FALSE000170694600017069462023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 7, 2023

____________________________

Virgin Galactic Holdings, Inc.

(Exact name of registrant as specified in its charter)

____________________________ | | | | | | | | | | | | | | |

|

|

|

|

|

| Delaware | | 001-38202 | | 85-3608069 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 1700 Flight Way Tustin, California | | 92782 | |

| (Address of principal executive offices) | | (Zip Code) | |

(949) 774-7640

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) |

| Name of each exchange on which registered | |

| Common stock, $0.0001 par value per share | | SPCE | | New York Stock Exchange |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Virgin Galactic Holdings, Inc. (the “Company”) issued a press release announcing certain financial and other results for the fiscal quarter ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

The information furnished in this Current Report (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 2.05. Costs Associated with Exit or Disposal Activities.

On November 7, 2023, the Company announced a workforce reduction of approximately 185 employees, constituting approximately 18% of the Company’s workforce. The Company is taking this action to decrease its costs and strategically realign its resources. This reduction will result in approximately $25 million in annualized cost savings.

The Company currently estimates that it will incur charges associated with the workforce reduction of approximately $5 million, primarily related to employee severance payments, benefits and related termination costs. The Company expects to recognize the majority of these charges in the fourth quarter of 2023 and that the reduction in force will be substantially complete during the first quarter of 2024.

The estimates of the charges and expenditures that the Company expects to incur in connection with the workforce reduction, and the timing thereof, are subject to several assumptions and the actual amounts incurred may differ materially from these estimates. In addition, the Company may incur other charges or cash expenditures not currently contemplated due to unanticipated events that may occur, including in connection with the implementation of the workforce reduction.

Item 7.01. Regulation FD Disclosure.

On November 7, 2023, the Company issued a press release announcing the workforce reduction. A copy of this press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Current Report (including Exhibit 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K (the “Form 8-K”) contains certain forward-looking statements within the meaning of federal securities laws with respect to Company, including statements regarding the timing and scope of the workforce reduction, the amount and timing of the related charges and costs, and intended objectives and benefits of the workforce reduction. These forward-looking statements generally are identified by words such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Form 8-K, including but not limited to the preliminary nature of the Company’s estimates of the charges and cash expenditures to be incurred, any timing delays in implementing the workforce reduction due to

legal requirements or otherwise, potential disruptions to the Company’s business and operations, and the factors, risks and uncertainties included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as such factors may be updated from time to time in our other filings with the Securities and Exchange Commission (the “SEC”), accessible on the SEC’s website at www.sec.gov and the Investor Relations section of our website at www.virgingalactic.com. These filings identify and address other important risks and uncertainties that could cause the Company’s actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

|

|

|

|

|

| | Virgin Galactic Holdings, Inc. |

|

|

|

Date: November 8, 2023 | | By: | | /s/ Douglas Ahrens |

| | Name: | | Douglas Ahrens |

| | Title: | | Executive Vice President,

Chief Financial Officer and Treasurer |

Virgin Galactic Announces Third Quarter 2023 Financial Results And Provides Business Update

•Successfully Completed Six Spaceflights in Six Months With Overwhelmingly Positive Customer Feedback

•Q3 Cash and Marketable Securities Position of $1.1 Billion Forecasted to be Sufficient to Bring First Delta Class Spaceships Into Service and Achieve Positive Cash Flow in 2026

ORANGE COUNTY, CALIFORNIA – November 8, 2023 – Virgin Galactic Holdings, Inc. (NYSE: SPCE) (“Virgin Galactic” or the "Company”) today announced its financial results for the third quarter ended September 30, 2023 and provided a business update.

Michael Colglazier, Chief Executive Officer of Virgin Galactic said, "With six spaceflights successfully completed in under six months, Virgin Galactic has demonstrated the repeatability of our spaceflight system and also showcased the overwhelmingly positive experience of our Astronauts. With our third quarter cash and marketable securities position of approximately $1.1 billion, we forecast having sufficient capital to bring our first two Delta ships into service and achieve positive cash flow in 2026."

Third Quarter 2023 Financial Highlights

•Cash position remains strong, with cash, cash equivalents and marketable securities of $1.1 billion as of September 30, 2023, a sequential increase of $108 million from the second quarter of 2023.

•Revenue of $1.7 million, compared to $0.8 million in the third quarter of 2022, driven by commercial spaceflight and membership fees related to future astronauts.

•GAAP total operating expenses of $116 million, compared to $146 million in the third quarter of 2022. Non-GAAP total operating expense of $102 million in the third quarter of 2023, compared to $133 million in the third quarter of 2022.

•Net loss of $105 million, compared to a $146 million net loss in the third quarter of 2022, with the improvement primarily driven by lower operating expenses and an increase in interest income.

•Adjusted EBITDA totaled $(87) million, compared to $(129) million in the third quarter of 2022, primarily driven by lower operating expenses and an increase in interest income.

•Net cash used in operating activities totaled $91 million, compared to $96 million in the third quarter of 2022.

•Cash paid for capital expenditures totaled $13 million, compared to $6 million in the third quarter of 2022.

•Free cash flow totaled $(105) million, compared to $(102) million in the third quarter of 2022.

•Generated $211 million in gross proceeds through the issuance of 62 million shares of common stock as part of the Company's at-the-market offering program.

Business Updates

•‘Galactic 06’ spaceflight mission planned for January 2024.

•Spaceship factory in Phoenix, Arizona is on track to open in mid-2024.

•Production schedule for the Delta Class spaceships remains on track for revenue service in 2026.

Financial Guidance

The following forward-looking statements reflect our expectations for the fourth quarter of 2023 as of November 8, 2023 and are subject to substantial uncertainty. Our results are based on assumptions that we believe to be reasonable as of this date, but may be materially affected by many factors, as discussed below in “Forward-Looking Statements.”

•Revenue for the fourth quarter of 2023 is expected to be approximately $3 million.

•Free cash flow for the fourth quarter of 2023 is expected to be in the range of $(125) million to $(135) million.

Non-GAAP Financial Measures

In addition to the Company's results prepared in accordance with generally accepted accounting principles in the United States (GAAP), the Company is also providing certain non-GAAP financial measures. A discussion regarding the use of non-GAAP financial measures and a reconciliation of such measures to the most directly comparable GAAP information is presented later in this press release.

Statement of Operations Presentation

Following the launch of commercial service and achievement of technological feasibility, the Company began presenting the operating expenses supporting the Company’s commercial spaceline activities as spaceline operations expense in the accompanying condensed consolidated statements of operations and comprehensive loss. Expenses incurred prior to the achievement of technological feasibility were classified as research and development and selling, general and administrative expenses. Spaceline operations expense includes costs associated with commercial spaceflight services and production costs that are not eligible for capitalization. Spaceline operations expense also includes costs to support the Company’s Future Astronaut Community and costs related to payload cargo and engineering services, which were previously presented as customer experience expense.

Conference Call Information

Virgin Galactic will host a conference call to discuss the results at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) today. To access the conference call, parties should dial +1 888 660-6431 or +1 929 203-2118 and enter the conference ID number 4014201. The live audio webcast along with supplemental information will be accessible on the Company’s Investor Relations website at https://investors.virgingalactic.com/events-and-presentations/. A recording of the webcast will also be available following the conference call.

About Virgin Galactic Holdings

Virgin Galactic is an aerospace and space travel company, pioneering human spaceflight for private individuals and researchers with its advanced air and space vehicles. It has developed a spaceflight system designed to connect the world to the love, wonder and awe created by space travel and to offer customers a transformative experience. You can find more information at https://www.virgingalactic.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding our spaceflight systems, expected flight schedule, scaling of our future fleet, providing repeatable and reliable access to space, development of our Delta class spaceships, the timing of the opening of our spaceship factory in Phoenix, our objectives for future operations and the Company’s financial forecasts, including the expectation for positive cash flow and the timing thereof, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “strategy,” “future,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements, including but not limited to the factors, risks and uncertainties included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as such factors may be updated from time to time in our other filings with the Securities and Exchange Commission (the "SEC"), accessible on the SEC’s website at www.sec.gov and the Investor Relations section of our website at www.virgingalactic.com, which could cause our actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change.

Third Quarter 2023 Financial Results

VIRGIN GALACTIC HOLDINGS, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited; in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Revenue | | $ | 1,728 | | | $ | 767 | | | $ | 3,991 | | | $ | 1,443 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Spaceline operations | | 25,648 | | | 590 | | | 26,200 | | | 737 | |

| Research and development | | 44,848 | | | 97,411 | | | 241,292 | | | 211,578 | |

| Selling, general and administrative | | 42,218 | | | 46,113 | | | 144,020 | | | 127,820 | |

| Depreciation and amortization | | 3,286 | | | 2,214 | | | 9,723 | | | 7,981 | |

| Total operating expenses | | 116,000 | | | 146,328 | | | 421,235 | | | 348,116 | |

| | | | | | | | |

| Operating loss | | (114,272) | | | (145,561) | | | (417,244) | | | (346,673) | |

| | | | | | | | |

| Interest income | | 12,856 | | | 3,524 | | | 28,590 | | | 6,327 | |

| Interest expense | | (3,221) | | | (3,293) | | | (9,648) | | | (8,924) | |

| Other income (expense), net | | 86 | | | (203) | | | 164 | | | 7 | |

| Loss before income taxes | | (104,551) | | | (145,533) | | | (398,138) | | | (349,263) | |

| Income tax expense | | 53 | | | 21 | | | 215 | | | 69 | |

| Net loss | | (104,604) | | | (145,554) | | | (398,353) | | | (349,332) | |

| Other comprehensive income (loss): | | | | | | | | |

| Foreign currency translation adjustment | | (60) | | | (181) | | | 9 | | | (314) | |

| Unrealized income (loss) on marketable securities | | 1,022 | | | (585) | | | 6,008 | | | (8,227) | |

| Total comprehensive loss | | $ | (103,642) | | | $ | (146,320) | | | $ | (392,336) | | | $ | (357,873) | |

| | | | | | | | |

| Net loss per share: | | | | | | | | |

| Basic and diluted | | $ | (0.28) | | | $ | (0.55) | | | $ | (1.26) | | | $ | (1.34) | |

| | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | |

| Basic and diluted | | 375,853 | | | 263,907 | | | 316,198 | | | 260,255 | |

VIRGIN GALACTIC HOLDINGS, INC.

Condensed Consolidated Balance Sheets

(Unaudited; in thousands) | | | | | | | | | | | | | | | | | |

| | | September 30, 2023 | | | | December 31, 2022 |

| Assets | | | | | | | |

| Current assets: | | | | | | | |

| Cash and cash equivalents | | | $ | 231,030 | | | | | $ | 302,291 | |

| Restricted cash | | | 38,031 | | | | | 40,336 | |

| Marketable securities, short-term | | | 766,047 | | | | | 606,716 | |

| Inventories | | | 17,062 | | | | | 24,043 | |

| Prepaid expenses and other current assets | | | 24,051 | | | | | 28,228 | |

| Total current assets | | | 1,076,221 | | | | | 1,001,614 | |

| Marketable securities, long-term | | | 53,130 | | | | | 30,392 | |

| Property, plant and equipment, net | | | 74,066 | | | | | 53,658 | |

| Other non-current assets | | | 64,567 | | | | | 54,274 | |

| Total assets | | | $ | 1,267,984 | | | | | $ | 1,139,938 | |

| Liabilities and Stockholders' Equity | | | | | | | |

| Current liabilities: | | | | | | | |

| Accounts payable | | | $ | 27,986 | | | | | $ | 16,326 | |

| Accrued liabilities | | | 49,888 | | | | | 61,848 | |

| Customer deposits | | | 97,923 | | | | | 102,647 | |

| Other current liabilities | | | 4,342 | | | | | 3,232 | |

| Total current liabilities | | | 180,139 | | | | | 184,053 | |

| Non-current liabilities: | | | | | | | |

| Convertible senior notes, net | | | 417,338 | | | | | 415,720 | |

| Other long-term liabilities | | | 71,148 | | | | | 59,942 | |

| Total liabilities | | | 668,625 | | | | | 659,715 | |

| Stockholders' Equity | | | | | | | |

| Common stock | | | 40 | | | | | 28 | |

| Additional paid-in capital | | | 2,622,776 | | | | | 2,111,316 | |

| Accumulated deficit | | | (2,022,148) | | | | | (1,623,795) | |

| Accumulated other comprehensive loss | | | (1,309) | | | | | (7,326) | |

| Total stockholders' equity | | | 599,359 | | | | | 480,223 | |

| Total liabilities and stockholders' equity | | | $ | 1,267,984 | | | | | $ | 1,139,938 | |

VIRGIN GALACTIC HOLDINGS, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited; in thousands) | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (398,353) | | | $ | (349,332) | |

| Stock-based compensation | | 35,598 | | | 34,488 | |

| Depreciation and amortization | | 9,723 | | | 7,981 | |

| Amortization of debt issuance costs | | 1,618 | | | 1,466 | |

| Other non-cash items | | (6,500) | | | 10,256 | |

| Change in operating assets and liabilities: | | | | |

| Inventories | | 3,996 | | | 6,817 | |

| Other current and non-current assets | | 10,297 | | | 2,253 | |

| Accounts payable and accrued liabilities | | (2,941) | | | 23,828 | |

| Customer deposits | | (4,724) | | | 13,108 | |

| Other current and long-term liabilities | | (1,598) | | | 136 | |

| Net cash used in operating activities | | (352,884) | | | (248,999) | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | | (25,941) | | | (12,306) | |

| Purchases of marketable securities | | (872,950) | | | (604,945) | |

| Proceeds from maturities and calls of marketable securities | | 702,346 | | | 294,612 | |

| Net cash used in investing activities | | (196,545) | | | (322,639) | |

| Cash flows from financing activities: | | | | |

| Payments of finance lease obligations | | (175) | | | (132) | |

| Proceeds from convertible senior notes | | — | | | 425,000 | |

| Debt issuance costs | | — | | | (11,278) | |

| Purchase of capped call | | — | | | (52,318) | |

| Repayment of commercial loan | | — | | | (310) | |

| Proceeds from issuance of common stock | | 484,145 | | | 99,573 | |

| Proceeds from issuance of common stock pursuant to stock options exercised | | — | | | 49 | |

| Withholding taxes paid on behalf of employees on net settled stock-based awards | | (3,001) | | | (3,479) | |

| Transaction costs related to issuance of common stock | | (5,106) | | | (1,137) | |

| Net cash provided by financing activities | | 475,863 | | | 455,968 | |

| Net decrease in cash, cash equivalents and restricted cash | | (73,566) | | | (115,670) | |

| Cash, cash equivalents and restricted cash at beginning of period | | 342,627 | | | 550,030 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 269,061 | | | $ | 434,360 | |

| | | | |

| Cash and cash equivalents | | $ | 231,030 | | | $ | 394,032 | |

| Restricted cash | | 38,031 | | | 40,328 | |

| Cash, cash equivalents and restricted cash | | $ | 269,061 | | | $ | 434,360 | |

Use of Non-GAAP Financial Measures

This press release references certain financial measures that are not prepared in accordance with generally accepted accounting principles in the United States (GAAP), including, total non-GAAP operating expenses, Adjusted EBITDA and free cash flow. The Company defines total non-GAAP operating expenses as total operating expenses other than stock-based compensation and depreciation and amortization. The Company defines Adjusted EBITDA as earnings before interest expense, income taxes, depreciation and amortization, stock-based compensation, and certain other items the Company believes are not indicative of its core operating performance. The Company defines free cash flow as net cash provided by operating activities less capital expenditures. None of these non-GAAP financial measures is a substitute for or superior to measures prepared in accordance with GAAP and should not be considered as an alternative to any other measures derived in accordance with GAAP.

The Company believes that presenting these non-GAAP financial measures provides useful supplemental information to investors about the Company in understanding and evaluating its operating results, enhancing the overall understanding of its past performance and future prospects, and allowing for greater transparency with respect to key financial metrics used by its management in financial and operational-decision making. However, there are a number of limitations related to the use of non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore any non-GAAP measures the Company uses may not be directly comparable to similarly titled measures of other companies.

A reconciliation of total operating expenses to total non-GAAP operating expenses for the three and nine months ended September 30, 2023 and 2022 is set forth below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Total operating expenses | | $ | 116,000 | | | $ | 146,328 | | | $ | 421,235 | | | $ | 348,116 | |

Stock-based compensation | | 10,763 | | | 11,510 | | | 35,598 | | | 34,488 | |

Depreciation and amortization | | 3,286 | | | 2,214 | | | 9,723 | | | 7,981 | |

Total non-GAAP operating expenses | | $ | 101,951 | | | $ | 132,604 | | | $ | 375,914 | | | $ | 305,647 | |

A reconciliation of net loss to Adjusted EBITDA for the three and nine months ended September 30, 2023 and 2022 is set forth below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | | $ | (104,604) | | | $ | (145,554) | | | $ | (398,353) | | | $ | (349,332) | |

| Interest expense | | 3,221 | | | 3,293 | | | 9,648 | | | 8,924 | |

| Income tax expense | | 53 | | | 21 | | | 215 | | | 69 | |

| Depreciation and amortization | | 3,286 | | | 2,214 | | | 9,723 | | | 7,981 | |

| Stock-based compensation | | 10,763 | | | 11,510 | | | 35,598 | | | 34,488 | |

| Adjusted EBITDA | | $ | (87,281) | | | $ | (128,516) | | | $ | (343,169) | | | $ | (297,870) | |

The following table reconciles net cash used in operating activities to free cash flow for the three and nine months ended September 30, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash used in operating activities | | $ | (91,497) | | | $ | (96,038) | | | $ | (352,884) | | | $ | (248,999) | |

| Capital expenditures | | (13,325) | | | (6,013) | | | (25,941) | | | (12,306) | |

| Free cash flow | | $ | (104,822) | | | $ | (102,051) | | | $ | (378,825) | | | $ | (261,305) | |

The following table reconciles forecasted net cash used in operating activities to forecasted free cash flow for the fourth quarter of 2023 (in thousands):

| | | | | | | | |

| | Forecasted Range |

| Net cash used in operating activities | | $(100,000) - $(105,000) |

| Capital expenditures | | (25,000) - (30,000) |

| Free cash flow | | $(125,000) - $(135,000) |

For media inquiries:

Aleanna Crane - Vice President, Communications

Virgingalacticpress@virgingalactic.com

575-800-4422

For investor inquiries:

Eric Cerny - Vice President, Investor Relations

vg-ir@virgingalactic.com

949-774-7637

Virgin Galactic Provides Business Update

ORANGE COUNTY, Calif. November 7, 2023 -- Virgin Galactic Holdings, Inc. (NYSE: SPCE) (“Virgin Galactic” or the “Company”), notified all employees today, Tuesday, November 7 of a strategic realignment of the Company’s resources and a related workforce reduction to support the production of its Delta Class spaceships.

Virgin Galactic’s senior leadership will share additional details on the Company’s third-quarter earnings call, scheduled for 2:00 PM PT Wednesday, November 8, 2023.

Please refer to internal memo below sent to all employees at Virgin Galactic from CEO, Michael Colglazier.

For media inquiries:

Aleanna Crane – Vice President, Communications

news@virgingalactic.com

575.800.4422

For investor inquiries:

Eric Cerny – Vice President, Investor Relations

vg-ir@virgingalactic.com

949.774.7637

About Virgin Galactic

Virgin Galactic is an aerospace and space travel company, pioneering human spaceflight for private individuals and researchers with its advanced air and space vehicles. It has developed a spaceflight system designed to connect the world to the love, wonder and awe created by space travel and to offer customers a transformative experience. You can find more information at https://www.virgingalactic.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding timing and scope of the workforce reduction, intended objectives and benefits of the workforce reduction, intent to announce future plans, and objectives for the Delta class spaceships are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “strategy,” “future,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including but not limited to the factors, risks and uncertainties included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as such factors may be updated from time to time in our other filings with the Securities and Exchange Commission (the “SEC”), accessible on the SEC’s website at www.sec.gov and the Investor Relations section of our website at www.virgingalactic.com, which could cause our actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change.

# # #

The following email was sent to all Virgin Galactic employees today, November 7, 2023 by Virgin Galactic CEO Michael Colglazier.

Hi Team,

We spoke in our town halls last month about the success of our recent spaceflights and the incredible experience that is being delivered to our early astronauts. We also spoke about the need to focus our resources on the work that will create long-term financial health and success for our company. As we discussed, our Delta Class ships will drive the capacity, growth, and profitability of our company, and we must focus our efforts on bringing these ships into service.

I’m writing today to share news that we will be streamlining our work outside of the Delta program, and we will be making related reductions in both staff and expenses. This is a difficult decision, as reductions in our workforce have direct and indirect impacts on our team, our co-workers, and our friends. I want to share how I arrived at this decision, what the process will be for those who are leaving, and what happens next.

Why are we making this decision?

To profitably scale our business, we must first invest upfront capital to create a fleet of ships based on a standardized production model — the Delta Class ships. At the same time, it has been imperative for us to demonstrate the value and potential of our product by bringing our initial ships, Unity and Eve, into commercial service. Both of these initiatives consume substantial resources, and both have been critical to our company. We have successfully advanced both of these important efforts in parallel, and we have been able to support our funding needs along the way with access to capital markets.

Recently, however, uncertainty has grown in the capital markets. Interest rates remain high, which adds pressure to companies who are investing today for profits that will come in the future. Geopolitical unrest continues to expand, and the combination of these factors makes near-term access to capital much less favorable. We are going to succeed in this environment by focusing our full company efforts on the safe, efficient, and successful completion of our Delta program that will allow us to create positive cash flow.

The Delta ships are powerful economic engines. To bring them into service, we need to extend our strong financial position and reduce our reliance on unpredictable capital markets. We will accomplish this, but it requires us to redirect our resources toward the Delta ships while streamlining and reducing our work outside of the Delta program.

By taking these actions now, we ensure Virgin Galactic continues to have access to the funding needed to deliver on our mission — bringing the wonder of space to both our existing customers and to the generations of customers who will follow.

What is the process for letting me know if I am being impacted?

Beginning this afternoon and extending through Thursday, we will be making phone calls to each of you to confirm your employment status. It will take a bit longer to reach everyone vs. simply sending an email, but we want to have personal discussions as much as possible. As a company, we will be working from home during the remainder of this week, as on-site work locations will be unavailable through the end of the week.

What happens next?

These actions, while necessary, come with great impact. Our teammates who will be leaving Virgin Galactic are talented, purpose-driven, and they excel in their professions… and it is deeply unfortunate to part ways with some of our co-workers and friends.

To those who will be leaving, I am very sorry these changes will impact you so directly. I want to thank each of you for the talent, passion, and perseverance you have put into our company each day — we became a commercial Spaceline this year thanks to your efforts, and I am grateful to you for the work you have done to advance the dream of opening access to space for generations to come.

To the larger teams who are not directly impacted, I know these changes can be unsettling and disruptive. Our friends and co-workers who are leaving are part of Virgin Galactic’s story and success, and while they will become a part of our history, we will miss them in our day to day interactions.

This is a tough moment… but these actions are being taken to remove reliance on unpredictable capital markets, and these actions protect our ability to succeed as we build and lead our industry through the long term. I ask for your understanding and continued engagement as we adjust our operating focus and move forward.

We will be sharing more about the plans that will take us successfully forward during our earnings call tomorrow afternoon. Next week, we will gather both in larger groups and smaller teams to answer your questions about program plans, share company economics in greater detail, and align our focus towards profitably scaling up our spaceship fleet for a global audience.

Michael

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

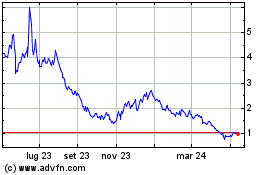

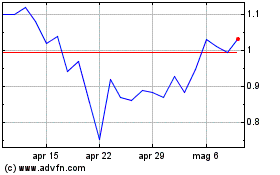

Grafico Azioni Virgin Galactic (NYSE:SPCE)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Virgin Galactic (NYSE:SPCE)

Storico

Da Mag 2023 a Mag 2024