0001173313

false

0001173313

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): August

14, 2023

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth

company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreements

On August 14, 2023, ABVC BioPharma,

Inc., a Nevada corporation, (the “Company”) entered into a cooperation agreement (the “Agreement”,

the transaction contemplated therein the “Transaction”) with Zhonghui United Technology (Chengdu) Group Co., Ltd. (“中汇联和科技(成都)集团有限公司”),

a Company established under the Law of People’s Republic of China (“Zhonghui”). Pursuant to the Agreement, the

Company agreed to acquire 20% of the ownership of a property and the parcel of the land (the “Property”) owned by Zhonghui

in Leshan, Sichuan, China. The valuation of the Property as of April 18, 2023, which was assessed by an independent third party, is estimated

to be approximately CNY 264,299,400 or approximately US$37,000,000. In exchange, the Company agreed to issue to Zhonghui, an aggregate

of 370,000 shares (the “Shares”) of common stock of the Company, par value $0.001 per share, at a per share price

of $20.0. The Company and Zhonghui plan to jointly develop the Property into a healthcare center for senior living, long-term care, and

medical care in the areas of ABVCs' special interests, such as Ophthalmology, Oncology, and Central Nervous Systems, which can be established

as a base for the China market and global development.

Zhonghui

agreed that the Shares will be subject to a lock-up period of one year following the closing date of this Transaction. In addition, parties

agreed that, after one year following the closing of the Transaction, the market value of the Shares or the value of the Property increase

or decrease, the parties will negotiate in good faith to make reasonable adjustment. For example, if the market value of the Shares is

less than the value of the Property, the Company will issue more shares to Zhonghui, provided that, the Zhonghui’s ownership of

the Company’s shares shall not exceed 19.99% of the then issued and outstanding shares; in return, if the value of the Property

becomes less than the market value of the Shares, Zhonghui shall transfer additional ownership of the Property to the Company.

On August 17, 2023, the Company issued a press release announcing the

entry into the Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing summary of the terms

of the Agreement is subject to, and qualified in its entirety by, the complete Term Sheet, which is attached as an exhibit to this filing

and incorporated herein by reference.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities and

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| August 17, 2023 |

By: |

/s/ Uttam

Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

COOPERATION

AGREEMENT

This COOPERATION AGREEMENT (“Agreement”,

the transaction contemplated herein the “Transaction”) is entered into as of

August 14, 2023, by and between ABVC BioPharma, Inc. (“ABVC”), and Zhonghui

United Technology (Chengdu) Group Co., Ltd. (“中汇联和科技(成都)集团有限公司”)

and its affiliated enterprises (hereinafter referred to as “ZHONGHUI”).

ABVC and ZHONGHUI are

sometimes referred to herein individually as a “Party,” and

collectively as the “Parties.”

Due to the mutual interests and benefits of both parties to strategically

cooperate and construct an integrated platform for global development of healthcare business and for the medical, pharmaceutical, biotechnology

and healthcare collaboration in China market, ABVC will acquire real estate through equity transfer for the development of a large-scale

health and wellness base.

Article 1: Subject Matter and Consideration

1.1 Subject Matter: The subject matter of this Agreement includes:

a) The common shares of ABVC (stock symbol: ABVC) on the Nasdaq Capital

Market, with a price of twenty US dollars per share.

b) ZHONGHUI’s ownership of a property located at No. 157 Huaxing Road,

Liuhe City, Jiajiang County (under construction) and a parcel of state-owned land in Xinhua Community, Third Residential Group, Liuhe

City, Jiajiang County, intended for town residential and other commercial service purposes (hereinafter referred to as The Property).

As of April 18, 2023, the valuation of the Property is CNY

264,299,400 or approximately US$37,000,000 (see Exhibit A).

1.2 Consideration: The consideration for ZHONGHUI shall be as follows:

a) ABVC shall transfer 370,000 shares of common stock of ABVC (the

“Shares”) to ZHONGHUI at a price of twenty dollars per share.

b) ZHONGHUI shall transfer 20% ownership of the Property to ABVC.

1.3 Transfer of Ownership: Upon completion of the transaction, ownership

of the shares shall be transferred from ABVC to ZHONGHUI, and ownership of the Property shall be transferred from ZHONGHUI to ABVC.

Article 2: Exchange of The Property through ABVC Equity Transfer

2.1 Agreement to Exchange Property: ABVC and ZHONGHUI agree to exchange

a 20% ownership stake in ZHONGHUI ‘s property through an equity transfer of ABVC shares.

2.2 Consideration The consideration shall be US$7,400,000, equivalent

to the Shares at twenty US dollars per share. ZHONGHUI agrees the Shares shall be restricted shares and the issuance of such is exempt

from registration in reliance on Regulation S promulgated under the 1933 Securities Act, as amended. In addition, Zhonghui agrees that

the Share Consideration will be locked up for one year (the “Lock-up Period”) and during the Lock-up Period the proxy

voting right of all the Shares will be delegated to the Chairman of ABVC.

2.3 Transfer Process: The transfer of Shares from ABVC to ZHONGHUI

shall be executed in accordance with the applicable laws, regulations, and procedures governing equity transfers.

2.4 Transfer of Ownership: Upon completion of the share transfer, a

20% ownership in the Property shall be transferred from ZHONGHUI to ABVC.

2.5 Representation regarding the Valuation: Both parties acknowledge

and agree that the value of the Transaction is based on the estimated value of the Property and the market value of ABVC shares at the

time of the equity transfer.

2.6 Valuation Dispute: In the event of any dispute regarding the valuation

or other matters related to the Transaction, the parties shall make good faith efforts to resolve the dispute through negotiation and

mediation.

2.7 Taxes and Fees: Any taxes, fees, or other charges arising from

the equity transfer and exchange shall be the responsibility of the respective parties as determined by applicable laws and regulations.

Article 3: Capital Protection Agreement

3.1 Agreement on Value Maintenance: One year after the execution of

this Agreement, both parties will make efforts to ensure that the value of The Property and the value of the Shares shall be maintained

at the same or higher value as at the closing day of this Agreement.

3.2 Adjustment Mechanism: In the event that either the value of the

Property or the Shares changes on the day of the one-year anniversary of the closing date of this Agreement, both parties agree to engage

in reasonable adjustments to address the disparity.

3.3 Adjustment Process: The process for making adjustments shall be

determined through mutual agreement and in accordance with the applicable laws and regulations. The parties shall engage in good faith

negotiations to reach a mutually acceptable solution. In case, the value of the Share Consideration is below US$7,400,000, more stock

shall be issued. In case the value of The Property is below US$7,400,000, a greater ownership interest in the property shall be transfer

to ABVC; provided, however, that ZHONGHUI’s ownership shall be capped at 19.99% of then issued and outstanding shares of ABVC common

stock.

3.4 Valuation Assessment: In the event of a dispute regarding the valuation

or value maintenance, the parties may engage an independent third-party expert or appraiser to assess the value and provide recommendations

for adjustment, the assessment fees will be shared equally between both parties.

3.5 Amendments to the Agreement: Any amendments or modifications to

this Agreement necessitated by the value adjustment shall be made in writing and signed by both parties.

3.6 Force Majeure: The provisions of this Agreement shall not apply

in cases of force majeure events that are beyond the reasonable control of either party and that significantly impact the value of The

Property or stocks.

3.7 Governing Law and Jurisdiction: This Agreement shall be governed

by and construed in accordance with the laws of the jurisdiction in the State of New York. Any disputes arising from or in connection

with this Agreement shall be subject to the exclusive jurisdiction of the courts in that jurisdiction.

Article 4: Mutual Goals

4.1 Development of a Large Health and Wellness Base: Both ABVC and

ZHONGHUI agree to collaborate on the development of a large-scale health and wellness base. The goal is to establish a comprehensive facility

that offers a wide range of health and wellness services to promote a healthy lifestyle and well-being. Specifically, a healthcare center

for senior living, long term care and medical care in the areas of ABVC’s special interests, such as Ophthalmology, Oncology and

Central Nervous Systems, will be established as the base for China market as well as global development.

4.2 Construction of an Integrated Platform for Industry-Academia-Research

Collaboration and Rural Revitalization: Both parties aim to build an integrated platform that facilitates collaboration between industry,

academia, and research. This platform seeks to contribute to rural revitalization by promoting innovation, knowledge exchange, and sustainable

development in rural areas.

Article 5: Termination, Replacement and Amendment

5.1 Both parties aim to complete the transfer of the Property by September

30th, 2023. If unable to do so, both parties shall negotiate and determine a subsequent transfer date.

5.2 If there are ownership restrictions, such as seizure or mortgage,

affecting The Property held by ZHONGHUI, preventing the transfer or transaction, ABVC agrees that ZHONGHUI can replace such assets with

other project assets that are legally valid, feasible for execution, tradable, and meet the requirements of ABVC. The specific details

of asset replacement shall be determined through further negotiation and documented in a supplementary agreement or attachment.

5.3 The Property for the final transaction can be adjusted based on

the legal due diligence of this transaction, considering The Property and equity situations of both parties, as well as the transaction

structure. Any adjustments will be documented through a supplementary agreement or attachment.

5.4 In case the due diligence results are inconsistent with the disclosures

or records in this agreement and its attachments, or if discrepancies are found with ABVC’s statements or warranties, or if undisclosed

debts, costs, expenses, expenditures, or other matters are discovered, or if there are legal/political defects in The Property that hinder

the transfer of rights, ABVC reserves the right to terminate this cooperation.

5.5 If, based on reasonable analysis and judgment through due diligence,

ABVC determines that the transaction’s objectives are difficult to achieve or pose significant obstacles to the transaction, ABVC reserves

the right to terminate this cooperation.

5.6 Composition: Supplementary agreements or appended documents related

to assets and equity transfer subsequently signed by both parties shall constitute valid integral parts of this Agreement. The rights

and obligations of both parties shall be subject to the terms and conditions stipulated in this agreement and in any supplementary agreements

or appended documents subsequently signed.

5.7 Amendment: The terms and conditions in this Agreement can be further

amended in writing upon the mutual agreement of both parties.

5.8 Termination: This Agreement shall become invalid or terminated

and shall no longer have any effect. However, the provisions of Sections 3.7, Sections 5, Sections 6, and Sections 7 shall remain in effect

after the termination or invalidation of this Agreement.

Article 6: Confidentiality

6.1 Duty of Care: Both parties agree to exercise due care in maintaining

the confidentiality of any relevant data or information. This duty of confidentiality shall not be affected by the termination or expiration

of this Agreement.

6.2 Non-Disclosure Obligation: Both parties shall keep all confidential

information received from the other party confidential and shall not disclose it to any third party without prior written consent, unless

required by law or authorized by the disclosing party.

6.3 Return or Destruction of Confidential Information: Upon the expiration,

termination, or at the request of either party, the receiving party shall promptly return to the disclosing party all confidential information

received, along with any copies or reproductions thereof. Alternatively, the receiving party shall follow the instructions of the disclosing

party regarding the destruction of such confidential information.

6.4 Survival of Confidentiality Obligations: The obligations of confidentiality

and non-disclosure shall survive the expiration or termination of this Agreement and shall continue to be binding on both parties.

6.5 Exceptions: The obligations of confidentiality shall not apply

to information that: (a) was already known to the receiving party prior to its disclosure by the disclosing party; (b) is or becomes publicly

available without breach of this Agreement; (c) is received from a third party without breach of any confidentiality obligation; or (d)

is independently developed by the receiving party without reference to the disclosing party’s confidential information.

Article 7: Copies of the Agreement

7.1 Two original copies of this Agreement have been prepared, with

each party holding one original copy.

7.2 After signing, each party shall retain the original copy held by

them as valid evidence between the parties.

7.3 Copies, reproductions, or electronic files of this Agreement shall

have the same legal effect and may be used for communication between the parties.

Article 8: Language.

The Agreement is in both English and Chinese, which both have binding

effects. If there is any conflict between the English and Chinese language, English language prevails.

Signature Page

Party A: ABVC BioPharma, Inc

Name: Uttam Yashwant Patil, Ph.D. Title: CEO

Address: 44370 Old Warm Springs Blvd.– Fremont, California 94538 USA

Party B: 中

汇 联 和 科 技 ( 成 都 )

集 團 有 限 公 司

Name:孙

文 成

Title: CHAIRMAN

Addess:中国(四川)成都青羊区順城大街249号西星大厦7楼

Exhibit A

10

Exhibit 99.1

ABVC Executes Cooperation Agreement

for Strategic Investments

Fremont, CA, August 17, 2023 – ABVC

BioPharma, Inc. (NASDAQ: ABVC) ("Company"), a clinical-stage biopharmaceutical company developing therapeutic solutions in Oncology/Hematology,

Neurology, and Ophthalmology, announced today that it had entered into a Cooperation Agreement

to exchange a 20% ownership stake in real estate property of Zhonghui United Technology (Chengdu) Group Co., Ltd. (“中汇联和科技(成都)集团有限公司”)

and its affiliated enterprises (“Zhonghui”).

Under the terms

of the Cooperation Agreement, the estimated value of the transaction is approximately $7.4 million, equivalent to 370,000 shares of ABVC

common stock at $20 per share.

"We are extremely proud to have executed

the Cooperation Agreement with Zhonghui; this transaction builds on ABVC's commitment to grow its biopharma industry and to provide best-in-class

innovations in research, development, and manufacturing of pharmaceuticals, biotechnology-based food and medicines, medical devices, biomedical

technologies, and nutraceuticals," said Dr. Uttam Patil, Chief Executive Officer of ABVC. "As per the current Cooperation Agreement,

ABVC and Zhonghui agree to collaborate on developing a large-scale health and wellness base. The goal is to establish a comprehensive

facility that offers a wide range of health and wellness services to promote a healthy lifestyle and well-being. Specifically, a healthcare

center for senior living, long-term care, and medical care in the areas of ABVCs' special interests, such as Ophthalmology, Oncology,

and Central Nervous Systems, is planned to be established as the base for the China market and global development. Both parties aim to

build an integrated industry, academia, and research collaboration platform. This platform will also seek to contribute to rural revitalization

by promoting innovation, knowledge exchange, and sustainable development in rural areas. Our strong partnership with leading institutions

and expertise in Oncology/Hematology, Neurology, and Ophthalmology will aid us in global expansion."

About ABVC

BioPharma

ABVC BioPharma

is a clinical-stage biopharmaceutical company with an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under

development. For its drug products, the Company utilizes in-licensed technology from its network of world-renowned research institutions

to conduct proof-of-concept trials through Phase II of clinical development. The Company's network of research institutions includes

Stanford University, the University of California at San Francisco, and Cedars-Sinai Medical Center. For Vitargus®, the Company intends

to conduct global clinical trials through Phase III.

Forward-Looking Statements

This press release contains "forward-looking

statements." The words may precede such statements "intends," "may," "will," "plans," "expects,"

"anticipates," "projects," "predicts," "estimates," "aims," "believes," "hopes,"

"potential," or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions,

and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company's control, and cannot be predicted

or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

None of the outcomes expressed herein are guaranteed. Such risks and uncertainties include, without limitation, risks and uncertainties

associated with (i) our inability to manufacture our product candidates on a commercial scale on our own, or in collaboration with third

parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size and nature of our competition;

(iv) loss of one or more key executives or scientists; and (v) difficulties in securing regulatory approval to proceed to the next level

of the clinical trials or to market our product candidates. More detailed information about the Company and the risk factors that may

affect the realization of forward-looking statements is set forth in the Company's filings with the Securities and Exchange Commission

(SEC), including the Company's Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors are urged to read these documents

free of charge on the SEC's website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise

its forward-looking statements as a result of new information, future events or otherwise.

Contact:

Tom Masterson

Email: tmasterson@allelecomms.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

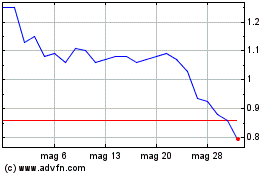

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Apr 2024 a Mag 2024

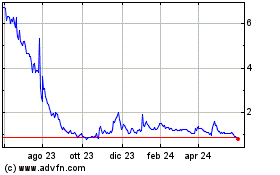

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Mag 2023 a Mag 2024