false

0000740260

0000740260

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

March 4, 2024

Ventas, Inc.

(Exact Name of Registrant as Specified in

Its Charter)

| Delaware |

|

1-10989 |

|

61-1055020 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 353

N. Clark Street, Suite

3300, Chicago, Illinois |

|

60654 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (877) 483-6827

Not applicable

Former Name or Former Address, if Changed

Since Last Report

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

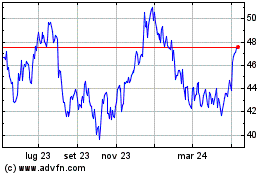

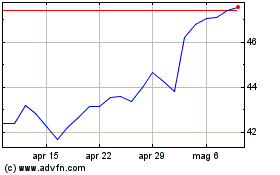

| Common stock, $0.25 par value |

|

VTR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On March 4, 2024, Ventas, Inc. (“we,” “us,”

“our,” “Company” and other similar terms) entered into a cooperation agreement (the “Cooperation Agreement”)

with Land & Buildings Investment Management, LLC and certain of its affiliates (collectively, “Land & Buildings”).

Pursuant to the Cooperation Agreement, the Company has appointed Theodore

R. Bigman, Founder and Chief Investment Officer of Bigman Holdings and former Head of Global Listed Real Assets Investing at Morgan Stanley

Investment Management and Joe V. Rodriguez, Jr., President of Burnt Mountain Investments LLC and former Chief Investment Officer

of Invesco Real Estate to the Company’s Board of Directors (the “Board”). In addition, Mr. Bigman has been appointed

to the Investment Committee of the Board and Mr. Rodriguez has been appointed to the Nominating, Governance and Corporate Responsibility

Committee of the Board. The Company also agreed to nominate Mr. Bigman and Mr. Rodriguez for re-election at the Company’s

2024 Annual Meeting of Stockholders.

The Cooperation Agreement will remain effective until the day after

the Company’s 2025 Annual Meeting of Stockholders.

Pursuant to the Cooperation Agreement, Land & Buildings has

agreed to abide by certain voting commitments and standstill restrictions. The Cooperation Agreement also contains a customary mutual

non-disparagement provision.

The foregoing description does not purport to be complete and is qualified

in its entirety by reference to the Cooperation Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated

by reference herein.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in Item 1.01 is incorporated herein by reference.

On March 4, 2024, Theodore R. Bigman and Joe V. Rodriguez, Jr.

were appointed to the Board effective immediately. The Board has affirmatively determined that each of Mr. Bigman and Mr. Rodriguez

is “independent” under the rules of the New York Stock Exchange and the rules and regulations of the U.S. Securities

Exchange Act of 1934, as amended. Mr. Bigman has been appointed to the Investment Committee of the Board effective immediately and

Mr. Rodriguez has been appointed to the Nominating, Governance and Corporate Responsibility Committee of the Board effective immediately.

Neither Mr. Bigman nor Mr. Rodriguez are a party to any transaction with the Company that would require disclosure under Item 404(a) of Regulation S-K, and there are no arrangements

or understandings between Mr. Bigman and Mr. Rodriguez and any other persons pursuant to which he was selected as a director,

other than with respect to the matters referred to in Item 1.01.

Mr. Bigman and Mr. Rodriguez will participate

in the compensation arrangements for non-employee directors, including receiving an initial award of shares of restricted stock, as described

in the Company’s 2023 proxy statement filed with the U.S. Securities and Exchange Commission on April 5, 2023.

Item 7.01 Regulation FD Disclosure.

On March 4, 2024, the Company issued a press

release announcing the Cooperation Agreement and Mr. Bigman and Mr. Rodriguez’s appointment to the Board. A copy of the

press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

The information furnished pursuant to Item 7.01

of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes

of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated

by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly

set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

VENTAS, INC. |

| |

|

| Date: March 4, 2024 |

By: |

/s/ Carey S. Roberts |

| |

|

Carey S. Roberts |

| |

|

Executive Vice President, General Counsel and Ethics and Compliance Officer |

Exhibit 10.1

COOPERATION AGREEMENT

This Cooperation Agreement (this “Agreement”)

is made and entered into as of March 4, 2024 by and between VENTAS, INC., a Delaware corporation (the “Company”),

on one hand, and LAND & BUILDINGS CAPITAL GROWTH FUND, LP, a Delaware limited partnership (“L&B Capital”),

and its Affiliates, including but not limited to LAND & BUILDINGS INVESTMENT MANAGEMENT, LLC, a Delaware limited liability company

(“L&B Management”), L&B OPPORTUNITY FUND, LLC, a Delaware limited liability company (“L&B Opportunity”),

L&B GP LP, a Delaware limited partnership (“L&B GP LP”), L&B GP LLC, a Delaware limited liability company

(“L&B GP LLC”), and JONATHAN LITT (together with L&B Capital, L&B Management, L&B Opportunity, L&B

GP LP, L&B GP LLC, and any other Affiliate of Mr. Litt or such entities, the “L&B Parties”), on the other

hand, with respect to the matters set forth below. In consideration of the mutual covenants and agreements contained herein, and for other

good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and the L&B Parties, intending

to be legally bound hereby, agree as follows:

1. Board

of Directors; Formation of Committee.

(a) Size

of Board. As promptly as practicable following the execution of this Agreement (and in any event, within two (2) business days

after the date hereof), the Board of Directors of the Company (the “Board”) shall fix the size of the Board at thirteen

(13) directors; provided, however, that the Board shall fix the size of the Board at twelve (12) directors upon conclusion

of the Company’s 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”); provided, further,

that, during the Cooperation Period, the Board shall fix the size of the Board at eleven (11) directors following the next departure of

a director from the Board.

(b) Director

Appointments. As promptly as practicable following the execution of this Agreement (and in any event, within two (2) business

days after the date hereof), the Board shall take all action necessary to appoint each of Theodore R. Bigman (the “First New

Director”) and Joe V. Rodriguez, Jr. (the “Second New Director” and together with the First New Director,

the “ New Directors” and each a “New Director”) as a member of the Board, in each case, with an

initial term expiring at the 2024 Annual Meeting (any or all of which additions the L&B Parties acknowledge and agree the Board may

implement by filling director vacancies created by the Board expanding its size). The Board shall include each New Director as a nominee

for the Board in the Company’s proxy statement for the 2024 Annual Meeting and shall recommend and solicit proxies for the election

of each New Director at the 2024 Annual Meeting in a manner no less rigorous and favorable than the manner in which the Company supports

its other director nominees.

(c) Board

Committees.

(i) As

promptly as practicable following the execution of this Agreement (and in any event, within two (2) business days after the date

hereof), Mr. Bigman shall be appointed to the Investment Committee of the Board (the “Investment Committee”) to

replace an existing member of such Investment Committee, and shall not be removed from the Investment Committee by the Board without cause

until the expiration of the Cooperation Period. If Mr. Bigman is unable or unwilling to serve as a member of the Investment Committee,

resigns as a member, is removed as a member or ceases to be a member for any other reason during the Cooperation Period, the Board shall

select the Second New Director or a Replacement First Director (as defined below) to serve on the Investment Committee as a replacement

member. Immediately following the execution of this Agreement, the Company shall make the Charter

of the Investment Committee publicly available on the Company’s website. During the Cooperation Period, the size of the Investment

Committee shall not be increased, subject to the Board’s fiduciary duties, without the prior written consent of the L&B Parties.

(ii) As

promptly as practicable following the execution of this Agreement (and in any event, within two (2) business days after the date

hereof), Mr. Rodriguez shall be appointed to the Nominating, Governance and Corporate Responsibility Committee of the Board (the

“Nominating & Governance Committee”) and shall not, without Mr. Rodriguez’s written consent, be

removed from the Nominating & Governance Committee by the Board without cause until the expiration of the Cooperation Period.

If Mr. Rodriguez is unable or unwilling to serve as a member of the Nominating & Governance Committee, resigns as a member,

is removed as a member or ceases to be a member for any other reason during the Cooperation Period, the Board shall select the First New

Director or a Replacement Second Director to serve on the Nominating & Governance Committee as a replacement member. Effective

upon conclusion of the 2024 Annual Meeting, the size of the Nominating & Governance Committee shall be reduced to four (4) directors

and shall not be further increased for the duration of the Cooperation Period without the prior written consent of the L&B Parties,

subject to the Board’s fiduciary duties.

(d) New

Director Replacements. If a New Director (or any replacement thereof) resigns, refuses or is unable to serve or fulfill his or her

duties as a director for any reason, in each case during the Cooperation Period, the Board and the L&B Parties shall (i) with

respect to the First New Director, cooperate in good faith to identify a replacement director candidate (a “Replacement First

Director”) who satisfies the Company’s corporate governance guidelines with respect to independent director nominations

and (ii) with respect to the Second New Director, consult with the L&B Parties regarding a replacement director candidate (a

“Replacement Second Director” and together with the Replacement First Director, the “Replacement Directors”

and each a “Replacement Director”). The Board shall take all actions necessary to promptly appoint each Replacement

Director as a director of the Company.

(e) Annual

Meetings. The 2024 Annual Meeting shall be held no later than May 30, 2024 and the 2025 Annual Meeting shall be held no later

than June 15, 2025.

(f) Termination.

The Company’s obligations under this Section 1 shall terminate upon any material breach of this Agreement (including

Section 2) by any L&B Party upon fifteen (15) business days’ written notice by the Company to the L&B Parties

if such breach has not been cured within such notice period, provided that the Company is not in material breach of this Agreement at

the time such notice is given or prior to the end of the notice period.

(g) Withdrawal

of Nominees. The L&B Parties hereby irrevocably withdraw the nomination of the slate of directors put forth in that certain letter

to the Company dated January 10, 2024 in connection with the 2024 Annual Meeting (the “L&B Nomination Notice”),

and any related materials or notices submitted to the Company in connection therewith or related thereto, and agrees not to make any other

nominations for election at the 2024 Annual Meeting.

2. Cooperation.

(a) Cooperation

Period. Except as otherwise provided herein, the cooperation period (the “Cooperation Period”) shall commence

on the date of this Agreement until the date that is one (1) calendar day following the date of the Company’s 2025 Annual Meeting.

(b) Non-Disparagement.

Each of the L&B Parties and the Company agrees that, during the Cooperation Period, the Company and each L&B Party shall refrain

from making, and shall cause its respective controlling and controlled (and under common control) Affiliates and its and their respective

Representatives (as defined below) not to make or cause to be made any statement or announcement (including any statement or announcement

that can reasonably be expected to become public or require public disclosure, and including any statement to any stockholder or holder

of other securities of the Company, sell-side or buy-side analyst or other person) that constitutes an ad hominem attack on, or that otherwise

disparages, defames, slanders, impugns or otherwise is reasonably likely to damage the reputation of (A) in the case of any such

statements or announcements by any of the L&B Parties or their Representatives, the Company and its Affiliates or any of its or their

current or former officers, directors, or employees, and (B) in the case of any such statements or announcements by the Company or

its Representatives, the L&B Parties and their Affiliates or any of their current or former principals, directors, members, general

partners, officers, or employees, in each case including (x) in any statement (oral or written), document, or report filed with,

furnished, or otherwise provided to the SEC (as defined below) or any other governmental or regulatory agency, (y) in any press release

or other publicly available format or (z) to any journalist or member of the media (including, in a television, radio, newspaper,

or magazine interview or podcast, Internet or social media communication); provided, however, that any unpremeditated,

private, and informal remark to any person that is not part of any coordinated communication or campaign, and is not intended or designed

to circumvent, directly or indirectly, the restrictions contemplated by this Section 2(a), will not be deemed a breach of

this Section 2(a). The foregoing shall not (A) restrict the ability of any person to comply with any subpoena or other

legal process or respond to a request for information from any governmental authority with jurisdiction over the party from whom information

is sought or to enforce such person’s rights hereunder or (B) apply to any private communications among the L&B Parties

and their Affiliates and Representatives (in their capacity as such), on the one hand, and among the Company and its Affiliates and Representatives

(in their capacity as such), on the other hand.

(c) Voting.

During the Cooperation Period, each L&B Party will cause all of the outstanding shares of common stock, par value $0.25 per share

(“Company Common Shares”), of the Company that such L&B Party or any of its controlling or controlled (or under

common control) Affiliates has the right to vote (or to direct the vote) as of the applicable record date, to be present in person or

by proxy for quorum purposes and to be voted at any meeting of stockholders of the Company or at any adjournments or postponements thereof,

to consent in connection with any action by written consent in lieu of a meeting, (A) in favor of each director nominated and recommended

by the Board for election at the 2024 Annual Meeting and, if applicable, any other meeting of stockholders of the Company during the Cooperation

Period, (B) against any stockholder nominations for director that are not approved and recommended by the Board for election at any

such meeting or through any such written consent, (C) against any proposals or resolutions to remove any member of the Board, and

(D) in accordance with recommendations by the Board on all other proposals or business that may be the subject of stockholder action

at such meetings or written consents; provided, however, that the L&B Parties and their Affiliates shall be permitted

to vote in their sole discretion on any proposal with respect to an Extraordinary Transaction (as defined below); provided, further,

that in the event that Institutional Shareholder Services Inc. (including any successor thereof) issues a voting recommendation that differs

from the voting recommendation of the Board at any annual or special meeting of the Company’s stockholders (other than with respect

to the election or removal of directors to the Board), then the L&B Parties and any of its controlling or controlled (or under common

control) Affiliates shall be permitted to vote in accordance with any such recommendation.

(d) Standstill.

During the Cooperation Period, each L&B Party will not, and will cause its controlling and controlled (and under common control) Affiliates

and its and their respective Representatives acting on their behalf (collectively with the L&B Parties, the “Restricted Persons”)

to not, directly or indirectly, without the prior written consent, invitation, or authorization of or by the Company or the Board:

(i) acquire,

or offer or agree to acquire, by purchase or otherwise, or direct any Third Party (as defined below) in the acquisition of, record or

beneficial ownership of any Voting Securities (as defined below), or engage in any swap or hedging transactions or other derivative agreements

of any nature with respect to any Voting Securities, in each case, if such acquisition, offer, agreement or transaction would result in

the L&B Parties (together with their Affiliates) having beneficial ownership of more than 5.0% of, or aggregate economic exposure

of more than 9.9% to, the Company Common Shares outstanding at such time;

(ii) (A) call

or seek to call (publicly or otherwise), alone or in concert with others, a meeting of the Company’s stockholders or action by written

consent (or the setting of a record date therefor), (B) seek, alone or in concert with others, election or appointment to, or representation

on, the Board or nominate or propose the nomination of, or recommend the nomination of, any candidate to the Board, except as expressly

set forth in Section 1, (C) make or be the proponent of any stockholder proposal to the Company or the Board or any committee

thereof, (D) seek, alone or in concert with others (including through any “withhold” or similar campaign), the removal

of any member of the Board, (E) conduct a referendum of stockholders of the Company or (F) submit any notice regarding cumulation

of votes with respect to a meeting of the Company’s stockholders or a consent solicitation; provided, however, that

nothing in this Agreement will prevent the L&B Parties or their Affiliates from taking actions in furtherance of identifying any director

candidate in connection with the Company’s 2026 Annual Meeting of Stockholders;

(iii) make

any request for stock list materials or other books and records of the Company or any of its subsidiaries under any statutory or regulatory

provisions providing for stockholder access to books and records of the Company or its Affiliates;

(iv) engage

in any “solicitation” (as such term is used in the proxy rules promulgated under the Exchange Act (as defined below)

excluding, for the avoidance of doubt, carve-outs relating to solicitations of ten or fewer stockholders) of proxies or consents with

respect to the election or removal of directors of the Company or any other matter or proposal relating to the Company or become a “participant”

(as such term is defined in Instruction 3 to Item 4 of Schedule 14A promulgated under the Exchange Act) in any such solicitation of proxies

or consents;

(v) make

or submit to the Company or any of its Affiliates any proposal for, or offer of (with or without conditions), either alone or in concert

with others, any tender offer, exchange offer, merger, consolidation, acquisition, business combination, recapitalization, restructuring,

liquidation, dissolution or similar extraordinary transaction involving the Company (including its subsidiaries and joint ventures or

any of their respective securities or assets) (each, an “Extraordinary Transaction”) either publicly or in a manner

that would reasonably require public disclosure by the Company or any of the L&B Parties (it being understood that the foregoing shall

not restrict the Restricted Persons from electing in their own discretion to tender or not tender shares, seeking and exercising statutory

appraisal rights, receiving payment for shares or otherwise participating in any Extraordinary Transaction on the same basis as other

stockholders of the Company);

(vi) make

any public proposal with respect to (A) any change in the number, term or identity of directors or the filling of any vacancies on

the Board other than as provided under Section 1 of this Agreement, (B) any change in the capitalization, capital allocation

policy or dividend policy of the Company, (C) any other change in the Company’s management or corporate or governance structure,

(D) any waiver, amendment or modification to the Company’s Amended and Restated Certificate of Incorporation, as amended, or

the Company’s Sixth Amended and Restated Bylaws, as amended (collectively, the “Organizational Documents”), (E) causing

the Company Common Shares to be delisted from, or to cease to be authorized to be quoted on, any securities exchange or (F) causing

the Company Common Shares to become eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act;

(vii) knowingly

encourage or advise any Third Party or knowingly assist any Third Party in encouraging or advising any other person (A) with respect

to the giving or withholding of any proxy or consent relating to, or other authority to vote, any Voting Securities, or (B) in conducting

any type of referendum relating to the Company (including for the avoidance of doubt with respect to the Company’s management or

the Board) (other than such encouragement or advice that is consistent with the Board’s recommendation in connection with such matter,

or as otherwise specifically permitted under this Agreement);

(viii) form,

join or act in concert with any “group” as defined in Section 13(d)(3) of the Exchange Act, with respect to any

Voting Securities, other than solely with Affiliates of the L&B Parties with respect to Voting Securities now or hereafter owned by

them;

(ix) enter

into a voting trust, arrangement or agreement with respect to any Voting Securities, or subject any Voting Securities to any voting trust,

arrangement or agreement (excluding customary brokerage accounts, margin accounts, prime brokerage accounts and the like), in each case

other than (A) this Agreement, (B) solely with Affiliates of the L&B Parties or (C) granting proxies in solicitations

approved by the Board;

(x) sell,

offer, or agree to sell, all or substantially all, directly or indirectly, through swap or hedging transactions or otherwise, voting rights

decoupled from the underlying Company Common Shares held by a Restricted Person to any Third Party;

(xi) institute,

solicit or join, as a party, any litigation, arbitration, or other proceeding against or involving the Company or any of its subsidiaries

or any of its or their respective current or former directors or officers (including derivative actions); provided, however,

that for the avoidance of doubt, the foregoing shall not prevent any Restricted Person from (A) bringing litigation against the Company

to enforce any provision of this Agreement instituted in accordance with and subject to Section 9, (B) making counterclaims

with respect to any proceeding initiated by, or on behalf of, the Company or its Affiliates against a Restricted Person, (C) bringing

bona fide commercial disputes that do not relate to the subject matter of this Agreement, (D) exercising statutory appraisal

rights or (E) responding to or complying with validly issued legal process;

(xii) enter

into any negotiations, agreements (whether written or oral), arrangements, or understandings with any Third Party to take any action that

the Restricted Persons are prohibited from taking pursuant to this Section 2(d);

(xiii) make

any disclosure, communication, announcement or statement, either publicly or in a manner reasonably likely to result in or require public

disclosure, regarding the Board, the Company, its management, policies or affairs, strategy, operations, financial results, any of its

securities or assets or this Agreement, except in a manner consistent with the Press Release (as defined below); or

(xiv) make

any request or submit any proposal to amend or waive the terms of this Agreement (including this subclause), in each case publicly or

which would reasonably be expected to result in a public announcement or disclosure of such request or proposal by the Company or any

of the Restricted Persons;

Notwithstanding anything in this Agreement to the contrary, the restrictions

in this Section 2(d) shall terminate automatically upon the earliest of the following: (i) any material breach of

this Agreement by the Company (including, without limitation, a failure to appoint Mr. Bigman to the Board or the Investment Committee

in accordance with Section 1 or a failure to issue the Press Release in accordance with Section 3) upon fifteen

(15) business days’ written notice by any of the L&B Parties to the Company if such breach has not been cured within such notice

period, provided that the L&B Parties are not in material breach of this Agreement at the time such notice is given or prior to the

end of the notice period; (ii) the Company’s entry into (x) a definitive agreement with respect to any Extraordinary Transaction

that would result in the acquisition by any person or group of more than 50% of the Voting Securities or assets having an aggregate value

exceeding 50% of the aggregate enterprise value of the Company or (y) one or more definitive agreements providing for a transaction

or series of related transactions which would in the aggregate result in the Company issuing to one or more Third Parties at least 10%

of the Company Common Shares (including on an as-converted basis) outstanding immediately prior to such issuance(s) (including in

a PIPE, convertible note, convertible preferred security or similar structure) during the Cooperation Period; and (iii) the commencement

of any tender or exchange offer (by any person or group other than the L&B Parties or their Affiliates) which, if consummated, would

constitute an Extraordinary Transaction that would result in the acquisition by any person or group of more than 50% of the Voting Securities,

where the Company files with the SEC a Schedule 14D-9 (or amendment thereto) that does not recommend that its stockholders reject such

tender or exchange offer (it being understood that nothing herein will prevent the Company from issuing a “stop, look and listen”

communication pursuant to Rule 14d-9(f) promulgated under the Exchange Act in response to the commencement of any tender or

exchange offer). Notwithstanding anything to the contrary in this Agreement, nothing in this Agreement (including but not limited to the

restrictions in this Section 2(d)) will prohibit or restrict any of the Restricted Persons from (A) making any public

or private statement or announcement with respect to any Extraordinary Transaction that is publicly announced by the Company or a Third

Party, (B) making any factual statement to comply with any subpoena or other legal process or respond to a request for information

from any governmental authority with jurisdiction over such person from whom information is sought (so long as such process or request

did not arise as a result of discretionary acts by any Restricted Person), (C) granting any liens or encumbrances on any claims or

interests in favor of a bank or broker-dealer or prime broker holding such claims or interests in custody or prime brokerage in the ordinary

course of business, which lien or encumbrance is released upon the transfer of such claims or interests in accordance with the terms of

the custody or prime brokerage agreement(s), as applicable, (D) negotiating, evaluating and/or trading, directly or indirectly, in

any index fund, exchange traded fund, benchmark fund or broad basket of securities which may contain or otherwise reflect the performance

of, but not primarily consist of, securities of the Company or (E) providing its views privately to the Board or management regarding

any matter, or privately requesting a waiver of any provision of this Agreement, as long as such private communications or requests would

not reasonably be expected to require public disclosure of such communications or requests by the Company or any of the Restricted Persons.

3. Public

Announcement. Unless otherwise agreed by the parties, not later than 9:00 AM Eastern Time on March 4, 2024, the Company shall

issue a press release in the form attached to this Agreement as Exhibit A (the “Press Release”) and not

later than March 4, 2024, the Company shall file with the SEC a Current Report on Form 8-K (the “Form 8-K”)

disclosing its entry into this Agreement and file a copy of this Agreement and the Press Release as exhibits thereto (provided if the

Company is unable to issue the Press Release or file the Form 8-K for reasons outside of its control, the Company shall issue the

Press Release and file the Form 8-K as promptly as practicable following the execution of this Agreement). The Company shall provide

the L&B Parties and their Representatives with a copy of such Form 8-K at a reasonable time prior to its filing with the SEC

and shall consider in good faith any timely comments of the L&B Parties and their Representatives. Neither of the Company or any of

its Affiliates nor the L&B Parties or any of their Affiliates shall make any public statement regarding the subject matter of this

Agreement, this Agreement or the matters set forth in the Press Release prior to the issuance of the Press Release without the prior written

consent of the other party.

4. Representations

and Warranties of the Company. The Company represents and warrants to the L&B Parties as follows: (a) the Company has the

power and authority to execute, deliver, and carry out the terms and provisions of this Agreement and to consummate the transactions contemplated

by this Agreement; (b) this Agreement has been duly and validly authorized, executed, and delivered by the Company, constitutes a

valid and binding obligation and agreement of the Company and is enforceable against the Company in accordance with its terms, except

as enforcement of this Agreement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance,

or similar laws generally affecting the rights of creditors and subject to general equity principles; (c) the execution, delivery,

and performance of this Agreement by the Company does not and will not (i) violate or conflict with any law, rule, regulation, order,

judgment, or decree applicable to the Company, or (ii) result in any breach or violation of or constitute a default (or an event

which with notice or lapse of time or both could constitute a breach, violation or default) under or pursuant to, or result in the loss

of a material benefit under, or give any right of termination, amendment, acceleration, or cancellation of, any organizational document,

agreement, contract, commitment, understanding, or arrangement to which the Company is a party or by which it is bound; and (d) the

Company has not received prior to the date hereof any director nomination stockholder notice with respect to the 2024 Annual Meeting in

accordance with the Organizational Documents other than the L&B Nomination Notice.

5. Representations

and Warranties of the L&B Parties. Each L&B Party represents and warrants to the Company as follows: (a) such L&B

Party has the power and authority to execute, deliver, and carry out the terms and provisions of this Agreement and to consummate the

transactions contemplated by this Agreement; (b) this Agreement has been duly and validly authorized, executed, and delivered by

such L&B Party, constitutes a valid and binding obligation and agreement of such L&B Party and is enforceable against such L&B

Party in accordance with its terms, except as enforcement of this Agreement may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance, or similar laws generally affecting the rights of creditors and subject to general equity principles;

and (c) the execution, delivery, and performance of this Agreement by such L&B Party does not and will not (i) violate or

conflict with any law, rule, regulation, order, judgment, or decree applicable to such L&B Party, or (ii) result in any breach

or violation of or constitute a default (or an event which with notice or lapse of time or both could constitute a breach, violation or

default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration,

or cancellation of, any organizational document, agreement, contract, commitment, understanding, or arrangement to which such L&B

Party is a party or by which it is bound.

6. Definitions.

For purposes of this Agreement:

(a) the

term “Affiliate” has the meaning set forth in Rule 12b-2 promulgated by the SEC under the Exchange Act; provided,

that none of the Company or its Affiliates or Representatives, on the one hand, and the L&B Parties and their Affiliates or Representatives,

on the other hand, shall be deemed to be “Affiliates” with respect to the other for purposes of this Agreement; provided,

further, that “Affiliates” of a person shall not include any entity, solely by reason of the fact that one or more

of such person’s employees or principals serves as a member of its board of directors or similar governing body, unless such person

otherwise controls such entity (as the term “control” is defined in Rule 12b-2 promulgated by the SEC under the Exchange

Act); provided, further, that with respect to the L&B Parties, “Affiliates” shall not include any portfolio

operating company (as such term is understood in the private equity industry) of any of the L&B Parties or their Affiliates;

(b) the

terms “beneficial owner” and “beneficially own” have the same meanings as set forth in Rule 13d-3

promulgated by the SEC under the Exchange Act, except that a person will also be deemed to be the beneficial owner of all shares of the

Company’s authorized share capital which such person has the right to acquire (whether such right is exercisable immediately or

only after the passage of time) pursuant to the exercise of any rights in connection with any securities or any agreement, arrangement,

or understanding (whether or not in writing), regardless of when such rights may be exercised and whether they are conditional, and all

shares of the Company’s authorized share capital which such person or any of such person’s Affiliates has or shares the right

to vote or dispose;

(c) the

term “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated

by the SEC thereunder;

(d) the

terms “person” or “persons” mean any individual, corporation (including not-for-profit), general

or limited partnership, limited liability or unlimited liability company, joint venture, estate, trust, association, organization, or

other entity of any kind or nature;

(e) the

term “Representatives” means a party’s directors, members, general partners, managers, officers, employees, agents,

and other representatives;

(f) the

term “SEC” means the U.S. Securities and Exchange Commission;

(g) the

term “Third Party” means any person that is not a party to this Agreement or a controlling or controlled (or under

common control) Affiliate thereof, a director or officer of the Company, or legal counsel to any party to this Agreement; and

(h) the

term “Voting Securities” means the Company Common Shares and any other Company securities entitled to vote in the election

of directors, or securities convertible into, or exercisable or exchangeable for, such shares or other securities, whether or not subject

to the passage of time or other contingencies; provided, that as pertains to any obligations of the L&B Parties or any Restricted

Persons hereunder (including under Sections 2(c) and 2(d)), “Voting Securities” will not include any securities

contained in any index fund, exchange traded fund, benchmark fund, or broad basket of securities which may contain or otherwise reflect

the performance of, but not primarily consist of, securities of the Company.

7. Notices.

All notices, consents, requests, instructions, approvals, and other communications provided for herein and all legal process in regard

to this Agreement will be in writing and will be deemed validly given, made or served, if (a) given by email, when such email is

sent to the email address(es) set forth below, (b) given by a nationally recognized overnight carrier, one business day after being

sent or (c) if given by any other means, when actually received during normal business hours at the address specified in this Section 7:

| |

if to the Company: |

Ventas, Inc. |

| |

|

353 N. Clark Street, Suite 3300 |

| |

|

Chicago, Illinois 60654 |

| |

|

Attention: |

Carey S. Roberts |

| |

|

E-mail: |

Carey.Roberts@ventasreit.com |

| |

|

| |

with a copy to: |

Wachtell, Lipton, Rosen & Katz |

| |

|

51 West 52nd Street |

| |

|

New York, New York 10019 |

| |

|

Attention: |

Robin Panovka |

| |

|

|

Carmen X.W. Lu |

| |

|

E-mail: |

RPanovka@wlrk.com |

| |

|

|

CXWLu@wlrk.com |

| |

|

| |

if to the L&B Parties: |

Land & Buildings Investment Management LLC |

| |

|

Soundview Plaza |

| |

|

1266 E Main St., Suite 700R |

| |

|

Stamford, Connecticut 06902 |

| |

|

Attention: |

Jonathan Litt |

| |

|

Email: |

jonathan.litt@landandbuildings.com |

| |

|

| |

with a copy to: |

Olshan Frome Wolosky LLP |

| |

|

13225 Avenue of the Americas |

| |

|

New York, New York 10019 |

| |

|

Attention: |

Meagan M. Reda |

| |

|

|

Ian Engoron |

| |

|

Email: |

MReda@olshanlaw.com |

| |

|

|

IEngoron@olshanlaw.com |

8. Expenses.

Each party shall be responsible for its own fees and expenses incurred in connection with this Agreement and all matters related to this

Agreement; provided, however, that the Company agrees to reimburse the L&B Parties for all reasonable fees, costs, and

expenses incurred by the L&B Parties in connection with the L&B Parties’ investment and involvement at the Company, including,

without limitation, with respect to all matters related to the L&B Parties’ director nominations and this Agreement, in an amount

not to exceed an aggregate of $2,000,000.

9. Specific

Performance; Remedies; Venue.

(a) The

Company and the L&B Parties acknowledge and agree that irreparable injury to the other party hereto may occur in the event any of

the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached and that such injury

may not be adequately compensable by the remedies available at law (including the payment of money damages). It is accordingly agreed

that the Company and the L&B Parties will each respectively be entitled to seek an injunction or injunctions to prevent breaches of

this Agreement and to enforce specifically the terms and provisions of this Agreement, in addition to any other remedy to which they are

entitled at law or in equity. FURTHERMORE, THE COMPANY AND EACH L&B PARTY AGREES (1) THE NON-BREACHING PARTY WILL BE ENTITLED

TO SEEK INJUNCTIVE AND OTHER EQUITABLE RELIEF, WITHOUT PROOF OF ACTUAL DAMAGES; (2) THE BREACHING PARTY WILL NOT PLEAD IN DEFENSE

THERETO THAT THERE WOULD BE AN ADEQUATE REMEDY AT LAW; AND (3) THE BREACHING PARTY AGREES TO WAIVE ANY BONDING REQUIREMENT UNDER

ANY APPLICABLE LAW, IN THE CASE ANY OTHER PARTY SEEKS TO ENFORCE THE TERMS BY WAY OF EQUITABLE RELIEF. THIS AGREEMENT WILL BE GOVERNED

IN ALL RESPECTS, INCLUDING VALIDITY, INTERPRETATION AND EFFECT, BY THE LAWS OF THE STATE OF DELAWARE WITHOUT GIVING EFFECT TO

THE CHOICE OF LAW PRINCIPLES OF SUCH STATE.

(b) The

Company and each L&B Party (i) irrevocably and unconditionally submits to the personal jurisdiction of the Delaware Court of

Chancery in and for New Castle County, Delaware, or in the event (but only in the event) that such Delaware Court of Chancery does not

have subject matter jurisdiction over such matter, the federal, or other state courts located in Delaware, (ii) agrees that it will

not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such courts, (iii) agrees

that any actions or proceedings arising in connection with this Agreement or the transactions contemplated by this Agreement shall be

brought, tried, and determined only in such courts, (iv) waives any claim of improper venue or any claim that those courts are an

inconvenient forum and (v) agrees that it will not bring any action relating to this Agreement or the transactions contemplated hereunder

in any court other than the aforesaid courts. The parties to this Agreement agree that mailing of process or other papers in connection

with any such action or proceeding in the manner provided in Section 7 or in such other manner as may be permitted by applicable

law as sufficient service of process, shall be valid and sufficient service thereof.

10. Severability.

If at any time subsequent to the date hereof, any provision of this Agreement is held by any court of competent jurisdiction to be illegal,

void, or unenforceable, such provision will be of no force and effect, but the illegality or unenforceability of such provision will have

no effect upon the legality or enforceability of any other provision of this Agreement.

11. Termination.

This Agreement will terminate upon the expiration of the Cooperation Period. Upon such termination, this Agreement shall have no further

force and effect. Notwithstanding the foregoing, Sections 6 to 16 shall survive termination of this Agreement, and no termination

of this Agreement shall relieve any party of liability for any breach of this Agreement arising prior to such termination.

12. Counterparts.

This Agreement may be executed in one or more counterparts and by scanned computer image (such as .pdf), each of which will be deemed

to be an original copy of this Agreement.

13. No

Third-Party Beneficiaries. This Agreement is solely for the benefit of the Company and the L&B Parties and is not enforceable

by any other persons. No party to this Agreement may assign its rights or delegate its obligations under this Agreement, whether by operation

of law or otherwise, without the prior written consent of the other parties, and any assignment in contravention hereof will be null and

void.

14. No

Waiver. No failure or delay by any party in exercising any right or remedy hereunder will operate as a waiver thereof, nor will any

single or partial waiver thereof preclude any other or further exercise thereof or the exercise of any other right or remedy hereunder.

15. Entire

Understanding; Amendment. This Agreement contains the entire understanding of the parties with respect to the subject matter hereof

and supersedes any and all prior and contemporaneous agreements, memoranda, arrangements and understandings, both written and oral, between

the parties, or any of them, with respect to the subject matter of this Agreement. This Agreement may be amended only by an agreement

in writing executed by the Company and L&B Management.

16. Interpretation

and Construction. The Company and the L&B Parties acknowledge that each party has been represented by counsel of its choice throughout

all negotiations that have preceded the execution of this Agreement, and that it has executed the same with the advice of said counsel.

Each party and its counsel cooperated and participated in the drafting and preparation of this Agreement and the documents referred to

herein, and any and all drafts relating thereto exchanged among the parties will be deemed the work product of all of the parties and

may not be construed against any party by reason of its drafting or preparation. Accordingly, any rule of law or any legal decision

that would require interpretation of any ambiguities in this Agreement against any party that drafted or prepared it is of no application

and is hereby expressly waived by the Company and the L&B Parties, and any controversy over interpretations of this Agreement will

be decided without regard to events of drafting or preparation. Whenever the words “include,” “includes,” or “including”

are used in this Agreement, they shall be deemed to be followed by the words “without limitation.”

[Signature pages follow]

IN WITNESS WHEREOF, this Agreement has been duly

executed and delivered by the duly authorized signatories of the parties as of the date hereof.

| VENTAS, INC. |

| | |

| By: | /s/ Debra A. Cafaro |

| | | Debra A. Cafaro |

| | | Chief Executive Officer |

[signatures continue on next page]

[Signature Page to the

Cooperation Agreement]

IN WITNESS WHEREOF, this Agreement has been duly

executed and delivered by the duly authorized signatories of the parties as of the date hereof.

| |

LAND & BUILDINGS CAPITAL

GROWTH FUND, LP |

| |

|

| |

By: Land & Buildings Investment

Management, LLC, its Investment Manager |

| |

|

| |

|

By: |

/s/ Jonathan Litt |

| |

|

Name: |

Jonathan Litt |

| |

|

Title: |

Managing Principal |

| |

|

| |

LAND & BUILDINGS INVESTMENT

MANAGEMENT, LLC |

| |

By: | /s/ Jonathan Litt |

| | |

| Name: Jonathan Litt |

| | |

| Title: Managing Principal |

[Signature Page to the

Cooperation Agreement]

| |

L&B OPPORTUNITY FUND, LLC |

| |

|

| |

By: Land & Buildings Investment

Management, LLC, its Investment Manager |

| |

|

| |

|

By: |

/s/ Jonathan Litt |

| |

|

Name: |

Jonathan Litt |

| |

|

Title: |

Managing Principal |

| |

|

| |

L&B GP LLC |

| |

|

| |

|

By: |

/s/ Jonathan Litt |

| |

|

Name: |

Jonathan Litt |

| |

|

Title: |

Managing Principal |

| |

|

| |

L&B GP LP |

| |

|

| |

By: L&B GP LLC, its General Partner |

| |

|

| |

|

By: |

/s/ Jonathan Litt |

| |

|

Name: |

Jonathan Litt |

| |

|

Title: |

Managing Principal |

| |

|

| |

/s/ Jonathan Litt |

| |

JONATHAN LITT |

[Signature Page to the

Cooperation Agreement]

EXHIBIT A

Company Press Release

[Filed separately as

Exhibit 99.1 to the Current Report on Form 8-K]

Exhibit 99.1

Ventas Appoints Theodore Bigman and Joe V. Rodriguez, Jr.

to Board of Directors

Enters Into Cooperation Agreement with Land &

Buildings

CHICAGO – MARCH 4, 2024 – Ventas, Inc. (NYSE:

VTR) today announced that its Board of Directors has appointed Theodore Bigman and Joe V. Rodriguez, Jr. to the Board, effective

immediately. In connection with the appointments, which align with Ventas’s ongoing focus on Board refreshment and maintaining strong

governance, the Company has entered into a mutual cooperation agreement (the “Cooperation Agreement”) with shareholder Land &

Buildings Investment Management LLC (“Land & Buildings”).

Mr. Bigman brings significant investing and capital markets experience,

and has served as a private investor and as founder and Chief Investment Officer of Bigman Holdings, his family office, since March 2021.

Prior to that, Mr. Bigman held a number of positions at MSIM, an asset management firm and subsidiary of Morgan Stanley, from 1995

to 2021, most recently as Head of Global Listed Real Assets Investing. In connection with his position at MSIM, Mr. Bigman served

as a member of the Board of Trust Managers for each of American Industrial Properties REIT, a real estate investment trust, and Grove

Property Trust, a real estate investment trust.

Mr. Rodriguez is a seasoned real estate investor with 30 years

of experience across capital markets, finance and portfolio management. Mr. Rodriguez was a Founding Partner and Chief Investment

Officer at Invesco Real Estate and helped scale the firm from $1 billion to more than $90 billion in assets under management. He has served

as a Board Advisor to Invesco Office J-REIT and AIM Select Real Estate Income Fund.

Debra A. Cafaro, Ventas Chairman and CEO, said, “I am pleased

to welcome Ted and Joe to the Board and look forward to working with them to drive value for shareholders. I have great respect for their

professional accomplishments and REIT investment experience and am delighted we are adding directors of their caliber to the Board.”

“We appreciate the constructive dialogue we have had with a cross-section

of shareholders, as we continue to refresh Ventas’s Board to complement our existing skillset, support the Company’s execution

of its strategy and enhance value for Ventas shareholders,” said Melody Barnes, Chair of the Board’s Nominating, Governance

and Corporate Responsibility Committee.

“Joe and Ted are both accomplished investors who will add important

perspectives to the Board as it seeks to drive value for all shareholders,” said Jonathan Litt, Founder & CIO, Land &

Buildings. “We are confident these appointments will benefit the Company as it executes its strategy, and we would like to thank

the Board for its collaborative engagement in reaching this outcome.”

With Mr. Bigman’s and Mr. Rodriguez’s appointments,

the Ventas Board will temporarily expand to 13 directors, 12 of whom are independent and over 50% of whom identify as diverse by gender

or ethnicity. The Board is expected to comprise 12 directors following the Annual Meeting. Mr. Bigman will join the Investment Committee

of Ventas’s Board and Mr. Rodriguez will join the Nominating, Governance and Corporate Responsibility Committee, effective

immediately.

In connection with the Cooperation Agreement, Land & Buildings

will vote its shares in favor of all of the Board’s director nominees at the 2024 Annual Meeting of Stockholders. Land &

Buildings has also agreed to customary standstill, voting and other provisions. The full agreement between Ventas and Land &

Buildings will be filed on a Form 8-K with the U.S. Securities and Exchange Commission (the “SEC”).

In a separate release issued today, Ventas announced additional governance

actions.

About Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate

investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large

and growing aging population. The Company’s growth is fueled by its senior housing communities, which provide valuable services

to residents and enable them to thrive in supported environments. Ventas leverages its unmatched operational expertise, data-driven insights

from its Ventas Operational InsightsTM platform, extensive relationships and strong financial position to achieve its

goal of delivering outsized performance across approximately 1,400 properties. The Ventas portfolio is composed of senior housing communities,

outpatient medical buildings, research centers and healthcare facilities in North America and the United Kingdom. The Company benefits

from a seasoned team of talented professionals who share a commitment to excellence, integrity and a common purpose of helping people

live longer, healthier, happier lives.

Forward-Looking Statements

This communication includes forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements include, among others, statements of expectations, beliefs, future plans and strategies, anticipated

results from operations and developments and other matters that are not historical facts. Forward-looking statements include, among other

things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “assume,”

“may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,”

“seek,” “target,” “forecast,” “plan,” “potential,” “opportunity,”

“estimate,” “could,” “would,” “should” and other comparable and derivative terms or the

negatives thereof.

Forward-looking statements are based on management’s beliefs

as well as on a number of assumptions concerning future events. You should not put undue reliance on these forward-looking statements,

which are not a guarantee of performance and are subject to a number of uncertainties and other factors that could cause actual events

or results to differ materially from those expressed or implied by the forward-looking statements. We do not undertake a duty to update

these forward-looking statements, which speak only as of the date on which they are made. We urge you to carefully review the disclosures

we make concerning risks and uncertainties that may affect our business and future financial performance, including those made below and

in our filings with the Securities and Exchange Commission, such as in the sections titled “Cautionary Statements - Summary Risk

Factors,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023.

Certain factors that could affect our future results and our ability

to achieve our stated goals include, but are not limited to: (a) our ability to achieve the anticipated benefits and synergies from,

and effectively integrate, our completed or anticipated acquisitions and investments of properties, including our ownership of the properties

included in our equitized loan portfolio; (b) our exposure and the exposure of our tenants, managers and borrowers to complex healthcare

and other regulation, including evolving laws and regulations regarding data privacy and cybersecurity and environmental matters, and

the challenges and expense associated with complying with such regulation; (c) the potential for significant general and commercial

claims, legal actions, regulatory proceedings or enforcement actions that could subject us or our tenants, managers or borrowers to increased

operating costs, uninsured liabilities, fines or significant operational limitations, including the loss or suspension of or moratoriums

on accreditations, licenses or certificates of need, suspension of or nonpayment for new admissions, denial of reimbursement, suspension,

decertification or exclusion from federal, state or foreign healthcare programs or the closure of facilities or communities; (d) the

impact of market and general economic conditions on us, our tenants, managers and borrowers and in areas in which our properties are geographically

concentrated, including macroeconomic trends and financial market events, such as bank failures and other events affecting financial institutions,

market volatility, increases in inflation, changes in or elevated interest and exchange rates, tightening of lending standards and reduced

availability of credit or capital, geopolitical conditions, supply chain pressures, rising labor costs and historically low unemployment,

events that affect consumer confidence, our occupancy rates and resident fee revenues, and the actual and perceived state of the real

estate markets, labor markets and public and private capital markets; (e) our reliance and the reliance of our tenants, managers

and borrowers on the financial, credit and capital markets and the risk that those markets may be disrupted or become constrained, including

as a result of bank failures or concerns or rumors about such events, tightening of lending standards and reduced availability of credit

or capital; (f) the secondary and tertiary effects of the COVID-19 pandemic on our business, financial condition and results of operations

and the implementation and impact of regulations related to the CARES Act and other stimulus legislation, including the risk that some

or all of the CARES Act or other COVID-19 relief payments we or our tenants, managers or borrowers received could be recouped; (g) our

ability, and the ability of our tenants, managers and borrowers, to navigate the trends impacting our or their businesses and the industries

in which we or they operate, and the financial condition or business prospect of our tenants, managers and borrowers; (h) the risk

of bankruptcy, inability to obtain benefits from governmental programs, insolvency or financial deterioration of our tenants, managers,

borrowers and other obligors which may, among other things, have an adverse impact on the ability of such parties to make payments or

meet their other obligations to us, which could have an adverse impact on our results of operations and financial condition; (i) the

risk that the borrowers under our loans or other investments default or that, to the extent we are able to foreclose or otherwise acquire

the collateral securing our loans or other investments, we will be required to incur additional expense or indebtedness in connection

therewith, that the assets will underperform expectations or that we may not be able to subsequently dispose of all or part of such assets

on favorable terms; (j) our current and future amount of outstanding indebtedness, and our ability to access capital and to incur

additional debt which is subject to our compliance with covenants in instruments governing our and our subsidiaries’ existing indebtedness;

(k) the recognition of reserves, allowances, credit losses or impairment charges are inherently uncertain, may increase or decrease

in the future and may not represent or reflect the ultimate value of, or loss that we ultimately realize with respect to, the relevant

assets, which could have an adverse impact on our results of operations and financial condition; (l) the non-renewal of any leases

or management agreement or defaults by tenants or managers thereunder and the risk of our inability to replace those tenants or managers

on a timely basis or on favorable terms, if at all; (m) our ability to identify and consummate future investments in or dispositions

of healthcare assets and effectively manage our portfolio opportunities and our investments in co-investment vehicles, joint ventures

and minority interests, including our ability to dispose of such assets on favorable terms as a result of rights of first offer or rights

of first refusal in favor of third parties; (n) risks related to development, redevelopment and construction projects, including

costs associated with inflation, rising or elevated interest rates, labor conditions and supply chain pressures, and risks related to

increased construction and development in markets in which our properties are located, including adverse effect on our future occupancy

rates; (o) our ability to attract and retain talented employees; (p) the limitations and significant requirements imposed upon

our business as a result of our status as a REIT and the adverse consequences (including the possible loss of our status as a REIT) that

would result if we are not able to comply with such requirements; (q) the ownership limits contained in our certificate of incorporation

with respect to our capital stock in order to preserve our qualification as a REIT, which may delay, defer or prevent a change of control

of our company; (r) the risk of changes in healthcare law or regulation or in tax laws, guidance and interpretations, particularly

as applied to REITs, that could adversely affect us or our tenants, managers or borrowers; (s) increases in our borrowing costs as

a result of becoming more leveraged, including in connection with acquisitions or other investment activity and rising or elevated interest

rates; (t) our reliance on third-party managers and tenants to operate or exert substantial control over properties they manage for

or rent from us, which limits our control and influence over such operations and results; (u) our exposure to various operational

risks, liabilities and claims from our operating assets; (v) our dependency on a limited number of tenants and managers for a significant

portion of our revenues and operating income; (w) our exposure to particular risks due to our specific asset classes and operating

markets, such as adverse changes affecting our specific asset classes and the real estate industry, the competitiveness or financial viability

of hospitals on or near the campuses where our outpatient medical buildings are located, our relationships with universities, the level

of expense and uncertainty of our research tenants, and the limitation of our uses of some properties we own that are subject to ground

lease, air rights or other restrictive agreements; (x) the risk of damage to our reputation; (y) the availability, adequacy

and pricing of insurance coverage provided by our policies and policies maintained by our tenants, managers or other counterparties; (z) the

risk of exposure to unknown liabilities from our investments in properties or businesses; (aa) the occurrence of cybersecurity threats

and incidents that could disrupt our or our tenants’, managers’ or borrower’s operations, result in the loss of confidential

or personal information or damage our business relationships and reputation; (bb) the failure to maintain effective internal controls,

which could harm our business, results of operations and financial condition; (cc) the impact of merger, acquisition and investment activity

in the healthcare industry or otherwise affecting our tenants, managers or borrowers; (dd) disruptions to the management and operations

of our business and the uncertainties caused by activist investors; (ee) the risk of catastrophic or extreme weather and other natural

events and the physical effects of climate change; (ff) the risk of potential dilution resulting from future sales or issuances of our

equity securities; and (gg) the other factors set forth in our periodic filings with the Securities and Exchange Commission.

Contacts

Investors

BJ Grant

(877) 4-VENTAS

Media

Andrew Siegel / Joseph Sala / Greg Klassen

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

v3.24.0.1

Cover

|

Mar. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity File Number |

1-10989

|

| Entity Registrant Name |

Ventas, Inc.

|

| Entity Central Index Key |

0000740260

|

| Entity Tax Identification Number |

61-1055020

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

353

N. Clark Street

|

| Entity Address, Address Line Two |

Suite

3300

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60654

|

| City Area Code |

877

|

| Local Phone Number |

483-6827

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.25 par value

|

| Trading Symbol |

VTR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |