Ethereum Sees Net Outflows On Spot Exchanges—Is a Major Price Rally Coming?

18 Dicembre 2024 - 9:30AM

NEWSBTC

As Ethereum attempts to rally alongside Bitcoin, the asset appears

to have been spotlighted as analysts assess its fundamentals to

grasp what is ongoing behind the scenes. A key factor influencing

ETH’s price so far, according to the latest analysis, is the

relationship between net flows on spot exchanges and investor

behaviour. Net flows measure the balance between Ethereum entering

and exiting exchanges, providing a critical indicator of potential

price trends. Related Reading: Ethereum May Retest $3,700 Before a

Major Rally, Analyst Predicts Net Outflows And Conditions For

Ethereum Price Growth Notably, net outflows typically signal

bullish sentiment as investors transfer their ETH to cold wallets,

reducing selling pressure on the market. In contrast, an increase

in net inflows often reflects readiness to sell, which can create

downward pressure. According to CryptoQuant analyst cryptoavails,

these patterns in Ethereum’s net flow data have played a notable

role in past price cycles. For example, in early 2022, when

Ethereum’s price dropped from $4,000 to $1,000, net inflows were

dominant, indicating heightened selling activity. However, the

trend reversed in July 2022, with net outflows supporting

Ethereum’s gradual price recovery. For Ethereum to maintain an

upward trend, the analyst highlights that sustained net outflows

are essential. When ETH is withdrawn from exchanges, the

circulation tightens, reducing selling pressure. This supply-demand

imbalance can favor higher prices as investor confidence grows.

Particularly, a steady pattern of net outflows signals that

investors are holding Ethereum long-term, suggesting an environment

for price appreciation. However, cryptoavails mentioned that

Ethereum’s growth momentum remains sensitive to sudden market

shifts. A significant influx of ETH back onto exchanges could

increase selling pressure, leading to short-term corrections. The

analyst wrote: This dynamic supports upward pressure on the price.

However, sustainability is crucial—sudden net inflows can lead to

short-term selling pressure, weakening the trend. What This Means

For The Altcoin Market Ethereum’s performance holds broader

implications for the altcoin market. As a leading altcoin in

cryptocurrency, its movements often set the tone for altcoin

trends. According to the CryptoQuant analyst, a strong Ethereum

rally supported by consistent net outflows can ignite an “altcoin

season,” where altcoins experience significant price gains

following Ethereum’s upward trajectory. Related Reading: Ethereum

Reaches $4,100 For The First Time In Over Three Years, Aiming For

$5,000 Next During such periods, investor sentiment shifts

positively across the broader crypto market, driving demand for

smaller-cap assets. cryptoavails concluded: Ethereum’s strong

performance is essential for the anticipated altcoin season. ETH’s

movements will significantly influence the future performance of

altcoins. Thus, Ethereum’s net flow data on spot exchanges is a

critical indicator that investors should closely monitor. Featured

image created with DALL-E, Chart from TradingView

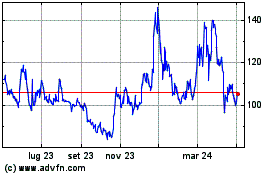

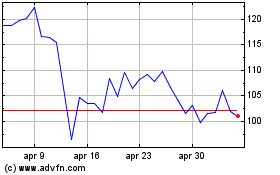

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2023 a Dic 2024