SAP to Launch Restructuring Program Affecting 8,000 Jobs in AI Push -- Update

24 Gennaio 2024 - 8:26AM

Dow Jones News

By Mauro Orru and Dean Seal

SAP plans to undertake a restructuring program this year that

will affect some 8,000 jobs, ratcheting up its focus on artificial

intelligence.

The German business-software company said late Tuesday that most

of the roughly 8,000 positions affected should be covered by

voluntary leave programs and internal re-skilling, when workers are

trained to fill other roles within the group. SAP expects to end

2024 with a headcount similar to current levels. The company had a

workforce of 107,602 at the end of 2023.

Most of the costs related to the restructuring, currently

estimated at about 2 billion euros ($2.17 billion), should be

recognized in the first half of the year. Excluding restructuring

expenses, the overhaul is expected to convey only a minor cost

benefit this year.

The announcement comes a year after SAP said it was shedding

about 3,000 jobs as part of a separate restructuring as the group

leans on AI to streamline some processes and make work more

efficient.

"With the planned transformation program, we are intensifying

the shift of investments to strategic growth areas, above all

business AI," Chief Executive Christian Klein said.

Klein last year told The Wall Street Journal that SAP was open

to more investments in AI and acquisitions to streamline its

operations.

Recent advancements in generative AI--illustrated by the

popularity of OpenAI's ChatGPT, Microsoft's Bing and Google's Bard

chatbots--sparked a wave of investments from tech companies

jockeying for position in a rapidly evolving market that looks set

to revolutionize the future of business and human labor.

Last year, SAP made investments in three generative AI

companies--Aleph Alpha, Anthropic and Cohere--and appointed

Microsoft's Walter Sun as its global head of artificial

intelligence, underscoring its commitment to the technology.

On Tuesday, SAP posted revenue and operating profit ahead of

analysts' expectations for the fourth quarter, led by growth at its

core cloud business.

Reporting on a non-IFRS basis, the Walldorf, Germany-based

company said total revenue climbed to EUR8.47 billion from EUR8.06

billion in the fourth quarter of 2022. Revenue from SAP's cloud

business jumped to EUR3.70 billion from EUR3.08 billion, while

software-licenses revenue slipped to EUR841 million from EUR907

million.

SAP has been moving away from software-licenses sales to

subscription-based cloud services, banking on a more profitable and

predictable model based on recurring revenue. The company said

Brazil, Germany, France, India, and South Korea had enjoyed

outstanding cloud revenue growth in the quarter.

"We met or exceeded our outlook for 2023 in all key metrics.

Based on a stellar order entry, our current cloud backlog expanded

by 27%--an all-time high," Klein said.

Operating profit for the fourth quarter fell to EUR2.51 billion

from EUR2.56 billion, with SAP's operating margin falling to 29.6%

from 31.7%.

Analysts had forecast total revenue of EUR8.32 billion and cloud

revenue of EUR3.72 billion on operating profit of EUR2.47 billion

and a 29.9% operating margin, according to a company-provided

consensus on a non-IFRS basis.

SAP, like other European software companies, presents its

figures as two sets of numbers. One set is based on the

International Financial Reporting Standards--an international

accounting method that seeks to provide a global reporting

standard--though analysts and investors tend to follow SAP's

non-IFRS numbers.

Those figures had so far excluded share-based compensation,

restructuring expenses and acquisition-related charges. However,

SAP began including share-based compensation expenses in its

non-IFRS results from Jan. 1 of this year. While its 2023 figures

don't reflect the change, guidance for the new year and 2025

does.

For 2024, SAP expects non-IFRS operating profit at constant

currencies between EUR7.6 billion and EUR7.9 billion, cloud revenue

at constant currencies between EUR17 billion and EUR17.3 billion

and free cash flow of roughly EUR3.5 billion.

By 2025, SAP expects non-IFRS operating profit of approximately

EUR10 billion, including share-based compensation expenses of

roughly EUR2 billion, and free cash flow of about EUR8 billion.

Write to Mauro Orru at mauro.orru@wsj.com and Dean Seal at

dean.seal@wsj.com

(END) Dow Jones Newswires

January 24, 2024 02:11 ET (07:11 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

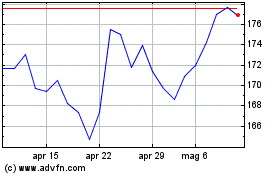

Grafico Azioni Sap (TG:SAP)

Storico

Da Nov 2024 a Dic 2024

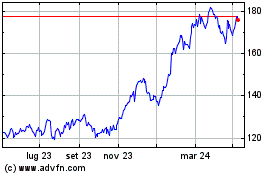

Grafico Azioni Sap (TG:SAP)

Storico

Da Dic 2023 a Dic 2024