Mitek Systems, Inc. (NASDAQ: MITK, www.miteksystems.com, “Mitek”

or the “Company”), a global leader in digital identity and fraud

prevention, today reported financial results for its third quarter

ended June 30, 2024 and revised its previously provided guidance

for its 2024 fiscal year ending September 30, 2024.

Fiscal 2024 Third Quarter Financial Highlights

- Total revenue was $45.0 million, compared to $43.1

million a year ago, or 4% year-over-year growth.

- GAAP operating income was $0.7 million, an operating

margin of 2%, compared to GAAP operating income of $1.8 million, an

operating margin of 4% a year ago.

- GAAP net income was $0.2 million, or $0.00 per diluted

share, compared to GAAP net loss of $0.4 million, or $0.01 per

diluted share a year ago.

- Non-GAAP operating income was $11.6 million and non-GAAP

operating margin was 26%, compared to non-GAAP operating income of

$12.0 million and a non-GAAP operating margin of 28% a year

ago.

- Non-GAAP net income increased 27% to $12.0 million, or

$0.25 per diluted share, compared to $9.5 million, or $0.20 per

diluted share a year ago.

- Cash flow from operations was $13.0 million, compared to

$16.6 million a year ago.

- Total cash and investments was $133.2 million at June

30, 2024, an increase of $2.9 million from $130.3 million at March

31, 2024.

- Mitek repurchased 819,623 shares at an average per share price

of $12.25, totaling approximately $10.0 million.

Mitek Executive Chairman and Interim CEO Scott Carter’s

Comments

“While we grew total revenue 4% year over year with Deposits

leading the way, I am disappointed in our fiscal Q3 Identity

product revenue and revenue outlook for fiscal year 2024. Although

we had challenges in Identity, which we are addressing, I remain

confident that our superior technology, strategic investments and

upcoming product launches position us well to drive growth and

deliver long-term shareholder value.”

Fiscal 2024 Full Year Guidance

Mitek is revising its previously provided guidance for its

fiscal year ending September 30, 2024, as follows:

- Mitek now expects full-year revenue to be between $169 million

and $173 million, a decrease of 1% at the midpoint of the range

when compared to last year’s revenue. In fiscal 2023, Mitek signed

a large multi-year mobile deposit reorder with one customer that

locked in favorable pricing over a four-year period. Due to the

unique terms of this contract, Mitek recognized additional license

revenue relating to future years of approximately $7 million in

fiscal 2023. If the Company backs out the future year revenue of

approximately $7 million from its fiscal 2023 revenue and

attributes the approximately $2.7 million that would have been

attributable to fiscal 2024 to the midpoint of the fiscal 2024

revenue guidance, the Company estimates that it would represent

growth of approximately 5% at the midpoint.

- Mitek now expects its Non-GAAP operating margin for fiscal 2024

to be between 23% and 25%. If the Company adjusts for the impact of

the $7 million revenue item as described above, the Company

estimates that it would represent a Non-GAAP operating margin of

approximately 25% at the midpoint.

Conference Call Information

Mitek management will host a conference call and live webcast

for analysts and investors today at 2:00 p.m. Pacific Time (5:00

p.m. Eastern Time) to discuss the Company’s financial results for

its fiscal 2024 third quarter ended June 30, 2024. To access the

live call, dial 888-999-5318 (US and Canada) or +1 848-280-6460

(International) and ask to join the Mitek call. A live and archived

conference call webcast will also be accessible on the Investor

Relations section of the Company’s website at www.miteksystems.com.

A phone replay will be available approximately two hours after the

end of the call and will remain available for one week. The phone

call replay can be accessed by dialing 877-481-4010 (US or Canada)

or +1-919-882-2331 (International) and entering the passcode

50966.

About Mitek Systems, Inc.

Mitek (NASDAQ: MITK) is a global leader in digital access,

founded to bridge the physical and digital worlds. Mitek’s advanced

identity verification technologies and global platform make digital

access faster and more secure than ever, providing companies new

levels of control, deployment ease and operation, while protecting

the entire customer journey. Trusted by 99% of U.S. banks for

mobile check deposits and 7,900 of the world’s largest

organizations, Mitek helps companies reduce risk and meet

regulatory requirements. Learn more at www.miteksystems.com.

[(MITK-F)]

Follow Mitek on LinkedIn and YouTube, and read Mitek’s latest

blog posts here.

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the

Company or its management’s intentions, hopes, beliefs,

expectations or predictions of the future, including, but not

limited to, statements relating to the Company’s fiscal 2024

guidance, the Company’s ability to address its challenges in

Identity and the Company’s superior technology, strategic

investments and upcoming product launches positioning the Company

well to drive growth and deliver long-term shareholder value, are

forward-looking statements. Such forward-looking statements are

subject to a number of risks and uncertainties, including, but not

limited to, risks related to the Company’s ability to withstand

negative conditions in the global economy, a lack of demand for or

market acceptance of the Company’s products, the impact of the

Company’s acquisition of HooYu Ltd. including any operational or

cultural difficulties associated with the integration of the

businesses of Mitek and HooYu Ltd., the Company’s ability to

continue to develop, produce and introduce innovative new products

in a timely manner, the Company’s ability to capitalize on a

growing market, quarterly variations in revenue, the profitability

of certain sectors of the Company, the performance of the Company’s

growth initiatives, the outcome of any pending or threatened

litigation, and the timing of the implementation and launch of the

Company’s products by the Company’s signed customers.

Additional risks and uncertainties faced by the Company are

contained from time to time in the Company’s filings with the U.S.

Securities and Exchange Commission (SEC), including, but not

limited to, the Company’s Annual Report on Form 10-K for the fiscal

year ended September 30, 2023, as filed with the SEC on March 19,

2024 and its quarterly reports on Form 10-Q and current reports on

Form 8-K, which you may obtain for free on the SEC’s website at

www.sec.gov. Collectively, these risks and uncertainties could

cause the Company’s actual results to differ materially from those

projected in its forward-looking statements and you are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. The Company disclaims any

intention or obligation to update, amend or clarify these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Note Regarding Use of Non-GAAP Financial Measures

This news release contains non-U.S. generally accepted

accounting principles (“GAAP”) financial measures for non-GAAP net

income, non-GAAP net income per share, non-GAAP operating income,

and non-GAAP operating expense that exclude acquisition-related

costs and expenses, litigation and other legal costs, executive

transition costs, stock compensation expense, non-recurring audit

fees, enterprise risk, portfolio positioning and other related

costs, restructuring costs and amortization of debt discount and

issuance costs. These financial measures are not calculated in

accordance with GAAP and are not based on any comprehensive set of

accounting rules or principles. In evaluating the Company’s

performance, management uses certain non-GAAP financial measures to

supplement financial statements prepared under GAAP. Management

believes these non-GAAP financial measures provide a useful measure

of the Company’s operating results, a meaningful comparison with

historical results and with the results of other companies, and

insight into the Company’s ongoing operating performance. Further,

management and the Board of Directors of the Company utilize these

non-GAAP financial measures to gain a better understanding of the

Company’s comparative operating performance from period-to-period

and as a basis for planning and forecasting future periods.

Management believes these non-GAAP financial measures, when read in

conjunction with the Company’s GAAP financial statements, are

useful to investors because they provide a basis for meaningful

period-to-period comparisons of the Company’s ongoing operating

results, including results of operations against investor and

analyst financial models, which helps identify trends in the

Company’s underlying business and provides a better understanding

of how management plans and measures the Company’s underlying

business.

The Company has not provided a reconciliation of its forward

outlook for non-GAAP operating margin with its forward-looking GAAP

operating margin in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company

is unable, without unreasonable efforts, to quantify share-based

compensation expense, which is excluded from our non-GAAP operating

margin, as it requires additional inputs such as the number of

shares granted and market prices that are not ascertainable due to

the volatility of the Company’s share price. Additionally, a

significant portion of the Company’s operations are in foreign

countries and the transactional currencies are primarily Euros and

British pound sterling and the Company is not able to predict

fluctuations in those currencies without unreasonable efforts.

MITEK SYSTEMS, INC.

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(amounts in thousands except

share data)

June 30, 2024

September 30, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

84,351

$

58,913

Short-term investments

38,718

74,700

Accounts receivable, net

41,609

32,132

Contract assets, current portion

16,805

18,355

Prepaid expenses

11,520

3,513

Other current assets

2,681

2,396

Total current assets

195,684

190,009

Long-term investments

10,157

1,304

Property and equipment, net

2,597

2,829

Right-of-use assets

2,848

4,140

Goodwill and intangible assets

181,434

188,222

Deferred income tax assets

13,268

11,645

Contract assets, non-current portion

1,793

5,579

Other non-current assets

1,446

1,647

Total assets

$

409,227

$

405,375

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

6,275

$

7,589

Accrued payroll and related taxes

10,889

10,554

Accrued interest payable

500

305

Income tax payables

132

4,329

Deferred revenue, current portion

23,746

17,360

Lease liabilities, current portion

747

1,902

Acquisition-related contingent

consideration

—

7,976

Restructuring accrual

42

—

Other current liabilities

1,577

1,482

Total current liabilities

43,908

51,497

Convertible senior notes

141,531

135,516

Deferred revenue, non-current portion

1,257

957

Lease liabilities, non-current portion

2,409

2,867

Deferred income tax liabilities

6,696

6,476

Other non-current liabilities

3,790

2,874

Total liabilities

199,591

200,187

Stockholders’ equity:

Preferred stock, $0.001 par value,

1,000,000 shares authorized, none issued and outstanding

—

—

Common stock, $0.001 par value,

120,000,000 shares authorized, 46,148,999 and 45,591,199 issued and

outstanding, as of June 30, 2024 and September 30, 2023,

respectively

46

46

Additional paid-in capital

244,110

228,691

Accumulated other comprehensive loss

(9,874

)

(14,237

)

Accumulated deficit

(24,646

)

(9,312

)

Total stockholders’ equity

209,636

205,188

Total liabilities and stockholders’

equity

$

409,227

$

405,375

MITEK SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(amounts in thousands except

per share data)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Revenue

Software and hardware

$

22,662

$

21,447

$

63,531

$

73,083

Services and other

22,314

21,623

65,330

61,813

Total revenue

44,976

43,070

128,861

134,896

Operating costs and expenses

Cost of revenue—software and hardware

(exclusive of depreciation & amortization)

54

428

123

816

Cost of revenue—services and other

(exclusive of depreciation & amortization)

6,428

5,284

18,108

15,863

Selling and marketing

10,354

10,296

31,231

29,434

Research and development

9,982

7,461

28,569

22,504

General and administrative

12,604

11,588

43,085

30,126

Amortization and acquisition-related

costs

3,750

6,207

11,581

15,302

Restructuring costs

1,070

14

1,648

2,000

Total operating costs and expenses

44,242

41,278

134,345

116,045

Operating income (loss)

734

1,792

(5,484

)

18,851

Interest expense

2,329

2,362

6,895

6,662

Other income (expense), net

1,436

925

4,268

1,719

Income (loss) before income taxes

(159

)

355

(8,111

)

13,908

Income tax benefit (provision)

375

(783

)

2,816

(4,437

)

Net income (loss)

$

216

$

(428

)

$

(5,295

)

$

9,471

Net income (loss) per share—basic

$

0.00

$

(0.01

)

$

(0.11

)

$

0.21

Net income (loss) per share—diluted

$

0.00

$

(0.01

)

$

(0.11

)

$

0.20

Shares used in calculating net income

(loss) per share—basic

47,017

46,002

46,764

45,625

Shares used in calculating net income

(loss) per share—diluted

48,307

46,473

47,792

46,210

MITEK SYSTEMS, INC.

STOCK-BASED COMPENSATION

EXPENSE

(Unaudited)

(amounts in thousands)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Cost of revenue

$

194

$

124

$

447

$

316

Selling and marketing

818

885

2,579

2,423

Research and development

1,344

644

3,751

2,097

General and administrative

1,229

991

4,124

2,954

Total stock-based compensation expense

$

3,585

$

2,644

$

10,901

$

7,790

MITEK SYSTEMS, INC.

DISAGGREGATION OF

REVENUE

(Unaudited)

(amounts in thousands)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

% of Total

2023

% of Total

2024

% of Total

2023

% of Total

Major product category

Deposits software and hardware

$

21,793

74

%

$

18,300

74

%

$

58,335

73

%

$

64,979

77

%

Deposits services and other

7,493

26

%

6,504

26

%

21,539

27

%

18,866

23

%

Deposits revenue

29,286

24,804

79,874

83,845

Identity verification software and

hardware

869

6

%

3,147

17

%

5,196

11

%

8,104

16

%

Identity verification services and

other

14,821

94

%

15,119

83

%

43,791

89

%

42,947

84

%

Identity verification revenue

15,690

18,266

48,987

51,051

Total revenue

$

44,976

$

43,070

$

128,861

$

134,896

MITEK SYSTEMS, INC.

NON-GAAP NET INCOME

RECONCILIATION

(Unaudited)

(amounts in thousands except

per share data)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Net income (loss)

$

216

$

(428

)

$

(5,295

)

$

9,471

Non-GAAP adjustments:

Acquisition-related costs and

expenses(1)

3,749

6,207

11,581

15,302

Litigation and other legal costs(2)

157

393

3,244

1,119

Executive transition costs

1,265

91

2,033

672

Stock-based compensation expense

3,585

2,644

10,901

7,790

Non-recurring audit fees

1,014

812

5,025

2,185

Enterprise risk, portfolio positioning and

other related costs(3)

—

—

996

—

Restructuring costs(4)

1,070

14

1,648

2,000

Amortization of debt discount and issuance

costs

2,081

1,909

6,057

5,609

Income tax effect of pre-tax

adjustments

(1,880

)

(3,415

)

(9,274

)

(9,113

)

Cash tax difference(5)

740

1,243

2,939

2,410

Non-GAAP net income

$

11,997

$

9,470

$

29,855

$

37,445

Non-GAAP income per share—basic

$

0.26

$

0.21

$

0.64

$

0.82

Non-GAAP income per share—diluted

$

0.25

$

0.20

$

0.62

$

0.81

Shares used in calculating non-GAAP net

income per share—basic

47,017

46,002

46,764

45,625

Shares used in calculating non-GAAP net

income per share—diluted

48,307

46,473

47,792

46,210

(1)

Amortization of intangible assets

recognized primarily from the ID R&D and HooYu acquisitions and

the change in fair value of acquisition-related contingent

consideration.

(2)

During the three and nine month periods

ended December 31, 2023 and June 30, 2024, our legal team used

third party legal experts to perform and provide advice regarding a

variety of activities including intellectual property litigation

matters and risk analysis and in providing support for customers in

their litigation, matters and options related to getting our SEC

filings current, the process for a potential delisting from the

Nasdaq Capital Market, ongoing litigation support, and various

other projects.

(3)

During the nine months ended June 30,

2024, we used three third party experts to evaluate our product

portfolio positioning, competitive landscape, enterprise risk and

other related analyses.

(4)

Restructuring costs consist of employee

severance obligations and other related costs. Restructuring costs

were $1.6 million in the nine months ended June 30, 2024 and were

related to expenses incurred to relocate employees and a

restructuring that occurred in the third quarter of fiscal 2024.

Restructuring costs were $2.0 million in the nine months ended June

30, 2023 and were related to a restructuring plan that was

initially implemented in June and November 2022.

(5)

The Company’s non-GAAP net income is

calculated using a cash tax rate of 13% in fiscal 2024 and 23% in

fiscal 2023. The estimated cash tax rate is the estimated annual

tax payable on the Company’s tax returns as a percentage of

estimated annual non-GAAP pre-tax net income. The Company uses an

estimated cash tax rate to adjust for the historical variation in

the effective book tax rate associated with the reversal of

valuation allowances, and the utilization of research and

development tax credits which currently have an overall effect of

reducing taxes payable. The Company believes that the cash tax rate

provides a more transparent view of the Company’s operating

results. The Company’s effective tax rate used for the purposes of

calculating GAAP net income for fiscal 2024 and 2023 was 35% and

32%, respectively.

MITEK SYSTEMS, INC.

NON-GAAP OPERATING INCOME

RECONCILIATION

(Unaudited)

(amounts in thousands)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

GAAP operating income

$

734

$

1,792

$

(5,484

)

$

18,851

Non-GAAP adjustments:

Acquisition-related costs and expenses

3,749

6,207

11,581

15,302

Litigation and other legal costs

157

393

3,244

1,119

Executive transition costs

1,265

91

2,033

672

Stock-based compensation expense

3,585

2,644

10,901

7,790

Non-recurring audit fees

1,014

812

5,025

2,185

Enterprise risk, portfolio positioning and

other related costs

—

—

996

—

Restructuring costs

1,070

14

1,648

2,000

Non-GAAP operating income

$

11,574

$

11,953

$

29,944

$

47,919

Total Revenue

$

44,976

$

43,070

$

128,861

$

134,896

Non-GAAP operating margin

26

%

28

%

23

%

36

%

MITEK SYSTEMS, INC.

SUPPLEMENTAL RECONCILIATIONS

OF GAAP ACTUALS TO NON-GAAP ACTUALS

(Unaudited)

(amounts in thousands)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Selling and marketing

$

10,354

$

10,296

$

31,231

$

29,434

Non-GAAP adjustments:

Stock-based compensation expense

818

885

2,579

2,423

Non-GAAP Selling and marketing

$

9,536

$

9,411

$

28,652

$

27,011

Research and development

$

9,982

$

7,461

$

28,569

$

22,504

Non-GAAP adjustments:

Stock-based compensation expense

1,344

644

3,751

2,097

Non-GAAP Research and development

$

8,638

$

6,817

$

24,818

$

20,407

General and administrative

$

12,604

$

11,588

$

43,085

$

30,126

Non-GAAP adjustments:

Stock-based compensation expense

1,229

991

4,124

2,954

Litigation and other legal costs

157

393

3,244

1,119

Executive transition costs

1,265

91

2,033

672

Non-recurring audit fees

1,014

812

5,025

2,185

Enterprise risk, portfolio positioning and

other related costs

—

—

996

—

Non-GAAP General and administrative

$

8,939

$

9,301

$

27,663

$

23,196

Total Non-GAAP Operating Expense

$

27,113

$

25,529

$

81,133

$

70,614

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808303098/en/

Investor Contact: Todd Kehrli or Jim Byers MKR Investor

Relations, Inc. mitk@mkr-group.com

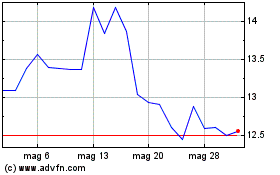

Grafico Azioni Mitek Systems (NASDAQ:MITK)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Mitek Systems (NASDAQ:MITK)

Storico

Da Feb 2024 a Feb 2025