WNS (Holdings) Limited (WNS) (NYSE: WNS), a leading provider of

global digital-led Business Process Management (BPM) solutions,

today announced results for the fiscal 2025 first quarter ended

June 30, 2024.

Highlights – Fiscal 2025 First

Quarter:

GAAP

Financials

- Revenue of $323.1 million, down 1.0% from $326.5 million in

Q1 of last year and down 4.1% from $336.8 million last

quarter

- Profit of $28.9 million, compared to $32.0 million in Q1 of

last year and $14.5 million last quarter

- Diluted earnings per share of $0.61, compared to $0.64 in Q1

of last year and $0.30 last quarter

Non-GAAP

Financial Measures*

- Revenue less repair payments of $312.4 million, down 1.6%

from $317.5 million in Q1 of last year and down 4.1% from $325.9

million last quarter

- Adjusted Net Income (ANI) of $44.0 million, compared to

$51.1 million in Q1 of last year and $53.9 million last

quarter

- Adjusted diluted earnings per share of $0.93, compared to

$1.02 in Q1 of last year and $1.12 last quarter

Other

Metrics

- Added 8 new clients in the quarter, expanded 36 existing

relationships

- Days sales outstanding (DSO) at 36 days

- Global headcount of 60,513 as of June 30, 2024

As announced previously, beginning this quarter WNS transitioned

from reporting to the SEC on the forms available to foreign private

issuers and preparing its financial statements in accordance with

IFRS to voluntarily reporting on US domestic issuer forms and

preparing its financial statements in accordance with US GAAP. On

July 9, 2024, WNS furnished a report on Form 8-K with the SEC

containing a supplementary financial information package comprising

its unaudited quarterly financial results for each of the quarters

in fiscal 2024 and for full year fiscal 2024 and 2023 prepared in

accordance with US GAAP. The supplementary financial information

package sets forth the key impact on our quarterly financial

statements for each of the quarters in fiscal 2024 and for full

year fiscal 2024 and 2023 as a result of our transition to US GAAP.

The comparative financial information in this release for the

previous fiscal periods are also under US GAAP.

Reconciliations of the non-GAAP financial measures discussed

below to our GAAP operating results are included at the end of this

release. See also “About Non-GAAP Financial Measures.”

Revenue in the first quarter was $323.1 million, representing a

1.0% decrease versus Q1 of last year and a decrease of 4.1% from

the previous quarter. Revenue less repair payments* in the first

quarter was $312.4 million, decreasing 1.6% year-over-year and 4.1%

sequentially. Excluding exchange rate impacts, constant currency

revenue less repair payments* in the fiscal first quarter was down

1.8% versus Q1 of last year and 3.9% sequentially. Year-over-year,

Q1 revenue declined as a result of the offshore delivery transition

of a large internet client, volume reductions with certain clients,

particularly in our travel vertical, and reductions in

discretionary project work. These headwinds were partially offset

by new client additions, the expansion of existing relationships,

and favorable currency movements. Sequentially, volume reductions

with certain clients, ongoing project weakness, and unfavorable

currency movements more than offset solid demand for business

transformation and cost-reduction-focused initiatives.

Profit in the fiscal first quarter was $28.9 million, as

compared to $32.0 million in Q1 of last year and $14.5 million in

the previous quarter. Year-over-year, profit decreased as a result

of lower revenue, higher SG&A expenses, an increase in net

interest expense, and a higher effective tax rate. These headwinds

were partially offset by reductions in share-based compensation

expense, amortization of intangibles, and favorable currency

movements. Sequentially, Q1 profit increased as a result of a $30.9

million intangible asset impairment recorded in Q4 of last year,

and a reduction in expenses associated with our ADS program

termination and transition to voluntarily reporting on US domestic

issuer forms. These benefits were partially offset by lower

revenue, higher share-based compensation expense, higher SG&A

expenses, an increase in net interest expense, a higher effective

tax rate, and unfavorable currency movements.

Adjusted net income (ANI)* in Q1 was $44.0 million, as compared

to $51.1 million in Q1 of last year and $53.9 million in the

previous quarter. Explanations for the ANI* movements on a

year-over-year and sequential basis are the same as described for

GAAP profit above with the exception of amortization of intangible

expenses, share-based compensation expense, impairment of

intangible assets, costs associated with ADS program termination

and transition to voluntarily reporting on US domestic issuer

forms, acquisition-related items, and associated tax impacts which

are excluded from ANI*.

From a balance sheet perspective, WNS ended Q1 with $301.5

million in cash and investments and $301.5 million in debt. In the

quarter, the company generated $21.4 million in cash from

operations, incurred $10.7 million in capital expenditures, and

repaid $10.5 million in debt. WNS also repurchased 1,643,731

ordinary shares at an average price of $51.24, impacting Q1 cash by

$78.0 million. First quarter days sales outstanding were 36 days,

as compared to 34 days reported in Q1 of last year and 33 days in

the previous quarter.

“Our first quarter results were largely in line with company

expectations and highlight some of the opportunities and challenges

in our business today. Demand for digitally-led business

transformation and cost reduction continues to be robust, including

larger deals and a strengthening pipeline. At the same time, we

continue to see headwinds from declining client volumes,

particularly in the travel vertical, and reduced demand for

project-based work,” said Keshav Murugesh, WNS’ Chief Executive

Officer. “WNS is confident that our strategic growth initiatives

are well underway, and that successful execution through the

remainder of this year will position the company well entering

fiscal 2026. In addition, we remain committed to investing ahead of

the curve in technology-enabled offerings leveraging AI and GenAI,

improving our access to capital, and opportunistically repurchasing

stock.”

Fiscal 2025 Guidance

WNS is updating guidance for the fiscal year ending March 31,

2025, as follows:

- Revenue less repair payments* is expected to be between $1,290

million and $1,354 million, up from $1,284.3 million in fiscal

2024. Guidance assumes an average GBP to USD exchange rate of 1.28

for the remainder of fiscal 2025.

- ANI* is expected to range between $203 million and $215 million

versus $218.0 million in fiscal 2024. Guidance assumes an average

USD to INR exchange rate of 83.4 for the remainder of fiscal

2025.

- Based on a diluted share count of 45.9 million shares, the

company expects fiscal 2025 adjusted diluted earnings per share* to

be in the range of $4.42 to $4.68 versus $4.42 in fiscal 2024.

“The company has updated our forecast for fiscal 2025 based on

current visibility levels and exchange rates,” said Sanjay Puria,

WNS’ Chief Financial Officer. “Our guidance for the full year

reflects growth in revenue less repair payments* of 0% to 5% on

both a reported* and constant currency* basis. For the year, we

continue to expect capital expenditures of up to $65 million.”

____________________

*

See “About Non-GAAP Financial

Measures” and the reconciliations of the historical non-GAAP

financial measures to our GAAP operating results at the end of this

release.

Conference Call

WNS will host a conference call on July 18, 2024, at 8:00 am

(Eastern) to discuss the company's quarterly results. To access the

call in “listen-only” mode, please join live via the company’s

investor relations website at ir.wns.com. For call participants,

please register using this online form to receive your dial-in

number and unique PIN/passcode which can be used to access the

call. A replay of the webcast will be archived on the company

website at ir.wns.com.

About WNS

WNS (Holdings) Limited (NYSE: WNS) is a leading Business Process

Management (BPM) company. WNS combines deep industry knowledge with

technology, analytics, and process expertise to co-create

innovative, digitally led transformational solutions with over 600

clients across various industries. WNS delivers an entire spectrum

of BPM solutions including industry-specific offerings, customer

experience services, finance and accounting, human resources,

procurement, and research and analytics to re-imagine the digital

future of businesses. As of June 30, 2024, WNS had 60,513

professionals across 64 delivery centers worldwide including

facilities in Canada, China, Costa Rica, India, Malaysia, the

Philippines, Poland, Romania, South Africa, Sri Lanka, Turkey, the

United Kingdom, and the United States. For more information, visit

www.wns.com.

Safe Harbor Statement

This release contains forward-looking statements, as defined in

the safe harbor provisions of the US Private Securities Litigation

Reform Act of 1995. These forward-looking statements are based on

our current expectations and assumptions about our Company and our

industry. Generally, these forward-looking statements may be

identified by the use of terminology such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “will,” “seek,” “should”

and similar expressions. These statements include, among other

things, expressed or implied forward-looking statements relating to

discussions of our strategic initiatives and the expected resulting

benefits, our growth opportunities, industry environment, our

expectations concerning our future financial performance and growth

potential, including our fiscal 2025 guidance, estimated capital

expenditures, and expected foreign currency exchange rates.

Forward-looking statements inherently involve risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements. Such risks and

uncertainties include but are not limited to worldwide economic and

business conditions, our dependence on a limited number of clients

in a limited number of industries; currency fluctuations; political

or economic instability in the jurisdictions where we have

operations; regulatory, legislative and judicial developments;

increasing competition in the BPM industry; technological

innovation; our liability arising from fraud or unauthorized

disclosure of sensitive or confidential client and customer data;

telecommunications or technology disruptions; our ability to

attract and retain clients; negative public reaction in the US or

the UK to offshore outsourcing; our ability to collect our

receivables from, or bill our unbilled services to our clients; our

ability to expand our business or effectively manage growth; our

ability to hire and retain enough sufficiently trained employees to

support our operations; the effects of our different pricing

strategies or those of our competitors; our ability to successfully

consummate, integrate and achieve accretive benefits from our

strategic acquisitions, and to successfully grow our revenue and

expand our service offerings and market share; future regulatory

actions and conditions in our operating areas; our ability to

manage the impact of climate change on our business; volatility of

our share price; the possibility of a resurgence of coronavirus

disease 2019 pandemic and related impact on our and our clients’

business, financial condition, results of operations and cash

flows; and our ability to transition to reporting on US domestic

issuer forms. These and other factors are more fully discussed in

our most recent annual report on Form 20-F and subsequent reports

on Form 6-K and Form 8-K filed with or furnished to the US

Securities and Exchange Commission (SEC) which are available at

www.sec.gov. We caution you not to place undue reliance on any

forward-looking statements. Except as required by law, we do not

undertake to update any forward-looking statements to reflect

future events or circumstances.

References to “$” and “USD” refer to the United States dollars,

the legal currency of the United States; references to “GBP” refer

to the British pound, the legal currency of Britain; and references

to “INR” refer to Indian Rupees, the legal currency of India.

References to GAAP or US GAAP refer to United States generally

accepted accounting principles. References to IFRS refer to

International Financial Reporting Standards, as issued by the

International Accounting Standards Board.

WNS (HOLDINGS) LIMITED

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited, amounts in

millions, except share and per share data)

Three months ended

Jun 30, 2024

Jun 30, 2023

Mar 31, 2024

Revenue

$

323.1

$

326.5

$

336.8

Cost of revenue (1)

209.4

213.9

217.7

Gross profit

113.7

112.6

119.1

Operating expenses:

Selling and marketing expenses

21.5

20.0

19.3

General and administrative expenses

45.7

46.9

45.2

Foreign exchange loss/ (gain), net

1.0

(0.9

)

(0.3

)

Amortization of intangible assets

6.9

8.7

7.0

Impairment of intangible assets

—

—

30.9

Operating income

38.6

37.9

16.9

Other income, net

(3.9

)

(4.8

)

(4.9

)

Interest expense

4.4

3.6

3.8

Income before income tax expense

38.0

39.0

18.0

Income tax expenses

9.1

7.0

3.5

Net income

$

28.9

$

32.0

$

14.5

Earnings per share

Basic

$

0.64

$

0.67

$

0.31

Diluted

$

0.61

$

0.64

$

0.30

Weighted average number of shares used in

computing earnings per share

Basic

45,443,899

47,997,486

46,274,349

Diluted

47,425,017

50,259,257

48,252,531

(1) Exclusive of amortization expense

WNS (HOLDINGS) LIMITED

CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

(Unaudited, amounts in

millions, except share and per share data)

As at Jun 30, 2024

As at Mar 31, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

83.9

$

87.4

Investments

217.3

156.5

Accounts receivable, net

128.9

124.6

Unbilled revenue

106.6

107.8

Funds held for clients

7.4

6.9

Derivative assets

7.6

5.8

Contract assets

13.3

11.9

Prepaid expense and other current

assets

30.2

28.7

Total current assets

595.2

529.7

Goodwill

356.3

356.3

Other intangible assets, net

124.4

124.4

Property and equipment, net

71.8

73.7

Operating lease right-of-use assets

178.6

181.4

Derivative assets

2.7

1.9

Deferred tax assets

50.7

49.9

Investments

0.3

0.3

Contract assets

54.0

52.8

Other assets

63.5

63.6

TOTAL ASSETS

$

1,497.6

$

1,434.1

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

24.6

$

25.0

Provisions and accrued expenses

32.8

31.2

Derivative liabilities

9.1

4.0

Pension and other employee obligations

71.9

105.4

Short-term borrowings

73.0

40.0

Current portion of long-term debt

56.6

36.7

Contract liabilities

17.5

12.9

Income taxes payable

14.1

8.3

Operating lease liabilities

28.3

28.8

Other liabilities

43.3

19.9

Total current liabilities

371.2

312.0

Derivative liabilities

1.5

0.6

Pension and other employee obligations,

less current portion

24.7

24.6

Long-term debt, less current portion

171.9

102.5

Contract liabilities

12.7

12.6

Operating lease liabilities, less current

portion

159.1

161.1

Other liabilities

0.1

13.9

Deferred tax liabilities

19.5

19.4

TOTAL LIABILITIES

$

760.7

$

646.8

Shareholders' equity:

Share capital (ordinary shares $0.16

(£0.10) par value, authorized 60,000,000 shares; issued: 45,814,718

shares and 45,684,145 shares; each as at June 30, 2024 and March

31, 2024, respectively)

7.4

7.3

Additional paid-in capital

11.1

—

Retained earnings

1,065.5

1,034.4

Other reserves

3.9

6.1

Accumulated other comprehensive loss

(266.8

)

(260.6

)

Total shareholders’ equity including

shares held in treasury

$

821.1

$

787.3

Less: 1,643,731 shares as at June 30, 2024

and Nil shares as at March 31, 2024, held in treasury, at cost

(84.2

)

—

Total shareholders’ equity

$

736.9

$

787.3

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

1,497.6

$

1,434.1

About Non-GAAP Financial

Measures

The financial information in this release includes certain

non-GAAP financial measures that we believe more accurately reflect

our core operating performance. Reconciliations of these non-GAAP

financial measures to our GAAP operating results are included

below. A more detailed discussion of our GAAP results is contained

in “Part I –Item 5. Operating and Financial Review and Prospects”

in our annual report on Form 20-F filed with the SEC on May 10,

2024.

Revenue less repair payments is a non-GAAP financial measure

that is calculated as (a) revenue less (b) in our BFSI segment,

payments to repair centers for “fault” repair cases where WNS acts

as the principal in its dealings with the third party repair

centers and its clients. WNS believes that revenue less repair

payments for “fault” repairs reflects more accurately the value

addition of the business process management services that it

directly provides to its clients. For more details, please see the

discussion in “Part I – Item 5. Operating and Financial Review and

Prospects – Overview” in our annual report on Form 20-F filed with

the SEC on May 10, 2024.

Constant currency revenue less repair payments is a non-GAAP

financial measure. We present constant currency revenue less repair

payments so that revenue less repair payments may be viewed without

the impact of foreign currency exchange rate fluctuations, thereby

facilitating period-to-period comparisons of business performance.

Constant currency revenue less repair payments is presented by

recalculating prior period’s revenue less repair payments

denominated in currencies other than in US dollars using the

foreign exchange rate used for the latest period, without taking

into account the impact of hedging gains/losses. Our non-US dollar

denominated revenues include, but are not limited to, revenues

denominated in pound sterling, South African rand, Australian

dollar and Euro.

WNS also presents or discusses (1) adjusted operating margin,

which refers to adjusted operating profit (calculated as operating

profit / (loss) excluding goodwill & intangible impairment,

share-based compensation expense, acquisition-related expenses or

benefits, costs related to the exchange of ADSs to ordinary shares,

costs related to change to US GAAP reporting and voluntarily filing

on US domestic issuer forms with SEC and amortization of intangible

assets) as a percentage of revenue less repair payments, (2) ANI,

which is calculated as profit excluding goodwill & intangible

impairment, share-based compensation expense, acquisition-related

expenses or benefits, costs related to the termination of ADS

program and listing of ordinary shares, costs related to the

transition to voluntarily reporting on US domestic issuer forms and

amortization of intangible assets and including the tax effect

thereon, (3) Adjusted net income margin, which refers to ANI as a

percentage of revenue less repair payments, and other non-GAAP

financial measures included in this release as supplemental

measures of its performance.

Acquisition-related expenses or benefits consists of transaction

costs, integration expenses, employment-linked earn-out as part of

deferred consideration and changes in the fair value of contingent

consideration including the impact of present value thereon. WNS

presents these non-GAAP financial measures because it believes they

assist investors in comparing its performance across reporting

periods on a consistent basis by excluding items that are

non-recurring in nature and those it believes are not indicative of

its core operating performance. In addition, it uses these non-GAAP

financial measures (i) to evaluate the effectiveness of its

business strategies and (ii) (with certain adjustments) as a factor

in evaluating management’s performance when determining incentive

compensation. WNS is excluding acquisition-related expenses as

described above with effect from fiscal 2023 second quarter.

These non-GAAP financial measures are not meant to be considered

in isolation or as a substitute for WNS’ financial results prepared

in accordance with US-GAAP.

The company is not able to provide our forward-looking GAAP

revenue, profit and earnings per share without unreasonable efforts

for a number of reasons, including our inability to predict with a

reasonable degree of certainty the payments to repair centers, our

future share-based compensation expense under US-GAAP (Share Based

payments), amortization of intangibles and acquisition-related

expenses or benefits associated with future acquisitions, goodwill

impairment and currency fluctuations. As a result, any attempt to

provide a reconciliation of the forward-looking GAAP financial

measures (revenue, profit, earnings per share) to our

forward-looking non-GAAP financial measures (revenue less repair

payments*, ANI* and Adjusted diluted earnings per share*,

respectively) would imply a degree of likelihood that we do not

believe is reasonable.

Reconciliation of revenue (GAAP) to

revenue less repair payments (non-GAAP) and constant currency

revenue less repair payments (non-GAAP)

Three months ended

Three months ended Jun

30, 2024 compared to

Jun 30, 2024

Jun 30, 2023

Mar 31, 2024

Jun 30, 2023

Mar 31, 2024

(Amounts in millions)

(% growth)

Revenue (GAAP)

$

323.1

$

326.5

$

336.8

(1.0

%)

(4.1

%)

Less: Payments to repair centers

10.7

9.0

10.9

18.4

%

(1.8

%)

Revenue less repair payments

(non-GAAP)

$

312.4

$

317.5

$

325.9

(1.6

%)

(4.1

%)

Exchange rate impact

0.9

1.5

0.1

Constant currency revenue less repair

payments (non-GAAP)

$

313.4

$

319.0

$

326.0

(1.8

%)

(3.9

%)

Reconciliation of operating income

(GAAP to non-GAAP)

Three months ended

Jun 30, 2024

Jun 30, 2023

Mar 31, 2024

(Amounts in millions)

Operating income (GAAP)

$

38.6

$

37.9

$

16.9

Add: Share-based compensation expense

11.2

16.2

9.0

Add: Amortization of intangible assets

6.9

8.7

7.0

Add: Impairment of intangible assets

—

—

30.9

Add: Acquisition-related expenses

0.6

1.0

0.6

Add: Costs related to the termination of

ADS program and listing of ordinary shares

0.1

—

3.6

Add: Costs related to the transition to

voluntarily reporting on US domestic issuer forms

0.3

—

0.1

Adjusted operating income (non-GAAP)

$

57.6

$

63.8

$

68.2

Operating income as a percentage of

revenue (GAAP)

11.9

%

11.6

%

5.0

%

Adjusted operating income as a percentage

of revenue less repair payments (non-GAAP)

18.4

%

20.1

%

20.9

%

Reconciliation of net income (GAAP) to

ANI (non-GAAP)

Three months ended

Jun 30, 2024

Jun 30, 2023

Mar 31, 2024

(Amounts in millions, except

per share data)

Net income (GAAP)

$

28.9

$

32.0

$

14.5

Add: Share-based compensation expense

11.2

16.2

9.0

Add: Amortization of intangible assets

6.9

8.7

7.0

Add: Impairment of intangible assets

—

—

30.9

Add: Acquisition-related expenses /

(benefits), net

0.8

1.3

0.3

Add: Costs related to the termination of

ADS program and listing of ordinary shares

0.1

—

3.6

Add: Costs related to the transition to

voluntarily reporting on US domestic issuer forms

0.3

—

0.1

Less: Tax impact on above (1)

(4.1

)

(7.1

)

(11.5

)

Adjusted Net Income (non-GAAP)

$

44.0

$

51.1

$

53.9

Net income as a percentage of revenue

(GAAP)

9.0

%

9.8

%

4.3

%

Adjusted net income as a percentage of

revenue less repair payments (non-GAAP)

14.1

%

16.1

%

16.6

%

Adjusted diluted earnings per share

(non-GAAP)

$

0.93

$

1.02

$

1.12

(1)

The company applies GAAP methodologies in

computing the tax impact on its non-GAAP ANI adjustments (including

amortization of intangible assets, acquisition-related expenses and

share-based compensation expense). The company’s non-GAAP tax

expense is generally higher than its GAAP tax expense if the income

subject to taxes is higher considering the effect of the items

excluded from GAAP profit to arrive at non-GAAP profit.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717914865/en/

Investors: David

Mackey EVP – Finance & Head of Investor Relations WNS

(Holdings) Limited +1 (646) 908-2615 david.mackey@wns.com

Media: Archana Raghuram

EVP & Global Head – Marketing & Communications WNS

(Holdings) Limited +91 (22) 4095 2397 archana.raghuram@wns.com;

pr@wns.com

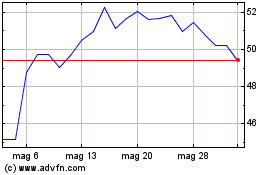

Grafico Azioni WNS (NYSE:WNS)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni WNS (NYSE:WNS)

Storico

Da Gen 2024 a Gen 2025