RETURN TO NORMALISED PROFIT LEVELS (EBIT/GP:

16.3%) Q2 BUSINESS VOLUMES AND EARNINGS UP SHARPLY VERSUS

Q1 HIGHLY ADVERSE BASIS FOR COMPARISON DUE TO STELLAR

PERFORMANCE IN 2022

Regulatory News:

Clasquin (Paris:ALCLA):

H1 2023

% GP

H1 2022

% GP

H1 2023/

H1 2022

Q2 2023/Q2 2022

Q1 2023/Q1 2022

CONSOLIDATED FINANCIAL

STATEMENTS*

Number of shipments

163,301

154,435

+5.7%

+6.8%

+4.6%

Sales (€m)**

284.3

463.1

-38.6%

-36.7%

-40.5%

Gross profit (€m)

67.4

100.0%

71.8

100.0%

-6.1%

+1.4%

-14.1%

EBITDA (€m)

16.3

24.2%

23.4

32.6%

-30.4%

Current operating income (€m)

11.0

16.3%

19.3

26.9%

-43.2%

Consolidated net profit (€m)

7.7

11.4%

14.4

20.0%

-46.7%

Net profit Group share (€m)

6.6

9.7%

12.9

17.9%

-49.1%

→ Q2 2023 EBITDA (excluding IFRS 16) (€9.0m) improved

significantly compared to Q1 2023 (€4.6m).

Q2 2023 EBITDA (excluding IFRS 16) down only 14.0% versus Q2

2022.

* Unaudited financial statements approved by the Board of

Directors on 12 September 2023

** Sales is not a relevant indicator of business in our sector,

as it is greatly impacted by changing air and sea freight rates,

fuel surcharges, exchange rates (particularly versus USD), etc.

Changes in the number of shipments, volumes shipped and, in

financial terms, gross profit are relevant indicators.

H1 2023 HIGHLIGHTS

- Integration of the Timar group following Clasquin’s

acquisition of 63.52% of the share capital on 28 March

2023.

- Reminder:

- Timar is a Moroccan group specialising in the design of

innovative solutions in the fields of international transport,

logistics and goods transit. The group is listed on the Casablanca

Stock Exchange.

- 14 companies, 18 offices in 9 countries in North Africa

(Morocco, Tunisia, Mauritania), West Africa (Senegal, Mali, Ivory

Coast) and Europe (France, Spain, Portugal).

- 2022 sales: €61m

- Headcount: 414 people (30/06/2023).

- Several projects have been launched and are proceeding

according to plan (cross-selling, financial reporting, IT security,

HR policies, etc.).

- Furthermore, the mandatory takeover bid launched on 9 June 2023

was completed on 28 June 2023. At 31 August 2023, the Group held

66.02% of Timar’s capital.

- Opening of a 3rd office in Germany, located in Hanover

(4 people), specialising in air freight.

- Ongoing deployment of our new collaborative digital platform

LIVE by CLASQUIN: Scope covered by LIVE at 30 June 2023: 55% of

Group gross profit together with growth in deployment of the most

advanced and integrated solutions, particularly EDI and Purchase

Order Management (22% of Group gross profit).

- Increase in employee shareholding, which represented

15.1% of the share capital at 30 June 2023, mainly due to extensive

inflows in 2023 into the FCPE employee investment fund, which now

holds 6.7% of the share capital, up 1.4 percentage points vs. 31

December 2022.

- Confirmation through the “Funometer”, the Group’s annual

employee survey, of the extremely high level of employee

commitment to the corporate mission: 95.2% feel good in their

position/function, up 3.3 percentage points vs. 2022.

H1 2023 EARNINGS

The number of shipments (excluding Timar) rose 5.7% in H1

2023, driven by the surge in the number of air shipments (up

20.5%), solid growth in the Road Brokerage business (up 5.6%)

and strong resilience in the sea freight business (down 1.5% amid a

sharp decline in volumes).

Gross profit fell 6.1% due to three factors:

- A significant decrease in unit margins (down 15.7% in

sea freight and down 29.2% in air freight) following the

normalisation of freight rates

Significantly offset by:

- The acquisitions of CVL (July 2022), Exaciel

(July 2022) and Timar (consolidated from 1 April 2023),

which accounted for 10.9% of H1 2023 gross

profit

- New client acquisitions, which accounted for 8.1%

of H1 2023 gross profit (excluding the Timar

acquisition).

EBITDA fell 30.4% to €16.2m but represents 2.5 times

pre-COVID EBITDA (2019).

External charges and payroll expenses excluding Timar were down

2.2%.

→ EBITDA excluding IFRS 16 (€13.6m) rose 109% between Q1 2023

(€4.6m) and Q2 2023 (€9.0m).

Current operating income (EBIT) fell 43.2% to

€11.0m (2.8 times pre-COVID EBIT) resulting in an EBIT/GP

ratio of over 16%, well above pre-COVID levels.

→ EBIT rose 124% between Q1 2023 (€3.4m) and Q2 2023

(€7.6m).

Net profit Group share amounted to €6.6m, down 49.1% (3.5

times pre-COVID), while the cost of debt and currency gains

remained stable between H1 2022 and H1 2023.

The contribution of the Timar group, consolidated from 1

April 2023 (one quarter) to the Group financial statements was as

follows: €5.8m gross profit, €2.1m EBITDA, €1.4m EBIT and €0.9m net

income.

FINANCIAL POSITION

30/06/2023 (6 months)

31/12/2022 (12 months)

30/06/2022 (6 months)

Gross operating cash flow (€m)

15.3

41.1

23.2

% of gross profit

22.7%

29.3%

32.2%

Working capital (€m)

4.8

2.7

30.4

Shareholders’ equity (€m)

56.0

59.9

48.7

Net debt (€m)

18.9

(0.7)

35.5

Leverage (net debt/EBITDA)*

0.6

0.0

0.8

Shareholders’ equity (excl. IFRS 16)

(€m)

56.7

60.6

49.2

Net debt (excl. IFRS 16) (€m)

(3.0)

(20.8)

15.5

Leverage (excl. IFRS 16)*

(0.1)

(0.6)

0.4

* H1 EBITDA doubled.

The Group’s financial position remains very healthy

thanks to the level of working capital, persistently very low, and

gross operating cash flow representing 22.7% of gross profit.

Net cash (excluding IFRS 16) of €3.0m (negative net debt)

enabled the Group to continue to post a negative leverage ratio

(-0.1) and confirms the Group’s ability to finance its

development strategy through both organic growth and

acquisitions.

2023 OUTLOOK

2023 MARKET

- International trade by volume: up 1.0% (source: WTO)

- Air freight by volume: down 4.3% (source: IATA)

- Sea freight by volume: down 2.5-5%

CLASQUIN 2023

Business (volumes): outperform market growth Unit margins:

return to normalised margins

UPCOMING EVENTS

(publication after market closure)

Q3 2023 business report

CLASQUIN is an air and sea freight forwarding

and overseas logistics specialist. The Group designs and manages

the entire overseas transport and logistics chain, organising and

coordinating the flow of client shipments between France and the

rest of the world and, more specifically, to and from Asia-Pacific,

North America, North Africa and sub-Saharan Africa.

Its shares are listed on EURONEXT GROWTH, ISIN

FR0004152882, Reuters ALCLA.PA, Bloomberg ALCLA FP. Read more at

www.clasquin.com.

CLASQUIN confirms for FY 2023 the eligibility

of its share for the PEA-PME share savings plan (Article L.

221-32-2 of the French Monetary and Financial Code).

LEI: 9695004FF6FA43KC4764

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230913862012/en/

CLASQUIN Philippe LONS – Deputy Managing Director/Group

CFO Domitille CHATELAIN – Group Head of Communication &

Marketing CLASQUIN Group – 235 cours Lafayette – 69006 Lyon Tel.:

+33 (0)4 72 83 17 00

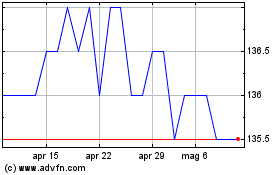

Grafico Azioni Clasquin (EU:ALCLA)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Clasquin (EU:ALCLA)

Storico

Da Mag 2023 a Mag 2024