- Survey finds ETF strategies are used by majority of

financial advisors and institutions; adoption by individual

investors on the rise

- Education key to increasing use of ETFs by

individuals

- Most institutional investors and financial advisors are

bullish on the S&P 500’s 2024 returns

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT) today released the results of

its 2024 ETF Impact Survey, which reveals more than two thirds of

financial advisors (70%) “always” or “often” recommend ETFs to

their clients and a similar percentage of institutional investors

(67%) use ETFs in investment strategies. While less than half of

all individual investors (45%) currently have ETFs in their

portfolio —adoption by individuals is up from 40% in 2022 and

appears poised for additional growth with more education. The

survey was first conducted in 2022 and is designed to understand a

wide range of investor attitudes and perceptions about ETFs, the

market and the economy.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240719373253/en/

While less than half (45%) of individual

investors have ETFs in their investment portfolios, nearly 70% of

financial advisors recommend ETFs to their clients “always” or

“often” and 67% of institutional investors use ETFs in their

investment strategies “extensively” or “frequently.” (Source: State

Street Global Advisors 2024 ETF Impact Survey, April 2024)

The use of ETFs by individual investors is highest among younger

individuals, as 58% of Millennial investors report they hold ETFs,

compared to 47% of Gen Xers and 37% of Baby Boomers. The top

reasons individual investors cite for holding ETFs in a portfolio

include diversification benefits (49%), access to specific asset

classes/exposures (47%) and lower costs/expense ratios (39%).

Notably, 65% of investors say that ETFs have improved the

overall performance of their portfolio (up from 59% in 2022), and

the percentage of investors who believe ETFs have made them a

better investor has held steady at 54%, compared to 53% in

2022.

"There is still growing confidence that ETFs should be a core

part of a diversified portfolio," said Anna Paglia, chief business

officer for State Street Global Advisors. "The rapid growth and

lower cost of ETFs since their introduction over 30 years ago has

made it easier for people from all walks of life to become

investors.”

Among individuals who do not own ETFs, a significant knowledge

gap exists with 71% reporting the tax efficiency of ETFs is

difficult to understand compared to 48% of ETF investors.

Similarly, more than two-thirds of investors (69%) who don’t own

ETFs say ETF pricing is difficult to understand (compared to 35% of

ETF investors) and more than half (57%) say they have a difficult

time understanding the difference between mutual funds and ETFs

(compared to 23% of ETF investors).

“Despite their popularity, significant investor education still

needs to be done to close the knowledge gap about ETFs,” said

Paglia. “We know many investors are initially drawn to ETFs for

their low cost, but more work needs to be done to raise awareness

of all the financial advantages ETFs offer investors, beyond

cost.”

Institutions & Financial Advisors More Bullish Than

Individual Investors

A majority of institutional investors (57%) and financial

advisors (55%) are bullish, expecting the S&P 500® to post

gains in 2024. Individual investors are less certain with 44%

predicting the index will finish up, 31% expecting S&P 500

returns to be flat, and 15% anticipating it will finish the year in

the red.

However, despite individual investors’ mixed outlook on the

near-term performance of the stock market, when it comes to the

long-term view of their own financial futures, they are decidedly

more optimistic. Eighty-four percent (84%) indicate they are

optimistic about their own financial futures in the year ahead — up

from 71% in Q4 2022.

There is a similar gap in confidence among individual investors

regarding their outlook for the country’s economic situation, with

just 32% indicating they are optimistic about the economy in the

year ahead.

Additional findings from State Street Global Advisors 2024 US

ETF Impact Survey for financial advisors and institutions

include:

Financial Advisors

- The top three reasons for recommending ETFs to clients include

cost efficiency (44%), diversification benefits (43%) and trading

flexibility (43%).

- When making a choice between ETFs that offer the same or

similar exposure, the most important factors considered by advisors

are best track record/performance (58%), lowest expense ratio

(54%), and highest liquidity (54%).

- More than three-quarters of advisors (77%) are optimistic about

the outlook for the US economy and 68% are optimistic about the

global economy.

Institutional Investors

- The top three reasons why institutions use ETFs include

diversification benefits (65%), cost efficiency (60%) and

cash/liquidity management (54%).

- When making a choice between ETFs that offer the same or

similar exposure, the most important factors considered by

institutions are highest liquidity (66%), best track

record/performance (62%), and lowest total cost (53%).

- A majority of institutional investors (60%) are optimistic

about the outlook for the US economy and 41% are optimistic about

the global economy.

- The top three concerns among institutional investors include

inflation (73%), fluctuations in interest rates (66%), and

geopolitical instability (65%).

“The nuances in how and why institutions, advisors, and

individuals are using ETFs speak to the many different investor

benefits provided by the ETF wrapper,” continued Paglia. “State

Street Global Advisors will continue to innovate and evolve its ETF

offerings to meet the changing demands of a wide variety of

investor segments.”

The SPDR ETF Impact Report 2024-2025: The Next Wave of

Innovation provides a comprehensive analysis of the global survey

findings and SPDR’s top predictions on the future of ETF

growth.

For more information, visit the ETF Impact Survey landing

zone.

About State Street Global Advisors 2024 ETF Impact

Survey

The survey was designed to understand investor attitudes and

perceptions about ETFs, the market and the economy in the US, APAC

and EMEA. The data reported here focuses on findings for the

US.

State Street Global Advisors, in partnership with A2Bplanning

and Prodege, conducted an online survey among individual investors,

financial advisors and institutional investors. In the US, data was

collected from April 1-25, 2024 from a nationally representative

sample of 1,000 adults 18+. It was then filtered for analysis among

319 Individual Investors with investable assets of $250,000 or

more, 201 financial advisors with AUM of $25 million or more with

90% with AUM of $50 million or more, and 100 institutional

investors who are involved in the decision making for AUM of $1

billion or more.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the

world’s governments, institutions, and financial advisors. With a

rigorous, risk-aware approach built on research, analysis, and

market-tested experience, we build from a breadth of index and

active strategies to create cost-effective solutions. As pioneers

in index and ETF investing, we are always inventing new ways to

invest. As a result, we have become the world’s fourth-largest

asset manager* with US $4.42 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of June 30, 2024 and includes ETF AUM

of $1,393.92 billion USD of which approximately $69.35 billion USD

is in gold assets with respect to SPDR products for which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) acts

solely as the marketing agent. SSGA FD and State Street Global

Advisors are affiliated. Please note all AUM is unaudited.

Important Risk Information

The information provided does not constitute investment advice

and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell a security. It does not

take into account any investor's particular investment objectives,

strategies, tax status or investment horizon. You should consult

your tax and financial advisor.

The whole or any part of this work may not be reproduced, copied

or transmitted or any of its contents disclosed to third parties

without SSGA’s express written consent.

Past performance is not a reliable indicator of future

performance.

Investing involves risk including the risk of loss of

principal.

The views expressed in this material are the views of the State

Street Global Advisors Practice Management Group through the period

ended May 30, 2024 are subject to change based on market and other

conditions. The opinions expressed may differ from those with

different investment philosophies. The information provided does

not constitute investment advice and it should not be relied on as

such. It does not take into account any investor's particular

investment objectives, strategies, tax status or investment

horizon.

All information is from SSGA unless otherwise noted and has been

obtained from sources believed to be reliable, but its accuracy is

not guaranteed. There is no representation or warranty as to the

current accuracy, reliability or completeness of, nor liability

for, decisions based on such information and it should not be

relied on as such.

Diversification does not ensure a profit or guarantee against

loss. The trademarks and service marks referenced herein are the

property of their respective owners.

Third party data providers make no warranties or representations

of any kind relating to the accuracy, completeness or timeliness of

the data and have no liability for damages of any kind relating to

the use of such data.

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs net asset value. Brokerage commissions and ETF expenses

will reduce returns. Frequent trading of ETFs could significantly

increase commissions and other costs such that they may offset any

savings from low fees or costs.

The S&P 500® Index is a product of S&P Dow Jones Indices

LLC or its affiliates (“S&P DJI”) and have been licensed for

use by State Street Global Advisors. S&P®, SPDR®, S&P

500®,US 500 and the 500 are trademarks of Standard & Poor’s

Financial Services LLC (“S&P”); Dow Jones® is a registered

trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has

been licensed for use by S&P Dow Jones Indices; and these

trademarks have been licensed for use by S&P DJI and

sublicensed for certain purposes by State Street Global Advisors.

The fund is not sponsored, endorsed, sold or promoted by S&P

DJI, Dow Jones, S&P, their respective affiliates, and none of

such parties make any representation regarding the advisability of

investing in such product(s) nor do they have any liability for any

errors, omissions, or interruptions of these indices.

In general, ETFs can be expected to move up or down in value

with the value of the applicable index. Although ETF shares may be

bought and sold on the exchange through any brokerage account, ETF

shares are not individually redeemable from the Fund. Investors may

acquire ETFs and tender them for redemption through the Fund in

Creation Unit Aggregations only. Please see the prospectus for more

details.

Distributor: State Street Global Advisors Funds

Distributors, LLC, member FINRA, SIPC, an indirect wholly owned

subsidiary of State Street Corporation. References to State Street

may include State Street Corporation and its affiliates. Certain

State Street affiliates provide services and receive fees from the

SPDR ETFs.

Before investing, consider the funds’ investment objectives,

risks, charges and expenses. To obtain a prospectus or summary

prospectus which contains this and other information, call

1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured - No Bank Guarantee - May Lose Value

State Street Global Advisors Fund Distributors, LLC,

member FINRA, SIPC

© 2024 State Street Corporation. All Rights Reserved. State

Street Global Advisors Funds Distributors, LLC, One Iron Street,

Boston, MA 02210

6790707.1.1.AM.RTL Exp. Date: 07/31/2025

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240719373253/en/

Deborah Heindel 617-662-9927 dheindel@statestreet.com

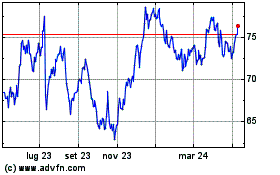

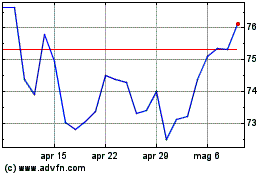

Grafico Azioni State Street (NYSE:STT)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni State Street (NYSE:STT)

Storico

Da Dic 2023 a Dic 2024