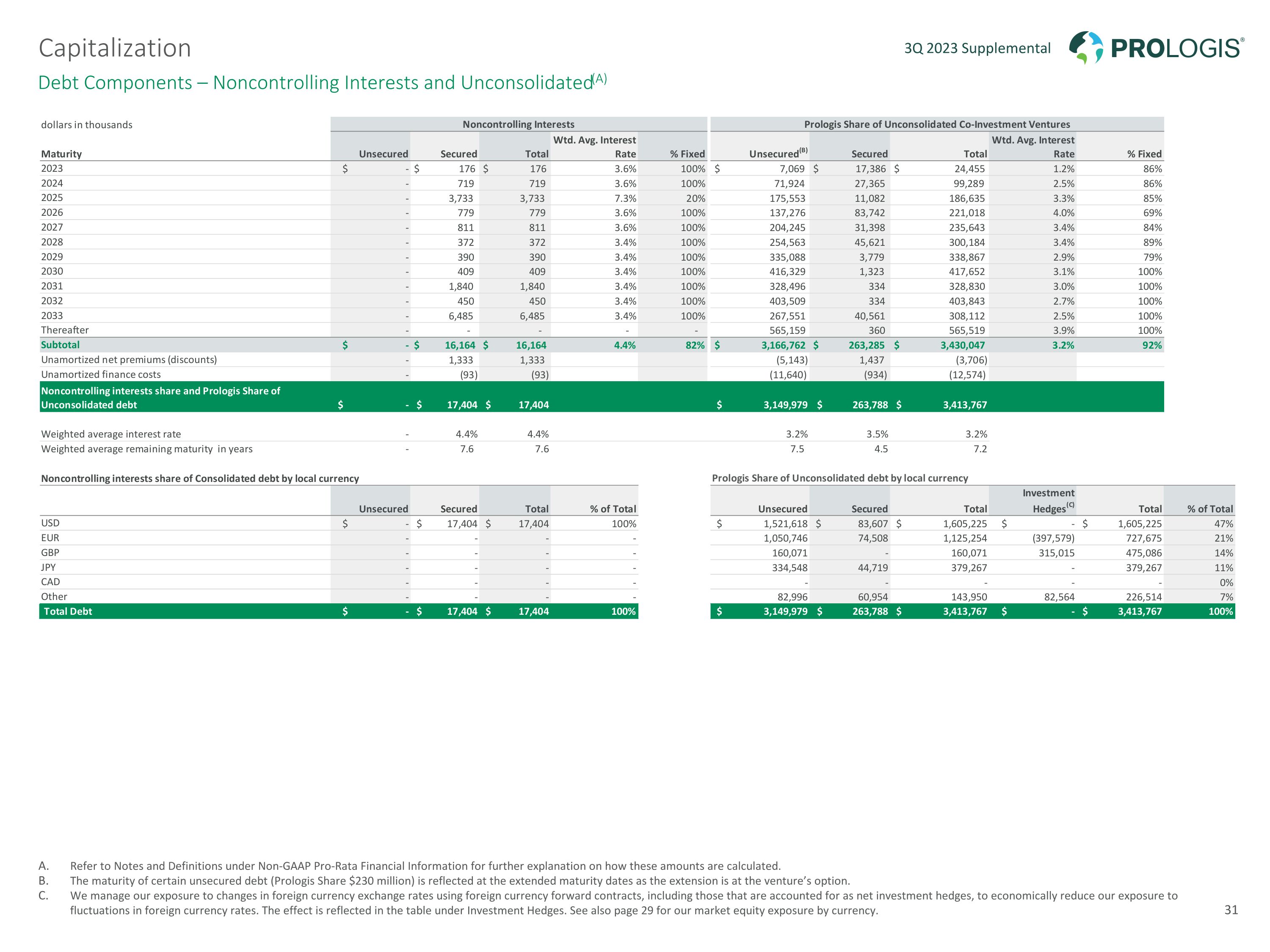

Debt Components – Noncontrolling Interests and Unconsolidated(A) Refer to Notes and Definitions under Non-GAAP Pro-Rata Financial Information for further explanation on how these amounts are calculated. The maturity of certain unsecured debt (Prologis Share $230 million) is reflected at the extended maturity dates as the extension is at the venture’s option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 29 for our market equity exposure by currency. 3Q 2023 Supplemental Capitalization 31

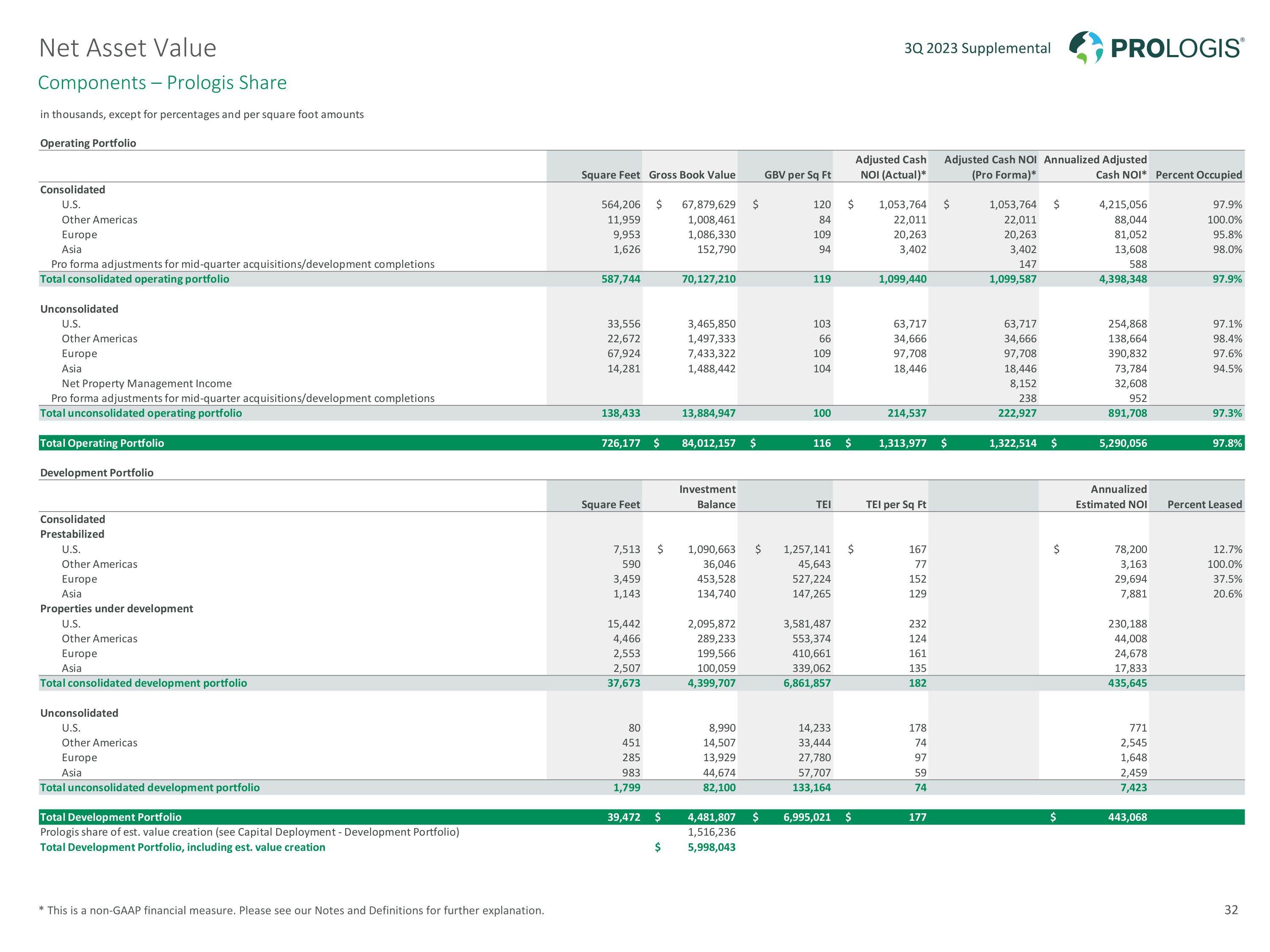

Components – Prologis Share * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 3Q 2023 Supplemental Net Asset Value 32

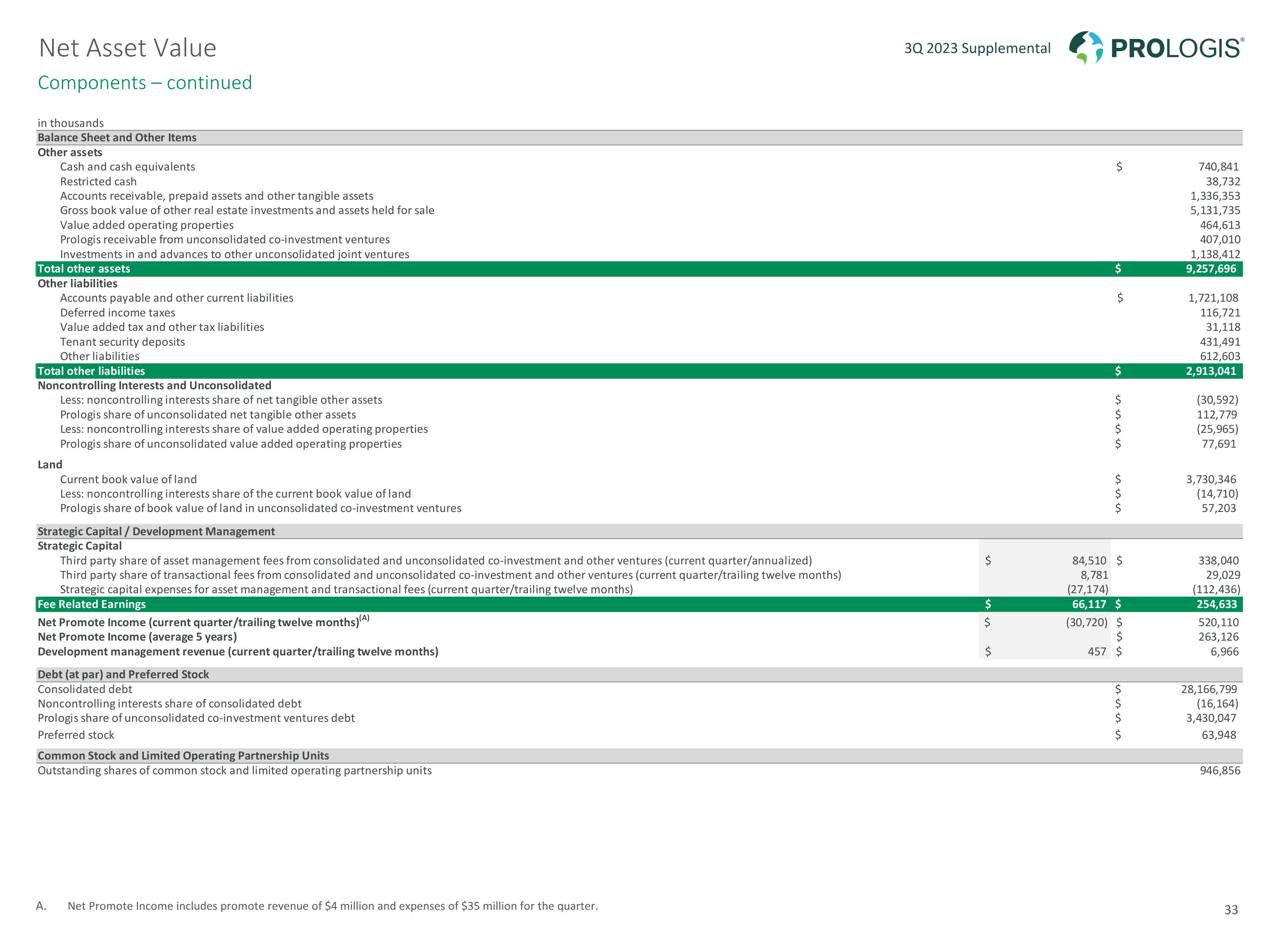

Components – continued Net Promote Income includes promote revenue of $4 million and expenses of $35 million for the quarter. 3Q 2023 Supplemental Net Asset Value 33

Notes and Definitions 3Q 2023 Supplemental Tres Rios, Mexico City, Mexico

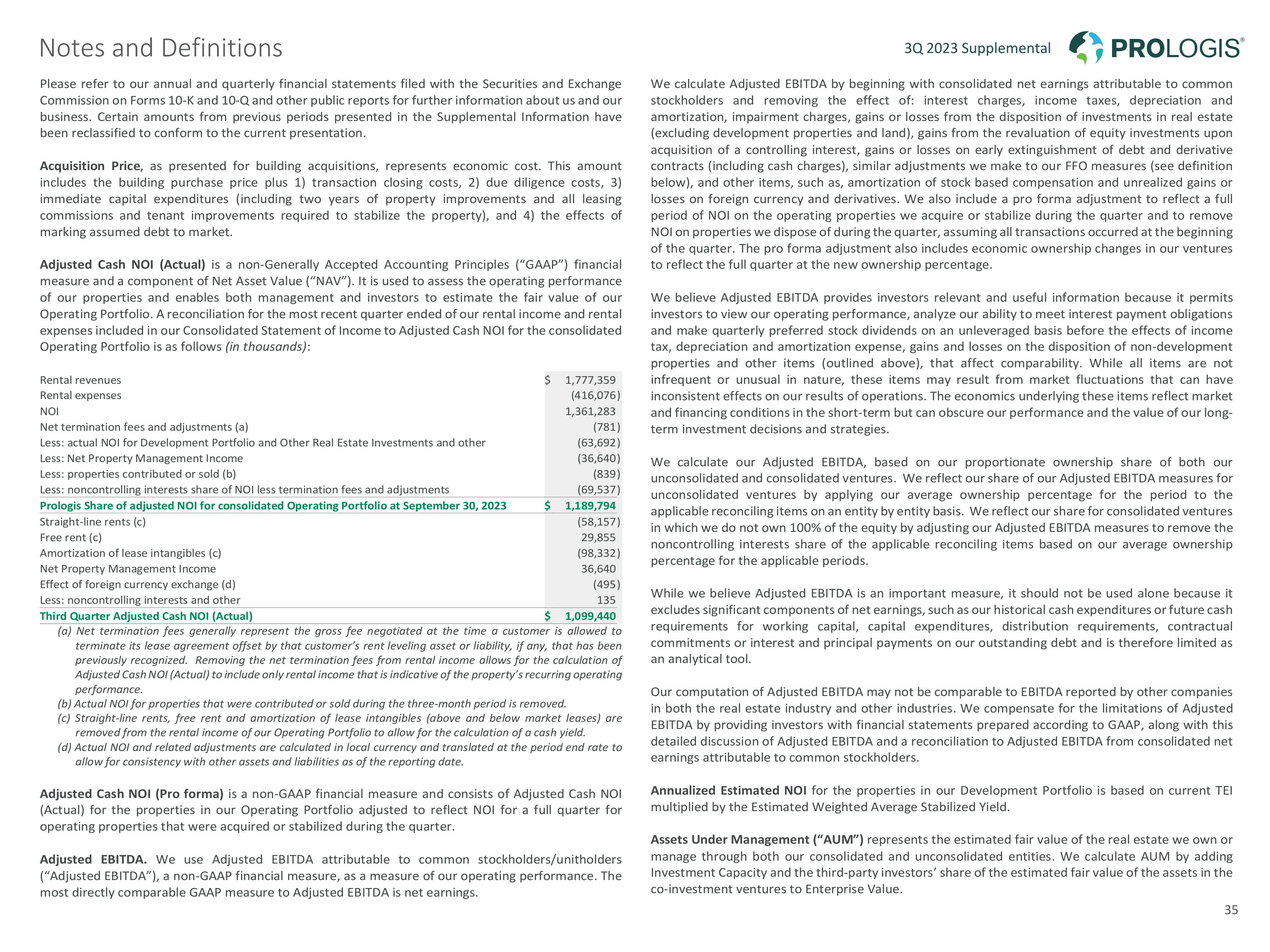

3Q 2023 Supplemental Notes and Definitions 35

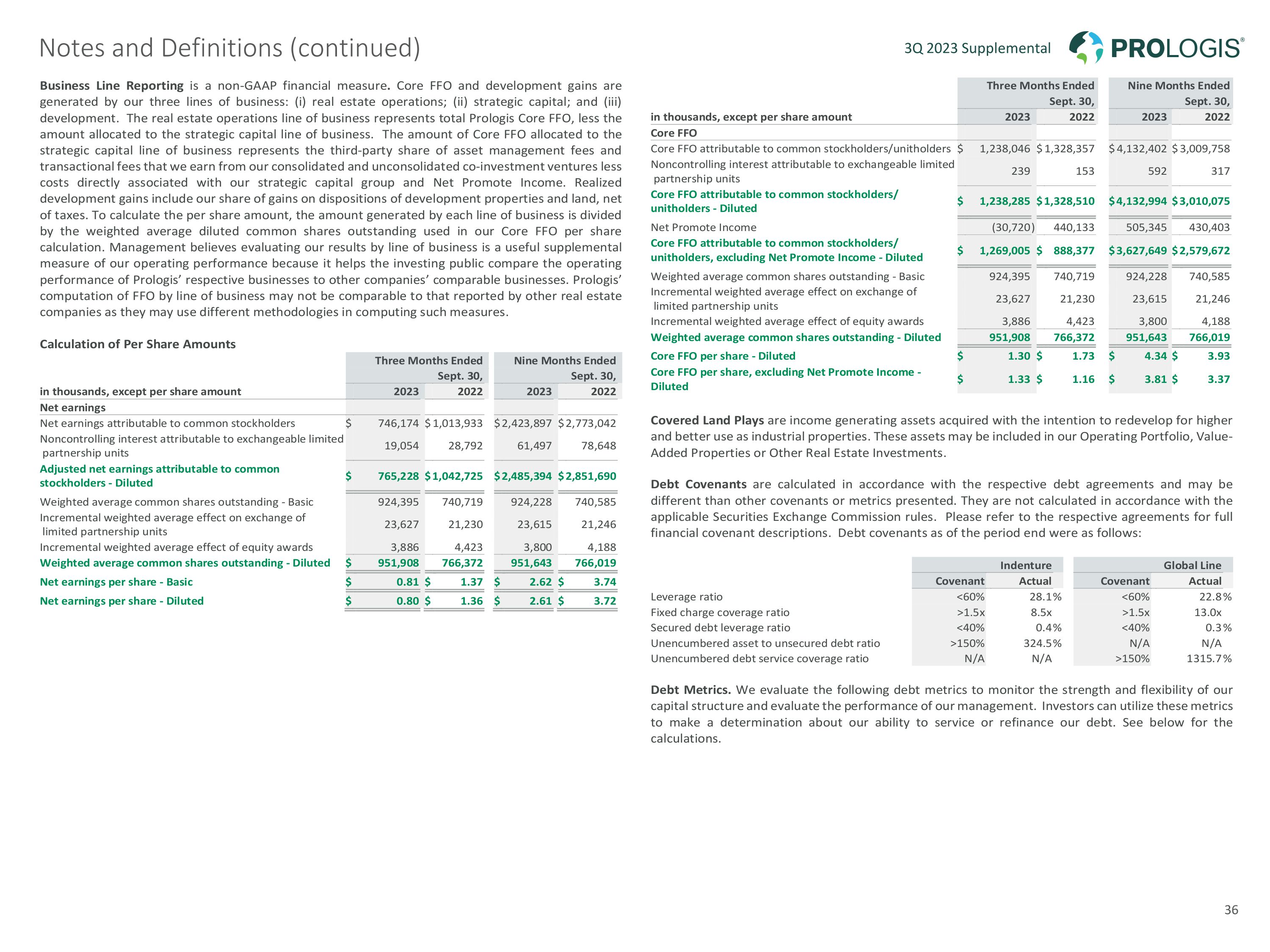

3Q 2023 Supplemental Notes and Definitions (continued) 36

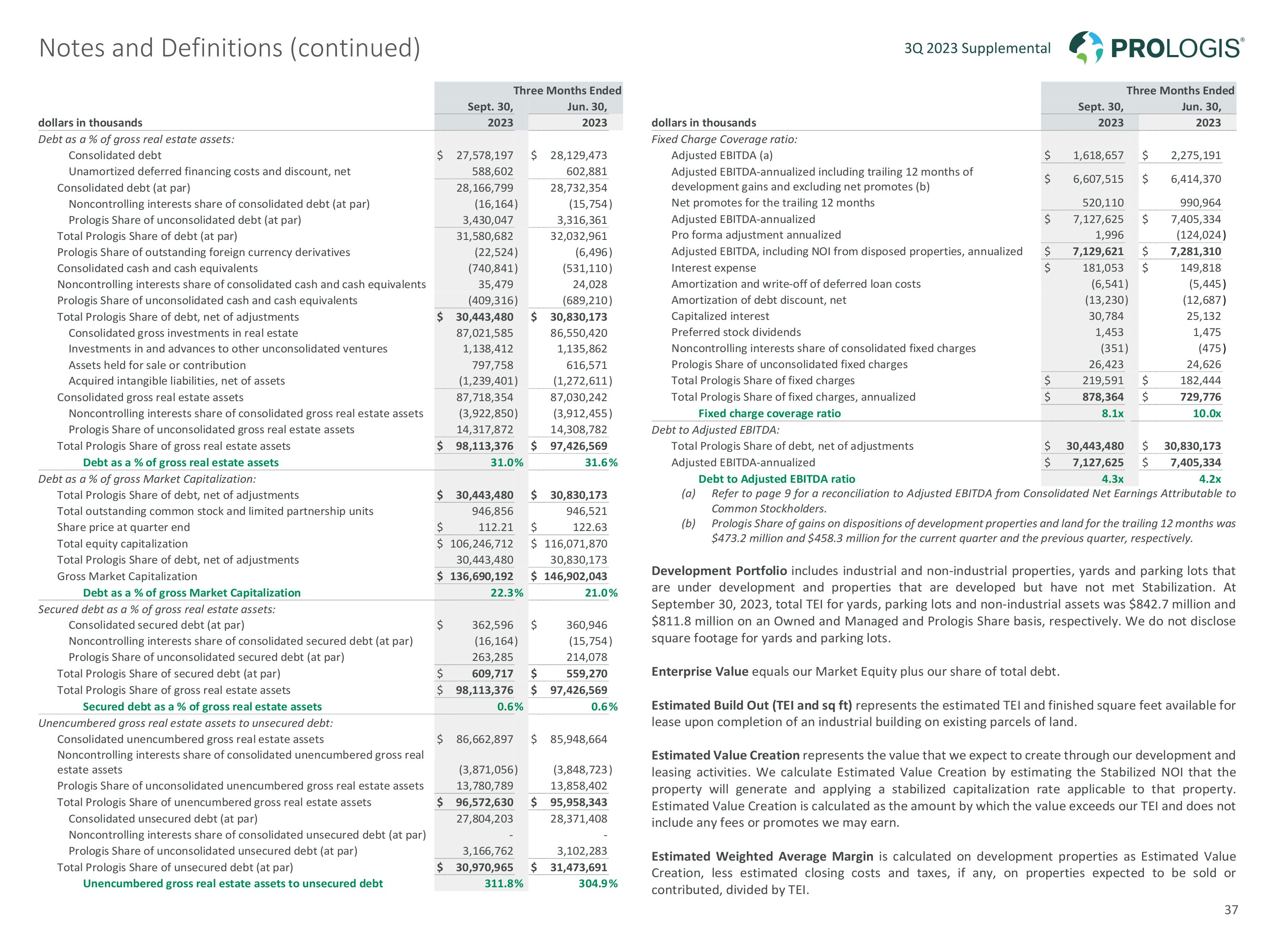

3Q 2023 Supplemental Notes and Definitions (continued) 37

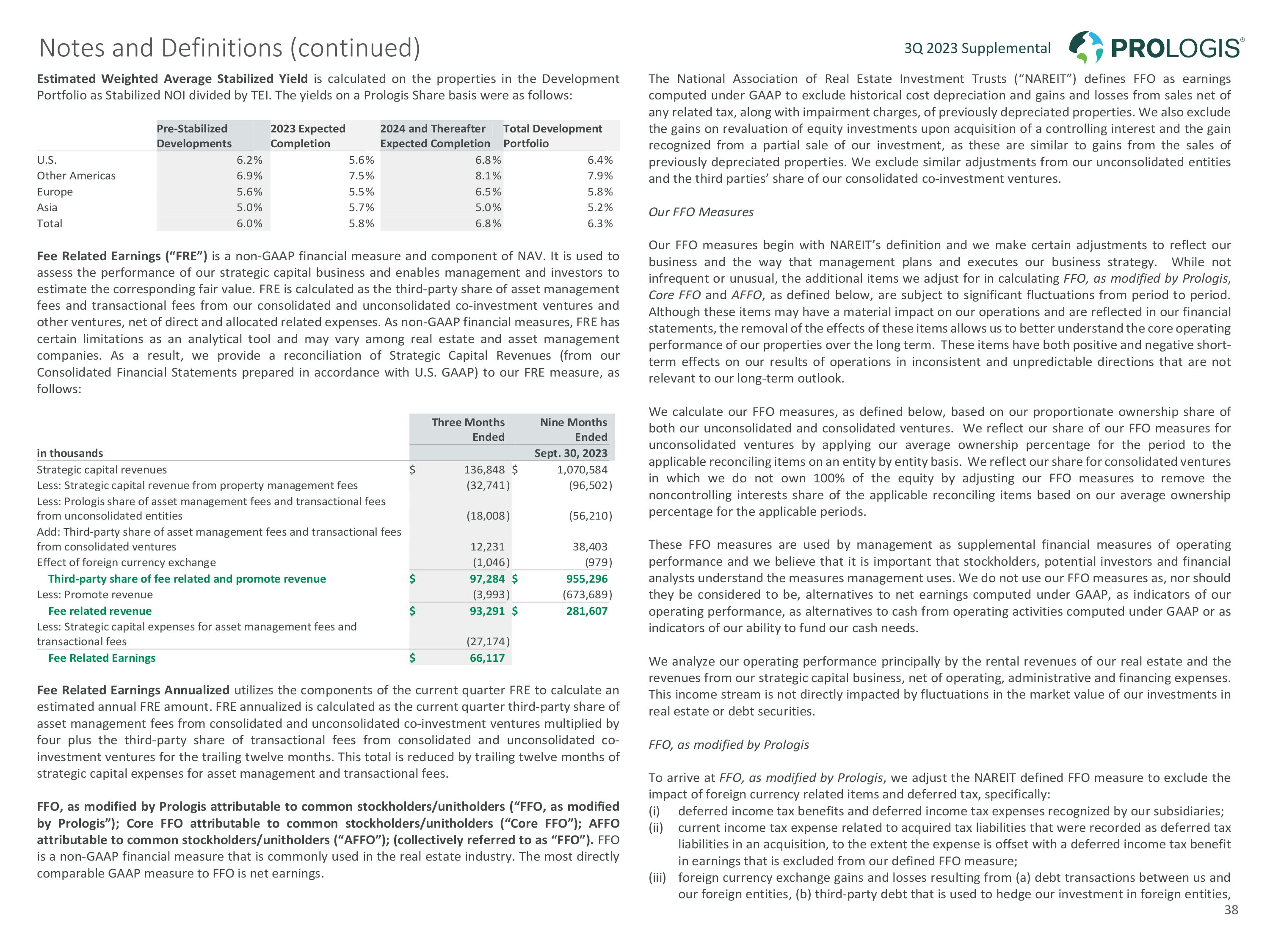

3Q 2023 Supplemental Notes and Definitions (continued) 38

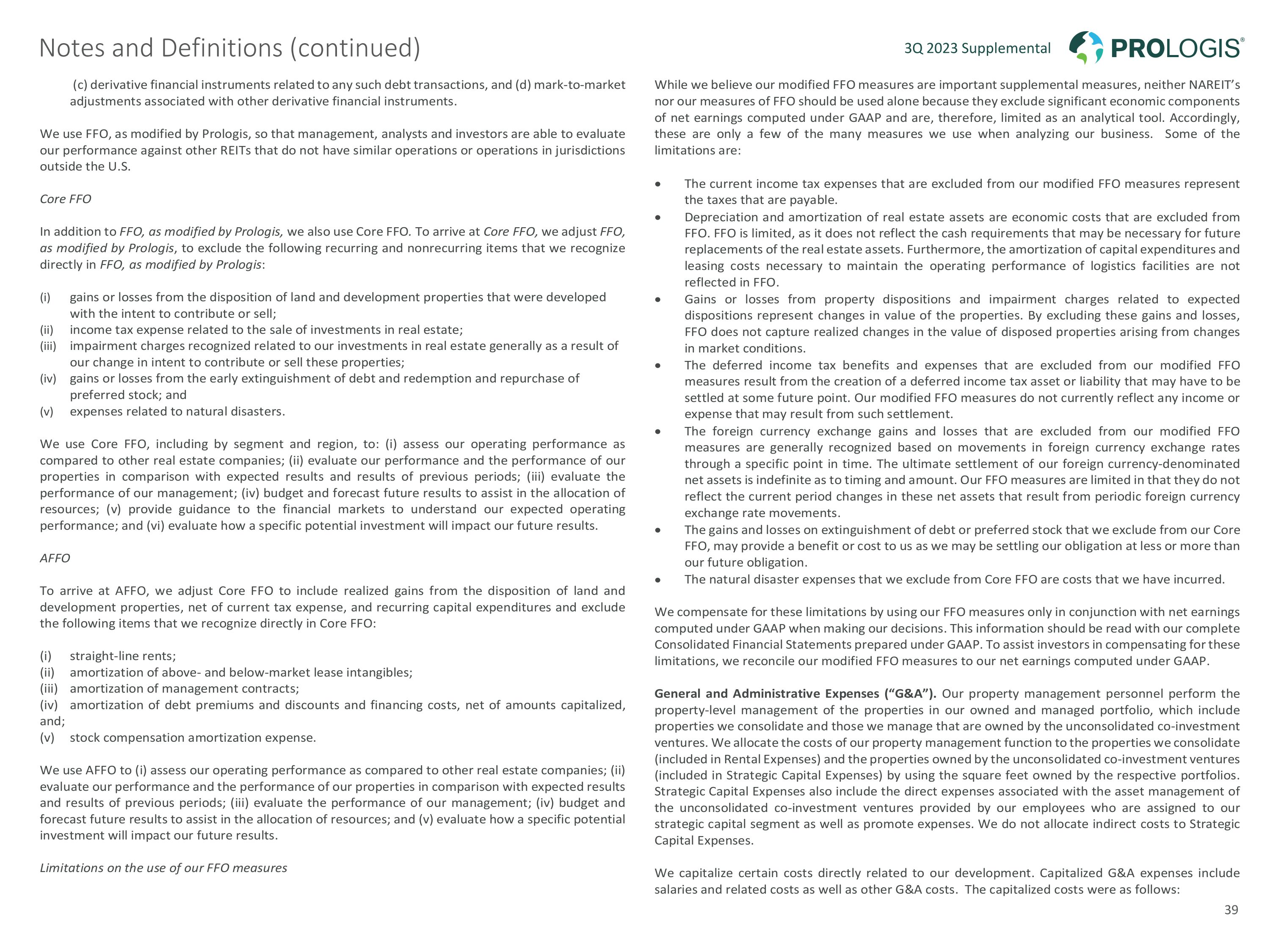

3Q 2023 Supplemental Notes and Definitions (continued) 39

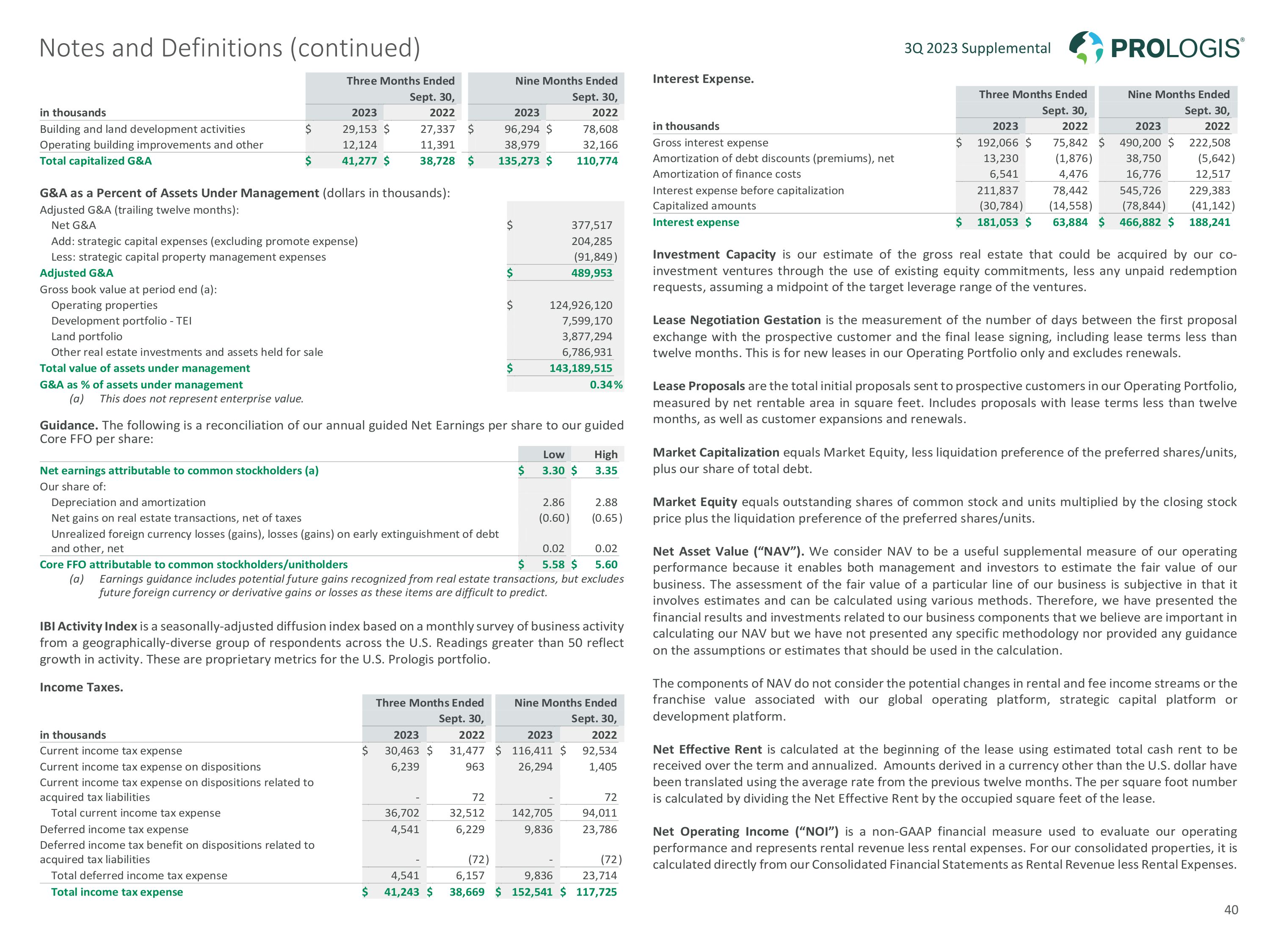

3Q 2023 Supplemental Notes and Definitions (continued) 40

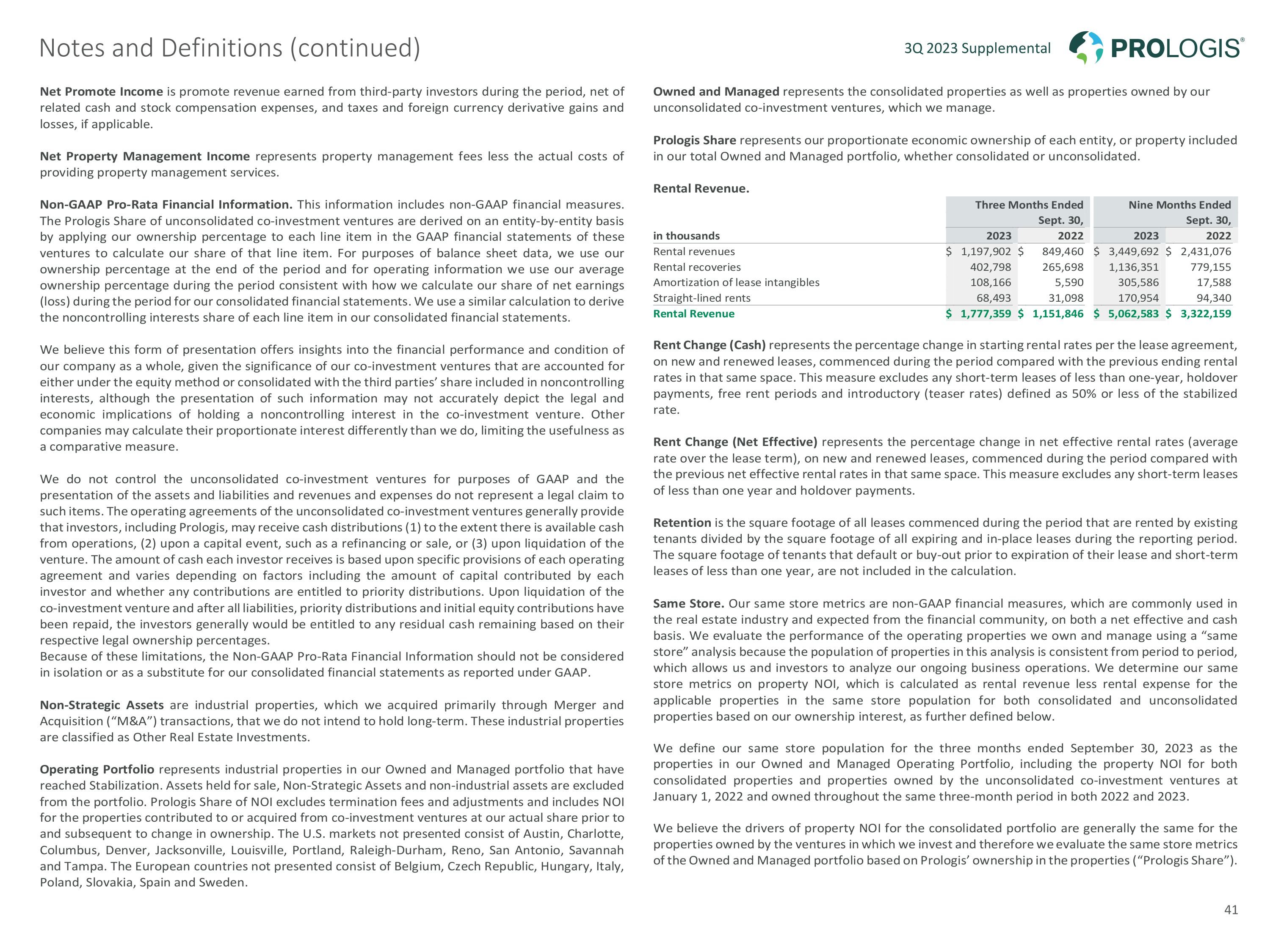

3Q 2023 Supplemental Notes and Definitions (continued) 41

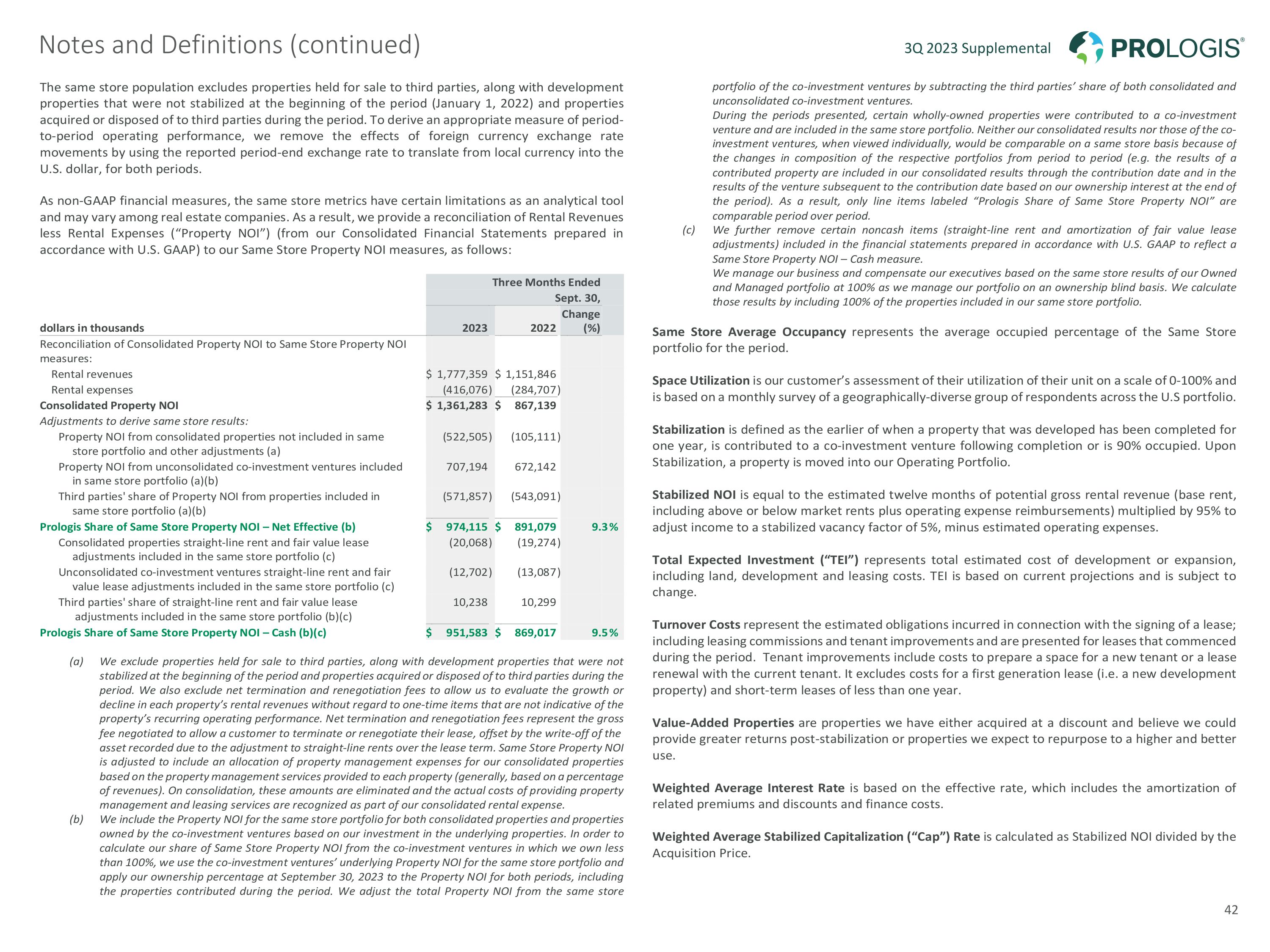

3Q 2023 Supplemental Notes and Definitions (continued) 42

FOR IMMEDIATE RELEASE

Prologis Reports Third Quarter 2023 Results

High-Quality Global Portfolio Continues to Drive Record Results

SAN FRANCISCO (October 17, 2023) – Prologis, Inc. (NYSE: PLD), the global leader in logistics real estate, today reported third quarter results for 2023.

Net earnings per diluted share was $0.80 for the third quarter of 2023 compared with $1.36 for the third quarter of 2022. Core funds from operations (Core FFO)* per diluted share was $1.30 for the third quarter of 2023, compared with $1.73 for the same period in 2022. Core FFO, excluding Net Promote Income* per diluted share for the third quarter of 2023 was $1.33 compared with $1.16 for the third quarter of 2022.

“Our results reflect strong execution by our team and the quality of our global portfolio,” said Hamid R. Moghadam, co-founder and CEO, Prologis. “That said, until there is more stability in the economy, negative customer sentiment will weigh on demand. We remain focused on capturing our embedded lease mark-to-market, building out our land bank into a favorable future supply environment, and partnering with our customers to address their most critical pain points.”

OPERATING PERFORMANCE

|

|

|

Owned & Managed |

3Q23 |

Notes |

Average Occupancy |

97.1% |

|

Leases Commenced |

46.4MSF |

42.3MSF operating portfolio and 4.1MSF development portfolio |

Retention |

76.8% |

|

|

|

|

Prologis Share |

3Q23 |

Notes |

Cash Same Store NOI* |

9.5% |

|

Net Effective Rent Change |

84.0% |

All-time high; Led by U.S. at 96.6% |

Cash Rent Change |

54.2% |

All-time high; Led by U.S. at 63.1% |

1

DEPLOYMENT ACTIVITY

|

|

Prologis Share |

3Q23 |

Acquisitions |

$66M |

Weighted avg stabilized cap rate (excluding other real estate) |

4.1% |

Development Stabilizations |

$456M |

Estimated weighted avg yield |

6.4% |

Estimated weighted avg margin |

25.8% |

Estimated value creation |

$118M |

% Build-to-suit |

10.9% |

Development Starts |

$943M |

Estimated weighted avg yield |

7.4% |

Estimated weighted avg margin |

28.1% |

Estimated value creation |

$265M |

% Build-to-suit |

72.6% |

Total Dispositions and Contributions |

$486M |

Weighted avg stabilized cap rate (excluding land and other real estate) |

4.6% |

BALANCE SHEET STRENGTH & LIQUIDITY

“We have worked hard and with discipline to build an industry-leading balance sheet, which we continue to manage prudently,” said Timothy D. Arndt, chief financial officer, Prologis. “Incredibly, our balance sheet has only strengthened over the last year in terms of coverage and liquidity, something we're very proud of and allows us to be opportunistic amidst challenging markets."

During the third quarter, Prologis and its co-investment ventures issued an aggregate of $1.4 billion of debt at a weighted average interest rate of 3.2%, and a weighted average term of 5.9 years.

At September 30, 2023, debt as a percentage of total market capitalization was 22.3%, and the company’s weighted average interest rate on its share of total debt was 2.9%, with a weighted average term of 9.5 years. In addition, the company has no significant debt maturities until 2026.

FOREIGN CURRENCY STRATEGY

Prologis hedges its exposure to foreign currency fluctuations by borrowing in the currencies in which it invests and using derivative financial instruments. At September 30, 2023, 96% of Prologis’ equity was in USD and forecasted earnings for 2023, 2024 and 2025 were 99%, 99% and 98%, respectively, in USD or hedged through derivative contracts.

2

PROLOGIS INVESTOR FORUM 2023

Join Prologis leaders for an Investor Forum at the New York Stock Exchange on Wednesday, December 13th. Prologis is at the forefront of one of the most complex and exciting transitions in history – driving innovation and partnering with customers to stay ahead of what’s next. We invite you to hear from Prologis’ senior management team as they take you inside our business and explore the opportunities shaping its future. Register now to attend live in New York or via online broadcast.

2023 GUIDANCE

Prologis’ guidance for net earnings is included in the table below as well as guidance for Core FFO*, which are reconciled in our supplemental information.

2023 GUIDANCE

Earnings (per diluted share) Previous Revised Change at M.P.

|

|

|

|

Net earnings attributable to common stockholders |

$3.30 to $3.40 |

$3.30 to $3.35 |

$(0.025) |

Core FFO attributable to common stockholders/unitholders* |

$5.56 to $5.60 |

$5.58 to $5.60 |

$0.010 |

Core FFO attributable to common stockholders/unitholders, excluding Net Promote Income* |

$5.06 to $5.10 |

$5.08 to $5.10 |

$0.010 |

Operations

|

|

|

|

Average occupancy |

97.00% to 97.50% |

97.25% to 97.50% |

12.5 bps |

Cash Same Store NOI* - PLD share |

9.50% to 10.00% |

9.75% to 10.00% |

12.5 bps |

Strategic Capital (in millions) Previous Revised Change at M.P.

|

|

|

|

Strategic Capital revenue, excluding promote revenue |

$520 to $530 |

$520 to $530 |

- |

Net Promote Income |

$475 |

$475 |

- |

G&A (in millions)

|

|

|

|

General & administrative expenses |

$380 to $390 |

$390 to $395 |

$7.5 |

Capital Deployment – Prologis Share (in millions)

|

|

|

|

Development stabilizations |

$2,600 to $3,000 |

$2,600 to $3,000 |

- |

Development starts |

$2,500 to $3,000 |

$3,000 to $3,500 |

$500 |

Acquisitions1 |

$300 to $600 |

$500 to $800 |

$200 |

Contributions |

$1,250 to $1,750 |

$1,200 to $1,300 |

$(250) |

Dispositions |

$800 to $1,200 |

$500 to $1,000 |

$(250) |

Net sources/(uses)1 |

$(750) to $(650) |

$(1,800) to $(2,000) |

$(1,200) |

Realized development gains |

$300 to $400 |

$425 to $475 |

$100 |

* This is a non-GAAP financial measure. See the Notes and Definitions in our supplemental information for further explanation and a reconciliation to the most directly comparable GAAP measure.

1. Excludes the $3.1 billion portfolio acquisition which closed on June 29, 2023.

The earnings guidance described above includes potential gains recognized from real estate transactions but excludes any future or potential foreign currency or derivative gains or losses as our guidance assumes constant foreign currency rates. In reconciling from net earnings to Core FFO*, Prologis makes certain adjustments, including but not limited to real estate depreciation and amortization expense, gains (losses) recognized from real estate transactions and early extinguishment of debt, impairment charges, deferred taxes and unrealized gains or losses on foreign currency or derivative activity. The difference between the company's Core FFO* and net

3

earnings guidance for 2023 relates predominantly to these items. Please refer to our quarterly Supplemental Information, which is available on our Investor Relations website at https://ir.prologis.com and on the SEC’s website at www.sec.gov for a definition of Core FFO* and other non-GAAP measures used by Prologis, along with reconciliations of these items to the closest GAAP measure for our results and guidance.

OCTOBER 17, 2023, CALL DETAILS

The call will take place on Tuesday, October 17, 2023, at 9:00 a.m. PT/12:00 p.m. ET. To access a live broadcast of the call, please dial +1 (877) 897-2615 (toll-free from the United States and Canada) or +1 (201) 689-8514 (from all other countries). A live webcast can be accessed from the Investor Relations section of www.prologis.com.

A telephonic replay will be available October 17 – October 31 at +1 (877) 660-6853 (from the United States and Canada) or +1 (201) 612-7415 (from all other countries) using access code 13741600. The webcast replay will be posted in the Investor Relations section of www.prologis.com under "Events & Presentations."

ABOUT PROLOGIS

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At September 30, 2023, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (114 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 6,700 customers principally across two major categories: business-to-business and retail/online fulfillment.

FORWARD-LOOKING STATEMENTS

The statements in this document that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which we operate as well as management's beliefs and assumptions. Such statements involve uncertainties that could significantly impact our financial results. Words such as "expects" "anticipates," "intends," "plans," "believes," "seeks," and "estimates" including variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future—including statements relating to rent and occupancy growth, acquisition and development activity, contribution and disposition activity, general conditions in the geographic areas where we operate, our debt, capital structure and financial position, our ability to earn revenues from co-investment ventures, form new co-investment ventures and the availability of capital in existing or new co-investment ventures—are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and, therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) international, national, regional and local economic and political climates and conditions; (ii) changes in global financial markets, interest rates and foreign currency exchange rates; (iii) increased or unanticipated competition for our properties; (iv) risks associated with acquisitions, dispositions and development of properties, including the integration of the operations of significant real estate portfolios; (v) maintenance of Real Estate Investment Trust status, tax structuring and changes in income tax laws and rates; (vi) availability of financing and capital, the levels of debt that we maintain and our credit ratings; (vii) risks related to our investments in our co-investment ventures, including our ability to establish new co-investment ventures; (viii) risks of doing business internationally, including currency

4

risks; (ix) environmental uncertainties, including risks of natural disasters; (x) risks related to global pandemics; and (xi) those additional factors discussed in reports filed with the Securities and Exchange Commission by us under the heading "Risk Factors." We undertake no duty to update any forward-looking statements appearing in this document except as may be required by law.

CONTACTS

Investors: Jill Sawyer, +1 (415) 733-9526, jsawyer@prologis.com, San Francisco

Media: Jennifer Nelson, +1 (415) 733-9409, jnelson2@prologis.com, San Francisco

5

v3.23.3

Cover

|

Oct. 17, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 17, 2023

|

| Entity File Number |

001-13545

|

| Entity Registrant Name |

Prologis, Inc.

|

| Entity Central Index Key |

0001045609

|

| Entity Tax Identification Number |

94-3281941

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

Pier 1

|

| Entity Address, Address Line Two |

Bay 1

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94111

|

| City Area Code |

415

|

| Local Phone Number |

394-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

PLD

|

| Security Exchange Name |

NYSE

|

| Prologis LP [Member] |

|

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 17, 2023

|

| Entity File Number |

001-14245

|

| Entity Registrant Name |

Prologis, L.P.

|

| Entity Central Index Key |

0001045610

|

| Entity Tax Identification Number |

94-3285362

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Pier 1

|

| Entity Address, Address Line Two |

Bay 1

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94111

|

| City Area Code |

415

|

| Local Phone Number |

394-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Prologis LP [Member] | Notes 3.000 Percent Due 2026 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.000% Notes due 2026

|

| Trading Symbol |

PLD/26

|

| Security Exchange Name |

NYSE

|

| Prologis LP [Member] | Notes 2.250 Percent Due 2029 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.250% Notes due 2029

|

| Trading Symbol |

PLD/29

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=pld_PrologisLPMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pld_Note3000PercentDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pld_Notes2250PercentDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

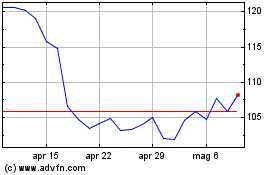

Grafico Azioni Prologis (NYSE:PLD)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Prologis (NYSE:PLD)

Storico

Da Mag 2023 a Mag 2024