0001519401false00015194012024-02-232024-02-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 23, 2024 |

Regional Management Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35477 |

57-0847115 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

979 Batesville Road, Suite B |

|

Greer, South Carolina |

|

29651 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (864) 448-7000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.10 par value |

|

RM |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

A copy of the presentation to be used by management of Regional Management Corp. (the “Company”) in meetings with bankers, investors, and others commencing on February 26, 2024 is attached to this Current Report on Form 8-K as Exhibit 99.1 and is also available at the Company’s website at www.regionalmanagement.com.

The information set forth in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. The information in this Item 7.01 of this Current Report on Form 8-K shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Regional Management Corp. |

|

|

|

|

Date: |

February 23, 2024 |

By: |

/s/ Harpreet Rana |

|

|

|

Harpreet Rana

Executive Vice President and Chief Financial Officer |

SFVegas Presentation February 2024

Legal Disclosures 2 This document contains summarized information concerning Regional Management Corp. (the “Company”) and the Company’s business, operations, financial performance, and trends. No representation is made that the information in this document is complete. For additional financial, statistical, and business information, please see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available on the Company’s website (www.regionalmanagement.com) and on the SEC’s website (www.sec.gov). The information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. This presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent the Company’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning financial outlook or future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of the Company. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on such statements. Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: managing growth effectively, implementing Regional Management's growth strategy, and opening new branches as planned; Regional Management's convenience check strategy; Regional Management's policies and procedures for underwriting, processing, and servicing loans; Regional Management's ability to collect on its loan portfolio; Regional Management's insurance operations; exposure to credit risk and repayment risk, which risks may increase in light of adverse or recessionary economic conditions; the implementation of evolving underwriting models and processes, including as to the effectiveness of Regional Management’s custom scorecards; changes in the competitive environment in which Regional Management operates or a decrease in the demand for its products; the geographic concentration of Regional Management's loan portfolio; the failure of third-party service providers, including those providing information technology products; changes in economic conditions in the markets Regional Management serves, including levels of unemployment and bankruptcies; the ability to achieve successful acquisitions and strategic alliances; the ability to make technological improvements as quickly as competitors; security breaches, cyber-attacks, failures in information systems, or fraudulent activity; the ability to originate loans; reliance on information technology resources and providers, including the risk of prolonged system outages; changes in current revenue and expense trends, including trends affecting delinquencies and credit losses; any future public health crises (including the resurgence of COVID-19), including the impact of such crisis on our operations and financial condition; changes in operating and administrative expenses; the departure, transition, or replacement of key personnel; the ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support Regional Management's operations and initiatives; changes in interest rates; existing sources of liquidity may become insufficient or access to these sources may become unexpectedly restricted; exposure to financial risk due to asset-backed securitization transactions; risks related to regulation and legal proceedings, including changes in laws or regulations or in the interpretation or enforcement of laws or regulations; changes in accounting standards, rules, and interpretations and the failure of related assumptions and estimates; the impact of changes in tax laws and guidance, including the timing and amount of revenues that may be recognized; risks related to the ownership of Regional Management's common stock, including volatility in the market price of shares of Regional Management's common stock; the timing and amount of future cash dividend payments; and anti-takeover provisions in Regional Management's charter documents and applicable state law. The foregoing factors and others are discussed in greater detail in the Company's filings with the SEC. The Company will not update or revise forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law.

Company Overview

4 Company Overview Founded 1987 NYSE Listed: RM 346 branches 19 states Total receivables of $1.77 billion Multi-channel marketing: branches, digital, and direct mail Legacy States (prior to 2021) 2021 New States (IL, UT) 2022 New States (MS, IN, CA, LA) Potential Future State Expansion Geographic footprint and net finance receivables as of 12/31/2023 Diversified consumer finance company operating under the name “Regional Finance” Provide installment loan products primarily to customers with limited access to consumer credit from banks, thrifts, credit card companies, and other lenders Goal to consistently grow finance receivables and soundly manage portfolio risk, while providing customers with attractive, safe, easy-to-understand loan products serving their varied financial needs 2023 New States (AZ) (ID – entered digitally in 2022 and branch in 2023)

Growth Strategy 5 Geographic Expansion Accelerated Innovation Product and Channel Expansion Identified states with favorable economics for expansion Continue to identify opportunities to optimize branch network within existing footprint Continue to drive scale using centralized originations and servicing Deploy new technology to further omni-channel experience Leverage data and analytics to improve credit underwriting, customer acquisition and retention, and back-office capabilities Execute on distribution of larger auto-secured loans and E2E originations Assess new product offerings in the marketplace National scale should enable additional strategic partnerships

Investment Highlights Strong balance sheet supports capital returns Geographic, product, and channel expansion drive growth Omni-channel growth strategy with abundant market opportunity Controlled growth with stable credit using advanced credit tools Modern infrastructure and digital capabilities Deep management experience through credit cycles High customer satisfaction and loyalty Scale, digital capabilities, and lighter footprint will drive operating leverage 6

7 Financial Results In millions In millions Continued growth in account base and portfolio in controlled and profitable manner Digital initiatives, new state expansion, and new product development have driven strong growth Enhanced prequalification capabilities and tighter integration with digital affiliate partners drive better digital leads Branch consolidations and our new-state, lighter-footprint strategy with larger branches are driving better efficiencies through higher ENR per branch Net income in millions

Abundant Total Addressable Market 8 Approximately 72 million Americans generally align with Regional’s customer base (1)(3) $91 billion market opportunity – RM has less than 2% market share and increased our addressable market by over 80% since 2020; still significant runway for growth $4.7 Trillion Consumer Finance Market (2) 28% of US Population with FICO Between 550 & 700 (3) Personal Installment Loans Account for ~$91 billion (1) Adult US Population sourced from US Census Bureau www.census.gov/library/stories/2021/08/united-states-adult-population-grew-faster-than-nations-total-population-from-2010-to-2020.html Sourced from Equifax US National Consumer Credit Trends Report; June 2023 Sourced from Arkali, Can. “Average U.S. FICO® Score Stays Steady at 716” FICO.com, 30 Aug. 2022, www.fico.com/blogs/average-us-fico-score-stays-steady-716-missed-payments-and-consumer-debt-rises Student Loans (31%) Auto Loans (34%) Credit Cards (21%) Other (11%) Personal Lending (3%)

Our Customer 9 Average Age (2) 55 Years Annual Income (2) $51,000 Some College or Advanced Degree (1) 54% Net promoter score of 64 representing our customers’ strong loyalty and willingness to recommend our products to others (1) 90%+ favorable ratings for key attributes (1): Loan process was quick, easy, and understandable People are professional, responsive, respectful, knowledgeable, helpful, and friendly 89% of customers would apply to Regional Finance first the next time they need a loan Continued investment in digital channels, remote servicing options, and laser focus on delivering a positive customer experience has allowed us to maintain strong metrics Origination Needs (1) Demographics Top-Notch Customer Service (1) Fall 2023 Customer Satisfaction Survey (performed by third-party and commissioned by RM) (2) Data as of 12/31/2023

Product Offering 10 Multi-Channel Acquisition Small Loans Large Loans In Branch $947.8MM Originated 68% Large/32% Small Direct Mail $418.9MM Originated Convenience Check Loans Digital $168.3MM Originated Digital Lead Generation Partnership Affiliates Customer Need Short-term cash needs Bill payment Back-to-school expenses Auto repair Characteristics Size: $500 to $2,500 Average Origination: ~$2,100 Average Origination APR: 45.2% Portfolio Outstanding Balance: $493.5MM # of Loans: 289,300 Customer Need Debt consolidation Medical expenses Home repairs Characteristics Size: $2,501 to $25,000 Average Origination: ~$5,800 Average Origination APR: 29.7% Portfolio Outstanding Balance: $1,274.1MM # of Loans: 246,600 Originations and portfolio metrics YTD and as of 12/31/2023

Originations Lower from Credit Tightening Year-over-year growth rate reduced from credit tightening actions; originations were more concentrated on programs to present and former borrowers, which perform better than new borrowers 4Q 23 direct mail, digital and branch originations were down year-over-year 21.8%, 16.4%, and 8.1%, respectively, from tightened credit and focus on present and former borrowers Originations 11 Controlled Portfolio Growth Record ENR of $1.8 billion, including highest level of small loans at $493 million Generated sequential portfolio growth of $20 million (inclusive of $16 million reduction from loan sale), or 1.2%, in 4Q 23 Achieved year-over-year loan growth of $72 million, or 4.2%, in 4Q 23, down from 19.2% in 4Q 22 due to credit tightening for disciplined growth As of December 31, 2023, 84% of our portfolio carried an APR at or below 36%, down from 86% as of the prior year-end, as we grew our small loan portfolio by $49 million over the last two quarters In millions In millions

Funding

Evolution of Regional Management Funding 1987 2007 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 RM Founded in South Carolina RM Enters Texas Private Equity Invests in RM RM Operates in 5 States (SC, TX, NC, TN, AL) RM Enters Oklahoma RM Closes Initial Public Offering RM Enters Georgia and Private Equity Exits Ownership Portfolio Reaches $500 Million in Size RM Closes $75 Million Amortizing Loan Facility RM Closes $125 Million Warehouse Facility RM Completes System Migration and Closes on First Securitization Portfolio Reaches $1 Billion in Size $125 Million Bilateral Warehouse Facilities and Private ABS Regional Management has operated successfully through multiple credit cycles 13 Custom Scorecards Deployed Next-Gen Scorecards Deployed 2023 RM Closes Two $75 Million Warehouse Facilities RM Closes Initial Public Offering and Enters New Mexico RM Enters Missouri and Wisconsin Custom Scorecards Deployed End to End Digital Pilot RM Closes on First $150 Million Securitization RM Closes on $130 Million Securitization RM Closes on $130 Million Securitization RM Closes on $180 Million Securitization RM Closes on $249 Million Securitization RM Closes on $200 Million Securitization RM Closes on $250 Million Securitization RM Closes on $184 Million Securitization

Diversified Liquidity Profile Long history of liquidity support from a strong group of banking partners Diversified funding platform with a senior revolving facility, warehouse facilities, and securitizations 14 (1) Based on the February 2024 senior revolver renewal

ABS Program Highlights Strength of Sponsor Regional has been in business since 1987 and has effectively managed multiple economic and business cycles Deep management and board experience in consumer finance industry Profitable every year since IPO in 2012 Seasoned Program Regional has successfully completed 9 securitizations (one private and eight 144A) totaling $1.6 billion Regional has called 3 of the 144A securitizations since program inception Revolving Period Revolving period allows for reinvestment and extended duration Historical issuances of 2–5-year revolving periods ‘AAA’ Rating from S&P The Class A Notes issued in the last ABS transaction were ‘AAA’ rated by S&P In November 2023, S&P raised ratings on nine classes of notes and affirmed ratings on the other ten classes of Regional Management Issuance Trust Transactions Credit Enhancement Structuring revolver to worst case pool provides additional credit enhancement versus actual pool Rapid Deleveraging Rapid deleveraging through fixed dollar overcollateralization once amortization begins Use of Proceeds Create capacity within warehouses and senior revolver to fund growth 15

Governance & Controls

Public Company Discipline and Transparency 17 Full Transparency – Public SEC Filings and Disclosures Internal Controls – SOX controls in place since 2013 External Audits – Deloitte & Touche LLP Compliance – Team of 20 FTE led by Chief Compliance Officer Enterprise Risk Management – Identifies and manages significant company risks Internal Audit – Covers corporate office functions and branch activities Cybersecurity – Guided by National Institute of Standards and Technology (NIST) framework, coupled with 3rd party assessments

Deep Management Experience 18 Accomplished team with extensive backgrounds in consumer finance Rob Beck President and CEO Manish Parmar Chief Credit Risk Officer Harp Rana CFO 20+ years of financial services experience Prior to joining Regional, was Managing Director, North America Retail at Citigroup Held additional roles in business and finance at Citi, including Head of US Retail Deposit and Lending Products 20 years of credit and financial experience in credit risk, analytics, financial partnerships, database marketing, and modeling Prior to joining Regional, was Chief Credit and Analytics Officer at Conn’s Also held several senior management roles at Discover Financial Services, including the Head of Consumer Risk Management 30+ years of finance, business management and M&A experience in financial services Spent 29 years at Citi in various roles, including COO for the US Retail bank and Co-head of Citigroup M&A Prior to joining Regional, was EVP and COO for the Leukemia and Lymphoma Society, the second largest cancer non-profit in the US Harp Rana Chief Financial Officer Manish Parmar Chief Credit Risk Officer Catherine Atwood General Counsel Jim Ryan Chief Marketing Officer Joseph Manavalan Chief Technology Officer Brian Fisher �Chief Strategy and Development Officer Rob Beck President and Chief Executive Officer Board of Directors David Korn Chief Compliance Officer Brian Fisher Chief Strategy and Development Officer 10+ years of consumer finance services experience Previously served as General Counsel and Secretary for Regional Prior to joining Regional, was a corporate and securities attorney for Womble Bond Dickinson, LLP Catherine Atwood General Counsel 10+ years of consumer finance services experience Previously served as VP, Deputy General Counsel, and Chief Compliance Officer for Regional Prior to joining Regional, was a business litigation attorney for Womble Bond Dickinson, LLP Chris Peterson Chief Data and Analytics Officer Bios of Executive Officers

Strong Corporate Governance and Diverse Board of Directors Jonathan Brown Partner with Basswood Capital Management, LLC Formerly at Sandelman Partners Formerly at Goldman Sachs Maria Contreras-Sweet Former Administrator of U.S. Small Business Administration Founder of ProAmerica Bank Former Secretary of CA’s Business, Transportation and Housing Agency Board of Directors (Non-Employee Directors) Awarded the Latino Corporate Directors Association 2019 Corporate Visionary Award, recognizing RM’s commitment to an inclusive and diverse Board of Directors. Nominated for NACD NXT™ recognition in 2019 by the National Association of Corporate Directors (NACD). This recognition, part of the NACD NXT initiative, applauds exemplary board leadership practices that promote greater diversity and inclusion. 19

Robust Procedures and Controls Oversight Collateral All borrowers must provide collateral Secured by titled assets (hard secured) or personal property (soft secured) Verifications Identity Employment Income Credit Scoring Diverse data attributes Review of credit bureau information Implementation of custom scorecards in 2018 Repayment Ability Debt to Income Calculation Minimum Annual Income Requirement Lend only against a portion of gross income Collateral Soft Secured Loans (Personal Property) Hard Secured (Titled Assets) Unsecured Verifications Identity Employment Income Credit Scoring Diverse data attributes Review of credit bureau and alternative data Implemented Next-Gen Scorecard in 2022 Repayment Ability Debt-to-Income Calculation Minimum Annual Income Requirement Lend only against a portion of gross income Risk-Based Audits by Internal Audit Department Yearly Required Training Program Detailed Policy and Procedure Manuals for Branch Consistency Incentive Program Based on Delinquency, Profitability, & Growth Detailed Supervisory Visits and Oversight Monitoring of Critical Analytics Monthly Branch Self-Assessments 20

Compliance and Audit Compliance Across Home Office Departments Monthly monitoring of critical analytics Establish standards and provide guidance for risk management and controls Well documented and controlled reporting framework Oversees external state regulatory audits and internal branch audits Alerts senior management and board to emerging risks Internal Audit Operates under a board approved plan Regularly review servicing and collection records Review internal policies and procedures to ensure compliance Branch and Central Employees Annual compliance trainings and re-certification Strong culture of compliance Detailed policies and procedures manuals Monthly branch self-assessments Detailed supervisory visits Governed by board of directors, performs branch and corporate audits Audit Comprised of multiple SME’s, each performs key function Compliance Team members represent a culture of compliance, with regular trainings Branches 21

Strong Servicing Capabilities and Loss Mitigation 22 Early-stage collection efforts primarily performed in the branches High-touch relationship allows branches to quickly anticipate and proactively resolve repayment problems Combination of payment options available Late-stage co-collection support for the branches by centralized collectors located in servicing centers in Dallas and Greenville Bankruptcy and post-charge-off collections handled centrally Qualifying charged-off accounts are sold to a third-party Regional employs a hybrid strategy of localized collection efforts through the branches and centralized support for late-stage collections In-Branch Servicing & Central Support Centralized Collections Refinance of previous loan similar to a renewal, with a recent payment and verified current employment generally required Provides assistance to customers that are experiencing short-term financial hardships and cash flow issues but requires employment Utilized for customers with short-term / temporary hardships Allows customer to defer their monthly payment which solves immediate cash flow concerns Current 1-29 30-59 60-89 90-119 120-149 150-179 180+ Post Charge-Off Tools are designed to lower overall loss in the portfolio by helping qualified customers These programs are targeted toward helping customers navigate through short-term cash flow issues Delinquent Renewal Deferral

Credit Performance

Credit 24 4Q 23 delinquency of 6.9% decreased 40 basis points sequentially and decreased 20 basis points versus prior year (inclusive of a 90 basis point reduction in 4Q 23 and 4Q 22 from the loan sale that occurred in each quarter) 30+ days past due of $122.9 million compares favorably to loan loss reserves of $187.4 million as of 4Q 23 4Q 23 net credit loss rate of 15.1% included 320 basis points related to accelerated charge-offs from the 4Q 23 loan sale 4Q 22 net credit loss rate of 15.0% included 320 basis points related to accelerated charge-offs from the 4Q 22 loan sale; 1Q 23 rate of 10.1% was inclusive of an estimated benefit of 280 basis points related to the loan sale

Origination Metrics by Product (Less than or equal to 36% APR loans) 25 FICO Original Term APR Original Loan Balance (1) The 4Q 22 increases in original term and original balance in the convenience check portfolio were due to targeted campaigns of large checks to former borrowers (1) (1)

30+ Delinquency Trend – Managed Portfolio (Less than or equal to 36% APR loans) 26 (1) 2020 and 2021 delinquency levels were favorably impacted by government stimulus Data as of 12/31/2023 (1)

Consistent Credit Performance for ABS Transactions 27 (1) RMIT 2022-2 closed in October of 2022 – minimal losses are normal during the early months of a new facility Credit performance for ABS transactions includes their revolving periods (1)

Payment Channel Mix (Less than or equal to 36% APR loans) 28 Significant reduction in cash and check payments in branch 83% of payments received by RM are currently made electronically (ACH and Debit)

Appendix

Consolidated Income Statements 30

Consolidated Balance Sheets 31

v3.24.0.1

Document And Entity Information

|

Feb. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 23, 2024

|

| Entity Registrant Name |

Regional Management Corp.

|

| Entity Central Index Key |

0001519401

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35477

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

57-0847115

|

| Entity Address, Address Line One |

979 Batesville Road, Suite B

|

| Entity Address, City or Town |

Greer

|

| Entity Address, State or Province |

SC

|

| Entity Address, Postal Zip Code |

29651

|

| City Area Code |

(864)

|

| Local Phone Number |

448-7000

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

RM

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

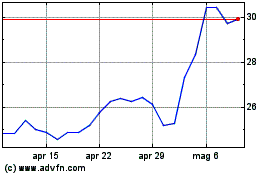

Grafico Azioni Regional Management (NYSE:RM)

Storico

Da Mar 2024 a Apr 2024

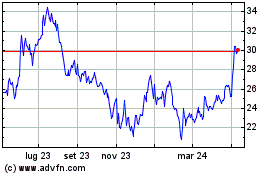

Grafico Azioni Regional Management (NYSE:RM)

Storico

Da Apr 2023 a Apr 2024