Bitcoin $90K Level Is Crucial For Bulls – Price Could Tag $79K If BTC Loses It

27 Dicembre 2024 - 5:30PM

NEWSBTC

Bitcoin has found itself in a challenging position, struggling to

reclaim the coveted $100,000 mark after a rapid shift in market

sentiment. Just weeks ago, optimism dominated the landscape, with

prices surging toward new heights. However, the narrative has taken

a sharp turn, as fear now grips the market following a sudden

correction. Related Reading: ONDO Faces 30% Correction Risk If It

Loses $1.46 Support – Top Analyst Currently trading below $100K,

Bitcoin’s price action reflects increased uncertainty among

investors. Top analyst Axel Adler recently shared his insights on

X, emphasizing the significance of the $90,000 level as a robust

support zone. According to Adler, this zone extends to a lower

range of $79,000, offering a safety net should further declines

occur. He highlights that maintaining this support is crucial for

Bitcoin to stabilize and regain bullish momentum. While the current

sentiment leans toward caution, historical trends suggest that

Bitcoin often thrives after testing key support levels. The

market’s focus has now shifted to whether BTC can defend this

critical zone and stage a recovery. In the coming days, the $90K

mark will be a pivotal battleground, determining whether Bitcoin

can regain its footing or continue its descent. Investors and

analysts alike are closely monitoring these developments, awaiting

the next major move. Bitcoin Finding Demand Below $100K Bitcoin’s

price action has shifted from testing new all-time highs to finding

solid demand below the $100,000 mark. This zone will determine

whether the rally resumes or the market confirms a deeper

correction. Amid this uncertainty, top analyst Axel Adler has

provided critical insights on X, shedding light on key levels

shaping Bitcoin’s trajectory. Adler’s analysis highlights the

significance of the $79,000 level, which recently recorded the

largest unrealized profit and loss (P/L) in the past decade. This

data suggests that the $79K zone is not only a psychological

benchmark but also a crucial support level with significant market

activity. Additionally, he emphasizes the $90K mark as a robust

support area, with its lower boundary set at $79K. Adler notes that

holding above $90K in the coming weeks would bolster bullish

momentum, making a surge past $100K highly probable. Related

Reading: Ethereum Price Setting For a Big Move – Breakout Or

Downturn? However, Adler also cautions about the potential for a

sideways consolidation phase. Such a move could serve as a

cooling-off period for the market, allowing it to digest recent

gains before resuming its upward trajectory. For now, Bitcoin’s

price action remains at a pivotal crossroads, with its ability to

maintain support levels dictating whether the next phase will be a

breakout or a correction. Investors are watching closely. Technical

Analysis: Key Levels To Hold Bitcoin is currently

trading at $96,200, reflecting days of indecision and sideways

price action that has left traders uncertain about the next move.

Despite this consolidation phase, BTC remains within a critical

range, with its next direction likely to depend on whether bulls or

bears take control. For bullish momentum to return, Bitcoin

must break decisively above the psychological $100,000 mark.

Achieving this milestone would signal renewed strength and could

pave the way for further price discovery, potentially igniting

another leg of the rally. On the flip side, holding above the

$92,000 level would still maintain a bullish narrative, as it

demonstrates resilience at a crucial support zone. However,

concerns about a potential downturn persist among analysts. Some

experts predict that Bitcoin could drop as low as $70,000 in the

coming weeks if the $92K support fails to hold. This bearish

scenario would represent a significant correction and could shake

market sentiment. Related Reading: Solana Sees Consistent Capital

Inflows Since 2023 – Liquidity Influx Signals Growth In the current

environment, Bitcoin’s price is at a pivotal point, with bulls

needing to reclaim control to push the market higher. Until then,

the market remains vulnerable to both bullish breakouts and bearish

breakdowns, leaving investors carefully monitoring these key levels

for further clues. Featured image from Dall-E, chart from

TradingView

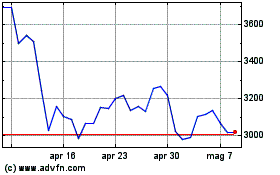

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Dic 2023 a Dic 2024