Bitcoin Drops Below $100,000: The End Or Beginning Of The Crypto Bull Market?

22 Dicembre 2024 - 5:30AM

NEWSBTC

Bitcoin, the titan of the cryptocurrency world with a market cap

hovering around $1.9 trillion, has experienced a significant

downturn, dipping below the psychological threshold of $100,000.

This flash dump, occurring over just three days, has left many

investors and analysts questioning whether this marks the end of

the current bull market or signals a healthy correction within an

ongoing bullish trend. Temporary Setback Or Trend Reversal? The

price action has been particularly notable this week, with Bitcoin

breaking through the $100,000 support level, which had held strong

for eight consecutive days. Market analysts point to several

factors contributing to this decline. One significant influence is

the market makers’ strategy, which involved driving the price

upward to encourage traders to open long positions at around

$98,000, thereby increasing liquidity. Related Reading: Is This The

Bottom? Experts Weigh In On Bitcoin 13% Dip And Potential Recovery

After exhausting this liquidity, market makers strategically used

Federal Reserve Chairman Jerome Powell’s speech as a catalyst to

drive a downward price movement, effectively filling the price

inefficiencies at $93,744 (50%) and $90,513 (100%). Analysts

explained, “The Bitcoin drop was necessary as there were

inefficiencies below the price that needed to be filled, which are

$93,744 for 50% and $90,513 for 100%. The inefficiency rule states

that traders must fill either 50% or 100% of the inefficiency.”

They added that market makers “purposely took the price upward to

induce traders to open long positions, thereby increasing the

liquidity at $98,000. Exhausted market makers decided to wipe out

the liquidity at $98,800 and used Powell’s speech as a catalyst to

fuel the downward movement.” Experts now predict a bounce to

$101,000 before either a pullback or a continuation of the trend,

as the $93,788-$92,200 range currently acts as robust support. This

zone has seen significant buy orders, aligning with the 50%

inefficiency recently filled. A bounce from this level appears

inevitable. BlackRock And Institutional Moves Signal Confidence In

Bitcoin Amid the volatility, BlackRock, one of the world’s leading

asset management firms, has made headlines for its substantial

investments in Bitcoin. According to insights from Arkham

Intelligence, BlackRock has not only net bought Bitcoin while other

ETFs were selling but has also amassed a considerable amount, now

holding 122.6K BTC. This makes BlackRock the 11th largest holder of

Bitcoin, controlling roughly 0.6% of the circulating supply.

Related Reading: Bitcoin Crashes: Here’s Where The Nearest On-Chain

Support Is Their aggressive accumulation, including a recent $1.5

billion purchase, contrasts sharply with the broader market’s net

selling of $785 million in BTC this week. BlackRock’s actions have

sparked discussions on platforms like X, with many applauding or

humorously noting their transition from traditional assets to

digital currencies. Additionally, BlackRock’s involvement in the

crypto market was underscored by their BUIDL Fund receiving $100

million USDC, signaling a strategic pivot towards digital assets.

Such a heavyweight in finance could interpret this move as a vote

of confidence in the long-term viability of cryptocurrencies,

potentially influencing market sentiment and dynamics. Market

Sentiment: Fear Or Opportunity? The market’s current sentiment, as

measured by the Fear and Greed Index, remains in the ‘greed’ zone

at 62, indicating minimal fear among investors. Instead, the dip

below $100,000 is viewed by many as a buying opportunity, with

expectations of an imminent recovery. Analysts predict a bounce

back to around $101,000 before any significant pullback or

continuation of the current trend, supported by robust buying at

the $93,788-$92,200 range, which aligns with the recently filled

50% inefficiency level. Featured image from iStock, chart from

Tradingview.com

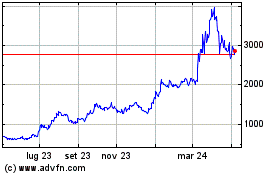

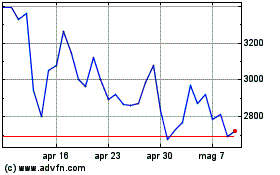

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Feb 2024 a Feb 2025