0001173313

false

0001173313

2023-09-13

2023-09-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 13, 2023

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreements

As previously announced,

on February 24, 2023, ABVC BioPharma, Inc., a Nevada corporation (the “Company”), entered into a Securities Purchase Agreement

(the “Purchase Agreement”) with Lind Global Fund II LP, a Delaware limited partnership (the “Investor”), pursuant

to which the Company issued to the Investor a secured, convertible note in the principal amount

of $3,704,167 (the “Offering”), for a purchase price of $3,175,000 (the “Note”), that is convertible into shares

of the Company’s common stock at an initial conversion price of $1.05 per share, subject to adjustment (the “Note Shares”).

Lind also received a common stock purchase warrant (the “Warrant”) to purchase up to 5,291,667 shares of the Company’s

common stock at an initial exercise price of $1.05 per share, subject to adjustment (each, a “Warrant Share,” together with

the Note, Note Shares and Warrants, the “Securities”).

On September 12, 2023,

the Company and the Investor entered into a letter agreement (the “Letter Agreement”) pursuant to which the Investor agreed

to waive any default, any Event of Default, and any Mandatory Default Amount (each as defined in the Note) associated with the Company’s

market capitalization being below $12.5 million for 10 consecutive days through February 23, 2024. Notwithstanding the waiver, the Investor

retains its right to exercise conversion rights under 2.2(a), 2.2(c)(2)(x) and 3.1 of the Note, which

could result in a substantial amount of common stock issued at a significant discount to the trading price of the Company’s common

stock. In addition, if the Company is unable to increase its market capitalization and is unable to obtain a further waiver or amendment

to the Note, then the Company could experience an event of default under the Note, which could have a material adverse effect on the Company’s

liquidity, financial condition, and results of operations. The Company cannot make any assurances regarding the likelihood, certainty,

or exact timing of the Company’s ability to increase its market capitalization, as such metric is not within the immediate control

of the Company and depends on a variety of factors outside the Company’s control.

The foregoing descriptions

of the Letter Agreement are not complete and are qualified in their entirety by reference to the full text of the form of the Letter Agreement,

a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

| Exhibit No. |

|

Description |

| 10.1 |

|

Letter Agreement |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| September 13, 2023 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

This waiver letter agreement

(this “Waiver Letter”), to the senior convertible promissory note, dated as of February 23, 2023 (the “Note”),

by and between ABVC BioPharma, Inc., a Nevada corporation (the “Company”) and Lind Global Fund II LP, a Delaware limited partnership

(“Lind Global”), is made as of September 12, 2023. Unless otherwise indicated, capitalized terms shall have the meanings ascribed

to them in the Note.

WHEREAS, pursuant

to Section 2.1(r) of the Note, an Event of Default includes the Market Capitalization of the Company being below $12,500,000 for ten (10)

consecutive days (a “Market Capitalization Event of Default”).

NOW THEREFORE,

Lind Global hereby waives any Market Capitalization Event of Default, with such waiver continuing through February 23, 2024, but reserves

its right, notwithstanding such waiver, to exercise its rights under Section 2.2(a) and Section 2.2(c)(2)(x) of the Note; provided, that

such waiver shall automatically terminate and be of no force or effect upon the occurrence of any Event of Default other than a Market

Capitalization Event of Default.

The parties also agree that

the “Mandatory Default Amount” shall mean an amount equal to one hundred fifteen percent (115%) of the Outstanding

Principal Amount of the Note on the date on which the first Event of Default has occurred and any other amounts owing under the Note or

the other Transaction Documents. As of the date of this Waiver Letter, the Outstanding Principal Amount of the Note is $2,754,167; therefore,

the Mandatory Default Amount is $3,167,292.05.

Except as expressly set forth herein, this Waiver

Letter shall not by implication or otherwise limit, impair, constitute a waiver of, or otherwise affect the rights and remedies of Lind

Global under the Transaction Documents, and shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations,

covenants or agreements contained in the Transaction Documents, all of which shall otherwise continue in full force and effect.

This Waiver Letter may

be executed in one or more counterparts (by facsimile or otherwise), each of which shall be deemed an original and all of which taken

together shall constitute one and the same instrument. This letter agreement shall be governed by and construed in accordance with the

laws of the State of Nevada.

[signatures on next page]

IN WITNESS WHEREOF, the parties hereto have executed

this Agreement as of the date first above written.

| |

COMPANY: |

| |

ABVC BioPharma, Inc |

| |

|

| |

|

| |

Name: |

Uttam Patil |

| |

Title: |

Chief Executive Officer |

| Agreed to and accepted by |

|

| HOLDER: |

|

| Lind Global Fund II LP |

|

| |

|

| |

|

| Name: |

Jeff Easton |

|

| Title: |

Managing Member of Lind Global Partners II LLC, General Partner |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

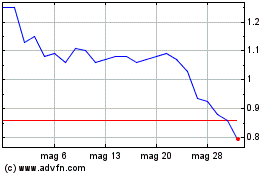

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Apr 2024 a Mag 2024

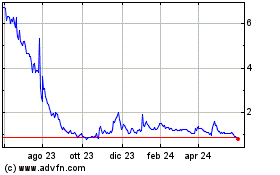

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Mag 2023 a Mag 2024