Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20211006005629/en/

Office Kennedy asset (Photo: Vitura)

This press release cannot be published,

transmitted or distributed, directly or indirectly, in the United

States, Canada, Australia or Japan.

Vitura (the “Company”) (Paris:VTR) announces the success

of its €34,526,296.80 share capital increase with shareholders’

preferential subscription rights (the “Rights Issue”). The

Rights Issue will result in the issuance of 935,672 new ordinary

shares (the “New Shares”) at a subscription price of €36.90

per New Share.

The proceeds of the Rights Issue will be used to finance part of

the acquisition of Office Kennedy building for an amount of €97

million, announced in a press release on 5 August 2021. The entire

balance will be financed by a bank loan of an amount of

approximately €65 million.

Following the subscription period, which ended on 30th September

2021, total subscription orders amounted to €36,454,912.20,

representing a total subscription rate of 105.59%:

- 801,663 New Shares were subscribed on an

irreducible basis (à titre irréductible) i.e., 85.68% of the New

Shares to be issued; and

- 186,275 New Shares were requested on a

reducible basis (à titre réductible), i.e., 19.91% of the New

Shares to be issued, and were only be satisfied with respect to

134,009 New Shares.

In accordance with their commitments and after the scale for

allotment has been applied, NW CGR 1 LLC, NW CGR 2 LLC, NW CGR 3

LLC, entities of Northwood Investors (the “Northwood Investors

Entities”) and Euro Bernini Private Limited, an entity of the

GIC group (the "GIC Entity") have fully exercised their

preferential subscription rights and have subscribed on an

irreducible basis (à titre irréductible) and on a reducible basis

(à titre réductible) for 609,162 New Shares and 275,000 New Shares,

respectively, representing an amount of €22,478,077.80 (i.e., 65.1%

of the New Shares to be issued) and €10,147,500.00 (i.e., 29.39% of

the New Shares to be issued), respectively.

After completion of the Rights Issue, Northwood Investors and

GIC will hold 57.60% and 25.18% of the share capital of the

Company, respectively.

Settlement and delivery and admission to trading of the New

Shares on the regulated market of Euronext in Paris (Segment B) on

the same line as the existing shares (FR 0010309096) should take

place on 8 October 2021 in accordance with the timetable of the

Rights Issue. As from that date, the share capital of Vitura will

be composed of 16,842,112 shares with a nominal value of €3.8 each,

for a total nominal share capital of €64,000,025.60, split as

follows:

Ownership structure

Shares

Theoretical voting

rights

Voting rights exercisable at

the General Shareholders' Meeting (3)

Number

%

Number

%

Number

%

Northwood (1)

9,701,031

57.60

9,701,031

57.60

9,701,031

57.69

GIC (2)

4,241,646

25.18

4,241,646

25.18

4,241,646

25.22

Free Float

2,873,195

17.06

2,873,195

17.06

2,873,195

17.09

Treasury Shares

26 240

0.16

26,240

0.16

-

-

Total

16,842,112

100

16,842,112

100

16,815,872

100

(1) means the companies NW CGR 1 S.a.r.l,

NW CGR 2 S.a.r.l and NW CGR 3 S.a.r.l, holding each 3,131,947

shares, and the company NW CGR Holdings LP, holding 305,190 shares,

members of the Northwood Parties Concerted Action

(2) means the company Euro Bernini Private

Limited

(3) Percentage calculated excluding the

treasury shares without voting rights held by the company

The New Shares will carry full rights (jouissance courante) as

from their issue date and will be immediately fully fungible with

the existing shares already traded on the regulated market of

Euronext in Paris.

Société Générale acted as Sole Global Coordinator and Bookrunner

of the transaction, and BNP Paribas as Co-Bookrunner.

Company’s lock-up

The Company has agreed to a lock-up expiring 90 calendar days

following the settlement and delivery date of the New Shares,

subject to certain customary exceptions.

Information available to the public

The Company has published a French language prospectus (the

“Prospectus”), which has been approved by the Autorité des

marchés financiers (“AMF”) on 13 September 2021 under number

21-394, comprising (i) the Universal Registration Document

(document d’enregistrement universel) of the Company filed with the

AMF on 6 April 2021 under number D.21-0262, (ii) the interim

financial report as of 30 June 2021 (rapport financier semestriel)

(iii) an amendment to the Universal Registration Document filed

with the AMF on 13 September 2021 under number D.21-0262-A01 and

(iv) a securities note (note d’opération) (including a summary of

the prospectus).

Vitura draws the public’s attention to the risk factors included

in pages 87 to 93 of the Universal Registration Document, in pages

23 et 24 of the interim financial report, in Chapter 3 of the

amendment to the Universal Registration Document and in chapter 2

of the securities note (note d’opération).

The French language Prospectus, approved by the AMF, is

available on the Company’s website (www.vitura.fr) and on the AMF’s

(www.amf-france.org). Hard copies of the Prospectus are also

available free of charge at the Company’s headquarters, located at

42 rue de Bassano, 75008 Paris.

About Vitura

Created in 2006, Vitura (formerly Cegereal) is a listed real

estate company that invests in prime office properties in Paris and

Greater Paris. The total value of the portfolio was estimated at

€1,455 million at June 30, 2021 (excluding transfer duties). Thanks

to its strong commitment to sustainable development, Vitura was

named a Global Sector Leader in the 2020 Global Real Estate

Sustainability Benchmark’s (GRESB) listed office property companies

category and received two Gold Awards from the European Public Real

Estate Association (EPRA) for the quality and transparency of its

financial and non-financial reporting. Its entire portfolio has

achieved NF HQETM Exploitation and BREEAM In-Use International

certification. Vitura is a REIT listed on Euronext Paris since

2006, in compartment B (ISIN: FR0010309096). The Company had a

market capitalization of €589 millions at 5 October 2021.

Visit our website to find out more: www.vitura.fr

Disclaimer

This press release and the information contained herein do not

constitute either an offer to sell or the solicitation of an offer

to purchase the Company’s securities, there shall not be any sale

of ordinary shares in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or approval under the securities laws of any such state or

jurisdiction.

The release, publication or distribution of this press release

in certain jurisdictions may be restricted by laws or regulations.

Therefore, persons in such jurisdictions into which this press

release is released, published or distributed must inform

themselves about and comply with such laws or regulations. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

The information contained in this announcement is for background

purposes only and does not purport to be full or complete and no

reliance may be placed by any person for any purpose on the

information contained in this announcement or its accuracy,

fairness or completeness. Any purchase of securities should be made

solely on the basis of the information contained in the prospectus

issued by the Company.

This press release is not a prospectus within the meaning of

Regulation (UE) 2017/1129 of the European Parliament and of the

Council of 14 June 2017 as amended (the “Prospectus

Regulation”). Potential investors are advised to read the

prospectus before making an investment decision in order to fully

understand the potential risks and benefits associated with the

decision to invest in the securities. The approval of the

prospectus by the AMF should not be construed as a favorable

opinion on the securities offered or admitted to trading on a

regulated market.

European Economic Area

The offer is open to the public in France.

With respect to each Member State of the European Economic Area

(other than France) and the United Kingdom (the "Relevant

States"), no action has been or will be taken to permit an

offer of securities to the public that would require the

publication of a prospectus in any of the Relevant States.

Accordingly, the securities may only be offered and will only be

offered in the Relevant States (i) to qualified investors within

the meaning of the Prospectus Regulation, for any investor in a

Member State, or within the meaning of Regulation (EU) 2017/1129 as

made part of national law under the European Union (Withdrawal) Act

2018 (the "UK Prospectus Regulation"), for any investor in

the United Kingdom, (ii) to fewer than 150 natural or legal persons

(other than qualified investors as defined in the Prospectus

Regulation or the UK Prospectus Regulation, as the case may be), or

(iii) in accordance with the exemptions provided for in Article

1(4) of the Prospectus Regulation or in other cases not requiring

the publication by Vitura of a prospectus under Article 3 of the

Prospectus Regulation, the UK Prospectus Regulation and/or the

regulations applicable in such Relevant States.

These selling restrictions with respect to Relevant States apply

in addition to any other selling restrictions which may be

applicable in the Relevant States who have implemented the

Prospectus Regulation.

United Kingdom

This press release is distributed only to, and directed only at,

“qualified investors” (as defined in section 86(7) of the Financial

Services and Markets Act 2000) who are (i) investment professionals

falling within Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (as amended) (the

“Order”) or (ii) persons falling within Article 49(2) (a) to

(d) of the Order (high net worth entities, non-registered

associations, etc.) or (iii) to any other person to whom this press

release may be sent in compliance with applicable laws (all such

persons being referred to as “Qualified Persons”). This

press release is directed only at Qualified Persons and must not be

used or relied upon by unqualified persons. Any investment or

investment activity applies to, and may only be made by, Qualified

Persons. Any person who is not a Qualified Person shall not act or

rely on this press release or on any information contained

herein.

United States

This press release may not be published, distributed or

disclosed in the United States (including its territories and

possessions).

This document does not constitute an offer to sell, or a

solicitation of offers to purchase or subscribe for securities in

the United States. The securities referred to herein have not been,

and will not be, registered under the U.S. Securities Act of 1933,

as amended (the “US. Securities Act”) or under any

applicable securities regulations of any state or other

jurisdiction in the United States, and may not be offered,

subscribed or sold in the United States absent registration or an

applicable exemption from registration requirements and may not be

offered or sold in the United States absent registration under the

Securities Act except pursuant to an exemption or in a transaction

exempt from registration under the US. Securities Act.

The shares of the Company have not been and will not be

registered under the US. Securities Act and the Company does not

intend to register any portion of the proposed offering in the

United States or to conduct a public offering in the United

States.

Canada, Australia and Japan

The new shares and the preferential subscription rights may not

be offered, sold or purchased in Canada (subject to certain

exceptions and pursuant to procedures set out by the Company),

Australia or Japan.

The distribution of this press release in certain countries may

constitute a violation of applicable legal provisions. Neither

Société Générale nor BNP Paribas undertake any responsibility in

relation thereof.

In connection with any offering of the securities referred

thereto (the "Financial Securities"), Société Générale, BNP

Paribas and any of their affiliates, may take up as a principal

position any securities and in that capacity may retain, purchase,

sell or offer to sell for their own accounts such securities and

other related securities. In addition, they may enter into

financing arrangements (including swaps or contracts for

differences) with investors in connection with which they may from

time to time acquire, hold or dispose of Securities. They do not

intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or

regulatory obligation to do so.

Société Générale and BNP Paribas are acting for the Company and

no one else in connection with the offering of Financial Securities

and will not regard any other person as their clients nor be

responsible to any other person for providing the protections

afforded to any of their clients or for providing advice in

relation to any offering of the Financial Securities nor for

providing advice in relation to the offering of securities, the

contents of this announcement or any transaction, arrangement or

other matter referred to herein.

None of Société Générale, BNP Paribas nor any of their

affiliates, directors, officers, employees, advisers or agents

accepts any responsibility or liability whatsoever for or makes any

representation or warranty, express or implied, as to the truth,

accuracy or completeness of the information in this announcement

(or whether any information has been omitted from the announcement)

or any other information relating to the Company, its subsidiaries

or associated companies, whether written, oral or in a visual or

electronic form, and howsoever transmitted or made available or for

any loss howsoever arising from any use of this announcement or its

contents or otherwise arising in connection therewith.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211006005629/en/

Investor relations Charlotte de Laroche +33 1 42 25 76 42

info@vitura.fr

Media relations Aliénor Miens / Marion Bouchut +33 6 34 45 34 09

marion.bouchut@havas.com

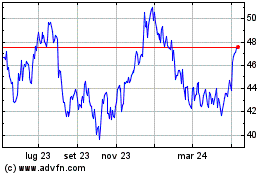

Grafico Azioni Ventas (NYSE:VTR)

Storico

Da Mar 2024 a Apr 2024

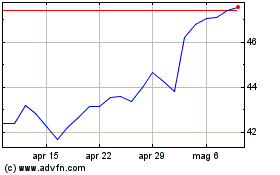

Grafico Azioni Ventas (NYSE:VTR)

Storico

Da Apr 2023 a Apr 2024