China's Cosco Puts Long Beach Container Terminal Up for Sale

20 Novembre 2018 - 7:23PM

Dow Jones News

By Costas Paris and Joanne Chiu

China's Cosco Shipping Holdings Co. is starting the process of

selling its large container terminal in Long Beach, Calif., a major

gateway for U.S. trade that is expected to bring bids of more than

$1 billion from some of the world's biggest port operators, people

involved in the matter said.

The sale is part of an agreement with U.S. regulators that gave

Cosco the green light to buy Hong Kong-based container shipping

line Orient Overseas International Ltd. for $6.3 billion in

July.

Orient Overseas operates the Long Beach Container Terminal under

a long-term concession. Cosco agreed earlier this year with the

Committee on Foreign Investment in the U.S. to place it into a

U.S-run trust and sell it within a year to allay national security

concerns over a Chinese state entity running a major U.S.

gateway.

Cfius has scuttled several international transactions in the

past couple of years including Broadcom Ltd.'s $117 billion

takeover of chip rival Qualcomm Inc. and the sale of MoneyGram

International Inc. to Chinese billionaire Jack Ma's Ant Financial

Services Group.

"Sale advisers are being hired and the expectation is for bids

of more than $1 billion from global port operators and maybe

pension funds and private equity," a person directly involved in

the matter said. "The sale is being run by OOIL and should be

completed by June at the latest."

The Long Beach terminal is one of the few in the U.S. with

extensive automation and can handle some of the world's largest

container vessels. The terminal is expanding to handle ships

carrying more than 20,000 boxes each.

The Port of Long Beach is one of the biggest in the U.S., with

more than 7.5 million containers moving in and out of the site last

year, or about one fifth of U.S. trade volumes. Apart from OOIL, a

number of foreign shipping operators have stakes in the port's

terminals including Geneva-based Mediterranean Shipping Company and

Japan's K Line.

People involved in the case said bids are likely from APM

Terminals, the port operating arm of Danish logistics giant A.P.

Moller-Maersk A/S, Japan's Ocean Network Express, Taiwan's

Evergreen Marine, Hong Kong's Hutchison Port Holdings and South

Korea's Hyundai Merchant Marine.

Seattle-based port operator SSA Terminals may also be in the

running. DP World, one of the world's biggest container terminal

operators, could offer a bid, but the Dubai-based company hasn't

sought to own any U.S. properties since an effort to buy several

American terminals in 2006 collapsed under political pressure and

security concerns.

Cosco has minor investments in other U.S. ports, including

another pier at Long Beach as well as at the ports of Los Angeles

and Seattle.

Imports to U.S. seaports in the West Coast have been surging in

recent months in an apparent push by retailers and manufacturers to

pull orders forward ahead of a new round of tariffs set to hit

U.S.-China trade in January.

Long Beach and the neighboring Port of Los Angeles and Long

Beach, the nation's top hub for container trade and the main

destination for imports from China, handled a combined 849,908

containers in October, up 17.7% from the same month last year and

10.2% from September.

Write to Costas Paris at costas.paris@wsj.com and Joanne Chiu at

joanne.chiu@wsj.com

(END) Dow Jones Newswires

November 20, 2018 13:08 ET (18:08 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

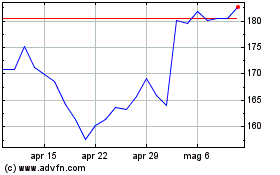

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2024 a Mag 2024

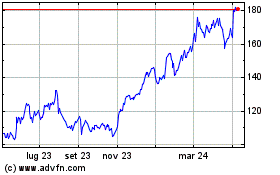

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mag 2023 a Mag 2024