Regulatory News:

VITURA (Paris:VTR):

- Continued leadership in the 2023 global GRESB ranking for its

sustainable development approach

- 13,000 sq.m let in 2023

- 32,000 sq.m renovated and completed

- Portfolio value excl. transfer duties of €1.3 billion

- EPRA NTA of €30.7/share

“In a particularly sensitive year for the real estate market,

due to a difficult geopolitical, macroeconomic and financial

environment, Vitura has demonstrated the effectiveness of its

strategy. It has continued the repositioning of its portfolio as a

collection of sustainable assets. Popular with the most dynamic

companies, the Arcs de Seine concept, developed at Europlaza, has

been applied to Rives de Bercy, with Office Kennedy and Passy

Kennedy to follow suit. Recently signed leases attest to how

attractive the properties are to tenants. This premium approach to

asset management is in line with our strategy of creating value for

our shareholders over the long term,” said Jérôme Anselme,

Vitura's Chief Executive Officer.

Further leases with major accounts

During 2023, Vitura benefited in particular from fresh momentum

around office premises in Boulogne-Billancourt. Thanks to the

quality and appeal of its portfolio, Vitura maintained a good level

of rental activity, completing eight transactions covering 13,000

sq.m, or 7% of the total surface area of the portfolio. New tenants

include Bouygues Telecom, which is returning to Arcs de Seine where

it was headquartered until 2011, and Bpifrance, the French public

institution that provides financing to entrepreneurs, which is

moving to Europlaza in the La Défense business district. These

properties have occupancy rates of 82% and 91%, respectively. The

Brandt group also renewed its lease in Hanami until the end of

2027, covering a surface area of almost 3,000 sq.m.

Thanks to these signings and renewals, the Group has maintained

an average remaining lease term of 5.5 years.

The occupancy rate of buildings in operation was up 2 percentage

points to 83% at December 31, 2023, compared with 81% at

end-20221.

2024 has started off strong, with three major transactions

signed on a total surface area of 10,000 sq.m. These include lease

renewals and extensions at Europlaza and Arcs de Seine, as well as

the arrival of a first-time tenant at Rives de Bercy, less than

three months after completion of the Charenton-le-Pont campus.

Vitura has signed a lease for a fixed six-year term on 5,600 sq.m

of space at Rives de Bercy – almost 20% of the property – with a

major French industry player. The new tenant will start preparing

the property for their move in March, aiming to welcome its teams

in the third quarter of 2024.

Strategic repositioning of the portfolio

In 2023, Vitura continued its program to reposition its

portfolio, bringing its assets to the forefront of new trends and

tenant expectations. Vitura calls on with recognized partners to

help make each of its projects a success, putting people first in

keeping with its vision of “Workplaces for people. By people.”

At the start of the year, the extensive renovation of building C

at Arcs de Seine was completed with delivery of the gym and

business center.

At the end of the year, the Rives de Bercy campus, located on

the banks of the Seine in Charenton‑le-Pont, was inaugurated after

a large-scale restructuring. The carbon footprint of the renovation

was 26 times smaller than had the building been demolished and

rebuilt. Employees can enjoy a wide range of services dedicated to

well-being, including a fitness center and a wide variety of areas

where they can enjoy a meal, meet up and chat with co-workers.

Rives de Bercy offers over 6,000 sq.m of private green spaces

dotted with spots to escape from the city heat in summer, alongside

terraces and patios to accommodate new ways and trends of working.

A second entrance for cyclists and pedestrians has also been added,

creating a real connection with the city. Marketing for the

remaining Rives de Bercy premises is ongoing, with interest from

clients driven by the quality and energy efficiency of the

property.

The third and final major program underway is the ambitious

project to bring together the Passy Kennedy and Office Kennedy

properties within a single 34,000 sq.m campus, for which a building

permit has been granted. The ambitious new complex, located in

Paris' extended CBD with a wide view over the Seine, will offer a

broad range of upscale amenities – food services, a gym, wellness

and social areas, and facilities encouraging low-carbon mobility –

and meet the highest environmental standards.

The estimated portfolio value (excluding transfer taxes) stood

at €1,307 million at year-end, down 13% over the previous 12 months

due to a rise in capitalization rates in all sectors, and in line

with market trends.

Key financial figures

On March 26, 2024, the Board of Directors approved the parent

company and consolidated financial statements as at December 31,

2023 and the statutory audit is underway.

Vitura's EPRA earnings totaled €14.3 million at December 31,

2023, stable compared with December 31, 2022 (€14.1 million).

EPRA NTA stood at €523 million at December 31, 2023, vs. €756

million one year earlier. The decrease reflects essentially changes

in the portfolio value (negative €229 million impact), related

transfer duties (negative €15 million impact), the dividend

distribution (negative €3.5 million impact), and 2023 EPRA earnings

(positive €14 million impact). At December 31, 2023, EPRA NTA stood

at €30.7 per share.

The Group's IFRS consolidated net debt stood at €817 million at

December 31, 2023, down €10 million compared with 2022. Nearly

two-thirds of its borrowings are made up of green loans, a

proportion that Vitura aims to increase to 100%.

In light of high interest rates, the Group has set up new

interest rate hedges to hedge against changes in the Euribor. Over

the next 12 months, 83% of the debt will be hedged at a rate of

0.50%, which will keep financial expenses under control.

Due to the negative impact of changing yields on asset values,

the loan-to-value ratio fell by 7.5 percentage points to 62.4%.

Discussions are underway with Hanami's banking pool in particular

to restructure the existing debt of €92 million.

Negotiations are also underway to extend the maturity of the

€140 million loan, entered into when Vitura acquired the Passy

Kennedy building, to June 30, 2024 so that an agreement can be

reached on the financing of the new Kennedy campus. This debt and

capital financing will allow Vitura to combine the Passy Kennedy

and Office Kennedy buildings into a single 34,000 sq.m complex.

In accordance with their professional standards, the statutory

auditors assess an entity’s ability to continue as a going concern

over a minimum period of 12 months from the balance sheet date. In

the absence of visibility over such a timeframe, they include a

section in their report entitled "Material uncertainty regarding

the entity's ability to continue as a going concern". In view of

the ongoing negotiations concerning the financing of the Kennedy

and Hanami campuses, Vitura anticipates that the statutory auditors

will add such a paragraph to their report.

A committed environmental approach

Vitura is as determined as ever in pursuing its environmental

approach. It has chosen to automate the collection of energy data

across all its sites, ensuring that environmental information is as

reliable and verifiable as its financial information.

It is also actively continuing its efforts to raise awareness

and train its stakeholders in energy issues. Building on the close

relationships forged with its tenants, Vitura has encouraged them

to take action themselves, including the implementation of

effective action plans in each building through regular CSR

committee meetings.

The GRESB (Global Real Estate Sustainability Benchmark) assesses

and benchmarks the environmental, social and governance (ESG)

performance of real estate companies worldwide. Thanks to its

pro-active approach to sustainable development, Vitura maintained

its 5-star rating with an excellent score of 94/100, after having

ranked world number one (Global Sector Leader) in the listed office

property companies category four times in a row.

The Company also received two Gold Awards from the European

Public Real Estate Association (EPRA) for the quality and

transparency of its financial and non-financial reporting.

Vitura's efforts and commitments to achieve carbon neutrality by

2050 continued apace during the period, in particular with the

rollout of an energy efficiency plan for each property in the

portfolio.

In 2023, the Group reduced its greenhouse gas emissions by 41%

and its energy consumption by 32% compared to 2013.

Distribution policy

The 2023 financial statements do not include a dividend payment

obligation. In line with Vitura's asset repositioning program, no

dividend distribution will be submitted to the General

Shareholders' Meeting to be held to approve the financial

statements for the year ended December 31, 2023.

Key figures

In € millions (as reported)

2023

2022

Change

Rental income (IFRS)

51.2

54.0

-5.3%

EPRA earnings

14.3

14.1

+1.8%

Portfolio (excl. transfer duties)

1307

1,506

-13.3%

Occupancy rate

83%

81%

+2 pts

LTV ratio

62.4%

54.9%

+7.5 pts

EPRA NTA (in €)

30.7

44.3

-30.7%

About Vitura

Created in 2006, Vitura is a listed real estate company (“SIIC”)

that invests in prime office properties in Paris and Greater Paris.

The total value of the portfolio was estimated at €1,307 million at

December 31, 2023 (excluding transfer duties).

Thanks to its strong commitment to sustainable development, the

Company's leadership position is recognized by ESG rating agencies.

Vitura has held a GRESB (Global Real Estate Sustainability

Benchmark) 5-star rating since 2014 and has been ranked world

number 1 (Global Sector Leader) in the listed office property

companies category four times. It has also received two Gold Awards

from the European Public Real Estate Association (EPRA) for the

quality and transparency of its financial and non-financial

reporting. Vitura is ISO 14001-certified.

Vitura is a REIT listed on Euronext Paris since 2006, in

compartment B (ISIN: FR0010309096).

Visit our website to find out more: www.vitura.fr/en

Find us: LinkedIn / Twitter

APPENDICES

IFRS Income Statement (consolidated)

In thousands of euros, except per share

data

2023

2022

12 months

12 months

Rental income

51 195

54 047

Income from other services

25 415

23 975

Building-related costs

(26 184)

(28 646)

Net rental income

50 427

49 377

0

0

Sale of building

0

0

Administrative costs

(8 716)

(8 817)

Other operating expenses

(310)

(10)

Other operating income

0

453

Total change in fair value of investment

property

(229 107)

(66 653)

0

0

Net operating income

(187 706)

(25 651)

0

0

Financial income

20 470

48 863

Financial expenses

(72 618)

(27 396)

Net financial expense

(52 148)

21 467

0

0

Corporate income tax

0

0

0

0

CONSOLIDATED NET

INCOME

(239 854)

(4 183)

of which attributable to owners of the

Company

(239 854)

(4 183)

of which attributable to

non-controlling interests

0

0

0

0

Other comprehensive income

0

0

0

0

TOTAL COMPREHENSIVE

INCOME

(239 854)

(4 183)

of which attributable to owners of the

Company

(239 854)

(4 183)

of which attributable to

non-controlling interests

0

0

-

-

Basic earnings per share (in

euros)

(14.07)

(0.25)

Diluted earnings per share (in

euros)

(14.07)

(0.25)

IFRS Balance Sheet (consolidated)

In thousands of euros

Dec. 31, 2023

Dec. 31, 2022

Non-current

assets

Property, plant and equipment

3

7

Investment property

1 306 860

1 506 480

Non-current loans and receivables

15 871

11 254

Financial instruments

25 360

50 487

Total non-current assets

1 348 095

1 568 228

Current

assets

Trade accounts receivable

14 647

19 412

Other operating receivables

13 150

17 237

Prepaid expenses

521

463

Total receivables

28 318

37 112

Financial instruments

7 712

3 699

Cash and cash equivalents

11 720

15 167

Total cash and cash equivalents

19 432

18 866

Total current assets

47 749

55 978

TOTAL ASSETS

1 395 844

1 624 207

Shareholders'

equity

Share capital

64 933

64 933

Legal reserve and additional paid-in

capital

60 047

60 047

Consolidated reserves and retained

earnings

626 782

634 642

Net attributable income

(239 854)

(4 183)

Total shareholders’ equity

511 908

755 438

Non-current

liabilities

Non-current borrowings

572 365

679 873

Other non-current borrowings and debt

7 426

10 541

Non-current corporate income tax

liability

0

0

Financial instruments

0

0

Total non-current liabilities

579 791

690 414

Current

liabilities

Current borrowings

249 802

144 974

Financial Instruments

0

0

Other non-current borrowings and debt

25 510

0

Trade accounts payable

6 158

7 124

Corporate income tax liability

0

0

Other operating liabilities

8 128

9 424

Prepaid revenue

14 546

16 833

Total current liabilities

304 144

178 354

Total liabilities

883 936

868 768

TOTAL SHAREHOLDERS' EQUITY AND

LIABILITIES

1 395 844

1 624 207

IFRS Statement of Cash Flows (consolidated)

In thousands of euros

2023

2022

OPERATING ACTIVITIES

Consolidated net income

(239 854)

(4 183)

Elimination of items related to the

valuation of buildings:

Fair value adjustments to investment

property

229 107

66 653

Annulation des dotations aux

amortissement

0

0

Indemnité perçue des locataires pour le

remplacement des composants

0

0

Elimination of other income/expense items

with no cash impact:

Depreciation of property, plant and

equipment (excluding investment property)

3

10

Free share grants not vested at the

reporting date

0

0

Fair value of financial instruments (share

subscription warrants, interest rate

caps and swaps)

21 115

(49 310)

Adjustments for loans at amortized

cost

2 207

2 069

Contingency and loss provisions

0

0

Corporate income tax

0

0

Penalty interest

0

0

Cash flows from operations

before tax and changes in working capital requirements

12 578

15 238

Other changes in working capital

requirements

(2 688)

(24 600)

Working capital adjustments to reflect

changes in the scope of consolidation

Change in working capital

requirements

(2 688)

(24 600)

Net cash flows from operating

activities

9 890

- 9 361

INVESTING ACTIVITIES

Acquisition of fixed assets

(29 486)

(13 343)

Net increase in amounts due to fixed asset

suppliers

169

(6 125)

Net cash flows used in

investing activities

(29 317)

(19 468)

FINANCING ACTIVITIES

Capital increase

0

8 225

Capital increase transaction costs

0

0

Change in bank debt

(9 065)

(3 971)

Issue of financial instruments (share

subscription warrants)

0

0

Refinancing/financing transaction costs

0

(1 073)

Net increase in liability in respect of

refinancing

0

0

Purchases of hedging instruments

0

0

Net increase in current borrowings

4 179

3 763

Net decrease in current borrowings

0

0

Net increase in other non-current

borrowings and debt

(3 115)

1 113

Net decrease in other non-current

borrowings and debt

0

0

Purchases and sales of treasury shares

(96)

(216)

Dividends paid

(1 433)

(21 323)

Net cash flows from financing

activities

(9 530)

(13 483)

Change in cash and cash

equivalents

(28 957)

(42 312)

Cash and cash equivalents at beginning of

period*

15 167

57 480

CASH AND CASH EQUIVALENTS AT

END OF PERIOD

(13 790)

15 167

* There were no cash liabilities for any

of the periods presented above.

French GAAP Income Statement

In euros

Dec. 31, 2023

Dec. 31, 2022

12 months

12 months

Sales of services

305 050

300 400

NET REVENUE

305 050

300 400

Reversal of depreciation and amortization

charges, impairment and expense transfers

0

0

Other revenue

34 997

24 887

Total operating revenue

340 047

325 287

Purchases of raw materials and other

supplies

0

0

Other purchases and external charges

1 646 074

1 487 700

Taxes, duties and other levies

78 909

58 596

Wages and salaries

452 251

450 506

Social security charges

225 375

247 276

Fixed assets: depreciation and

amortization

3 418

9 924

Contingency and loss provisions

0

0

Other expenses

240 350

255 250

Total operating expenses

2 646 377

2 509 252

OPERATING LOSS

(2 306 330)

(2 183 965)

Financial income from controlled

entities

4 823 601

10 515 746

Other interest income

0

4 464

Reversals of impairment and provisions,

and transferred charges

0

55 782

Total financial income

4 823 601

10 575 992

Interest expenses

464 384

1 132

Depreciation, amortization, provisions for

impairment and other provisions

16 911 746

345 067

Total financial expenses

17 376 129

346 198

NET FINANCIAL INCOME

(12 552 528)

10 229 794

RECURRING LOSS BEFORE TAX

(14 858 858)

8 045 829

Non-recurring income on capital

transactions

1 810

13 092

Reversal of impairment, provisions and

non-recurring expense transfers

0

0

Total non-recurring income

1 810

13 092

Non-recurring expenses on management

transactions

5 000

150

Non-recurring expenses on capital

transactions

115 025

60 710

Total non-recurring expenses

120 025

60 860

NET NON-RECURRING INCOME

(118 215)

(47 768)

Corporate income tax

0

0

TOTAL INCOME

5 165 458

10 914 372

TOTAL EXPENSES

20 142 532

2 916 310

NET LOSS

(14 977 075)

7 998 062

French GAAP Balance Sheet

In euros

ASSETS

Gross amount

Depr., amort. &

prov.

Dec. 31, 2023

Dec. 31, 2022

Property, plant and equipment

Other property, plant and equipment

34 218

(31 018)

3 200

6 618

Financial fixed assets

Receivables from controlled entities

184 392 870

- 16 634 491

167 758 378

194 448 994

Loans

-

-

-

-

Other financial fixed assets

1 200 387

- 622 322

578 065

969 674

FIXED ASSETS

185 627 475

(17 287 831)

168 339 643

195 425 286

Receivables

Trade accounts receivable

1 103 978

-

1 103 978

719 880

Other receivables

120 845 117

-

120 845 117

89 284 782

Cash and cash equivalents

1 625 024

-

1 625 024

2 277 858

Short-term investment securities

-

-

-

-

CURRENT ASSETS

123 574 119

-

123 574 119

92 282 520

Prepaid expenses

64 013

-

64 013

42 052

TOTAL ASSETS

309 265 608

(17 287 831)

291 977 776

287 749 859

In euros

EQUITY AND LIABILITIES

Dec. 31, 2023

Dec. 31, 2022

Capital

Share capital (including paid-up capital:

66,862,500)

64 933 291

64 933 291

Additional paid-in capital

54 814 096

54 814 096

Revaluation reserve

152 341 864

152 341 864

Reserves

Legal reserve

6 694 261

6 694 261

Other reserves

4 447 462

-

Retained earnings

Retained earnings

7 756

37 819

Net loss for the year

(14 977 075)

7 998 062

SHAREHOLDERS’ EQUITY

268 261 656

286 819 392

OTHER EQUITY

-

-

Loss provisions

-

-

CONTINGENCY AND LOSS PROVISIONS

-

-

Non-current borrowings and debt

Miscellaneous borrowings and debt

22 612 287

0

Trade accounts payable and other

current liabilities

Trade accounts payable

496 579

423 850

Tax and social liabilities

600 640

506 617

Amounts owed to fixed asset suppliers

-

-

Other debts

6 615

-

LIABILITIES

3 716 121

30 467

TOTAL EQUITY AND LIABILITIES

91 977 776

87 749 859

Reconciliation of Alternative Performance Measures

(APM)

EPRA

NTA

In thousands of euros

2023

2022

Shareholders’ equity under IFRS

511 908

755 438

Portion of rent-free periods (1)

(17 923)

(18 129)

Elimination of fair value of share

subscription warrants

0

0

Fair value of diluted NAV

493 985

737 309

Transfer duties (2)

57 142

71 660

Fair value of financial instruments

(28 171)

(53 257)

EPRA NTA

522 957

755 712

EPRA NTA per share

30.7

44.3

(1) Lease incentives recorded in assets in

the IFRS consolidated financial statements under “Non-current loans

and receivables” and “Other operating receivables”. (2) Transfer

duties of 5% applied to the net assets of the subsidiaries holding

the properties to allow for the sale of the shares in these

entities.

LTV

ratio

In millions of euros

2023

2022

Gross amount of balance sheet loans

(statutory financial statements) (1)

817

827

Fair value of investment property

1 307

1 506

LTV ratio (%)

62.4%

54.9%

(1) This is the Group's gross debt as

recorded in the statutory financial statements.

Occupancy

rate

The occupancy rate is the ratio of space

for which the Company receives rent under a lease agreement to the

total amount of available space.

1 For 2023, the property portfolio is divided into buildings in

use and assets undergoing repositioning, namely Rives de Bercy,

delivered at the end of 2023, and Office Kennedy and Passy Kennedy,

vacant at December 31, 2023. The 83% occupancy rate at December 31,

2023 excludes assets undergoing redevelopment work. Taking into

account the redevelopments, the overall occupancy rate was 54%,

compared with 68% at December 31, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240327050576/en/

Investor relations Charlotte de Laroche info@vitura.fr +33 1 42

25 76 38

Media relations Aliénor Miens alienor.miens@margie.fr +33 6 64

32 81 75

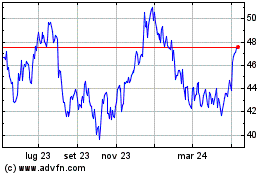

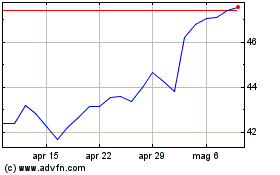

Grafico Azioni Ventas (NYSE:VTR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Ventas (NYSE:VTR)

Storico

Da Apr 2023 a Apr 2024