Registration No. 333-_________

As filed with the Securities and Exchange Commission on December 6, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SNAP-ON INCORPORATED

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 39-0622040 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification Number) |

2801 80th Street

Kenosha, Wisconsin 53143

(262) 656-5200

(Address, including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

Richard T. Miller

Vice President, General Counsel and Secretary

2801 80th Street, Kenosha, Wisconsin 53143

(262) 656-5200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with a copy to:

| | |

| David P. McHugh |

| ArentFox Schiff LLP |

| 233 South Wacker Drive, Suite 7100 |

| Chicago, Illinois 60606 |

| (312) 258-5500 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: FROM TIME TO TIME AFTER THE EFFECTIVE DATE OF THIS REGISTRATION STATEMENT.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box:

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box:

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box:

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | |

| Non-accelerated filer | | Smaller reporting company | |

| | Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

PROSPECTUS

COMMON STOCK

DEBT SECURITIES

DEBT WARRANTS

PREFERRED STOCK

PREFERRED WARRANTS

COMMON WARRANTS

UNITS

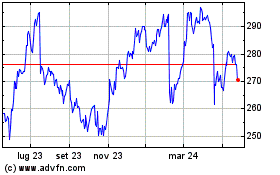

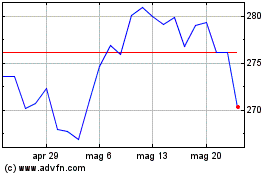

We may offer these securities in amounts, at prices and on terms determined at the time of offering. Each time securities are sold using this prospectus, we will provide a supplement to this prospectus and possibly other offering material containing specific information about the offering and the terms of the securities being sold. The supplement or other offering material may add, update or change information contained in this prospectus. Our common stock is traded under the symbol “SNA” on the New York Stock Exchange.

We may offer and sell these securities to or through underwriters, dealers or agents, or directly to investors, on a continued or a delayed basis. The supplements to this prospectus will provide the specific terms of the plan of distribution.

You should read this prospectus and any supplement carefully before you invest.

See “Risk Factors” in our most recent Annual Report on Form 10-K and in any prospectus supplement, or in such other document we refer you to in any prospectus supplement, for a discussion of certain risks that prospective investors should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 6, 2024.

TABLE OF CONTENTS

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS

This prospectus is a part of the registration statement that we filed with the Securities and Exchange Commission (the “SEC”). You should read this prospectus together with the more detailed information regarding our company, our securities and our financial statements and notes to those statements that appear elsewhere in this prospectus or that we incorporate in this prospectus by reference.

You should rely on the information contained in, or incorporated by reference in, this prospectus and in any prospectus supplement. We have not authorized anyone to provide you with information different from that contained in, or incorporated by reference in, this prospectus, any prospectus supplement or any other offering material. You should not assume that the information in this prospectus, any prospectus supplement or any other offering material is accurate as of any date other than the respective dates on the front of the prospectus, prospectus supplement or other offering material, as applicable. For purposes of this prospectus, unless the context otherwise indicates, when we refer to “Snap-on,” “us,” “we,” “our,” “ours,” or the “Company” we are describing Snap-on Incorporated, including, as appropriate, its subsidiaries.

FORWARD-LOOKING STATEMENTS

Statements in this document, and the documents incorporated by reference, that are not historical facts, including statements that (i) are in the future tense, (ii) include the words “expects,” “plans,” “targets,” “estimates,” “believes,” “anticipates,” or similar words that reference Snap-on or its management, (iii) are specifically identified as forward-looking, or (iv) describe Snap-on’s or management’s future outlook, plans, estimates, objectives or goals, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Snap-on cautions the reader that any forward-looking statements included in this document that are based upon assumptions and estimates were developed by management in good faith and are subject to risks, uncertainties and other factors that could cause (and in some cases have caused) actual results to differ materially from those described in any such statement. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results or regarded as a representation by the Company or its management that the projected results will be achieved. For those forward-looking statements, Snap-on cautions the reader that numerous important factors, such as those listed below, as well as those factors discussed in its Annual Report on Form 10-K for the fiscal year ended December 30, 2023, and in Snap-on’s other reports filed with the Securities and Exchange Commission, all of which are incorporated herein by reference, could affect the Company’s actual results and could cause its actual consolidated results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, Snap-on.

Risks and uncertainties include, without limitation

•Uncertainties related to estimates, assumptions and projections generally;

•The timing and progress with which Snap-on can attain value through its Snap-on Value Creation Processes, including its ability to (i) realize efficiencies and savings from its rapid continuous improvement and other cost reduction initiatives, (ii) improve workforce productivity, (iii) achieve improvements in the Company’s manufacturing footprint and greater efficiencies in its supply chain, and (iv) enhance machine maintenance, plant productivity and manufacturing line set-up and change-over practices, any or all of which could result in production inefficiencies, higher costs and/or lost revenues;

•Snap-on’s capability to successfully implement future strategies with respect to its existing businesses;

•Snap-on’s ability to refine its brand and franchise strategies, retain and attract franchisees, and further enhance service and value to franchisees in order to help improve the sales and profitability of franchisees;

•The Company’s ability to introduce successful new products;

•Significant changes in the current competitive environment;

•Risks related to pursuing, completing and integrating acquisitions;

•Inflation, interest rate changes and other monetary and market fluctuations;

•Price and supply fluctuations related to raw materials, components and certain purchased finished goods, such as steel, plastics, and electronics;

•The effects of external economic factors, including adverse developments in world financial markets, disruptions related to tariffs and other trade or sanction issues, and global supply chain inefficiencies, including as a result of the current war in Ukraine and other regional conflicts;

•Snap-on’s ability to successfully manage changes in prices and the availability of energy sources, including gasoline;

•Snap-on’s ability to withstand disruption arising from natural disasters, including climate-related events or other unusual occurrences;

•Risks associated with data security and technological systems and protections, including the effects of cyber incidents and from new legislation, regulations or government-related developments;

•The impact of labor interruptions or challenges, and Snap-on’s ability to effectively manage human capital resources;

•Weakness in certain geographic areas, including as a result of localized recessions, and the impact of matters related to the United Kingdom’s exit from the European Union;

•Changes in tax rates, laws and regulations as well as uncertainty surrounding potential changes;

•The amount, rate and growth of health care and postretirement costs, including continuing and potentially increasing required contributions to pension and postretirement plans;

•The effects of new requirements, legislation, regulations or government-related developments or issues, as well as third party actions, including those addressing climate change;

•Potential reputational damages and costs related to litigation;

•The impact of outbreaks of infectious diseases as well as the effects of governmental actions related thereto on Snap-on’s business, which could have the potential to amplify the impact of the other risks facing the Company; and

•Other world or local events outside Snap-on’s control, including terrorist disruptions, armed conflicts and civil unrest.

Snap-on disclaims any responsibility to update any forward-looking statement provided in this document, except as required by law.

In addition, investors should be aware that generally accepted accounting principles in the United States of America (“GAAP”) prescribe when a company should reserve for particular risks, including litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when a reserve is established for a major contingency. Reported results, therefore, may appear to be volatile in certain accounting periods.

THE COMPANY

Snap-on is a leading global innovator, manufacturer and marketer of tools, equipment, diagnostics, repair information and systems solutions for professional users performing critical tasks including those working in vehicle repair, aerospace, the military, natural resources, and manufacturing. From its founding in 1920, Snap-on has been recognized as the mark of the serious and the outward sign of the pride and dignity working men and women take in their professions. Products and services are sold through the Company’s network of widely recognized franchisee vans as well as through direct and distributor channels, under a variety of notable brands. Snap-on also provides financing programs to facilitate the sales of its products and to support its franchise business.

We market our products and brands worldwide in more than 130 countries. Our largest geographic markets include the United States, Europe, Canada and Asia Pacific.

Our primary customer segments include: (i) commercial and industrial customers, including professionals in critical industries and in emerging markets; (ii) professional vehicle repair technicians who purchase products through our multinational mobile tool distribution network; and (iii) other professional customers related to vehicle repair, including owners and managers of independent service and repair shops, as well as original equipment manufacturer (“OEM”) dealership service and repair shops (“OEM dealerships”). Snap-on’s Financial Services customer segment includes: (i) franchisees’ customers, principally serving vehicle repair technicians, and Snap-on customers who require financing for the purchase or lease of tools, diagnostics, and equipment products on an extended-term payment plan; and (ii) franchisees who require financing options for vehicle and business needs.

Our business segments are based on the organization structure used by management for making operating and investment decisions and for assessing performance. Our reportable business segments are: (i) the Commercial & Industrial Group; (ii) the Snap-on Tools Group; (iii) the Repair Systems & Information Group; and (iv) Financial Services. The Commercial & Industrial Group consists of business operations serving a broad range of industrial and commercial customers worldwide, including customers in the aerospace, natural resources, government and military, power generation, transportation and technical education market segments (collectively, “critical industries”), primarily through direct and distributor channels. The Snap-on Tools Group consists of business operations primarily serving vehicle service and repair technicians through the company’s multinational mobile tool distribution channel. The Repair Systems & Information Group consists of business operations serving other professional vehicle repair customers worldwide, primarily owners and managers of independent repair shops and OEM dealerships, through direct and distributor channels. Financial Services consists of the business operations of Snap-on Credit LLC (“SOC”), our financial services business in the United States, and our other financial services subsidiaries in those international markets where Snap-on has franchise operations.

Our headquarters are located at 2801 80th Street, Kenosha, Wisconsin 53143, and our telephone number is (262) 656-5200.

RISK FACTORS

Investing in our securities involves risks. Before making an investment decision, you should carefully consider the discussion of risks and uncertainties under the heading “Risk Factors” contained in any applicable prospectus supplement and any related free writing prospectus, and under similar headings in our most recent Annual Report on Form 10-K (together with any material changes or additions thereto contained in subsequently filed Quarterly Reports on Form 10-Q) and those contained in our other filings with the Securities and Exchange Commission, which are incorporated by reference in this prospectus. Additional risks and uncertainties not presently known to us or that we currently deem immaterial could materially affect our business, results of operations or financial position and cause the value of our securities to decline.

USE OF PROCEEDS

We intend to use the net proceeds from the sales of the securities as set forth in the applicable prospectus supplement and/or other offering material.

SECURITIES TO BE OFFERED

This prospectus is part of a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may offer and sell from time to time securities in one or more offerings. We may offer and sell the following securities: common stock, debt securities, debt warrants, preferred stock, preferred warrants, common warrants and units. This prospectus provides you with a general description of these securities.

Each time we offer securities, we will provide you with a prospectus supplement and possibly other offering material that will describe the specific amounts, prices and terms of the securities being offered. The prospectus supplement or other offering material may also add, update or change information contained in this prospectus.

DESCRIPTION OF COMMON STOCK

We are authorized by our restated certificate of incorporation to issue up to 250,000,000 shares of common stock, par value $1.00 per share. As of December 1, 2024, 52,489,808 shares of common stock were outstanding.

The description of our common stock included in Amendment No. 2 to our Registration Statement on Form 8-A, filed on Form 8-A/A on December 10, 2018 (Commission File No. 1-7724), is incorporated by reference in this prospectus.

DESCRIPTION OF DEBT SECURITIES

The following description of the debt securities sets forth the material terms and provisions of the debt securities to which any prospectus supplement may relate. The particular terms of the debt securities offered by any prospectus supplement and the extent, if any, to which the provisions described in this prospectus may apply to the offered debt securities will be described in the prospectus supplement and/or other offering material relating to the offered debt securities.

Senior debt securities would be issued under the indenture, dated January 8, 2007, between Snap-on and U.S. Bank National Association, as trustee, which is incorporated by reference as an exhibit to the registration statement of which this prospectus is a part. The indenture relating to the senior debt securities, as amended or otherwise supplemented by any supplemental indentures, is referred to in this prospectus as the “indenture.”

The following summaries of the material provisions of the indenture and the debt securities do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all of the provisions of the indenture, including the definitions of specified terms used in the indenture, and the debt securities. Wherever particular articles, sections or defined terms of an indenture are referred to, it is intended that those articles, sections or defined terms will be incorporated herein by reference, and the statement in connection with which reference is made is qualified in its entirety by the article, section or defined term in the indenture.

General

The indenture does not limit the amount of debt, either secured or unsecured, that we may issue under the indenture or otherwise. The debt securities may be issued in one or more series with the same or various maturities and may be sold at par, at a premium or at an original issue discount. Some of the debt securities may be issued under the indenture as original issue discount securities to be sold at a substantial discount below their principal amount. Federal income tax and other considerations applicable to any original issue discount securities will be described in the related prospectus supplement. We have the right to “reopen” a previous issue of a series of debt by issuing additional debt securities of such series.

Snap-on conducts a material amount of its operations through subsidiaries and it expects that it will continue to do so. As a result, the right of Snap-on to participate as a shareholder in any distribution of assets of any subsidiary upon its liquidation or reorganization or otherwise and the ability of holders of the notes to benefit as creditors of Snap-on from any distribution are subject to prior claims of creditors of the subsidiary. The notes will also effectively rank junior in right of payment to any secured debt of Snap-on.

The prospectus supplement relating to the particular debt securities offered thereby will describe the following terms of the offered debt securities:

•the title of the offered debt securities;

•any limit upon the aggregate principal amount of the offered debt securities;

•the date or dates (or the manner of calculation thereof) on which the principal of the offered debt securities is payable;

•the rate or rates (or the manner of calculation thereof) at which the offered debt securities shall bear interest, if any, the date or dates from which such interest shall accrue, the interest payment dates on which such interest shall be payable and the regular record date for the interest payable on any interest payment date;

•the place or places where the principal of and premium, if any, and interest, if any, on the offered debt securities will be payable and each office or agency where the offered debt securities may be presented for transfer or exchange;

•the period or periods within which, the price or prices at which, the currency or currency units in which, and the terms and conditions upon which the offered debt securities may be redeemed, in whole or in part, at our option;

•our obligation, if any, to redeem or purchase the offered debt securities pursuant to any sinking fund or analogous provisions or at the option of a holder thereof and the period or periods within which, the price or prices in the currency at which, the currency or currency units in which, and the terms and conditions upon which the offered debt securities shall be redeemed or purchased, in whole or in part, pursuant to such obligation;

•the denominations in which the offered debt securities shall be issuable if other than denominations of $1,000 and any integral multiple thereof;

•the application, if any, of certain provisions of the indenture relating to discharge and defeasance described in this prospectus with respect to the offered debt securities;

•if other than the currency of the United States of America, the currencies in which payments of interest or principal of (and premium, if any, with respect to) the offered debt securities are to be made;

•if the interest on or principal of (or premium, if any, with respect to) the offered debt securities are to be payable, at our election or at the election of a holder thereof or otherwise, in a currency other than that in which such offered debt securities are payable, the period or periods within which, and the other terms and conditions upon which, such election may be made, and the time and manner of determining the exchange rate between the currency in such offered debt securities are denominated or stated to be payable and the currency in which such offered debt securities or any of them are to be so payable;

•whether the amount of payments of interest on or principal of (or premium, if any, with respect to) the offered debt securities of such series may be determined with reference to an index, formula or other method (which index, formula or method may be based, without limitation, on one or more currencies, commodities, equity indices or other indices), and, if so, the terms and conditions upon which and the manner in which such amounts shall be determined and paid or payable;

•the extent to which any offered debt securities will be issuable in permanent global form, the manner in which any payments on a permanent global debt security will be made, and the appointment of any depository relating thereto;

•any deletions from, modifications of or additions to the events of default or covenants with respect to the offered debt securities of such series, whether or not such events of default or covenants are consistent with the events of default or covenants set forth herein;

•whether any of the offered debt securities are to be issuable upon the exercise of warrants, and, if so, the time, manner and place for such offered debt securities to be authenticated and delivered; and

•any other terms of the series (which terms shall not be inconsistent with the provisions of the indenture).

Unless otherwise indicated in any prospectus supplement, principal of and premium, if any, and interest, if any, on the offered debt securities will be payable, and transfers of the offered debt securities will be registerable, at the corporate trust office of the trustee. Alternatively, at our option, payment of interest may be made by check mailed to the address of the person entitled thereto as it appears in the debt security register.

Floating Rate Notes

Floating rate notes issued under the indenture will bear interest at a floating interest rate. Interest payable on any interest payment date or on the date of maturity will be the amount of interest accrued from and including the date of original issuance or from and including the most recent interest payment date on which interest has been paid or duly made available for payment to but excluding the interest payment date or the date of maturity, as the case may be.

The interest rate for the initial interest period will be described in the related prospectus supplement. The interest rate on floating rate notes for each subsequent interest period will be reset from time to time as described in the applicable prospectus supplement. Floating rate notes will bear interest at an annual rate (computed on the basis of the actual number of days elapsed over a 360-day year or on a basis otherwise described in the related prospectus supplement) equal to the applicable reference rate plus a number of basis points and will be described in the related prospectus supplement.

The interest rate in effect for floating rate notes on each day will be (a) if that day is an interest reset date, the interest rate determined as of the determination date (as described in the related prospectus supplement) immediately preceding such interest reset date, or (b) if that day is not an interest reset date, the interest rate determined as of the determination date immediately preceding the most recent interest reset date.

The calculation agent will be the trustee initially. The calculation agent will determine the interest rate for floating rate notes from time to time in accordance with the provisions described in the related prospectus supplement.

Fixed Rate Notes

Fixed rate notes will bear interest at a fixed interest rate as set forth in the applicable supplemental indenture, prospectus supplement or other document or agreement that may be executed from time to time. Unless set forth in such other agreement, the interest payable on any interest payment date or on the date of maturity will be the amount of interest accrued from and including the date of original issuance or from and including the most recent interest payment date on which interest has been paid or duly made available for payment to but excluding the interest payment date or the date of maturity, as the case may be.

Optional Redemption

Floating Rate Notes

All or a portion of floating rate notes may be redeemed at our option at any time or from time to time, after a set date to be identified in the applicable prospectus supplement. The redemption price of floating rate notes will be 100% of the principal amount thereof plus accrued and unpaid interest thereon to the redemption date.

Notwithstanding the foregoing, installments of interest on any floating rate notes that are due and payable on interest payment dates falling on or prior to a redemption date will be payable on the interest payment date to the registered holders as of the close of business on the relevant record date according to such floating rate notes and the

indenture. The redemption price will be calculated on the basis of a 360-day year consisting of twelve 30-day months.

We will mail notice of any redemption at least 30 days but not more than 60 days before the redemption date to each registered holder of floating rate notes. Once notice of redemption is mailed, floating rate notes will become due and payable on the redemption date and at the applicable redemption price, plus accrued and unpaid interest to the redemption date.

On and after the redemption date, interest will cease to accrue on floating rate notes or any portion of floating rate notes called for redemption (unless we default in the payment of the redemption price and accrued interest). On or before the redemption date, we will deposit with a paying agent (or the trustee) money sufficient to pay the redemption price of and accrued interest on any floating rate notes to be redeemed on that date. If less than all of any floating rate notes are to be redeemed, any floating rate notes to be redeemed shall be selected by lot by The Depository Trust Company (“DTC”), in the case of floating rate notes represented by a global security, or by the trustee by a method the trustee deems to be fair and appropriate, in the case of floating rate notes that are not represented by a global security.

Fixed Rate Notes

All or a portion of fixed rate notes may be redeemed at our option at any time or from time to time. The redemption price for any fixed rate notes to be redeemed on any redemption date will be equal to the greater of the following amounts (plus, in each case, accrued and unpaid interest on such fixed rate notes to the redemption date):

•100% of the principal amount of the fixed rate notes being redeemed on the redemption date; and

•the sum of the present values of the remaining scheduled payments of principal and interest on the fixed rate notes being redeemed on that redemption date (not including any portion of any payments of interest accrued to the redemption date), discounted to the redemption date on a semiannual basis at the Treasury Rate (as defined below), plus a set number of basis points to be identified in the applicable prospectus supplement, as determined by the Reference Treasury Dealer (as defined below).

Notwithstanding the foregoing, installments of interest on fixed rate notes that are due and payable on interest payment dates falling on or prior to a redemption date will be payable on the interest payment date to the registered holders as of the close of business on the relevant record date according to the fixed rate notes and the indenture. The redemption price will be calculated on the basis of a 360-day year consisting of twelve 30-day months.

We will mail notice of any redemption at least 30 days but not more than 60 days before the redemption date to each registered holder of such fixed rate notes. Once notice of redemption is mailed, fixed rate notes will become due and payable on the redemption date and at the applicable redemption price, plus accrued and unpaid interest to the redemption date.

“Treasury Rate” means, with respect to any redemption date, the rate per annum equal to the semiannual equivalent yield to maturity of the Comparable Treasury Issue, assuming a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such redemption date.

“Comparable Treasury Issue” means the United States Treasury security selected by the Reference Treasury Dealer as having a maturity comparable to the remaining term of fixed rate notes, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of fixed rate notes.

“Comparable Treasury Price” means, with respect to any redemption date, (a) the average of the Reference Treasury Dealer Quotations for such redemption date, after excluding the highest and lowest such Reference Treasury Dealer Quotations, or (b) if the trustee obtains fewer than three such Reference Treasury Dealer Quotations, the average of all such Quotations, or (c) if only one Reference Treasury Dealer Quotation is received, such Quotation.

“Reference Treasury Dealer” means any primary U.S. Government securities dealer in New York City (a “Primary Treasury Dealer”) that is selected by us.

“Reference Treasury Dealer Quotation” means, with respect to each Reference Treasury Dealer and any redemption date, the average, as determined by the trustee, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal amount) quoted in writing to the trustee by such Reference Treasury Dealer at 5:00 p.m. (New York City time) on the third business day preceding such redemption date.

On and after the redemption date, interest will cease to accrue on fixed rate notes or any portion of such fixed rate notes called for redemption (unless we default in the payment of the redemption price and accrued interest). On or before the redemption date, we will deposit with a paying agent (or the trustee) money sufficient to pay the redemption price of and accrued interest on fixed rate notes to be redeemed on that date. If less than all of any fixed rate notes are to be redeemed, any fixed rate notes to be redeemed shall be selected by lot by DTC, in the case of fixed rate notes represented by a global security, or by the trustee by a method the trustee deems to be fair and appropriate, in the case of fixed rate notes that are not represented by a global security.

Denominations, Registration and Transfer

Unless otherwise indicated in any prospectus supplement, the offered debt securities will be issued only in fully registered form without coupons in denominations of $1,000 or any integral multiple of $1,000, or the equivalent in foreign currency. No service charge will be made for any registration of transfer or exchange of offered debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with any transfer or exchange.

If the purchase price of any of the offered debt securities is denominated in a foreign currency or currencies or foreign currency unit or units or if the principal of, premium, if any, or interest, if any, on any series of offered debt securities is payable in a foreign currency or currencies or foreign currency unit or units, the restrictions, elections, tax consequences, specific terms and other information with respect to the issue of offered debt securities and the foreign currency or currencies or foreign currency unit or units will be described in the related prospectus supplement.

We will not be required to issue, register the transfer of, or exchange debt securities of any series during the period from 15 days prior to the mailing of a notice of redemption of debt securities of that series to the date the notice is mailed. We will also not be required to register the transfer of or exchange any debt security so selected for redemption, except the unredeemed portion of any debt security being redeemed in part.

Conversion and Exchange

The terms, if any, on which debt securities of any series are convertible into or exchangeable for common stock or preferred stock, property or cash, or a combination of any of the foregoing, will be set forth in the related prospectus supplement. Terms may include provisions for conversion or exchange that is either mandatory, at the option of the holder, or at our option. The number of shares of common stock or preferred stock to be received by the holders of the debt securities will be calculated in the manner, according to the factors and at the time as described in the related prospectus supplement.

Covenants Applicable to Senior Debt Securities

Limitations on Secured Debt

We may not, and may not permit our restricted subsidiaries to, create, assume, or guarantee any indebtedness secured by mortgages, pledges, liens, encumbrances, conditional sale or title retention agreements (excluding operating leases) or other security interests, which we refer to collectively as security interests, on any of our principal properties or any shares of capital stock or indebtedness of any of our restricted subsidiaries without making effective provision for securing the senior debt securities offered under this prospectus and any prospectus

supplement equally and ratably with the secured debt. Notwithstanding this limitation on secured debt, we and our restricted subsidiaries may have debt secured by:

•(a) any security interest on any property hereafter acquired or constructed by us or a restricted subsidiary to secure or provide for the payment of all or any part of the purchase price or construction cost of such property, including, but not limited to, any indebtedness incurred by us or a restricted subsidiary prior to, at the time of, or within 180 days after the later of the acquisition, the completion of construction (including any improvements on an existing property) or the commencement of commercial operation of such property, which indebtedness is incurred for the purpose of financing all or any part of the purchase price thereof or construction or improvements thereon; or (b) the acquisition of property subject to any security interest upon such property existing at the time of acquisition thereof, whether or not assumed by us or such restricted subsidiary; or (c) any security interest existing on the property or on the outstanding shares of capital stock or indebtedness of a person at the time such person shall become a restricted subsidiary; or (d) a security interest on property or shares of capital stock or indebtedness of a person existing at the time such person is merged into or consolidated with us or a restricted subsidiary or at the time of a sale, lease or other disposition of the properties of a person or firm as an entirety or substantially as an entirety to us or a restricted subsidiary, provided, however, that no such security interest shall extend to any other principal property of ours or such restricted subsidiary prior to such acquisition or to the other principal property thereafter acquired other than additions to such acquired property;

•security interests in property of ours or a restricted subsidiary in favor of the United States of America or any State thereof, or any department, agency or instrumentality or political subdivision of the United States of America or any State thereof, or in favor of any other country, or any department, agency or instrumentality or political subdivision thereof (including, without limitation, security interests to secure indebtedness of the pollution control or industrial revenue bond type), in order to permit us or a restricted subsidiary to perform any contract or subcontract made by it with or at the request of any of the foregoing, or to secure partial, progress, advance or other payments pursuant to any contract or statute or to secure any indebtedness incurred for the purpose of financing all or any part of the purchase price or the cost of constructing or improving the property subject to such security interests;

•any security interest on any property or assets of any restricted subsidiary to secure indebtedness owing by it to us or to a restricted subsidiary;

•any security interest on any property or assets of ours to secure indebtedness owing by us to any restricted subsidiary;

•mechanics’, materialmen’s, carriers’ or other like liens arising in the ordinary course of business (including construction of facilities) in respect of obligations which are not due or which are being contested in good faith;

•any security interest arising by reason of deposits with, or the giving of any form of security to, any governmental agency or any body created or approved by law or governmental regulations, which is required by law or governmental regulation as a condition to the transaction of any business, or the exercise of any privilege, franchise or license and any security interest to secure public or statutory obligations;

•security interests for taxes, assessments or governmental charges or levies not yet delinquent, or the security interests for taxes, assessments or government charges or levies already delinquent but the validity of which is being contested in good faith;

•security interests (including judgment liens) arising in connection with legal proceedings so long as such proceedings are being contested in good faith and, in the case of judgment liens, execution thereon is stayed;

•landlords’ liens on fixtures located on premises leased by us or a restricted subsidiary in the ordinary course of business;

•security interests in connection with certain permitted receivables financings; or

•any extension, renewal or replacement (or successive extensions, renewals or replacements) in whole or in part of any security interest permitted by the indenture.

Limitation on Sale and Leaseback Transactions

We and our restricted subsidiaries may not engage in sale and leaseback transactions (excluding such transactions between us and our restricted subsidiaries or between our restricted subsidiaries) whereby a principal property that is owned by us or one of our restricted subsidiaries and that has been in full operation for more than 180 days is sold or transferred with the intention of taking back a lease of such property (except a lease for a term of no more than three years entered into with the intent that the use by us or such restricted subsidiary of such property will be discontinued on or before the expiration of such term).

The sale and leaseback of a principal property is not prohibited, however, if we and the applicable restricted subsidiary would be permitted under the indenture to incur secured debt equal in amount to the amount realized or to be realized upon the sale or transfer secured by a lien on the principal property to be leased without equally and ratably securing the senior debt securities. We and our restricted subsidiaries may also engage in an otherwise prohibited sale and leaseback transaction if an amount equal to the value of the principal property so leased is applied, subject to credits for delivery by us to the trustee of senior debt securities we have previously purchased or otherwise acquired and specified voluntary redemptions of the senior debt securities, to the retirement (other than mandatory retirement), within 120 days of the effective date of the arrangement, of specified indebtedness for borrowed money incurred or assumed by us or a restricted subsidiary, as shown on our most recent consolidated balance sheet and, in the case of our indebtedness, the indebtedness is not subordinate and junior in right of payment to the prior payment of the senior debt securities.

Permitted Secured Debt

Notwithstanding the limitations on secured debt and sale and leaseback transactions described in this prospectus, we and our restricted subsidiaries may, without securing the senior debt securities, issue, assume or guarantee secured debt which would otherwise be subject to the foregoing restrictions, provided that after giving effect to any secured debt permitted by this exception, the aggregate amount of our secured debt and that of our restricted subsidiaries then outstanding (excluding indebtedness secured by the types of security interests listed above under the heading “Limitations on Secured Debt”) and the aggregate value of sale and leaseback transactions, other than sale and leaseback transactions in connection with which indebtedness has been, or will be, retired in accordance with the preceding paragraph, at such time does not exceed 10% of our consolidated stockholders’ equity.

For purposes of determining the amount of secured debt permitted by the exception described in the paragraph above, “consolidated stockholders’ equity” means, at any date, our stockholders’ equity and that of our consolidated subsidiaries determined on a consolidated basis as of such date in accordance with generally accepted accounting principles; provided that, our consolidated stockholders’ equity and that of our consolidated subsidiaries is to be calculated without giving effect to (i) the application of Accounting Standards Codification Topic 715 relating to postretirement benefits and pension plans, or (ii) the cumulative foreign currency translation adjustment. The term “consolidated subsidiary” means, as to any person, each subsidiary of such person (whether now existing or hereafter created or acquired) the financial statements of which shall be (or should have been) consolidated with the financial statements of such person in accordance with generally accepted accounting principles.

Restrictions on Transfer of Principal Properties to Specified Subsidiaries

The indenture provides that, so long as the senior debt securities of any series are outstanding, we will not, and will not cause or permit any restricted subsidiary to, transfer any principal property to any unrestricted subsidiary, unless such subsidiary shall apply within one year after the effective date of the transaction, or shall have committed

within one year of the effective date to apply, an amount equal to the fair value of the principal property at the time of transfer:

•to the acquisition, construction, development or improvement of properties or facilities which are, or upon the acquisition, construction, development or improvement will be, a principal property or properties or a part thereof;

•to the redemption of senior debt securities;

•to the repayment of indebtedness of us or any of our restricted subsidiaries for money borrowed having a maturity of more than 12 months from the date of our most recent consolidated balance sheet, other than any indebtedness owed to any restricted subsidiary; or

•in part, to an acquisition, construction, development or improvement, and in part, to redemption and/or repayment, in each case as described above.

The fair value of any principal property for purposes of this paragraph will be as determined by our board of directors. In lieu of applying all or any part of any amount to the redemption of senior debt securities, we may, within one year of the transfer, deliver to the trustee under the indenture senior debt securities of any series (other than senior debt securities made the basis of a reduction in a mandatory sinking fund payment) for cancellation and thereby reduce the amount to be applied to the redemption of senior debt securities by an amount equivalent to the aggregate principal amount of the senior debt securities so delivered.

Certain Definitions

The following are the meanings of terms that are important in understanding the covenants previously described:

•“principal property” means any manufacturing plant, office building or similar facility (including associated fixtures but excluding leases and other contract rights that might otherwise be deemed real property) owned by us or any restricted subsidiary, whether owned on the date hereof or thereafter, provided each such plant, office building or similar facility has a gross book value (without deduction for any depreciation reserves) at the date as of which the determination is being made of in excess of five percent of the consolidated net tangible assets of us and the restricted subsidiaries and is located in the United States of America, Canada or the Commonwealth of Puerto Rico, other than any such plant, office building or similar facility or portion thereof which, in the opinion of the board of directors (evidenced by a certified board resolution thereof delivered to the Trustee), is not of material importance to the business conducted by us and our restricted subsidiaries taken as a whole;

•“restricted subsidiary” means any subsidiary of the Company that is not an unrestricted subsidiary;

•“secured debt” means indebtedness for money borrowed and any debt which is secured by a security interest in (a) any principal property or (b) any shares of capital stock or indebtedness of any restricted subsidiary;

•“subsidiary” means any person of which we, or we and one or more of our subsidiaries, or any one or more subsidiaries, directly or indirectly own more than 50% of the voting stock of such person; and

•“unrestricted subsidiary” means (a) any subsidiary of ours that at the time of determination shall be designated an unrestricted subsidiary by the board of directors (provided, however, that any subsidiary of ours having, as of the end of our most recently completed fiscal year, (i) assets with a value in excess of 5% of the total value of the assets of us and our subsidiaries taken as a whole, or (ii) gross revenue in excess of 5% of our total (gross) revenue and of our subsidiaries taken as a whole, may not be designated as an unrestricted subsidiary under the indenture); and (b) any subsidiary of an unrestricted subsidiary.

Merger

The indenture provides that we may, without the consent of the holders of debt securities, consolidate with, or sell, lease or convey all or substantially all of our assets to, or merge into any other person, provided that:

•the successor person is a person organized and existing under the laws of the United States or a state thereof;

•the successor person expressly assumes the due and punctual payment of the principal of and premium, if any, and interest on all debt securities, according to their tenor, and the due and punctual performance and observance of all the covenants and conditions of the indenture to be performed by us by supplemental indenture satisfactory to the trustee, executed and delivered to the trustee by the successor corporation; and

•immediately after giving effect to the transaction, no default under the indenture has occurred and is continuing.

In addition, we must provide to the trustee an opinion of legal counsel that any such transaction and any assumption by a successor person complies with the applicable provisions of the indenture and that we have complied with all conditions precedent provided in the indenture relating to such transaction.

Other than the covenants described above, or as set forth in any accompanying prospectus supplement, the indenture contains no covenants or other provisions designed to afford holders of the debt securities protection in the event of a takeover, recapitalization or a highly leveraged transaction involving us.

Modification of the Indenture

With the consent of the holders of more than 50% in aggregate principal amount of any series of debt securities then outstanding under the indenture, waivers, modifications and alterations of the terms of either indenture may be made which affect the rights of the holders of the series of debt securities. However, no modification or alteration may be made which will:

•extend the fixed maturity of any debt security, or reduce the rate or extend the time of payment of interest thereon, or reduce the principal amount thereof or any premium thereon, or make the principal thereof or interest or premium thereon payable in any coin or currency other than that provided in the debt securities, without the consent of the holder of each outstanding debt security affected thereby; or

•without the consent of all of the holders of any series of debt securities then outstanding affected thereby, reduce the percentage of debt securities of that series, the holders of which are required to consent to:

•any supplemental indenture;

• rescind and annul a declaration that the debt securities of any series are due and payable as a result of the occurrence of an event of default;

• waive any past event of default under the indenture and its consequences; and

•waive compliance with other specified provisions of the indenture.

In addition, as described in the description of “Events of Default” set forth below, holders of more than 50% in aggregate principal amount of the debt securities of any series then outstanding may waive past events of default in specified circumstances and may direct the trustee in enforcement of remedies.

We and the trustee may, without the consent of any holders, modify and supplement the indenture:

•to evidence the succession of another person to us under the indenture, or successive successions, and the assumption by the successor person of the covenants, agreements and obligations of us pursuant to specified provisions of the indenture;

•to add to the covenants of us such further covenants, restrictions, conditions or provisions as our board of directors and the trustee shall consider to be for the protection of the holders of debt securities of any or all series, and to make the occurrence, or the occurrence and continuance, of a default in any of such additional covenants, restrictions, conditions or provisions a default or event of default with respect to such series permitting the enforcement of all or any of the several remedies provided in the indenture; provided, however, that in respect of any such additional covenant, restriction or condition, such supplemental indenture may provide for a particular period of grace after default (which period may be shorter or longer than that allowed in the case of other defaults) or may provide for an immediate enforcement upon such default or may limit the remedies available to the trustee upon such default;

•to modify the indenture to permit the qualification of any supplemental indenture under the Trust Indenture Act of 1939;

•to cure any ambiguity or to correct or supplement any provision contained in the indenture or in any supplemental indenture which may be defective or inconsistent with any other provision contained in the indenture or in any supplemental indenture; to convey, transfer, assign, mortgage or pledge any property to or with the trustee; or to make such other provisions in regard to matters or questions arising under the indenture as shall not adversely affect the interests of the holders;

•to secure the debt securities of all series in accordance with the indenture;

•to evidence and provide for the acceptance of appointment by another corporation as a successor trustee under the indenture with respect to one or more series of debt securities and to add to or change any of the provisions of the indenture as shall be necessary to provide for or facilitate the administration of the trusts under the indenture by more than one trustee;

•to provide for the issuance under the indenture of debt securities in coupon form (including debt securities registrable as to principal only) and to provide for exchangeability of such debt securities with debt securities of the same series issued hereunder in fully registered form and to make all appropriate changes for such purpose;

•to change or eliminate any of the provisions of the indenture, provided, however, that any such change or elimination shall become effective only when there is no debt security outstanding of any series created prior to the execution of such supplemental indenture which is entitled to the benefit of such provision; and

•to establish any additional form of debt security, as permitted by the indenture, and to provide for the issuance of any additional series of debt securities, as permitted by the indenture.

Defeasance, Satisfaction and Discharge to Maturity or Redemption

Defeasance of any Series

If we deposit with the trustee, in trust, at or before maturity or redemption, (a) lawful money in an amount, (b) direct obligations of the United States, or of any other government which issued the currency in which the debt securities of a series are denominated, or obligations which are guaranteed by the United States or the other government (which direct or guaranteed obligations are full faith and credit obligations of such government, are denominated in the currency in which the debt securities of such are denominated and which are not callable or redeemable at the option of the issuer there) in an amount and with a maturity so that the proceeds therefrom will provide funds, or (c) a combination thereof in an amount, sufficient, in the opinion of a nationally-recognized firm

of independent public accountants, to pay when due the principal, premium, if any, and interest to maturity or to the redemption date, as the case may be, with respect to any series of debt securities then outstanding, and any mandatory sinking fund payments or similar payments or payment pursuant to any call for redemption applicable to such debt securities of such series on the day on which such payments are due and payable in accordance with the terms of the indenture and such debt securities, then the provisions of the indenture would no longer be effective as to the debt securities to which such deposit relates, including the restrictive covenants described in this prospectus and events of default relating to the payment of other indebtedness and the performance of covenants that are not specifically described as events of default in the indenture, except as to:

•our obligation to duly and punctually pay the principal of and premium, if any, and interest on the series of debt securities if the debt securities are not paid from the money or securities held by the trustee;

•certain of the events of default described under “Events of Default” below; and

•other specified provisions of the indenture including, among others, those relating to registration, transfer and exchange, lost or stolen securities, maintenance of place of payment and, to the extent applicable to the series, the redemption and sinking fund provisions of the indenture.

Defeasance of debt securities of any series is subject to the satisfaction of specified conditions, including, among others, the absence of an event of default at the date of the deposit and the perfection of the holders’ security interest in the deposit.

Satisfaction and Discharge of any Series

Upon the deposit of money or securities contemplated above and the satisfaction of specified conditions, the provisions of the indenture (excluding the exceptions discussed above under the heading “Defeasance of any Series”) would no longer be effective as to the related debt securities, we may cease to comply with our obligation to pay duly and punctually the principal of and premium, if any, and interest on a particular series of debt securities, the events of default in the indenture no longer would be effective as to such debt securities and thereafter the holders of the series of debt securities will be entitled only to payment out of the money or securities deposited with the trustee.

The specified conditions include, among others, except in limited circumstances involving a deposit made within one year of maturity or redemption:

• the absence of an event of default at the date of deposit or on the 91st day thereafter;

•our delivery to the trustee of an opinion of nationally-recognized tax counsel, or our receipt or publication of a ruling by the Internal Revenue Service, to the effect that holders of the debt securities of the series will not recognize income, gain or loss for federal income tax purposes as a result of the deposit and discharge, and the holders will be subject to federal income tax on the same amounts and in the same manner and at the same times as would have been the case if the deposit and discharge had not occurred; and

•that we receive an opinion of counsel to the effect that the satisfaction and discharge will not result in the delisting of the debt securities of that series from any nationally-recognized exchange on which they are listed.

Events of Default

As to any series of debt securities, an event of default is defined in the indenture as being:

•default for 30 days in payment of any interest on the debt securities of that series;

•failure to pay principal or premium, if any, with respect to the debt securities of that series when due;

•failure to pay or satisfy any sinking fund payment or similar obligation with respect to any series of debt securities when due;

•failure to observe or perform any other covenant, warranty or agreement in the indenture or debt securities of any series, other than a covenant, warranty or agreement, a default in whose performance or whose breach is specifically dealt with in the section of the indenture governing events of default, if the failure continues for 60 days after written notice by the trustee or the holders of at least 25% in aggregate principal amount of the debt securities of the series then outstanding;

•uncured or unwaived failure to pay principal of or interest on any of our other obligations for borrowed money, including default under any other series of debt securities, beyond any period of grace with respect thereto if (a) the aggregate principal amount of the obligation is in excess of the greater of $50,000,000 or 5% of our consolidated total debt; and (b) the default in payment is not being contested by us in good faith and by appropriate proceedings;

•specified events of bankruptcy, insolvency, receivership or reorganization; or

•any other event of default provided with respect to debt securities of that series.

Notice and Declaration of Defaults

So long as the debt securities of any series remain outstanding, we will be required to furnish annually to the trustee a certificate of one of our corporate officers stating whether, to the best of their knowledge, we are in default under any of the provisions of the indenture, and specifying all defaults, and the nature thereof, of which they have knowledge. We will also be required to furnish to the trustee copies of specified reports filed by us with the SEC.

The indenture provides that the trustee will, within 90 days after the occurrence of a default with respect to any series for which there are debt securities outstanding which is continuing, give to the holders of those debt securities notice of all uncured defaults known to it, including events specified above without grace periods. Except in the case of default in the payment of principal, premium, if any, or interest on any of the debt securities of any series or the payment of any sinking fund installment on the debt securities of any series, the trustee may withhold notice to the holders if the trustee in good faith determines that withholding notice is in the interest of the holders of the debt securities.

The trustee or the holders of 25% in aggregate principal amount of the outstanding debt securities of any series may declare the debt securities of that series immediately due and payable upon the occurrence of any event of default after expiration of any applicable grace period. In some cases, the holders of a majority in principal amount of the debt securities of any series then outstanding may waive any past default and its consequences, except a default in the payment of principal, premium, if any, or interest, including sinking fund payments.

If a specified event of bankruptcy, insolvency, receivership, or reorganization occurs and is continuing, then the principal amount of (or, if the debt securities of that series are original issue discount debt securities, such portion of the principal amount as may be specified in their terms as due and payable upon acceleration) and any accrued and unpaid interest on that series will immediately become due and payable without any declaration or other act on the part of the trustee or any holder.

Actions upon Default

Subject to the provisions of the indenture relating to the duties of the trustee in case an event of default with respect to any series of debt securities occurs and is continuing, the indenture provides that the trustee will be under no obligation to exercise any of its rights or powers under the indenture at the request, order or direction of any of the holders of debt securities outstanding of any series unless the holders have offered to the trustee reasonable indemnity. The right of a holder to institute a proceeding with respect to the indenture is subject to conditions precedent including notice and indemnity to the trustee, but the holder has a right to receipt of principal, premium, if any, and interest on their due dates or to institute suit for the enforcement thereof, subject to specified limitations with respect to defaulted interest.

The holders of a majority in principal amount of the debt securities outstanding of the series in default will have the right to direct the time, method and place for conducting any proceeding for any remedy available to the trustee, or exercising any power or trust conferred on the trustee. Any direction by the holders will be in accordance with law and the provisions of the indenture, provided that the trustee may decline to follow any such direction if the trustee determines on the advice of counsel that the proceeding may not be lawfully taken or would be materially or unjustly prejudicial to holders not joining in the direction. The trustee will be under no obligation to act in accordance with the direction unless the holders offer the trustee reasonable security or indemnity against costs, expenses and liabilities which may be incurred thereby.

Governing Law

The indenture and the debt securities will be governed by, and construed in accordance with, the laws of the State of New York.

Concerning the Trustee

We and our affiliates utilize a full range of treasury services, including investment management and currency and derivative trading, from the trustee and its affiliates in the ordinary course of business to meet our funding and investment needs.

Under the indenture, the trustee is required to transmit annual reports to all holders regarding its eligibility and qualifications as trustee under the indenture and specified related matters.

Book-Entry, Delivery and Form

Except as set forth below, debt securities will be represented by one or more permanent, global note in registered form without interest coupons (the “Global Notes”).

The Global Notes will be deposited upon issuance with the trustee as custodian for DTC, in New York, New York, and registered in the name of DTC’s nominee, Cede & Co., in each case for credit to an account of a direct or indirect participant in DTC as described below. Beneficial interests in the Global Notes may be held through the Euroclear System (“Euroclear”) and Clearstream Banking, S.A. (“Clearstream”) (as indirect participants in DTC).

Except as set forth below, the Global Notes may be transferred, in whole but not in part, only to another nominee of DTC or to a successor of DTC or its nominee. Beneficial interests in the Global Notes may not be exchanged for Certificated Notes (as defined below) except in the limited circumstances described below. See “Exchange of Global Notes for Certificated Notes” below. Except in the limited circumstances described below, owners of beneficial interests in the Global Notes will not be entitled to receive physical delivery of Certificated Notes.

Transfers of beneficial interests in the Global Notes will be subject to the applicable rules and procedures of DTC and its direct or indirect participants (including, if applicable, those of Euroclear and Clearstream), which may change from time to time.

Depository Procedures

The following description of the operations and procedures of DTC, Euroclear and Clearstream are provided solely as a matter of convenience. These operations and procedures are solely within the control of the respective settlement systems and are subject to changes by them. We take no responsibility for these operations and procedures and urge investors to contact the system or their participants directly to discuss these matters.

DTC has advised us that DTC is a limited-purpose trust company created to hold securities for its participating organizations (collectively, the “Participants”) and to facilitate the clearance and settlement of transactions in those securities between Participants through electronic book-entry changes in accounts of its Participants. The Participants include securities brokers and dealers (including the initial purchasers), banks, trust companies, clearing corporations and certain other organizations. Access to DTC’s system is also available to other entities such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a Participant,

either directly or indirectly (collectively, the “Indirect Participants”). Persons who are not Participants may beneficially own securities held by or on behalf of DTC only through the Participants or the Indirect Participants. The ownership interests in, and transfers of ownership interests in, each security held by or on behalf of DTC are recorded on the records of the Participants and Indirect Participants.

DTC has also advised us that, pursuant to procedures established by it:

•upon deposit of the Global Notes, DTC will credit the accounts of Participants designated by the initial purchasers with portions of the principal amount of the Global Notes; and

•ownership of these interests in the Global Notes will be shown on, and the transfer of ownership of these interests will be effected only through, records maintained by DTC (with respect to the Participants) or by the Participants and the Indirect Participants (with respect to other owners of beneficial interests in the Global Notes).

Investors in the Global Notes who are Participants in DTC’s system may hold their interests therein directly through DTC. Investors in the Global Notes who are not Participants may hold their interests therein indirectly through organizations (including Euroclear and Clearstream) which are Participants in such system. Euroclear and Clearstream may hold interests in the Global Notes on behalf of their participants through customers’ securities accounts in their respective names on the books of their respective depositories, which are Euroclear Bank S.A./N.V., as operator of Euroclear, and Citibank, N.A., as operator of Clearstream. All interests in a Global Note, including those held through Euroclear or Clearstream, may be subject to the procedures and requirements of DTC. Those interests held through Euroclear or Clearstream may also be subject to the procedures and requirements of such systems.

The laws of some states require that certain Persons take physical delivery in definitive form of securities that they own. Consequently, the ability to transfer beneficial interests in a Global Note to such Persons will be limited to that extent. Because DTC can act only on behalf of Participants, which in turn act on behalf of Indirect Participants, the ability of a Person having beneficial interests in a Global Note to pledge such interests to Persons that do not participate in the DTC system, or otherwise take actions in respect of such interests, may be affected by the lack of a physical certificate evidencing such interests.

Except as described below, owners of an interest in the Global Notes will not have notes registered in their names, will not receive physical delivery of Certificated Notes and will not be considered the registered owners or “Holders” thereof under the indenture for any purpose.

Payments in respect of the principal of, and interest and premium, if any, on a Global Note registered in the name of DTC or its nominee will be payable to DTC in its capacity as the registered Holder under the indenture. Under the terms of the indenture, we and the trustee will treat the Persons in whose names the notes, including the Global Notes, are registered as the owners of the notes for the purpose of receiving payments and for all other purposes. Consequently, neither we, the trustee nor any of our agents or agents of the trustee has or will have any responsibility or liability for:

•any aspect of DTC’s records or any Participant’s or Indirect Participant’s records relating to or payments made on account of beneficial ownership interests in the Global Notes or for maintaining, supervising or reviewing any of DTC’s records or any Participant’s or Indirect Participant’s records relating to the beneficial ownership interests in the Global Notes; or

•any other matter relating to the actions and practices of DTC or any of its Participants or Indirect Participants.

DTC has advised us that its current practice, at the due date of any payment in respect of securities such as the notes, is to credit the accounts of the relevant Participants with the payment on the payment date unless DTC has reason to believe it will not receive payment on such payment date. Each relevant Participant is credited with an amount proportionate to its beneficial ownership of an interest in the principal amount of the notes as shown on the records of DTC. Payments by the Participants and the Indirect Participants to the beneficial owners of notes will be

governed by standing instructions and customary practices and will be the responsibility of the Participants or the Indirect Participants and will not be the responsibility of DTC, the trustee or us. Neither we nor the trustee will be liable for any delay by DTC or any of its Participants in identifying the beneficial owners of the notes, and we and the trustee may conclusively rely on and will be protected in relying on instructions from DTC or its nominee for all purposes.

Transfers between Participants in DTC will be effected in accordance with DTC’s procedures, and will be settled in same-day funds, and transfers between participants in Euroclear and Clearstream will be effected in accordance with their respective rules and operating procedures.

Cross-market transfers between the Participants in DTC, on the one hand, and Euroclear or Clearstream participants, on the other hand, will be effected through DTC in accordance with DTC’s rules on behalf of Euroclear or Clearstream, as the case may be, by its depositary; however, such cross-market transactions will require delivery of instructions to Euroclear or Clearstream, as the case may be, by the counterparty in such system in accordance with the rules and procedures and within the established deadlines (Brussels time) of such system. Euroclear or Clearstream, as the case may be, will, if the transaction meets its settlement requirements, deliver instructions to its respective depositary to take action to effect final settlement on its behalf by delivering or receiving interests in the relevant Global Note in DTC, and making or receiving payment in accordance with normal procedures for same-day funds settlement applicable to DTC. Euroclear participants and Clearstream participants may not deliver instructions directly to the depositories for Euroclear or Clearstream.

DTC has advised us that it will take any action permitted to be taken by a Holder of notes only at the direction of one or more Participants to whose account DTC has credited the interests in the Global Notes and only in respect of such portion of the aggregate principal amount of the notes as to which such Participant or Participants has or have given such direction. However, if there is an Event of Default under the notes, DTC reserves the right to exchange the Global Notes for definitive notes in registered certificated form (“Certificated Notes”), and to distribute such notes to its Participants.

Although DTC, Euroclear and Clearstream have agreed to the foregoing procedures to facilitate transfers of interests in the Global Notes among participants in DTC, Euroclear and Clearstream, they are under no obligation to perform or to continue to perform such procedures, and may discontinue such procedures at any time. None of the Company, the trustee or any of their respective agents will have any responsibility for the performance by DTC, Euroclear or Clearstream or their respective participants or indirect participants of their respective obligations under the rules and procedures governing their operations.

Exchange of Global Notes for Certificated Notes

A Global Note is exchangeable for Certificated Notes in minimum denominations of $1,000 and in integral multiples of $1,000, if:

•DTC (a) notifies us that it is unwilling or unable to continue as depositary for the Global Notes or (b) has ceased to be a clearing agency registered under the Exchange Act and in either event we fail to appoint a successor depositary within 90 days; or

•there has occurred and is continuing an Event of Default and DTC notifies the trustee of its decision to exchange the Global Note for Certificated Notes.

Beneficial interests in a Global Note also may be exchanged for Certificated Notes in the limited other circumstances permitted by the indenture. In all cases, Certificated Notes delivered in exchange for any Global Note or beneficial interests in Global Notes will be registered in the names, and issued in any approved denominations, requested by or on behalf of the depositary (in accordance with its customary procedures).

Same Day Settlement and Payment

We will make payments in respect of the notes represented by the Global Notes (including principal, premium, if any, and interest) by wire transfer of immediately available funds to the accounts specified by the Global Note