Shopping Trolleys Show Pent-Up Party Spirits -- Heard on the Street

08 Aprile 2021 - 1:12PM

Dow Jones News

By Carol Ryan

A year into the worst health crisis in modern history, French

Champagne, chocolate novelties and tequila have all shot up

consumers' grocery lists. Current trends bode well for liquor

stocks, less so for some of the early winners of the pandemic.

This time last year, shoppers were panic buying after the World

Health Organization declared a global pandemic on March 11.

Supermarket shelves were stripped of essentials such as toilet

paper, dried pasta, hand sanitizer and canned soup. Staples

companies such as Lysol-maker Reckitt and paper-products giant

Kimberly-Clark initially struggled to meet demand.

Today, Americans and Europeans are buying less at the grocery

store overall. Data from Nielsen show that sales of fast-moving

consumer products over the four weeks through March 21 -- the

latest figures available -- were down 10% in Europe's five biggest

markets compared with the same period of 2020. In the U.S., where

so-called pantry loading was more intense, sales were down 16%.

The contents of shopping trolleys have also changed. The

fastest-growing consumer products in Europe over the four weeks

through March 21 were chocolate novelties -- perhaps partly due to

the earlier Easter holiday -- Champagne, tequila, premixed alcohol

and ready-to-drink coffee. In the U.S., sales of Champagne and

prepared cocktails were up 78% and 69% respectively.

It has been tough for more mundane categories to maintain the

blistering growth they saw in the early days of the pandemic. Sales

of goods such as dried pasta and hand sanitizer must now be

compared against last year's unprecedented sharp increase. For the

four weeks in question, sales of toilet roll dropped 54% year over

year in the U.S., while hand-sanitizer sales fell 27%. Bleach and

soap sales are also off in Europe. Although demand for hygiene

products is higher than before the pandemic, cleaning brands

belonging to the likes of Reckitt and Domestos-owner Unilever will

start to look like underperformers.

The indulgent contents of shopping baskets add to a picture of

improving sentiment. Europe's consumer confidence index ticked up

in March and is almost back to its long-term average. America's

equivalent measure is at its highest level since the pandemic

began.

Alcohol's strong showing in supermarket sales partly reflects

the continuing closures of bars and restaurants in many markets.

Social-distancing restrictions tightened in March in countries such

as France and Italy.

Still, the shopping data should reassure investors who have

piled into liquor stocks. Shares in Diageo, which makes Johnnie

Walker whiskey, and its Paris-based rival Pernod Ricard are trading

at close to decade-high multiples of projected earnings. Rémy

Cointreau, which has higher exposure to the booming U.S. and

Chinese cognac markets, now fetches 50 times profits.

If 2020 will be remembered for toilet-paper hoarding, 2021 is

shaping up to be a good year for alcohol.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

April 08, 2021 06:57 ET (10:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

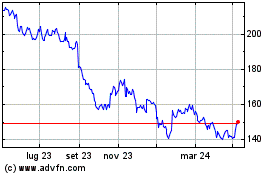

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

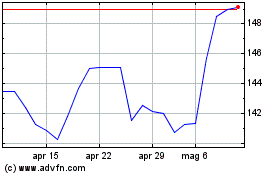

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024