By Maureen Farrell and Eliot Brown

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 23, 2019).

SoftBank Group Corp. said it agreed to take a majority stake in

WeWork after securing a deal that could hand co-founder Adam

Neumann a nearly $1.7 billion windfall and sever most of his ties

with the troubled office-space startup.

WeWork, in danger of running out of cash in the coming weeks,

chose a rescue offer from SoftBank over a competing proposal from

JPMorgan Chase & Co., according to people familiar with the

matter. It had asked both parties to submit proposals by a deadline

Monday.

The deal, which the companies announced late Tuesday, values

WeWork at about $8 billion, a far cry from what it was aiming for

in an initial public offering earlier this year and even less than

the $47 billion at which a January investment from SoftBank pegged

its worth. It will give SoftBank a roughly 80% ownership stake in

WeWork.

Mr. Neumann, who was forced out as chief executive after

pushback from prospective investors scuttled the IPO, has the right

to sell $970 million of shares, or about one-third of his stake, in

a so-called tender offer in which SoftBank will buy up to $3

billion in WeWork stock from employees and investors.

The Japanese conglomerate, which already owns about a third of

the company, will also extend Mr. Neumann credit to help him repay

a $500 million loan facility led by JPMorgan, the people said. It

will also pay him a $185 million consulting fee.

Mr. Neumann has promised to work exclusively with the company

for four years, some of the people said. Mr. Neumann, who has

remained chairman of WeWork parent We Co., will step down from the

board but remain an observer and hold a minority stake.

The money Mr. Neumann will receive on his way out, which he has

told people he sees as a validation of the job he did building the

company, is likely to raise hackles among employees, governance

experts and others. Mr. Neumann had previously sold hundreds of

millions of dollars of his stock in the company and borrowed

heavily against it.

While he will walk away a billionaire, most We employees are

left holding stock options that are underwater at the roughly

$20-a-share valuation implied by the SoftBank deal, according to

former executives familiar with the compensation packages. That

leaves them with little beyond their salaries and -- for thousands

set to be laid off -- any severance.

A top SoftBank executive, Marcelo Claure, will succeed Mr.

Neumann as executive board chairman, WeWork said. The Bolivian-born

former CEO of Sprint Corp., who is said to be close to Mr. Neumann,

also is expected to head a search for outside leadership, including

potentially a new chief executive to replace the two men who have

been sharing the job since Mr. Neumann's departure. The board will

be expanded and it will assume voting control of Mr. Neumann's

shares, the companies said.

SoftBank is racing to save an investment that has soured in

rapidly. Its founder, Masayoshi Son, was a major booster of Mr.

Neumann, and the Japanese-listed conglomerate invested several

times in WeWork, both on its own and through its $100 billion

Vision Fund, which includes outside investors.

On a call with some of those investors this week, Mr. Son

apologized for the WeWork investment, saying he had put too much

faith in Mr. Neumann, people familiar with the matter said.

SoftBank will also move up a $1.5 billion investment it had been

scheduled to make next year and extend the company a $5 billion

loan.

Between 2017 and earlier this year, SoftBank put more than $9

billion into WeWork at a roughly $24 billion valuation, according

to analysts at Sanford C. Bernstein & Co. What SoftBank has

agreed to add would bring its total equity investment to more than

$13 billion for a company now worth less than $8 billion.

Mr. Neumann, who co-founded WeWork in 2010, once owned shares

that carried 20 votes each, guaranteeing him ironclad control of

the company, even as new investors came in. The SoftBank deal would

require that all We shares carry one vote apiece. Mr. Neumann's

stake in the company is expected to fall to below 10% after he

sells shares.

SoftBank's $500 million loan to Mr. Neumann was a critical part

of the negotiations, as he previously borrowed against his stock at

a much higher valuation. With the company's worth plummeting, he

was in danger of falling below the collateral levels required by

JPMorgan and other banks.

By relinquishing the CEO title in late September, Mr. Neumann

was in technical default on that loan, which could have forced

imminent repayment, according to people familiar with the matter.

JPMorgan gave him 45 days to work out a solution. The new money

from SoftBank will allow Mr. Neumann to repay the loans and spare

JPMorgan -- which prides itself on a "fortress balance sheet" and

savvy lending decisions -- from suffering a major credit loss.

WeWork's swift fall erased nearly $40 billion on paper, a

collapse with little precedent among startups. Just five weeks ago,

WeWork was planning an IPO that its bankers at JPMorgan and Goldman

Sachs Group Inc. told company executives could fetch a valuation

around $20 billion.

Investors balked at the company's steep and growing losses and a

tangle of business and personal dealings with Mr. Neumann, whose

erratic management style and party-heavy lifestyle also raised

eyebrows.

Under its new co-CEOs, Artie Minson and Sebastian Gunningham,

WeWork has been crafting plans to sell or shut down side ventures,

including a private elementary school and the event-planning

website Meetup.com, to focus on its core business of leasing office

buildings, renovating them and subletting to short-term

tenants.

WeWork also has been planning to cut thousands of employees, but

delayed the layoffs earlier this month because it couldn't afford

the severance costs, people familiar with the matter have said.

A big aim of these moves is to pare down WeWork's cost structure

now that it will have to make do, at least for now, without the $3

billion or more the IPO was expected to bring in.

With the company's value now reset at around $8 billion, most of

the investment in the company since its inception is underwater and

many investors will likely have to mark down their stakes.

SoftBank, Fidelity Management and Chinese investment firm Hony

Capital bought shares at prices far above the valuation implied by

the pending SoftBank transaction, regulatory filings show.

A few winners: A 2012 investment of $17 million led by

venture-capital firm Benchmark Capital is now worth more than 40

times that amount, and a $150 million investment in 2014 led by

JPMorgan's asset-management division is worth roughly four times as

much.

--Liz Hoffman and Rolfe Winkler contributed to this article.

Write to Maureen Farrell at maureen.farrell@wsj.com and Eliot

Brown at eliot.brown@wsj.com

(END) Dow Jones Newswires

October 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

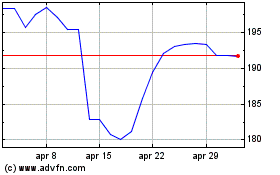

Grafico Azioni JP Morgan Chase (NYSE:JPM)

Storico

Da Mar 2024 a Apr 2024

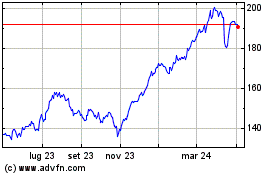

Grafico Azioni JP Morgan Chase (NYSE:JPM)

Storico

Da Apr 2023 a Apr 2024