UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

RULE 13e-3 TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934

Martin

Midstream Partners L.P.

(Name of the Issuer)

MARTIN

MIDSTREAM PARTNERS L.P.

MARTIN RESOURCE MANAGEMENT CORPORATION

MMGP HOLDINGS LLC

MARTIN

MIDSTREAM GP LLC

MRMC MERGER SUB LLC

MARTIN RESOURCE LLC

CROSS OIL REFINING & MARKETING, INC.

MARTIN PRODUCT SALES LLC

SENTERFITT HOLDINGS INC.

RUBEN S. MARTIN, III

ROBERT D. BONDURANT

(Name

of Persons Filing Statement)

COMMON UNITS

REPRESENTING LIMITED PARTNER INTERESTS

(Title of Class of Securities)

573331105

(CUSIP Number

of Class of Securities)

|

|

|

| Robert D. Bondurant

Martin Midstream Partners L.P.

4200 B Stone Road

Kilgore, TX 75662

Telephone: (903) 938-6200 |

|

Sharon L. Taylor

Martin Resource Management Corporation

MRMC Merger Sub LLC 4200

B Stone Road Kilgore, TX 75662

Telephone: (903) 938-6200 |

(Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of

the Persons Filing Statement)

With copies to:

M. Preston Bernhisel

Baker Botts L.L.P.

2001

Ross Street, Suite 900

Dallas, Texas 75201

Telephone: (214) 953-6500

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

| a. |

|

☒ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A (§§ 240.14a-1 through 240.14b-2), Regulation

14C (§§ 240.14c-1 through 240.14c-101) or Rule 13e-3(c)

(§ 240.13e-3(c)) under the Securities Exchange Act of 1934 (“the Act”). |

|

|

|

| b. |

|

☐ |

|

The filing of a registration statement under the Securities Act of 1933. |

|

|

|

| c. |

|

☐ |

|

A tender offer. |

|

|

|

| d. |

|

☐ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are

preliminary copies: ☒

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule 13E-3,

together with the exhibits hereto (this “Transaction Statement”), is being filed with the Securities and Exchange Commission (the “SEC”) by (i) Martin Midstream Partners L.P., a Delaware limited partnership (the

“Partnership”), (ii) Martin Resource Management Corporation, a Texas corporation (“Parent”), (iii) MMGP Holdings LLC, a Delaware limited liability company (“Holdings”), (iv) Martin Midstream GP LLC, a Delaware limited

liability company (the “General Partner”), (v) MRMC Merger Sub LLC, a Delaware limited liability company (“Merger Sub”), (vi) Martin Resource LLC, a Delaware limited liability company (“Resource”), (vii) Cross Oil

Refining & Marketing, Inc., a Delaware corporation (“Cross”), (viii) Martin Product Sales LLC, a Texas limited liability company (“Martin Product”), (ix) Senterfitt Holdings Inc., a Texas corporation

(“Senterfitt”), (x) Ruben S. Martin, III and (xi) Robert D. Bondurant. Collectively, the persons filing this Transaction Statement are referred to as the “filing persons” and the filing persons other than the Parent are

referred to as the “Buyer Filing Parties.”

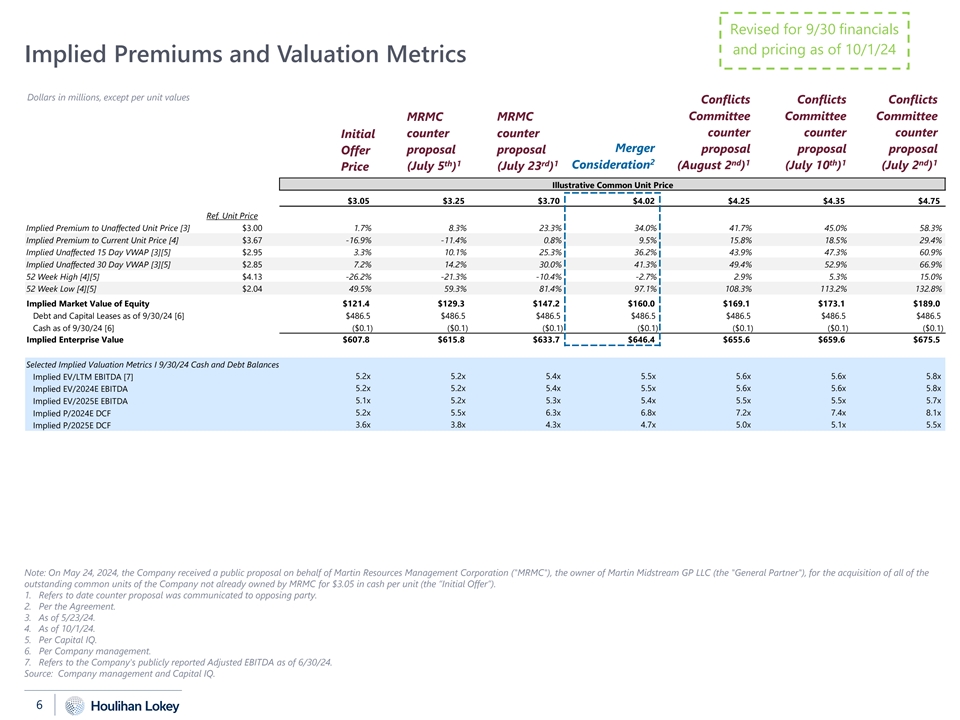

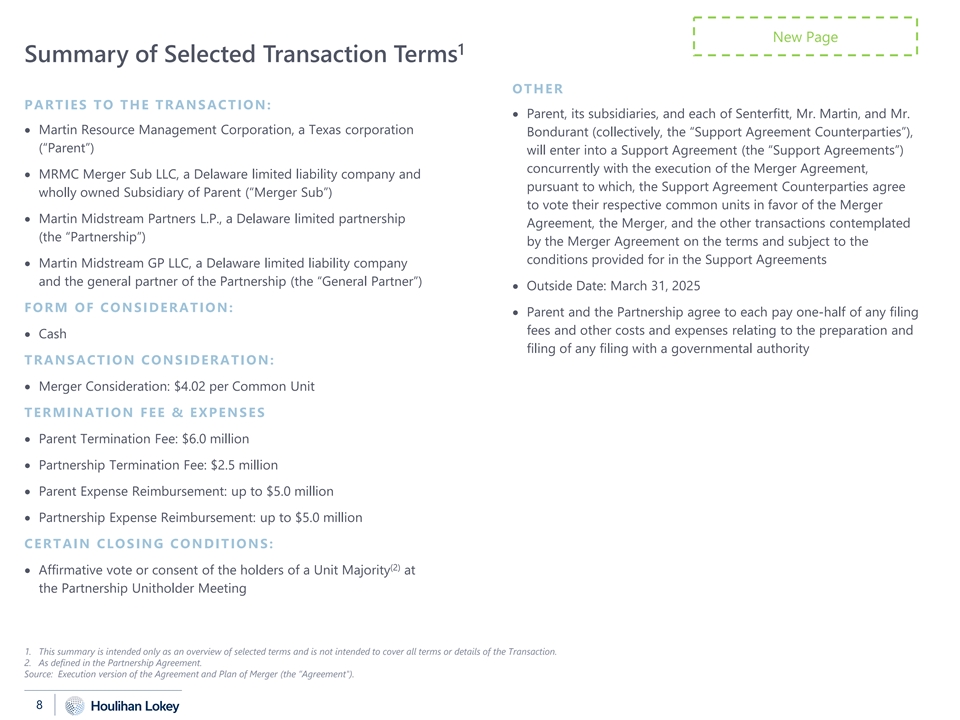

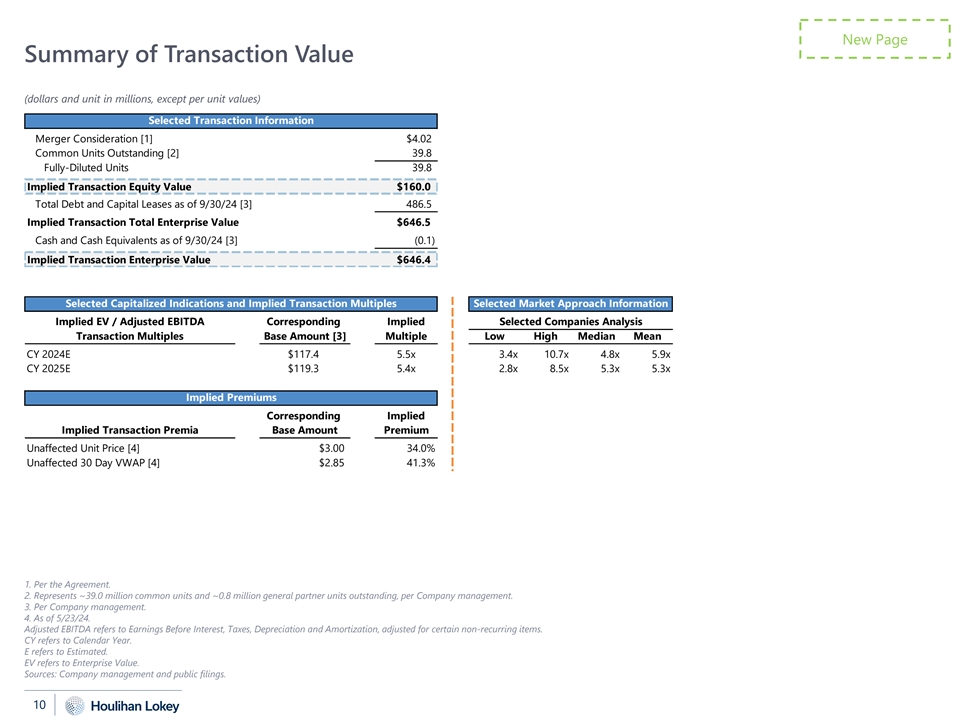

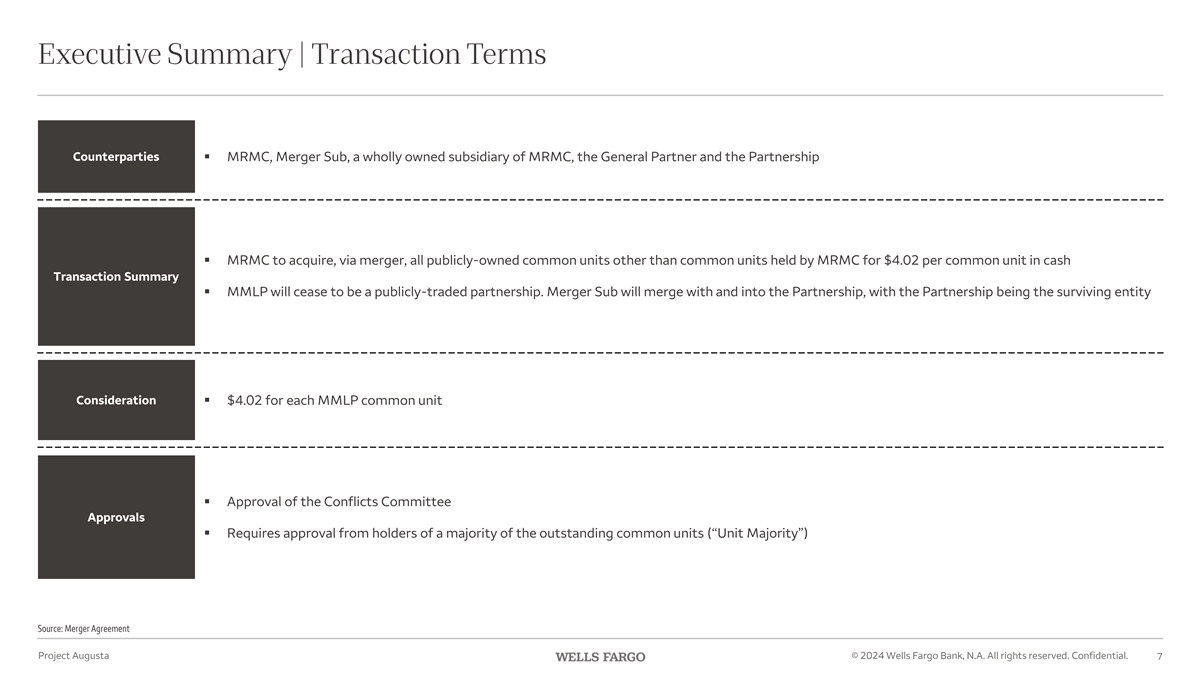

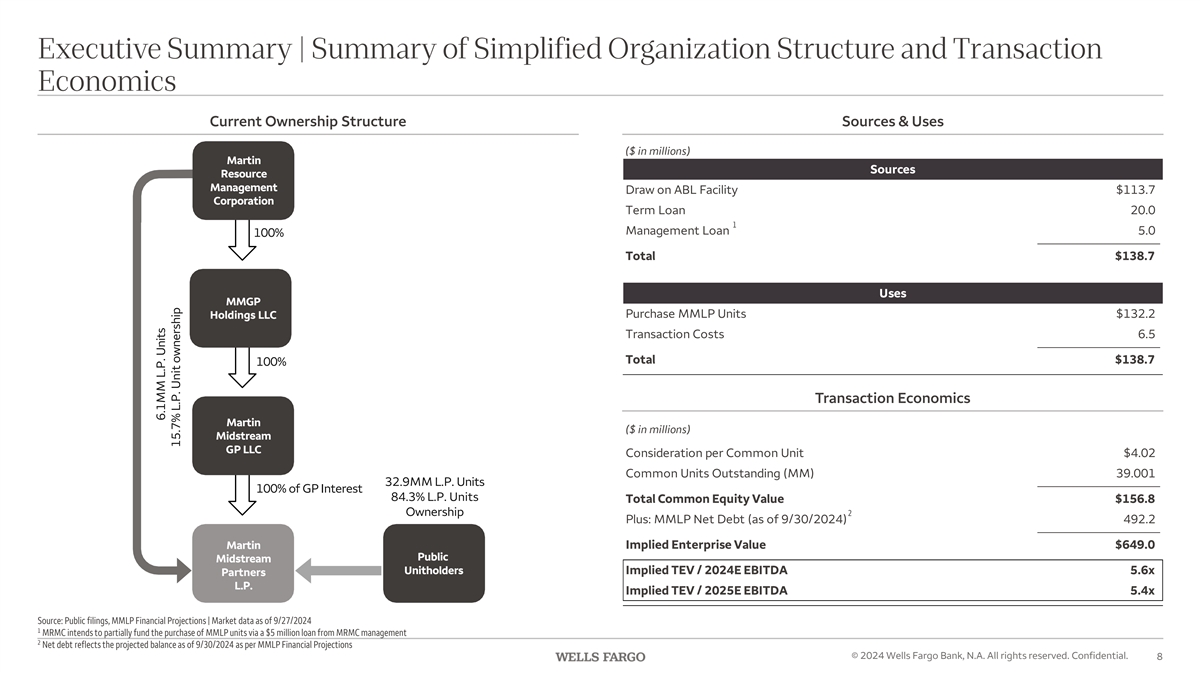

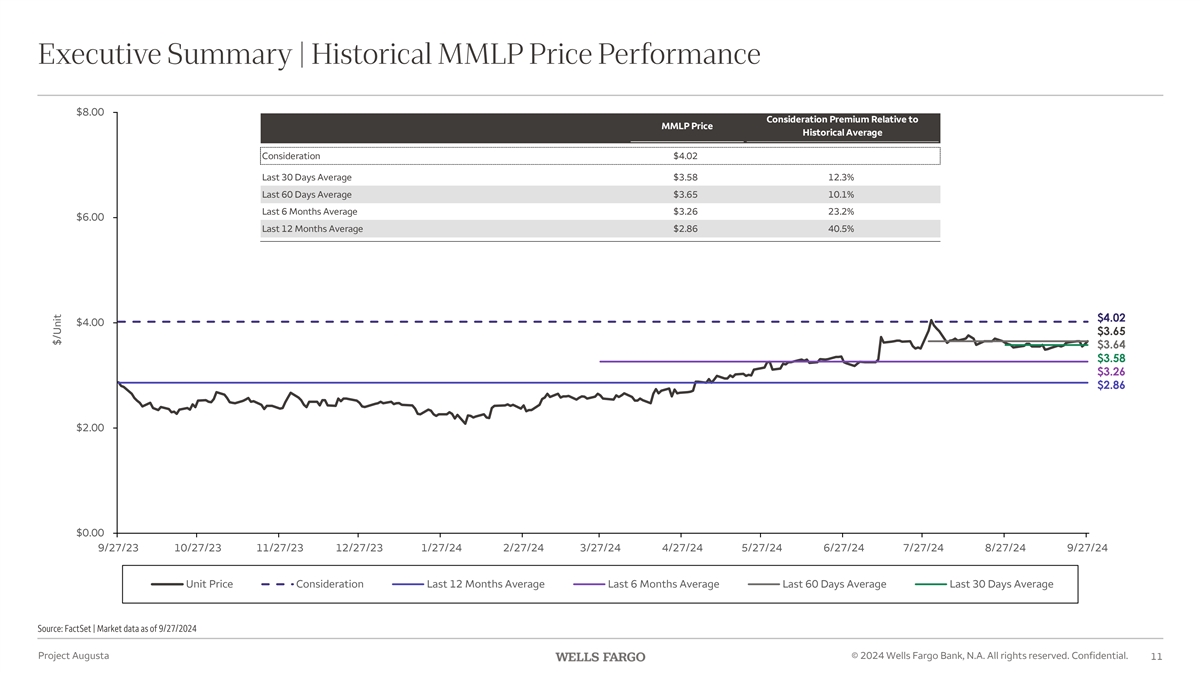

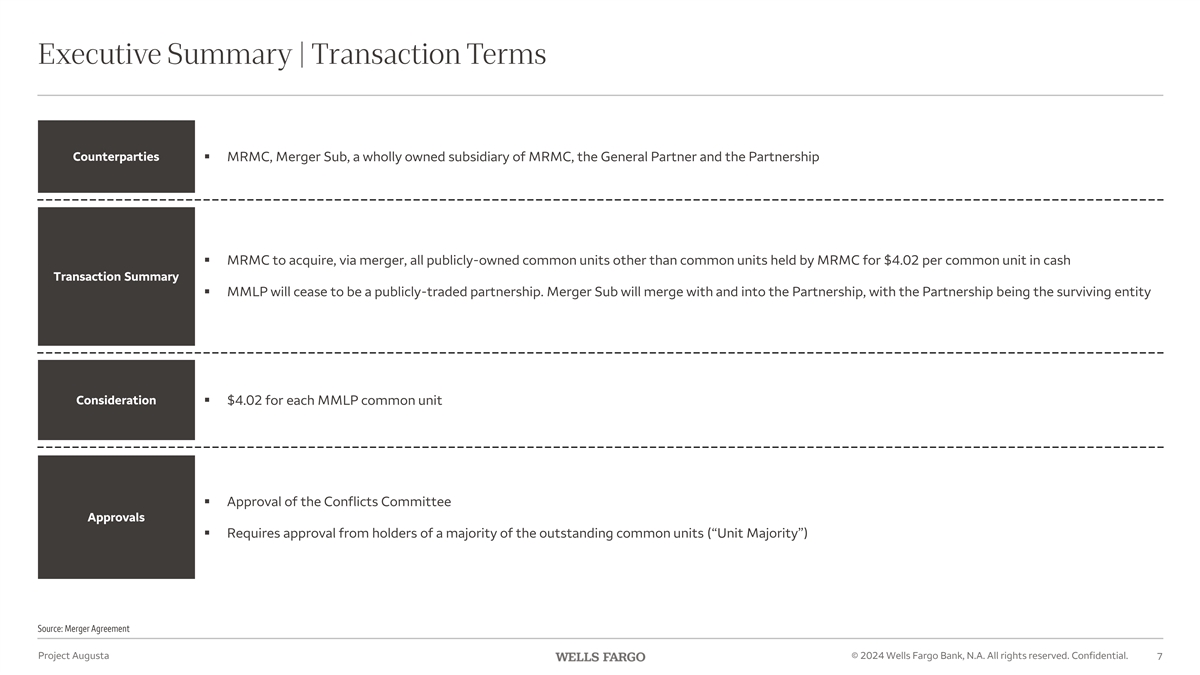

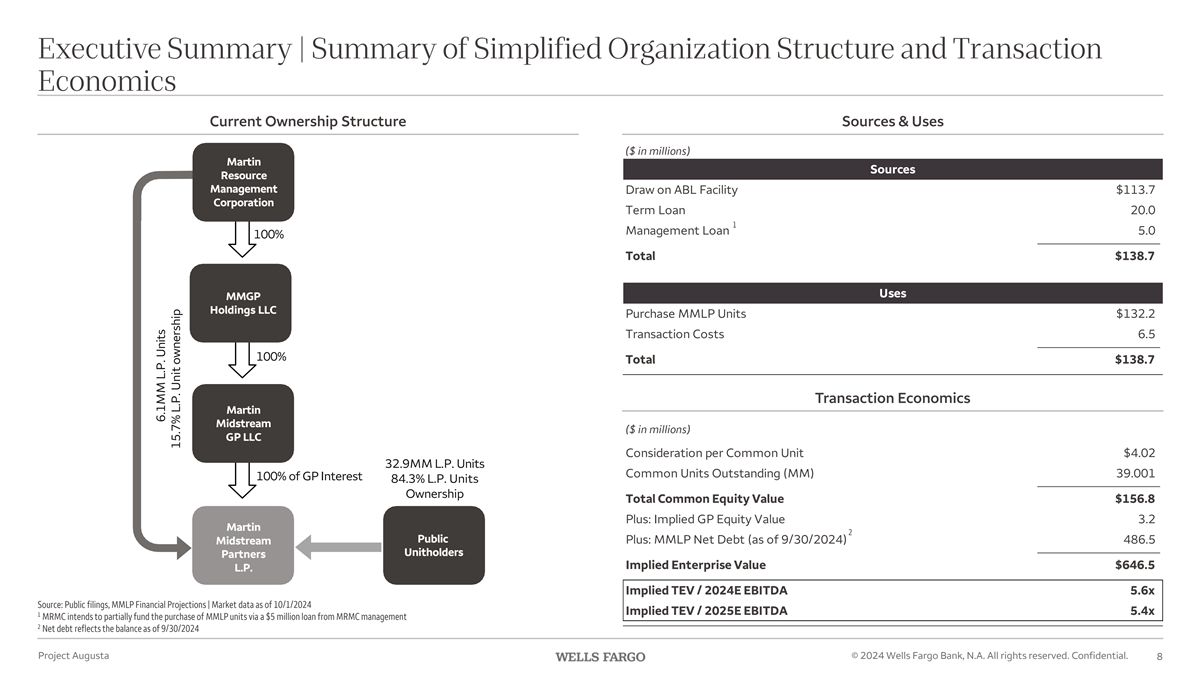

This Transaction Statement relates to the Agreement and Plan of Merger, dated as of

October 3, 2024, by and among Parent, Merger Sub, a wholly owned subsidiary of Parent, the General Partner, which is the general partner of the Partnership, and the Partnership (the “Merger Agreement”). Pursuant to the Merger

Agreement, Merger Sub will merge with and into the Partnership, with the Partnership surviving as a wholly owned subsidiary of Parent (the “Merger”). The Merger Agreement provides that, at the effective time of the Merger (the

“Effective Time”), each issued and outstanding common unit representing a limited partner interest in the Partnership (each, a “Common Unit”) other than Common Units owned by Parent and its subsidiaries, including the General

Partner (each, a “Public Common Unit”), will be converted into the right to receive $4.02 in cash without any interest (the “Merger Consideration”). The General Partner Interest (as defined in the Partnership Agreement (as

defined below)) of the Partnership and the Common Units held by Parent or its subsidiaries, as applicable, in each case that are issued and outstanding immediately prior to the Effective Time, will be unaffected by the Merger and will remain issued

and outstanding, and no consideration will be delivered in respect thereof. If the Merger is completed, the Common Units will no longer be listed on the Nasdaq Global Select market and the registration of the Common Units with the SEC under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) will be terminated.

The proposed Merger is a “Rule 13e-3 transaction” under the rules of the SEC. As of October 21, 2024, the Buyer Filing Parties owned an aggregate of 10,149,785 Common Units, representing approximately 26% of the outstanding Common

Units. Mr. Martin is the Chairman of the Board of Directors of the General Partner and the President and Chief Executive Officer and a Director of Parent, and Mr. Bondurant is the President and Chief Executive Officer of the General

Partner and a Director of Parent. Each of the other Buyer Filing Parties may be deemed an affiliate of the Partnership as described in the Proxy Statement (as defined below). Concurrently with the execution of the Merger Agreement, the Partnership

entered into Support Agreements with each of (i) Parent, Cross, Resource and Martin Product, (ii) Senterfitt, (iii) Mr. Bondurant and (iv) Mr. Martin (collectively, the “Support Parties”), pursuant to which the

Support Parties have agreed to vote or cause the 10,149,785 Common Units held by the Support Parties in the aggregate, representing approximately 26% of the total issued and outstanding Common Units as of October 21, 2024, to be voted in favor

of the Merger and the approval of the Merger Agreement (collectively, the “Support Agreements”). The Support Agreements will not be sufficient to approve the Merger and the Merger Agreement on behalf of the holders of the Common Units,

without also obtaining additional votes of other holders of Common Units.

The Conflicts Committee (the “Conflicts Committee”)

of the Board of Directors of the General Partner (the “GP Board”), consisting of three independent directors that satisfy the requirements for membership on the Conflicts Committee that are set forth in the Third Amended and Restated

Agreement of Limited Partnership of the Partnership, dated as of November 23, 2021 (the “Partnership Agreement”), and the Conflicts Committee Charter, has unanimously and in good faith (i) determined that the Merger Agreement and

the transactions contemplated by the Merger Agreement and the Support Agreements, including the Merger, are (A) fair and reasonable to the Partnership and the holders of the Public Common Units (other than Senterfitt, Mr. Martin and the

other directors and officers of Parent) (the “Partnership Unaffiliated Unitholders”) and (B) in the best interests of the Partnership and the Partnership Unaffiliated Unitholders, (ii) approved (such approval constituting

“Special Approval” for all purposes under the Partnership Agreement, including Section 7.9(a) thereof) the Merger Agreement, the Support Agreements and the transactions contemplated by the Merger Agreement and the Support Agreements,

including the Merger, (iii) recommended that the GP Board approve the Merger Agreement, the Support Agreements, the execution, delivery and performance of the Merger Agreement and the Support Agreements and the consummation of the transactions

contemplated by the Merger Agreement and the Support Agreements, including the Merger, (iv) recommended that the GP Board submit the Merger Agreement and the Merger to a vote of the limited partners of the Partnership (the

“Unitholders”), and (v) recommended, and recommended that the GP Board resolve to recommend, approval of the Merger Agreement and the Merger by the Unitholders.

Following the receipt of the recommendation of the Conflicts Committee, the GP Board unanimously and in good faith (i) determined that

the Merger Agreement and the transactions contemplated by the Merger Agreement and the Support Agreements, including the Merger, are (A) fair and reasonable to the Partnership and the Partnership Unaffiliated Unitholders and (B) in the

best interests of the Partnership and the Partnership Unaffiliated Unitholders, (ii) approved the Merger Agreement, the Support Agreements, the execution, delivery and performance of the Merger Agreement and the Support Agreements and the

consummation of the transactions contemplated by the Merger Agreement and the Support Agreements, including the Merger, (iii) authorized and directed that approval of the Merger Agreement and the Merger be submitted to a vote of the Unitholders

and (iv) recommended approval of the Merger Agreement and the Merger by the Unitholders.

Completion of the Merger is subject to certain customary conditions, including, among

others, approval of the Merger Agreement and the Merger, which requires the affirmative vote of holders of at least a majority of the issued and outstanding Common Units (the “Unitholder Approval”). The Partnership is holding a special

meeting of its Unitholders to obtain the Unitholder Approval.

Concurrently with the filing of this Transaction Statement, the Partnership

is filing with the SEC a preliminary proxy statement (the “Proxy Statement”) under Section 14(a) of the Exchange Act with respect to the special meeting of Unitholders, at which Unitholders will be asked to consider and vote on the

proposal to approve the Merger Agreement and the Merger. A copy of the Proxy Statement is attached hereto as Exhibit (a)(1) and a copy of the Merger Agreement is attached as Annex A to the Proxy Statement. All references in this Transaction

Statement to Items numbered 1001 to 1016 are references to Items contained in Regulation M-A under the Act.

Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Proxy Statement,

including all annexes thereto, is expressly incorporated herein by reference in its entirety, and responses to each item herein are qualified in their entirety by the information contained in the Proxy Statement and the annexes thereto. The

cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required to be included in response to the items of

Schedule 13E-3. As of the date hereof, the Proxy Statement is in preliminary form and is subject to completion. Terms used but not defined in this Transaction Statement shall have the meanings given to them in

the Proxy Statement.

While each of the filing persons acknowledges that the Merger is a “Rule

13e-3 transaction” under the rules of the SEC, the filing of this Transaction Statement shall not be construed as an admission by any filing person, or by any affiliate of a filing person, that the

Partnership is “controlled” by any of the filing persons and/or their respective affiliates.

All information concerning the

Partnership contained in, or incorporated by reference into, this Transaction Statement was supplied by the Partnership. Similarly, all information concerning each other filing person contained in, or incorporated by reference into, this Transaction

Statement was supplied by such filing person.

ITEM 1. SUMMARY TERM SHEET

Regulation M-A, Item 1001

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

ITEM 2. SUBJECT COMPANY INFORMATION

Regulation M-A, Item 1002

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Summary Term Sheet”

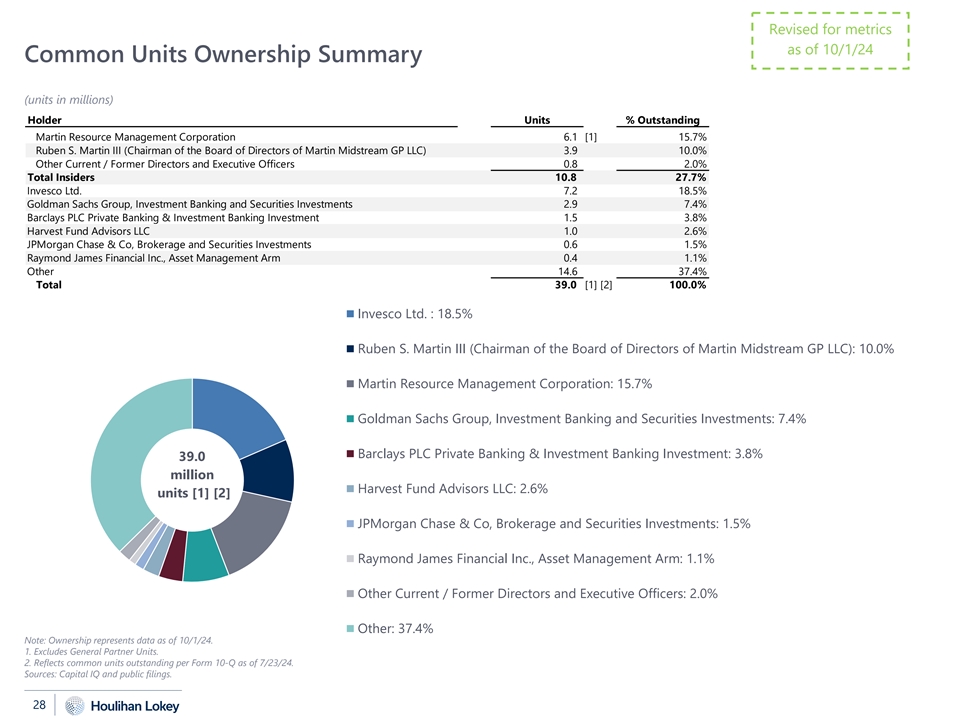

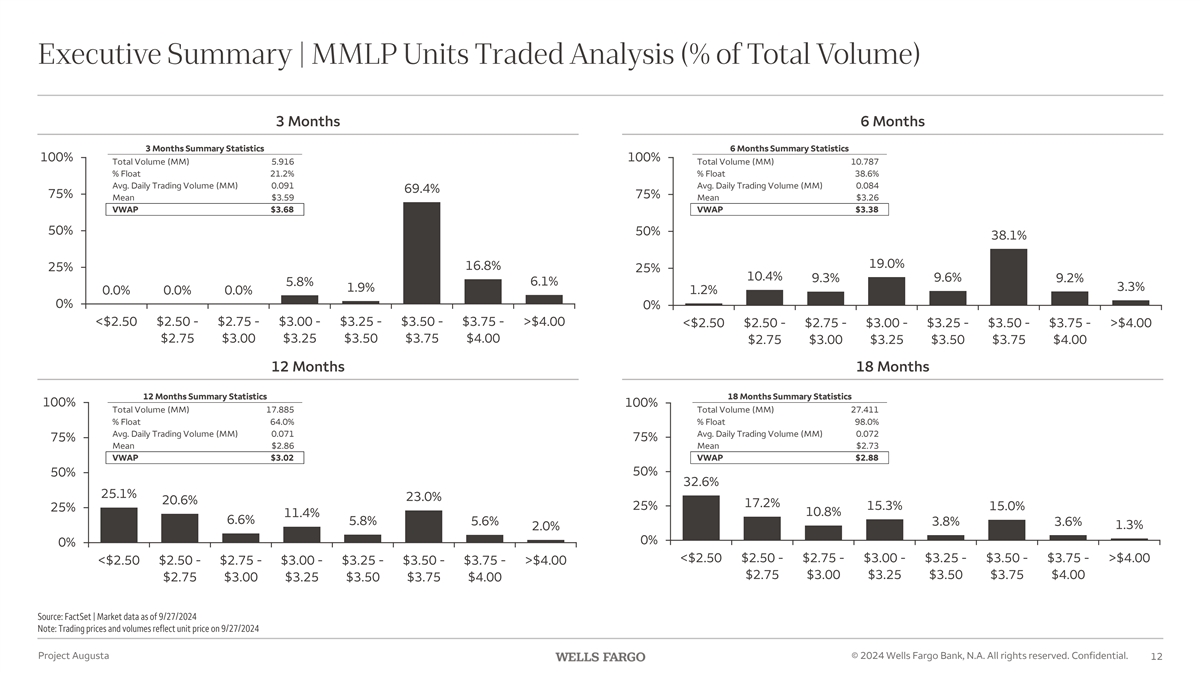

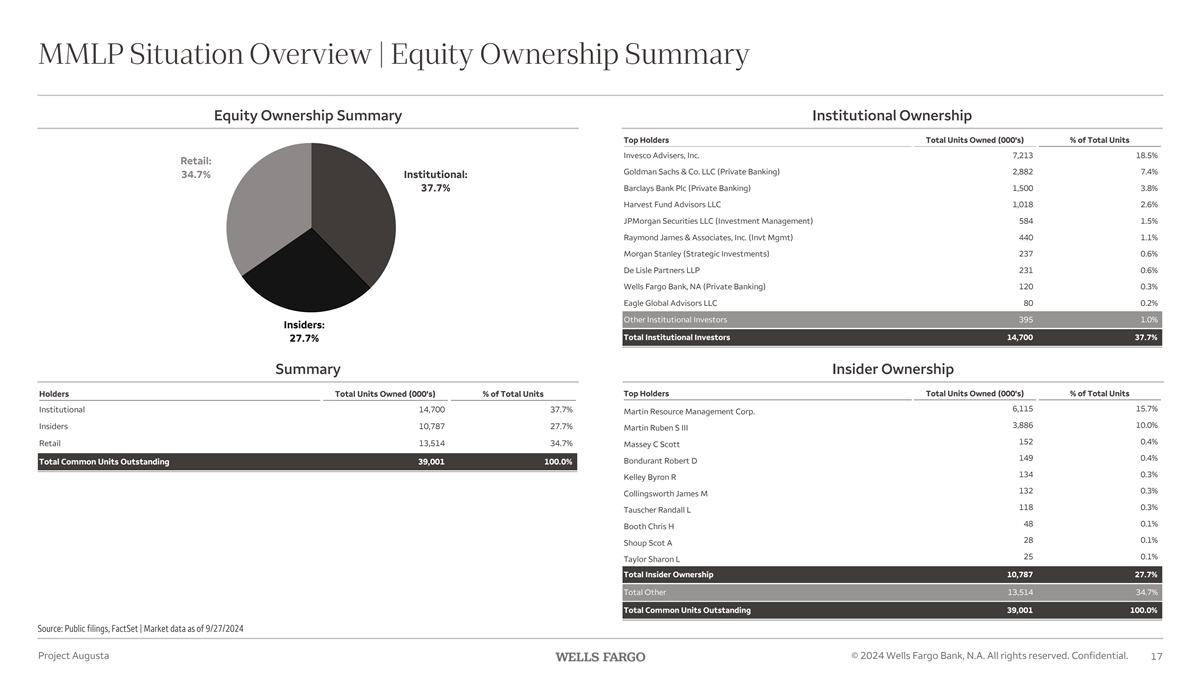

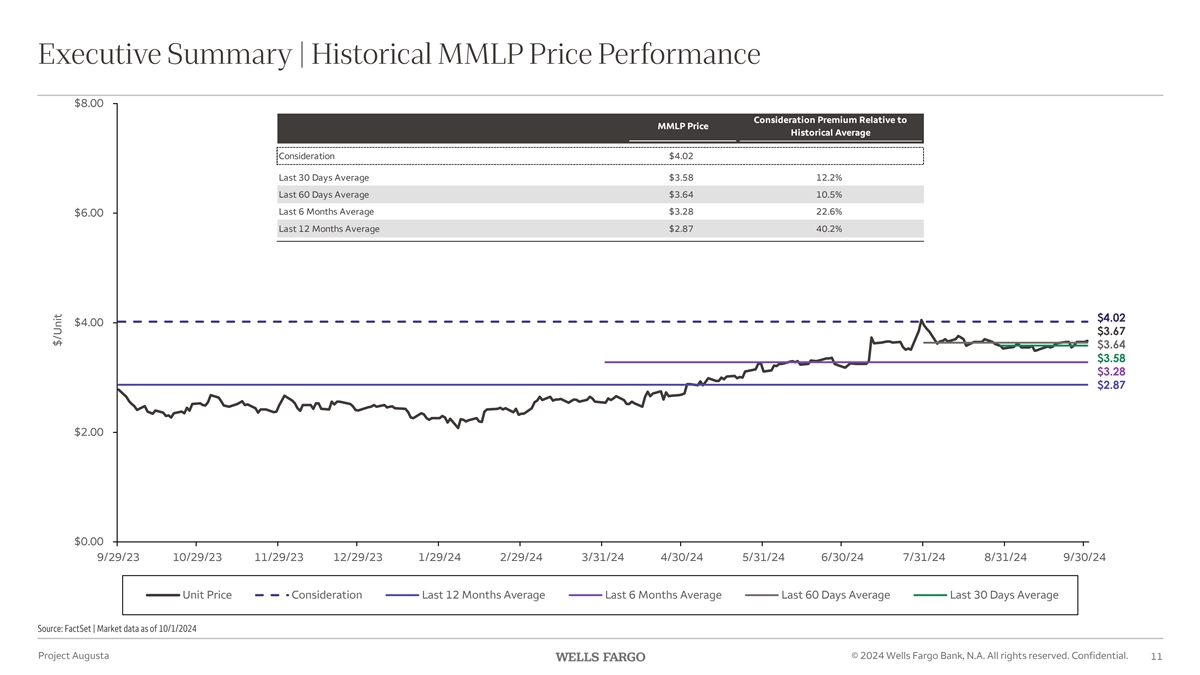

The subject class of equity securities are the Common Units. As of October 21, 2024, 39,001,086 Common Units were outstanding.

| (c) |

Trading Market and Price. |

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Important Information Regarding the Partnership—Market Price and Cash Distribution Information”

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Important Information Regarding the Partnership—Market Price and Cash Distribution Information”

| (e) |

Prior Public Offerings. |

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Certain Purchases and Sales of Common Units and Prior Public Offerings”

| (f) |

Prior Stock Purchases. |

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Certain Purchases and Sales of Common Units and Prior Public Offerings”

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSON

Regulation M-A, Item 1003

(a) – (c) Name and Address, Business and Background of Entities, Business and Background of Natural Persons.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Parties to the

Merger”

“Information Concerning the Buyer Filing Parties—Business and Background of the Buyer Filing Parties”

“Information Concerning the Buyer Filing Parties—Business and Background of Buyer Filing Parties Control Persons”

“Common Unit Ownership”

“Where You

Can Find More Information”

ITEM 4. TERMS OF THE TRANSACTION

Regulation M-A, Item 1004

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors—Effects of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in the Merger”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Ownership of the Partnership After the Merger”

“Special Factors—Delisting and Deregistration of Common Units”

“Special Factors—No Appraisal Rights”

“Special Factors—Accounting Treatment of the Merger”

“Special Factors—Tax Consequences of the Merger to Unitholders”

“The Partnership Special Meeting—Vote Required for Approval”

“Proposal No. 1 The Merger Proposal”

“Delisting and Deregistration”

“Annex

A: Agreement and Plan of Merger”

Not required by Schedule 13E-3.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers about the Merger and the Special Meeting”

“Special Factors—Effects of the Merger”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Proposal No. 1 The Merger Proposal”

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers about the Merger and the Special Meeting”

“Special Factors—No Appraisal Rights”

| (e) |

Provisions for Unaffiliated Unitholders. |

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Provisions for Partnership Unaffiliated Unitholders”

| (f) |

Eligibility for Listing or Trading. |

Not applicable.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS

Regulation M-A, Item 1005

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in the Merger”

“Certain Purchases and Sales of Common Units and Prior Public Offerings”

“Information Concerning the Buyer Filing Parties—Prior Contracts and Transactions”

(b) – (c) Significant Corporate Events, Negotiations or Contacts.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special

Factors—Background of the Merger”

“Special Factors—Effects of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—The Support Agreements”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in the Merger”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Proposal No. 1 The Merger Proposal”

“Information Concerning the Buyer Filing Parties—Prior Contracts and Transactions”

“Annex A: Agreement and Plan of Merger”

“Annex B: Support Agreement (Buyer Filing Parties)”

“Annex C: Support Agreement (Senterfitt)”

“Annex D: Support Agreement (R. Bondurant)”

“Annex E: Support Agreement (R. Martin)”

| (d) |

Conflicts of Interest. |

Not required by Schedule 13E-3.

| (e) |

Agreements Involving the Subject Company’s Securities. |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet—The Partnership Special Meeting—The Support Agreements”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—The Support Agreements”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in the Merger”

“Special Factors—Financing of the Merger”

“Proposal No. 1 The Merger Proposal”

“Annex A: Agreement and Plan of Merger”

“Annex B: Support Agreement (Buyer Filing Parties)”

“Annex C: Support Agreement (Senterfitt)”

“Annex D: Support Agreement (R. Bondurant)”

“Annex E: Support Agreement (R. Martin)”

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS

Regulation M-A, Item 1006

Not required by Schedule 13E-3.

| (b) |

Use of Securities Acquired. |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special

Factors—Effects of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Proposal No. 1 The Merger Proposal”

“Annex A: Agreement and Plan of Merger”

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

“Special Factors—Background of the Merger”

“Special Factors—Effects of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—The Support Agreements”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Financing of the Merger”

“Special Factors—Delisting and Deregistration of Common Units”

“Proposal No. 1 The Merger Proposal”

“Important Information Regarding the Partnership—Market Price and Cash Distribution Information”

“Delisting and Deregistration”

“Annex

A: Agreement and Plan of Merger”

“Annex B: Support Agreement (Buyer Filing Parties)”

“Annex C: Support Agreement (Senterfitt)”

“Annex D: Support Agreement (R. Bondurant)”

“Annex E: Support Agreement (R. Martin)”

| (d) |

Subject Company Negotiations. |

Not required by Schedule 13E-3.

ITEM 7. PURPOSES, ALTERNATIVES, REASONS AND EFFECTS

Regulation M-A, Item 1013

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers about the Merger and the Special Meeting”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Interests of the Directors and Officers of the General Partner in the Merger”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Ownership of the Partnership After the Merger”

“Special Factors—Financing of the Merger”

“Special Factors—Delisting and Deregistration of Common Units”

“Special Factors— Tax Consequences of the Merger to Unitholders”

“Proposal No. 1 The Merger Proposal”

“Delisting and Deregistration”

“Annex

A: Agreement and Plan of Merger”

ITEM 8. FAIRNESS OF THE TRANSACTION

Regulation M-A, Item 1014

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

“Special Factors—Resolution of Conflicts of Interest; Standards of Conduct and

Modification of Duties”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending

Approval of the Merger Proposal”

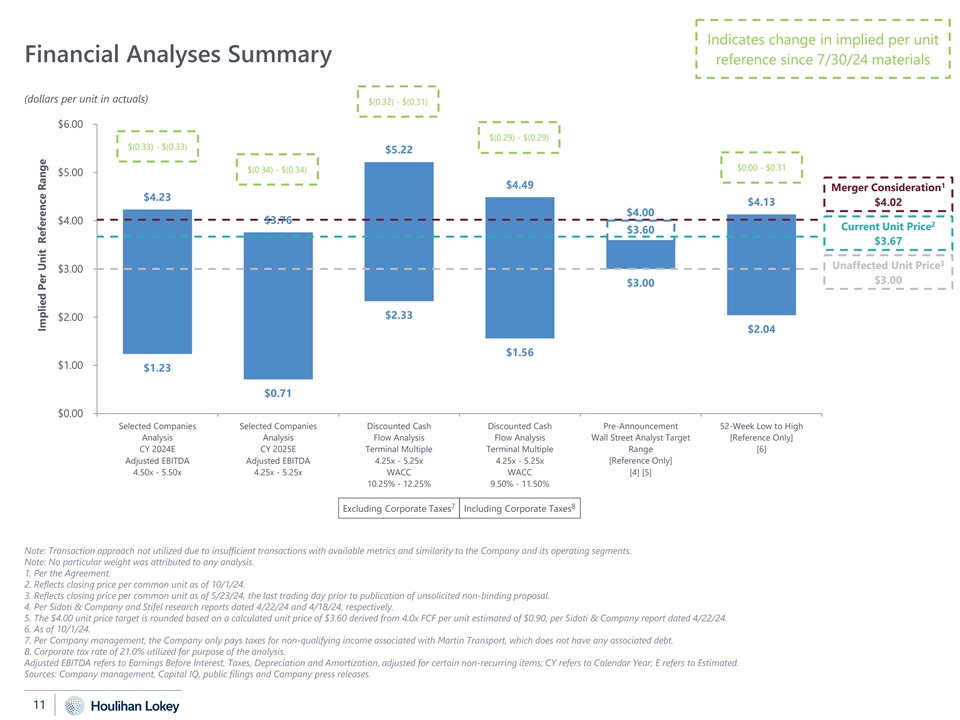

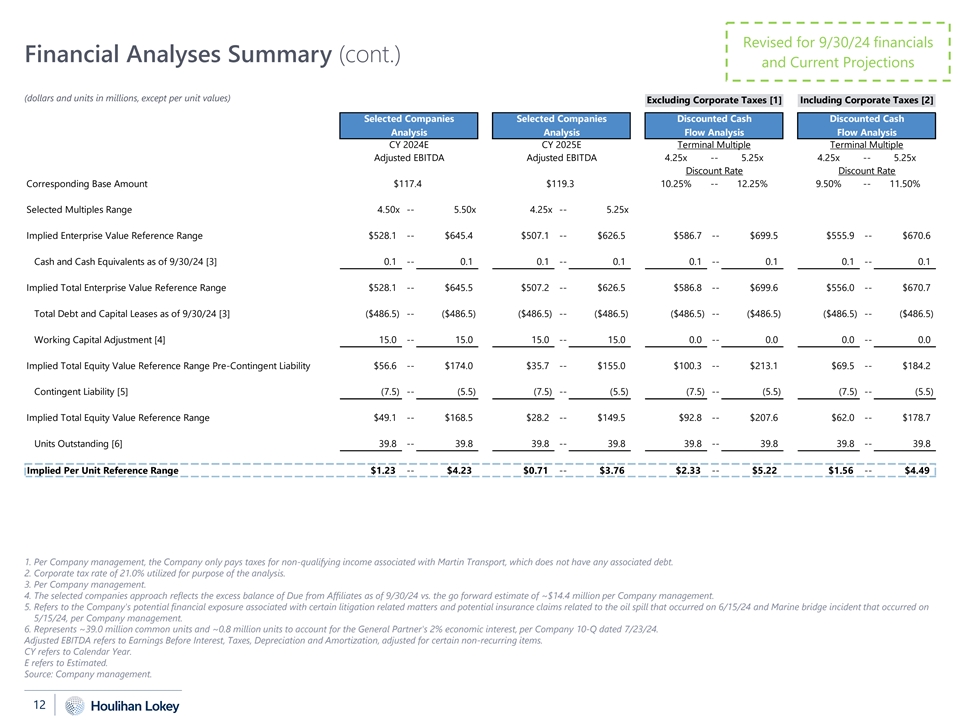

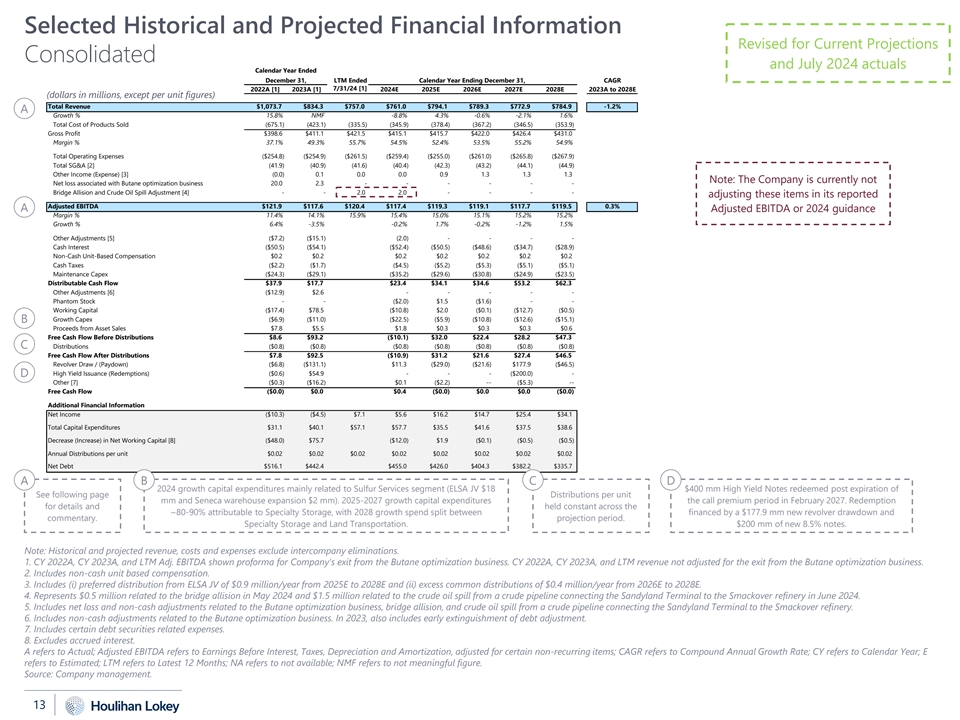

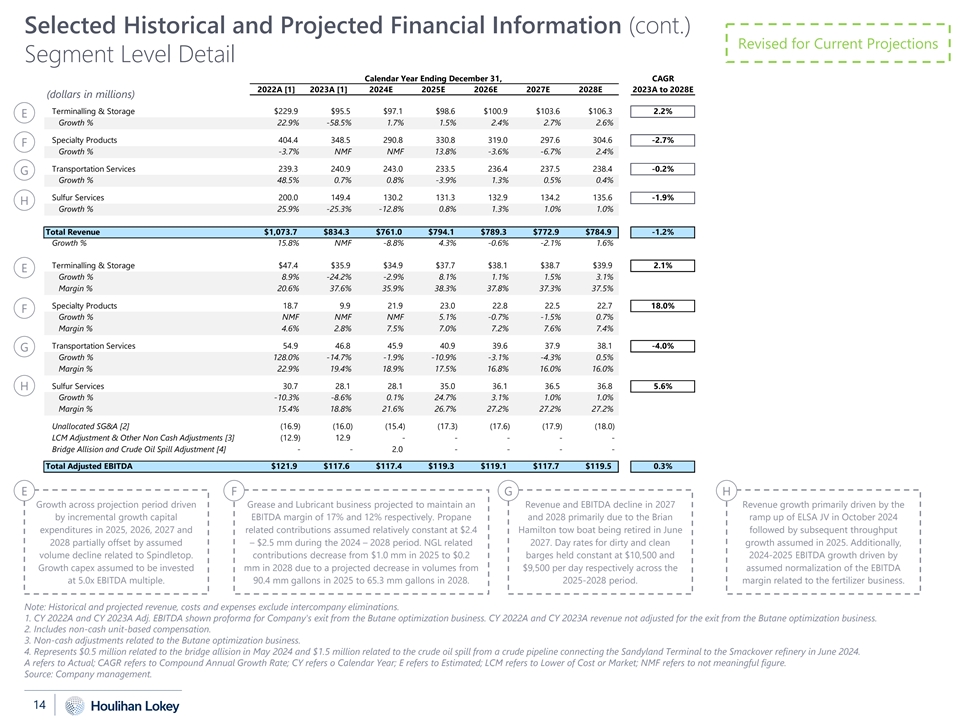

“Special Factors—Houlihan Lokey Opinion to the Conflicts Committee”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Proposal No. 1 The Merger Proposal”

“Annex F: Houlihan Fairness Opinion”

| (b) |

Factors Considered in Determining Fairness. |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Resolution of Conflicts of Interest; Standards of Conduct and Modification of Duties”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors — Houlihan Lokey Opinion to the Conflicts Committee”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Annex F: Houlihan Fairness Opinion”

| (c) |

Approval of Security Holders. |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—Position of the Buyer Filing Parties as to the Merger”

| (d) |

Unaffiliated Representative. |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for

Recommending Approval of the Merger Proposal”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the

Merger”

(e) Approval of Directors.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

“Special Factors—Background of the Merger”

“Special Factors—Resolution of Conflicts of Interest; Standards of Conduct and Modification of Duties”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“The Partnership Special Meeting—Recommendation of the Conflicts Committee”

“Proposal No. 1 The Merger Proposal”

(f) Other Offers.

“Special

Factors—Background of the Merger”

ITEM 9. REPORTS, OPINIONS, APPRAISALS AND CERTAIN NEGOTIATIONS

Regulation M-A, Item 1015

(a) – (b) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal.

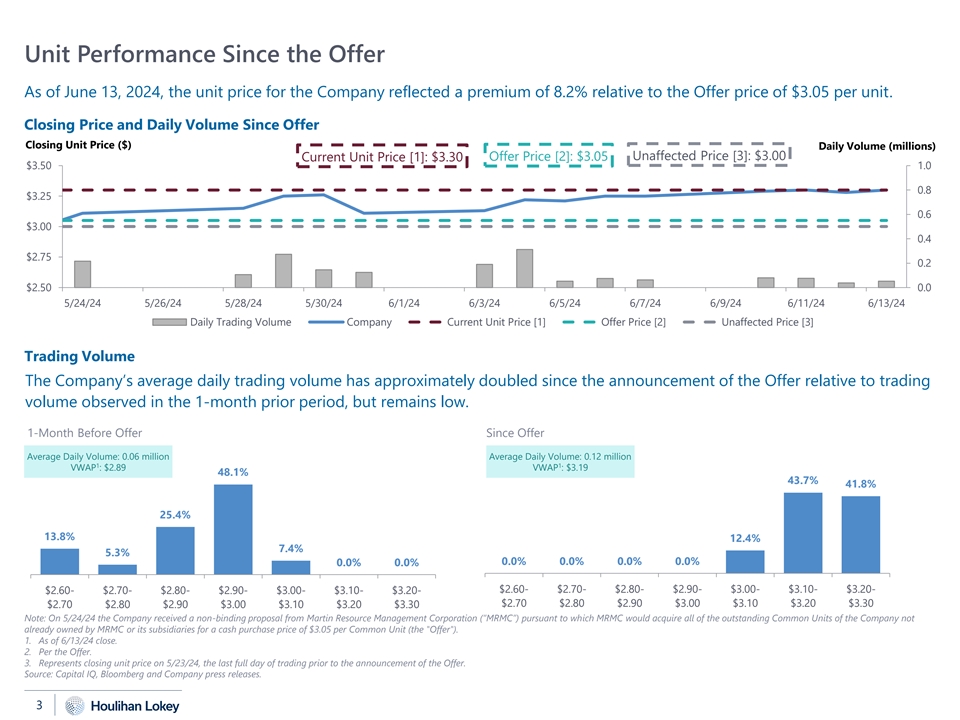

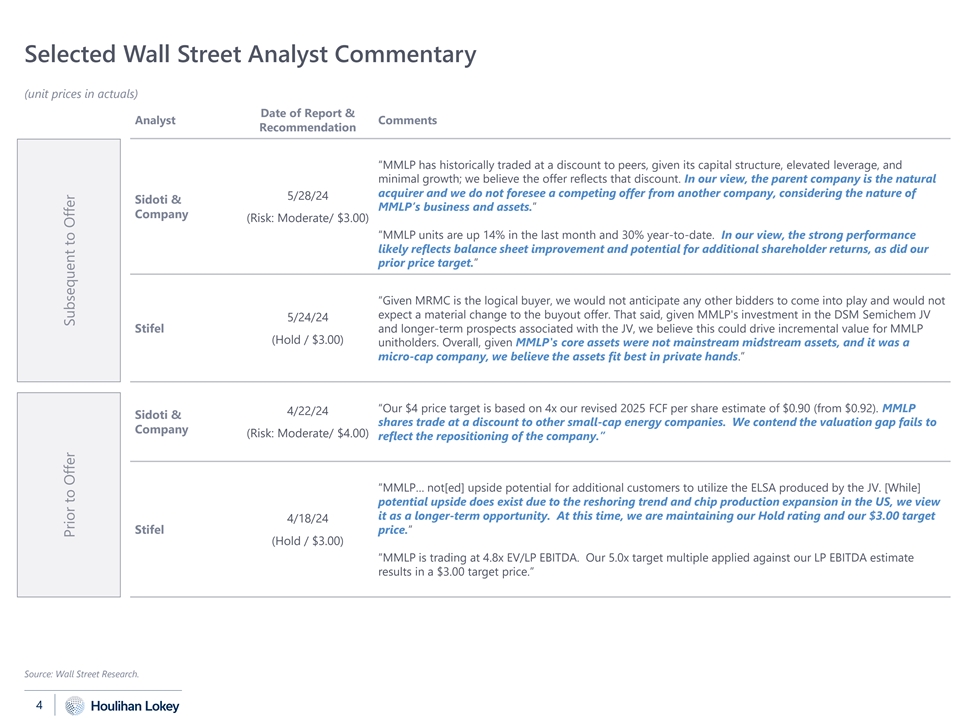

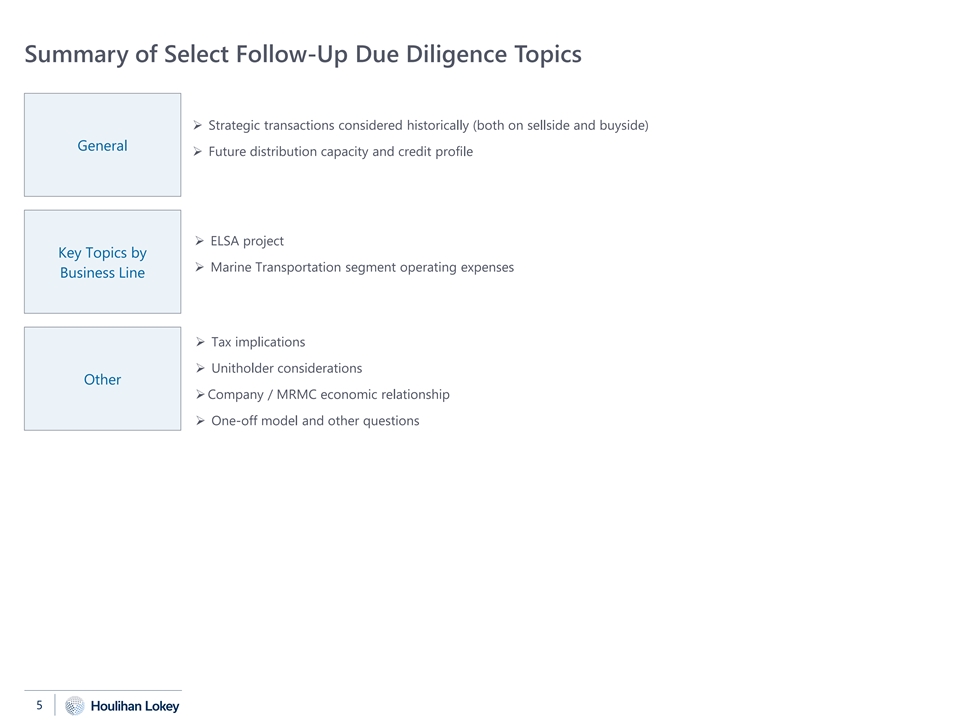

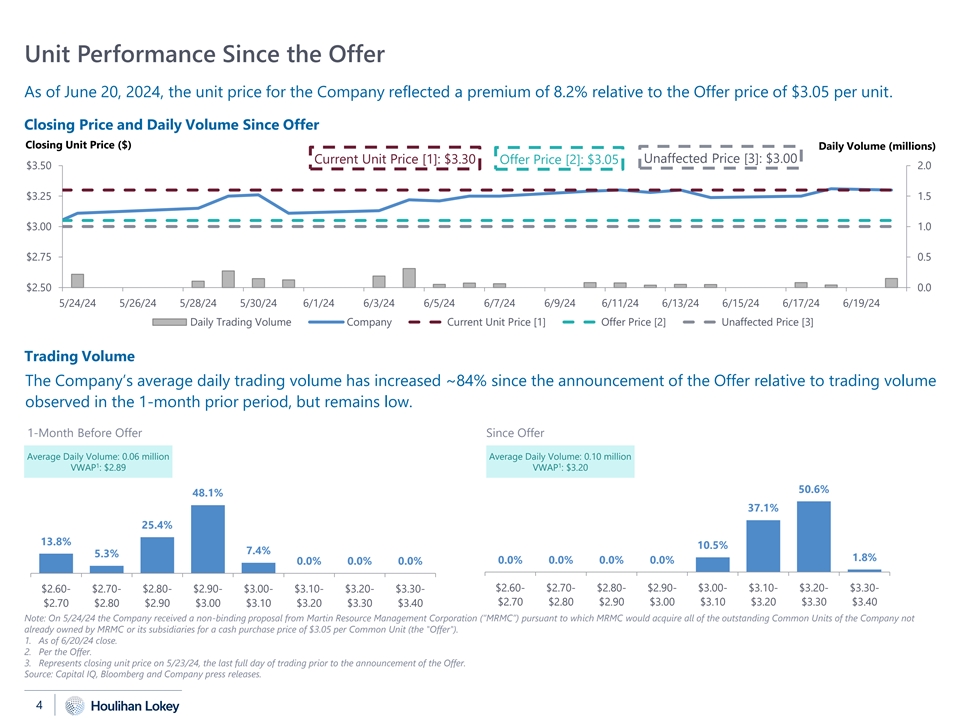

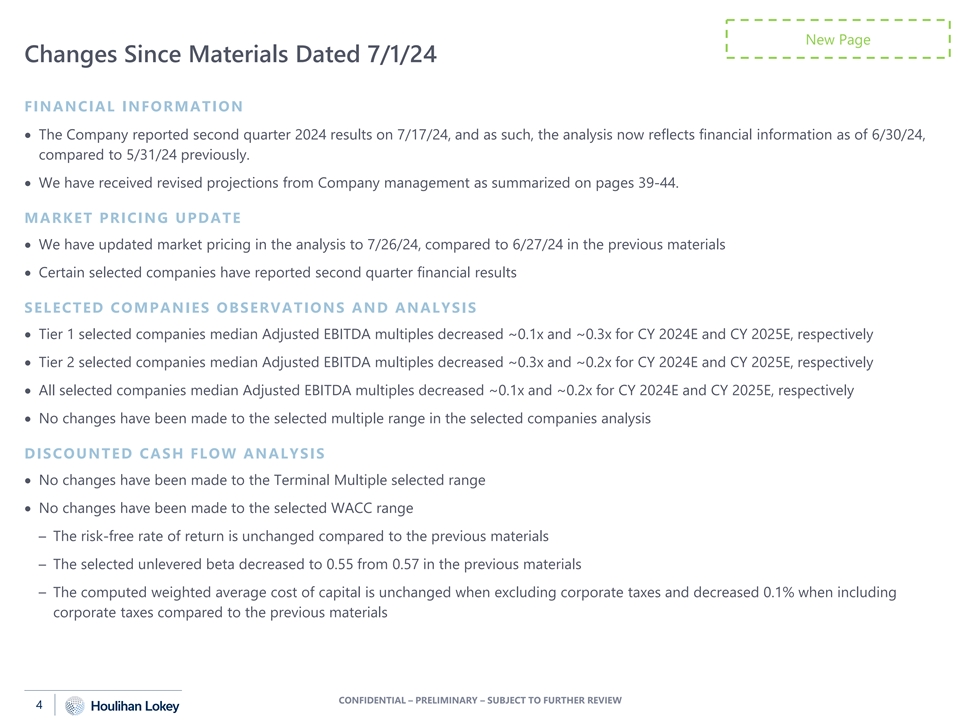

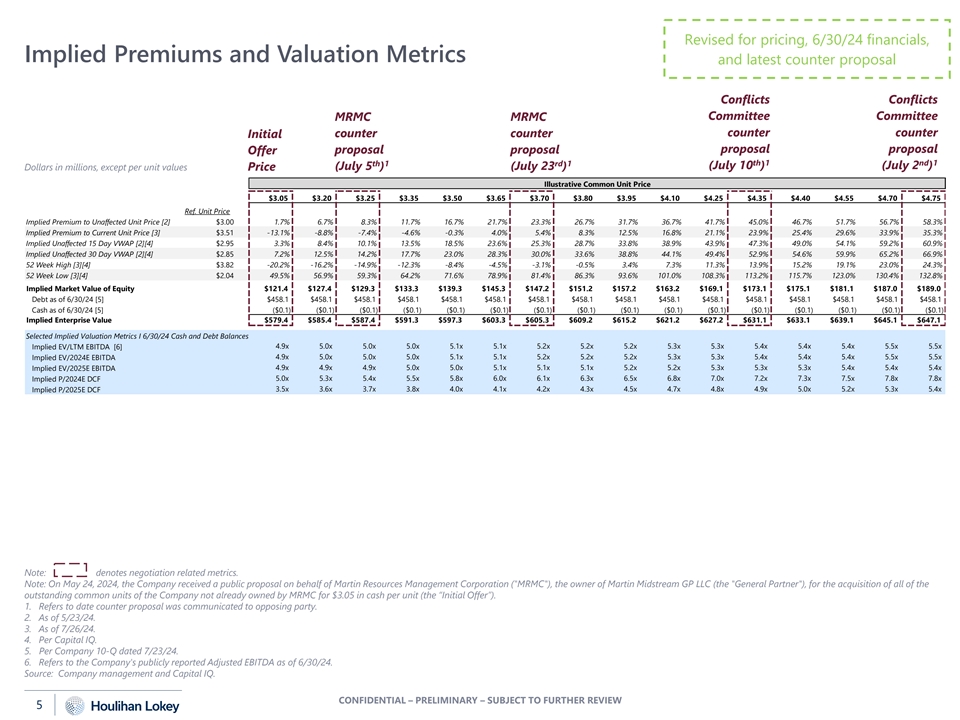

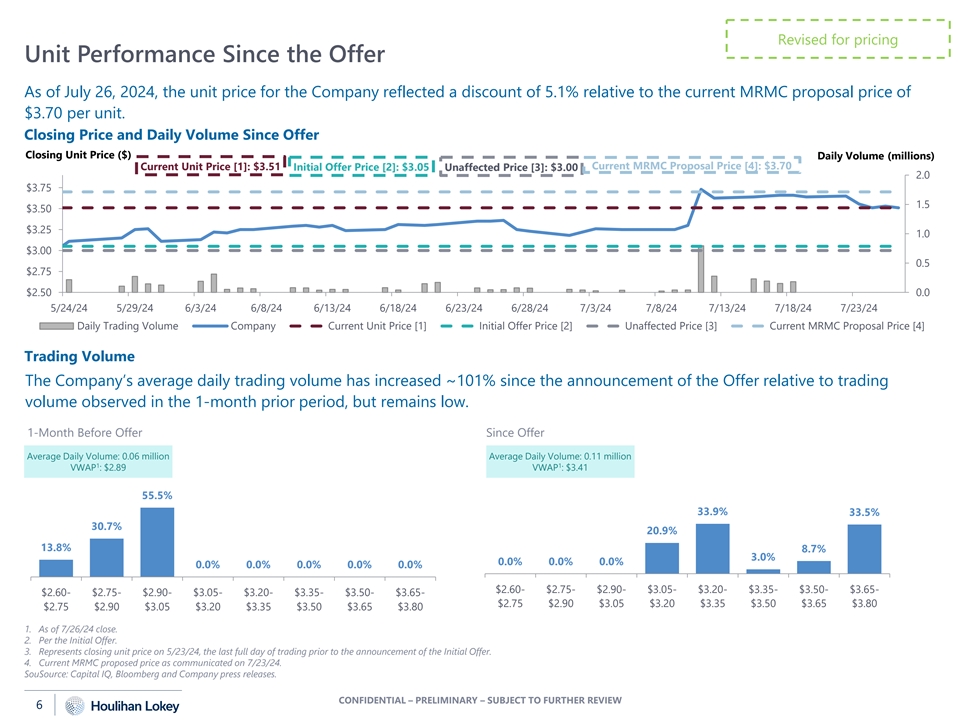

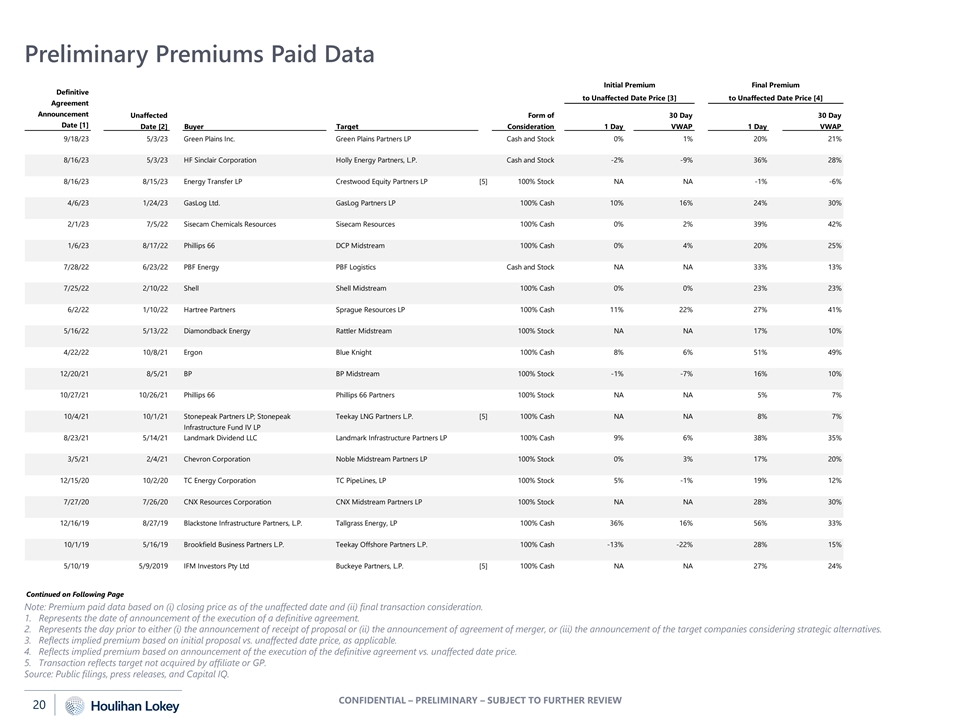

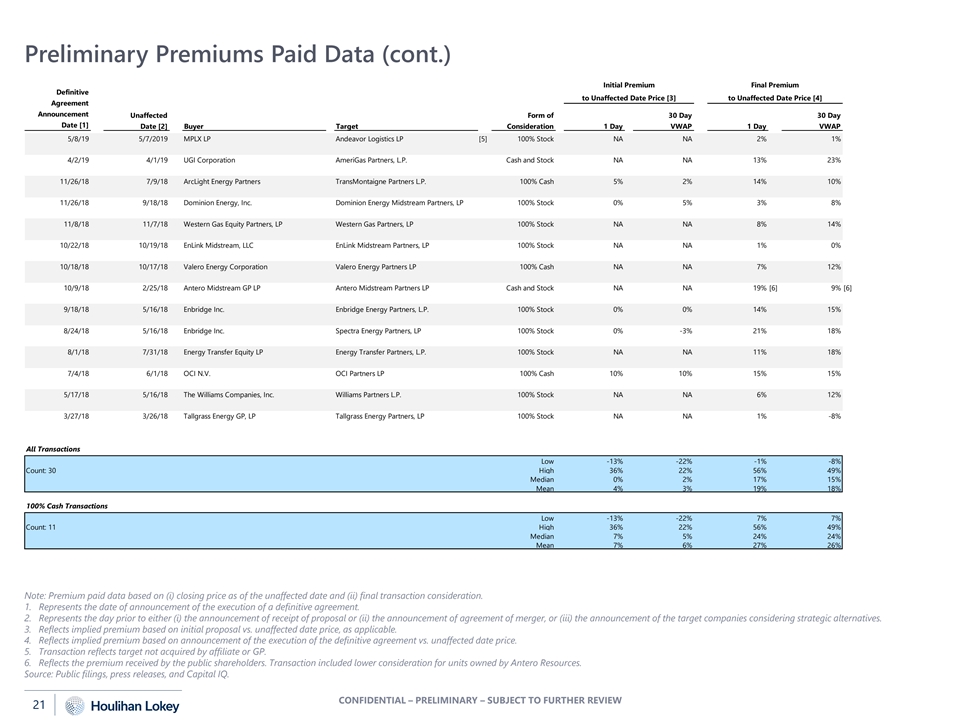

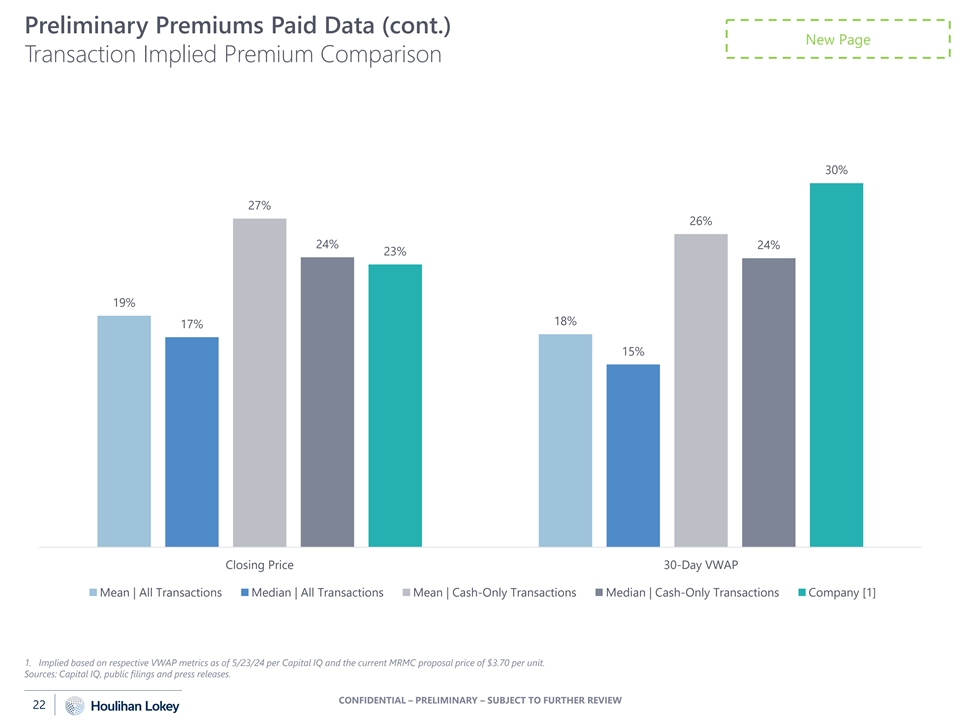

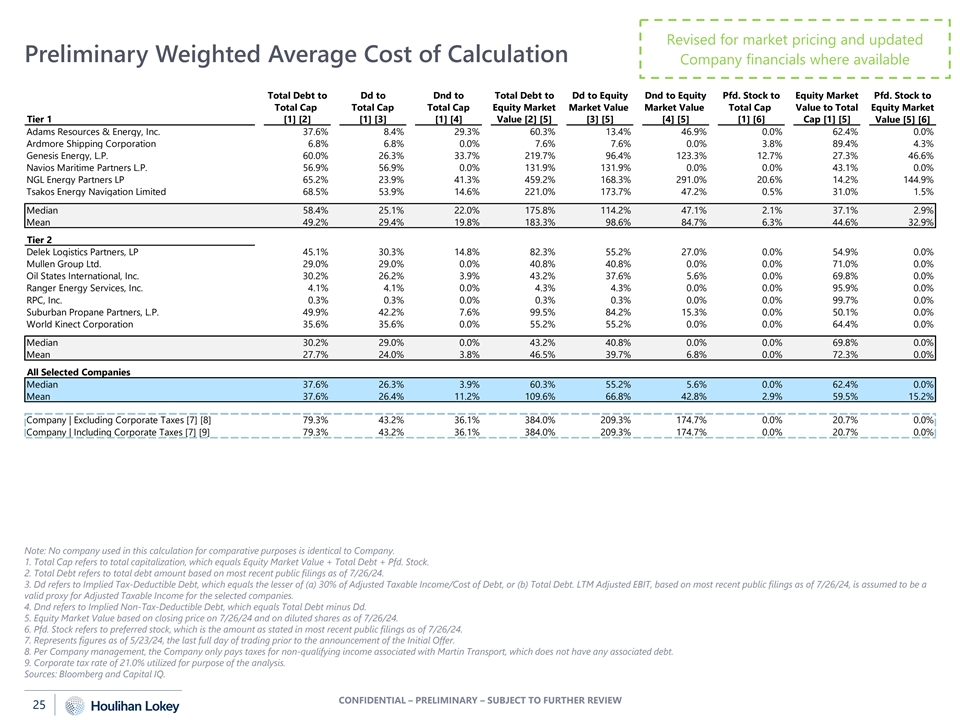

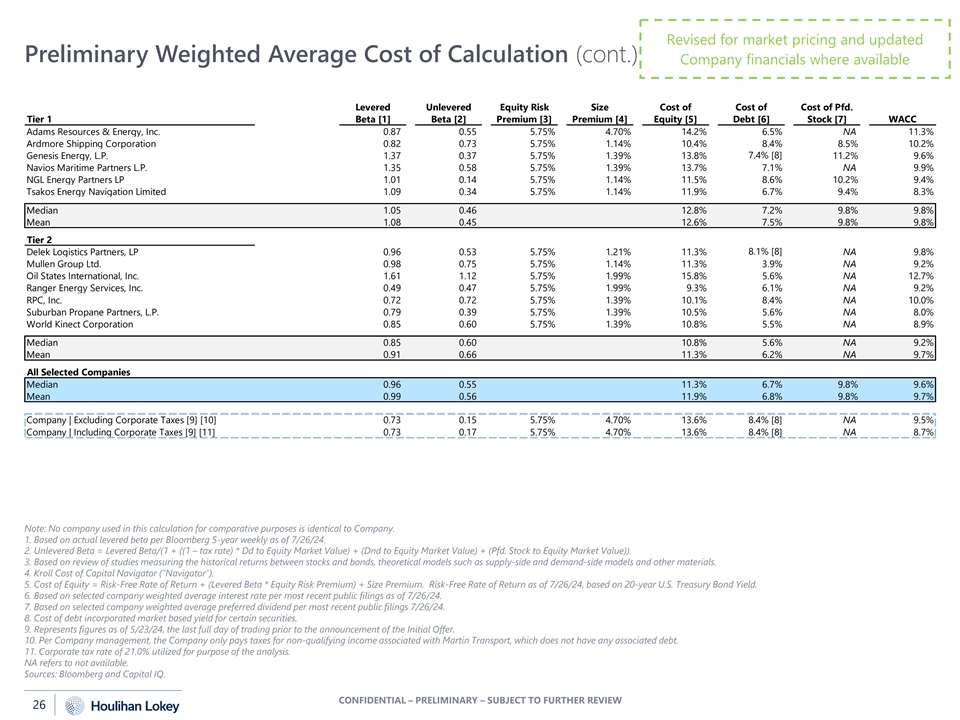

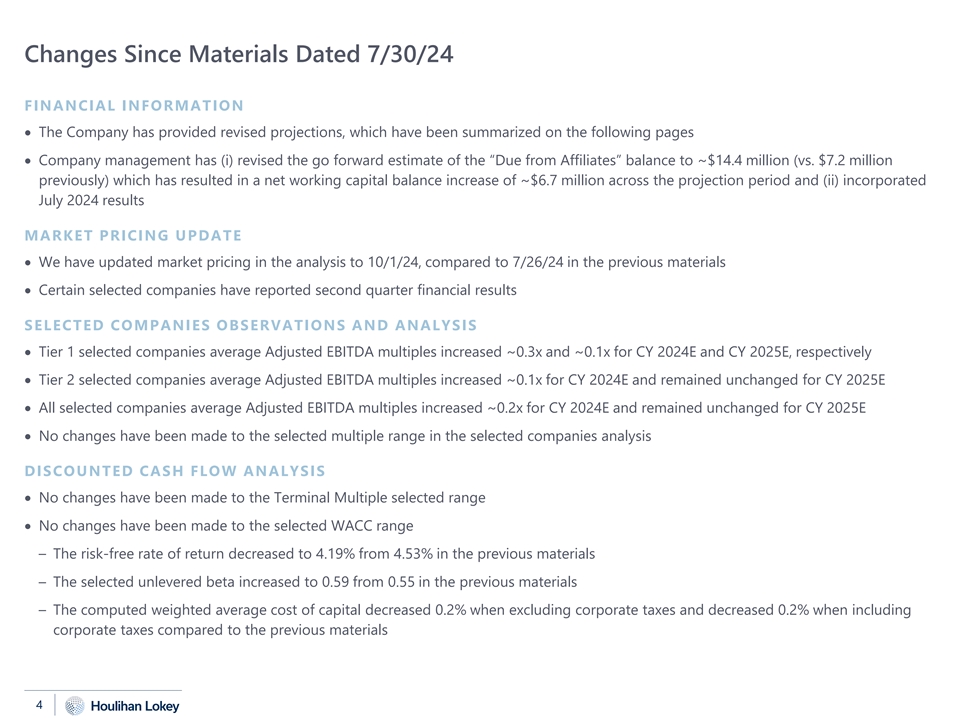

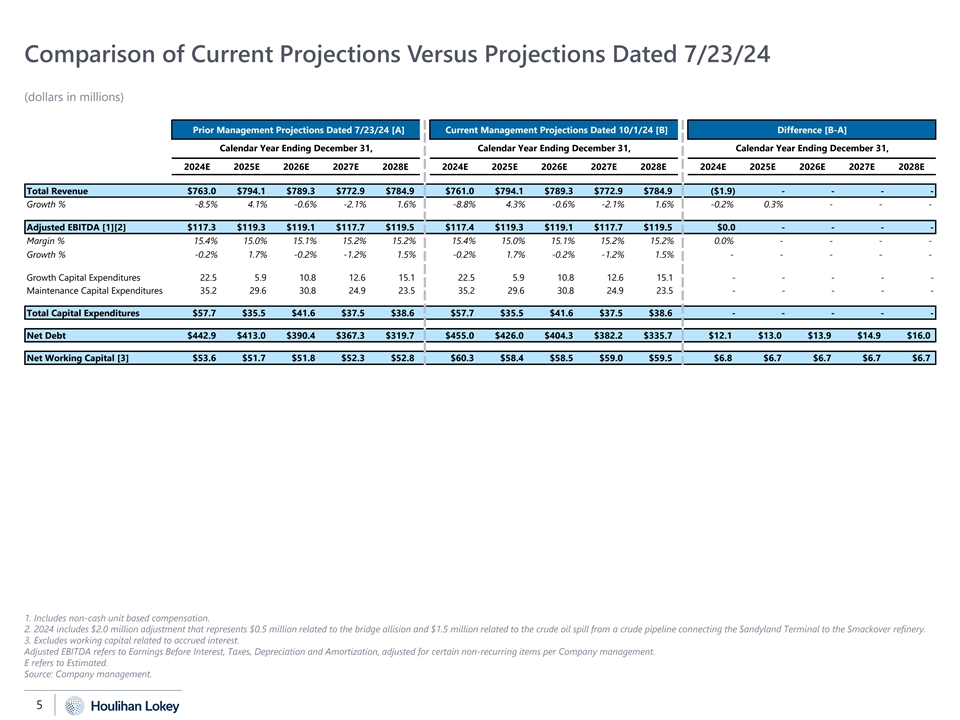

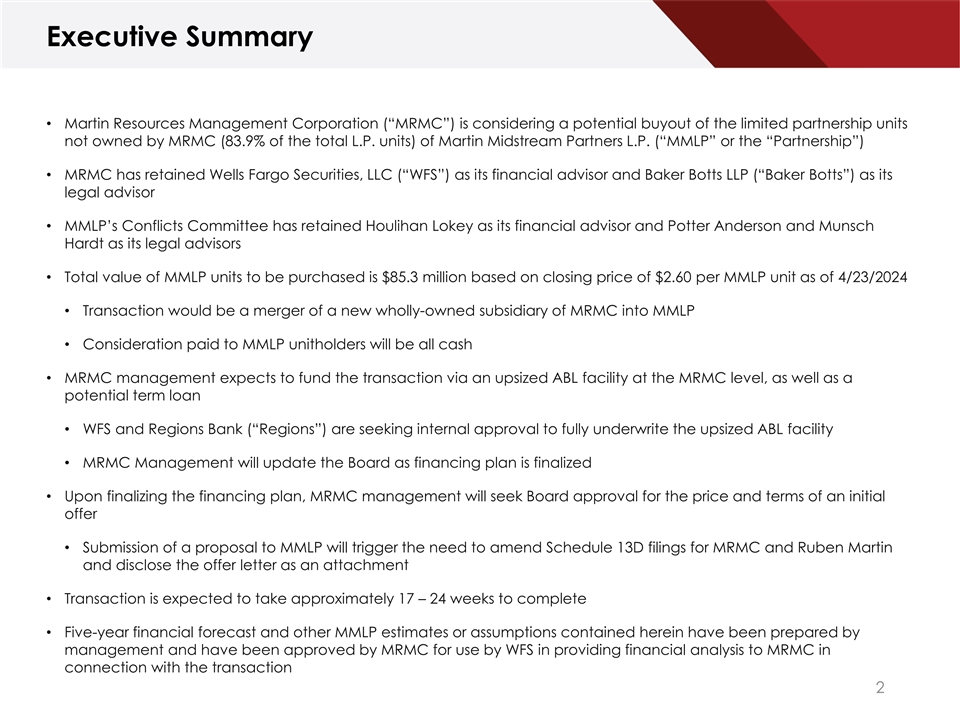

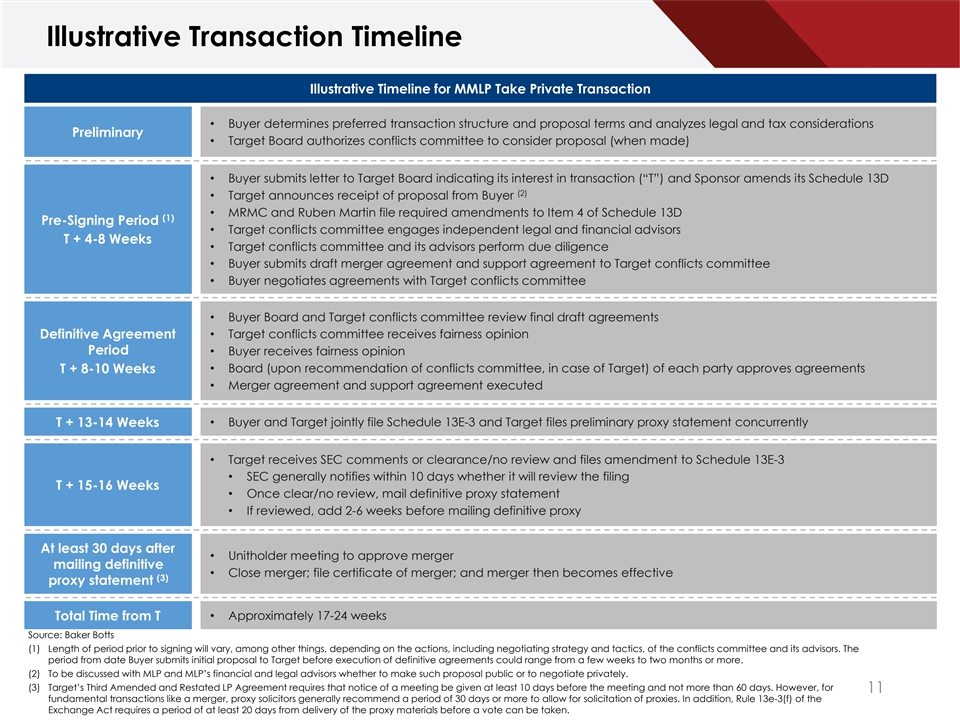

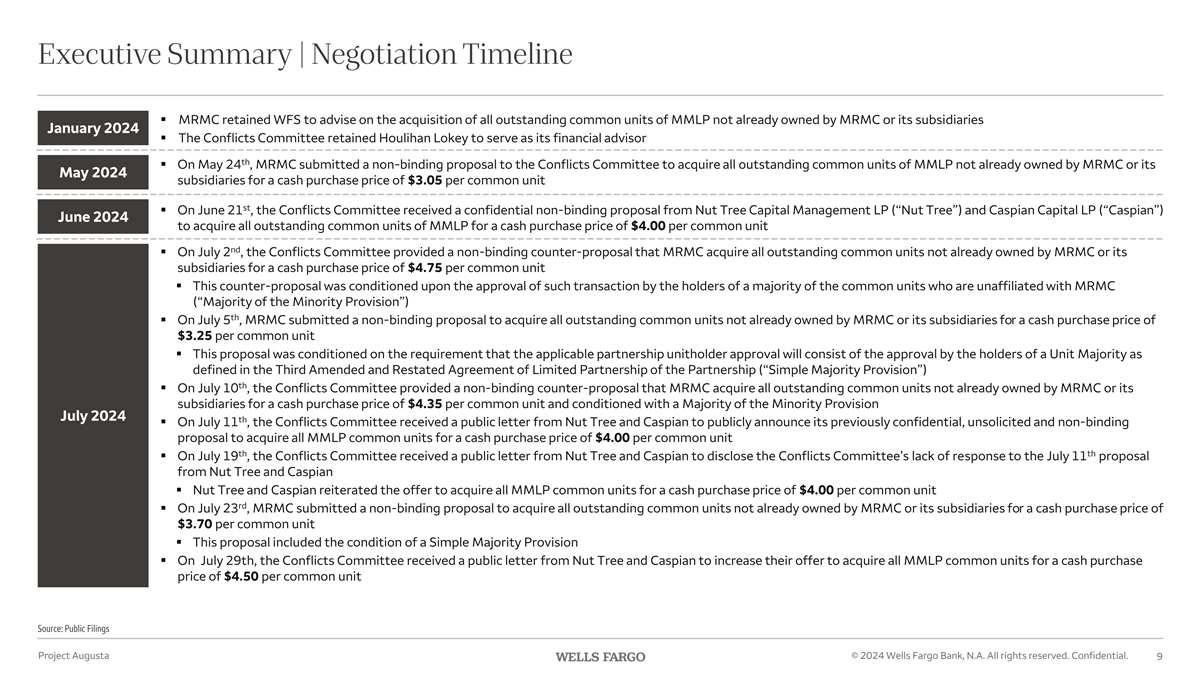

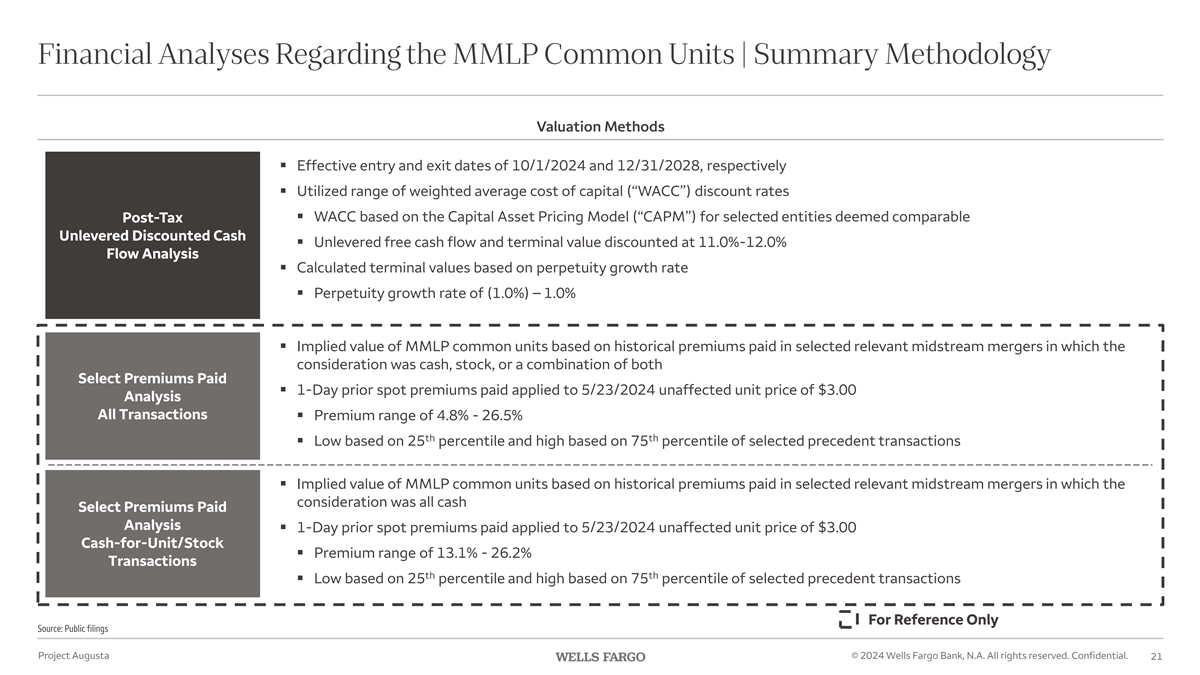

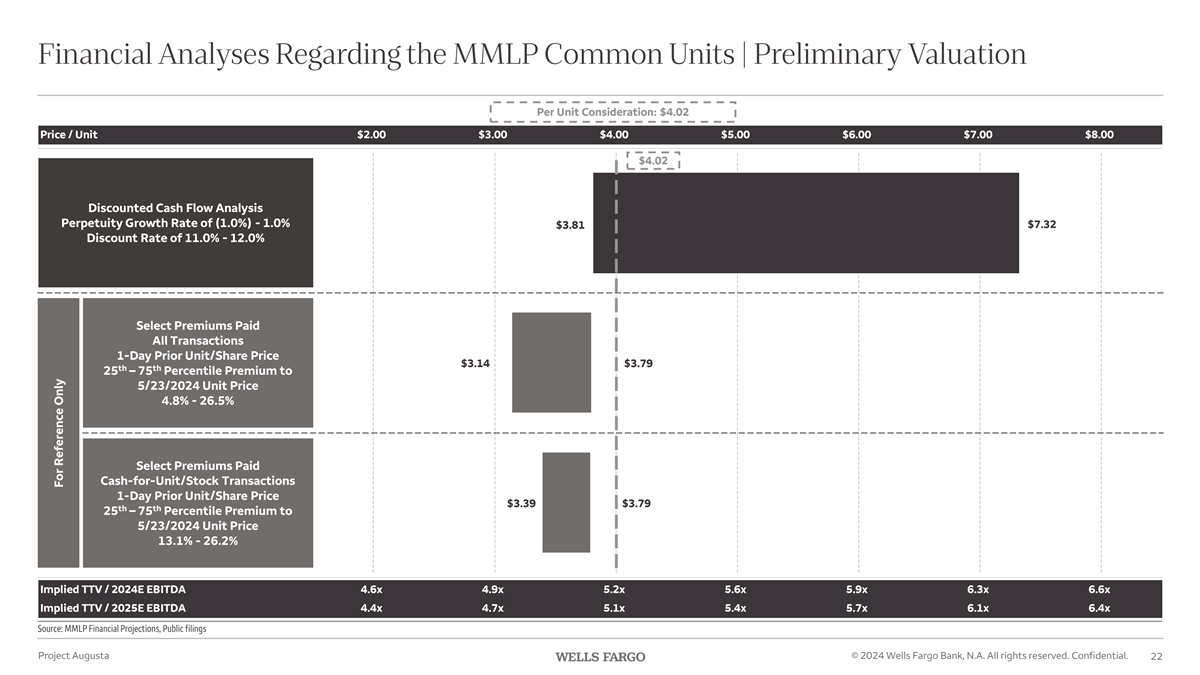

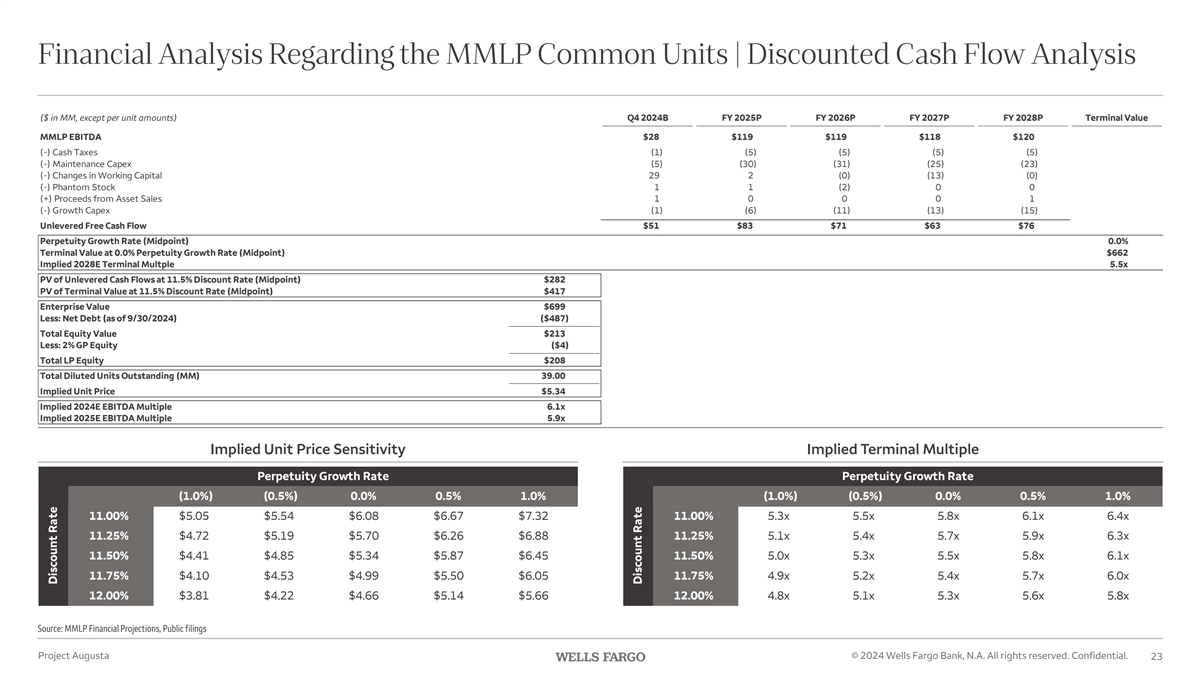

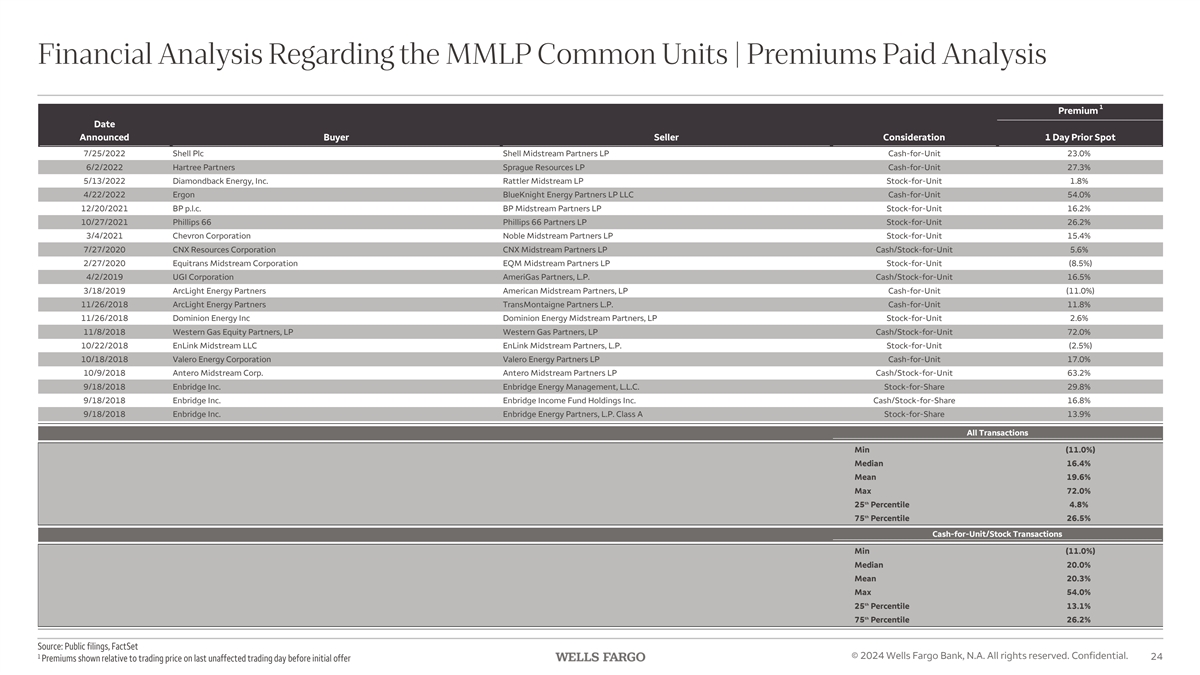

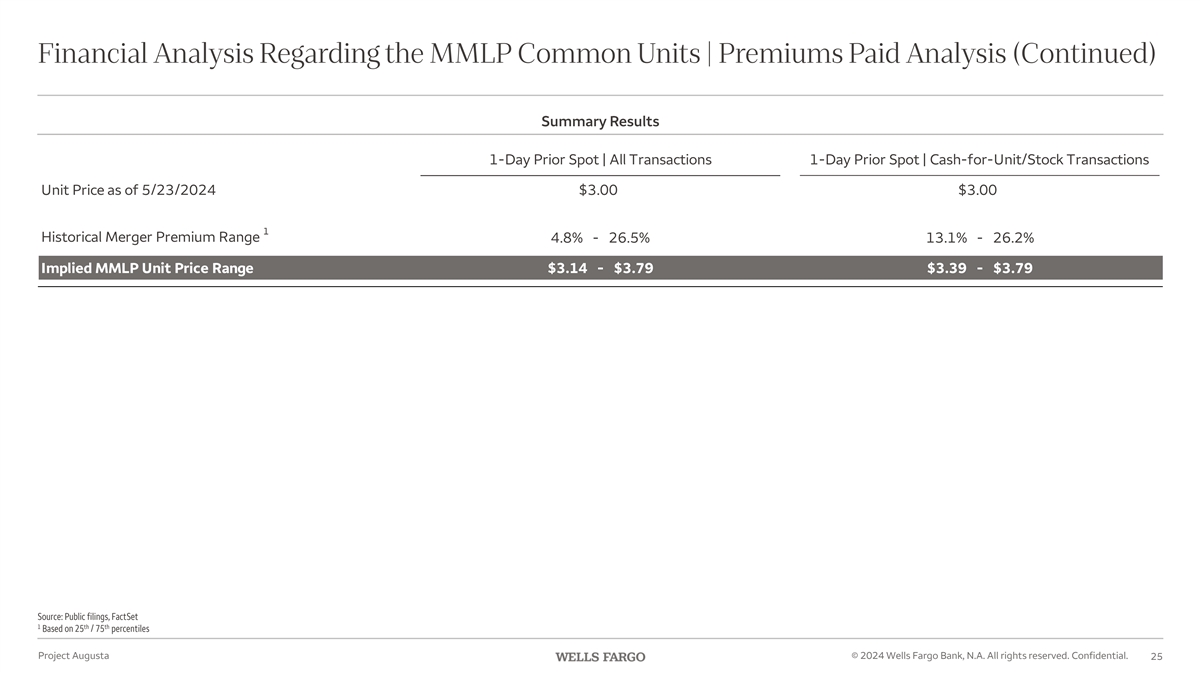

The discussion and/or presentation materials prepared by Houlihan Lokey, Inc. and provided to the Conflicts Committee, dated June 14, 2024, June 21,

2024, July 1, 2024, July 8, 2024, July 12, 2024, July 30, 2024, August 2, 2024 and October 3, 2024, are set forth as Exhibits (c)(2)–(c)(9), respectively, hereto and are incorporated herein by reference. The

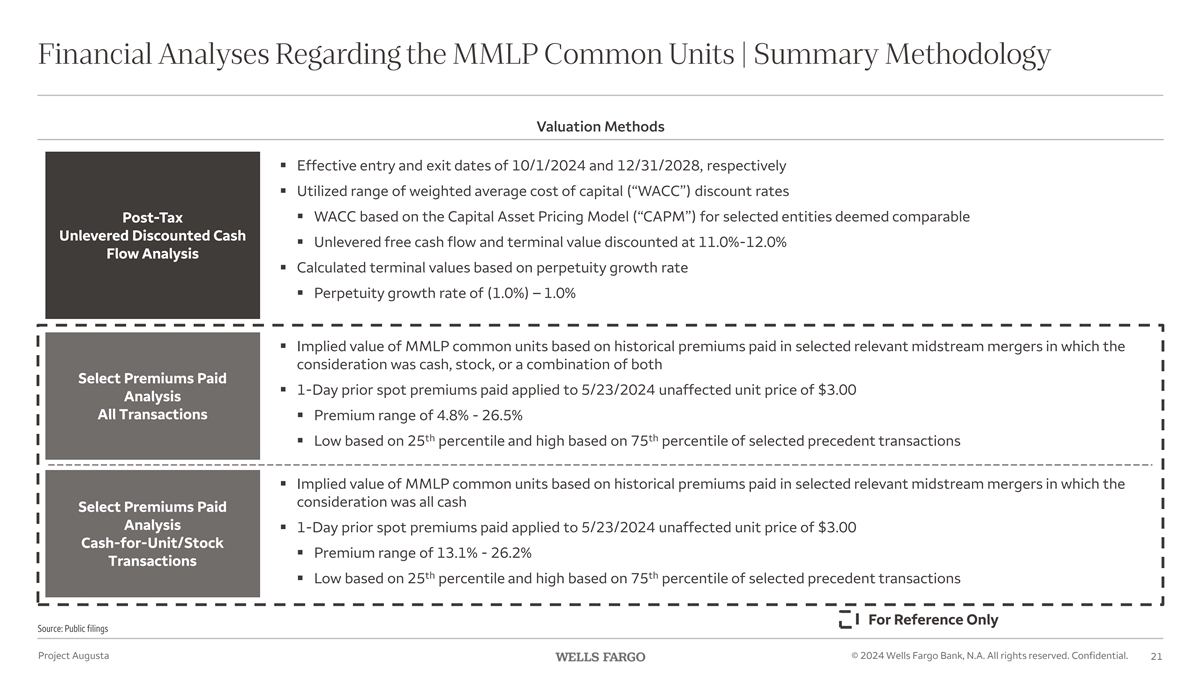

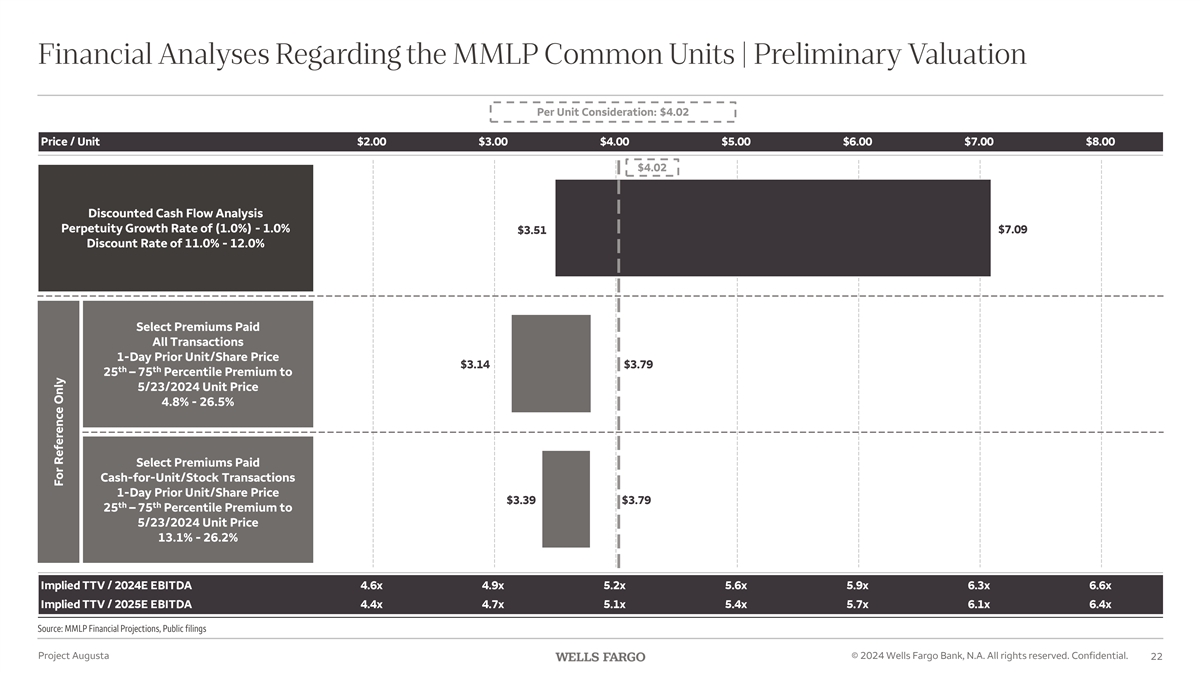

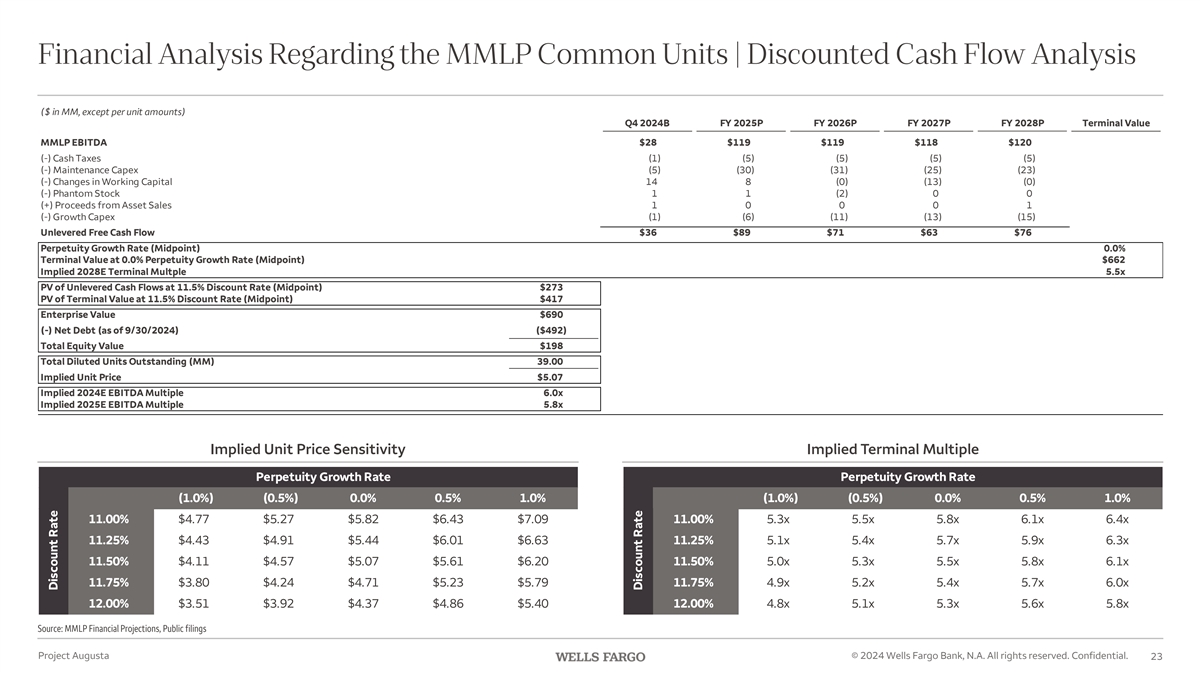

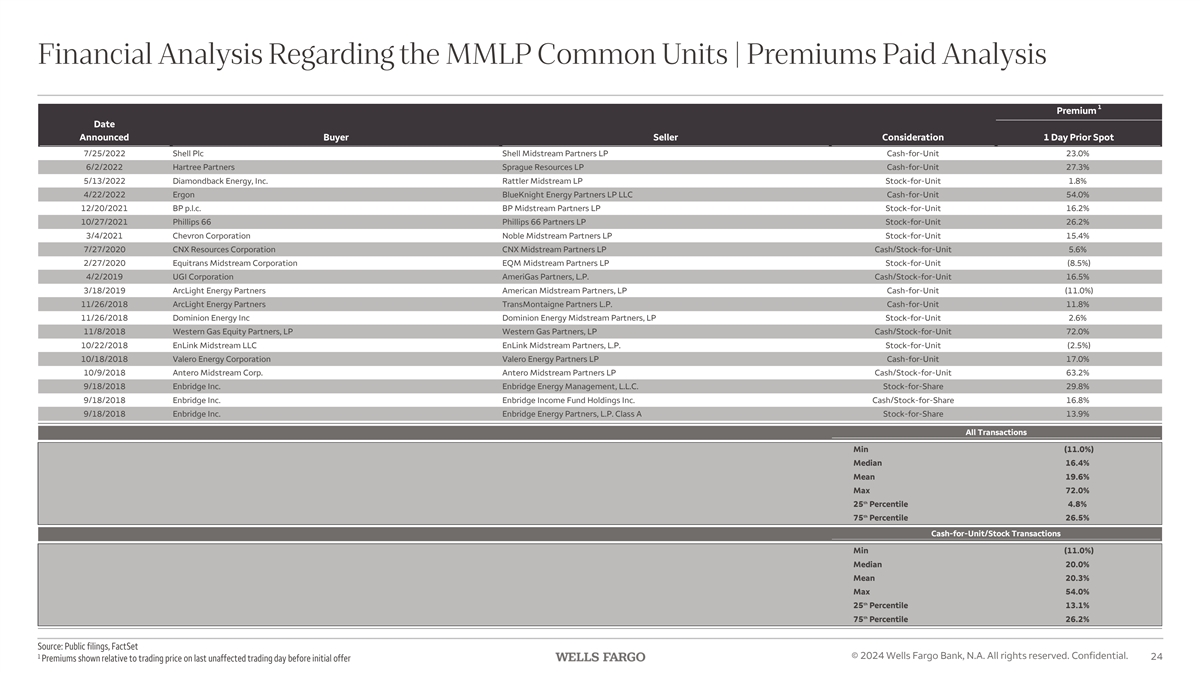

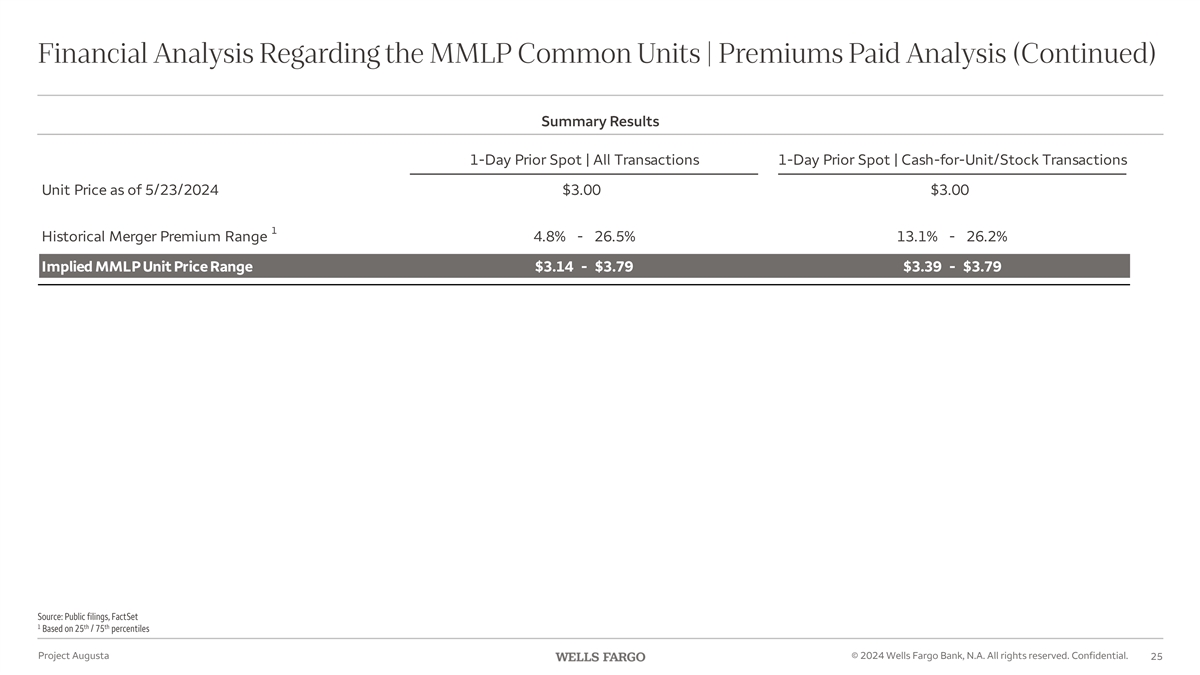

discussion and/or presentation materials prepared by Wells Fargo Securities, LLC and provided to Parent, dated April 25, 2024, May 24, 2024, October 1, 2024 and October 3, 2024, are set forth as Exhibits (c)(11)–(14) hereto

and are incorporated herein by reference. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special

Factors—Background of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for

Recommending Approval of the Merger Proposal”

“Special Factors—Houlihan Lokey Opinion to the Conflicts Committee”

“Special Factors—Wells Fargo Opinion to Parent”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filing Parties for the Merger”

“Proposal No. 1 The Merger Proposal”

“Annex F: Houlihan Fairness Opinion”

“Annex G: Wells Fargo Fairness Opinion”

(c) Availability of Documents.

The

reports, opinions or appraisals referenced in this Item 9 are filed herewith and will be made available for inspection and copying at the principal executive offices of the Partnership during its regular business hours by any interested holder of

Common Units.

ITEM 10. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

Regulation M-A, Item 1007

(a) Source of Funds.

The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Financing of the Merger”

“Special Factors—Fees and Expenses”

(b) Conditions.

The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Financing of the Merger”

“Proposal No. 1 The Merger Proposal”

(c) Expenses.

The information set

forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Financing of the Merger”

“Special Factors—Fees and Expenses”

“Proposal No. 1 The Merger Proposal”

(d) Borrowed Funds.

The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Financing of the Merger”

ITEM 11. INTEREST IN SECURITIES OF THE SUBJECT COMPANY

Regulation M-A, Item 1008

(a) Securities Ownership.

The

information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Common Unit Ownership”

(b) Securities Transactions.

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Certain Purchases and Sales of Common Units and Prior Public Offerings”

ITEM 12. THE SOLICITATION OR RECOMMENDATION

Regulation M-A, Item 1012

(a) Solicitation or Recommendation.

Not required by Schedule 13E-3.

(b) Reasons.

Not required by

Schedule 13E-3.

(c) Intent to Tender.

Not required by Schedule 13E-3.

(d) Intent to Tender or Vote in a Going-Private Transaction.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers About the Merger and the Special Meeting”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for

Recommending Approval of the Merger Proposal”

“Special Factors—The Support Agreements”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Buyer Filling Parties for the Merger”

“The Partnership Special Meeting—Voting by Directors and Executive Officers of the General Partner”

“The Partnership Special Meeting—Voting by Buyer Filing Parties”

“Proposal No. 1 The Merger Proposal”

“Annex B: Support Agreement (Buyer Filing Parties)”

“Annex C: Support Agreement (Senterfitt)”

“Annex D: Support Agreement (R. Bondurant)”

“Annex E: Support Agreement (R. Martin)”

(e) Recommendations of Others.

The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Merger and the Special Meeting”

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors—Position of the Buyer Filing Parties as to the Fairness of the Merger”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in the Merger”

“The Partnership Special Meeting—Recommendation of the Conflicts Committee”

“The Partnership Special Meeting—Recommendation of the GP Board”

“Proposal No. 1 The Merger Proposal”

“Annex A: Agreement and Plan of Merger”

ITEM 13. FINANCIAL STATEMENTS

Regulation M-A, Item 1010

(a) Financial Information.

The information set forth under the caption “Where You Can Find More Information” in the Proxy Statement is incorporated herein by reference.

The Partnership’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and Quarterly

Reports on Form 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024 and September 30, 2024 are incorporated herein by reference.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Effects of the Merger”

“Important Information Regarding the Partnership—Historical Selected Financial Information”

“Important Information Regarding the Partnership—Book Value Per Common Unit”

(b) Pro Forma Information.

Not

applicable.

ITEM 14. PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED

Regulation M-A, Item 1009

(a) – (b) Solicitations or Recommendations; Employees or Corporate Assets.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and

Answers about the Merger and the Special Meeting”

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the Conflicts Committee and the GP Board; Reasons for Recommending Approval of the Merger Proposal”

“Special Factors — Houlihan Lokey Opinion to the Conflicts Committee”

“Special Factors—Fees and Expenses”

“The Partnership Special Meeting—Solicitation of Proxies”

ITEM 15. ADDITIONAL INFORMATION

Regulation M-A Item 1011

(a) Agreements, Regulatory Requirements and Legal Proceedings.

Not required by Schedule 13E-3.

(b) Golden Parachute Compensation.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special

Factors—Effects of the Merger”

“Special Factors—Interests of the Directors and Executive Officers of the General Partner in

the Merger”

“Proposal No. 1 The Merger Proposal”

(c) Other Material Information.

The

information set forth in the Proxy Statement, including all annexes thereto, is incorporated herein by reference.

ITEM 16. EXHIBITS

Regulation M-A, Item 1016

|

|

|

Exhibit

No. |

|

Description |

|

|

| (a)(1) |

|

Proxy Statement of Martin Midstream Partners L.P. (incorporated herein by reference to Martin Midstream Partners’ Proxy Statement on Schedule 14A filed concurrently with the SEC). |

|

|

| (a)(2) |

|

Letter to Unitholders (incorporated herein by reference to the Proxy Statement filed herewith as Exhibit (a)(1)). |

|

|

| (a)(3) |

|

Notice of Special Meeting of Unitholders (incorporated herein by reference to the Proxy Statement filed herewith as Exhibit (a)(1)). |

|

|

| (a)(4) |

|

Press release issued by Martin Midstream Partners L.P., dated October

3, 2024 (incorporated by reference to Exhibit 99.1 to Martin Midstream Partners L.P.’s Current Report on Form 8-K filed on October 3, 2024). |

|

|

| (a)(5) |

|

Employee Letter, dated October

3, 2024 (incorporated by reference to Exhibit 99.2 to Martin Midstream Partners L.P.’s Current Report on Form 8-K filed on October 3, 2024). |

|

|

| (a)(6) |

|

Earnings Call Transcript, dated October 17, 2024 (included in Schedule 14A filed on October

18, 2024 and incorporated herein by reference). |

|

|

| (b)(1) |

|

Debt Commitment Letter, dated October 25, 2024, by and among Martin Resource Management Corporation, Regions Bank and Regions Capital Markets, a division of Regions Bank. |

|

|

| (c)(1) |

|

Opinion of Houlihan Lokey, Inc. to the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P., dated October 3, 2024 (incorporated herein by reference to Annex F to the Proxy Statement filed herewith as

Exhibit (a)(1)). |

|

|

| (c)(2) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated June 14, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

| (c)(3) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated June 21, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

| (c)(4) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated July 1, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

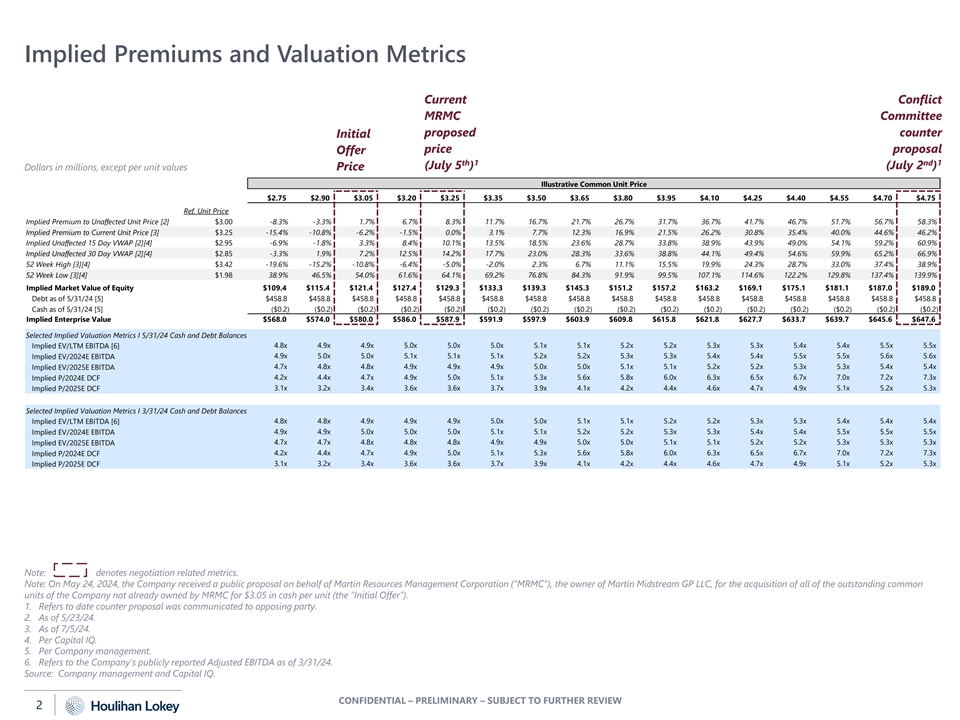

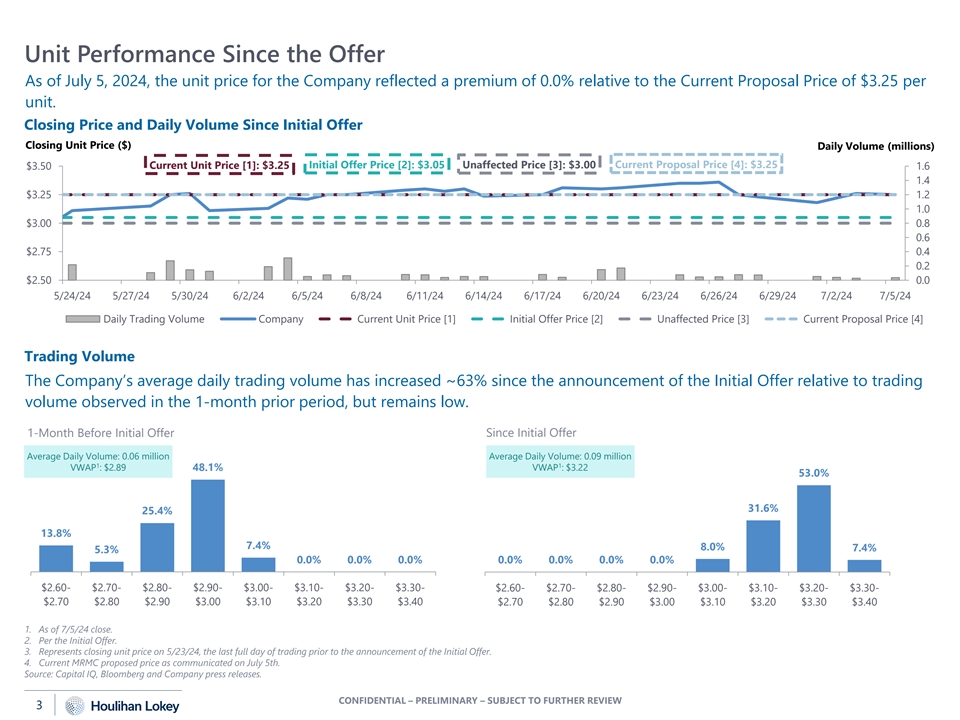

| (c)(5) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated July 8, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

| (c)(6) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated July 12, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

| (c)(7) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated July 30, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

| (c)(8) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated August 2, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

| (c)(9) |

|

Discussion materials prepared by Houlihan Lokey, Inc., dated October 3, 2024, for the Conflicts Committee of the Board of Directors of Martin Midstream Partners L.P. |

|

|

| (c)(10) |

|

Opinion of Wells Fargo Securities, LLC to Martin Resource Management Corporation, dated October 3, 2024 (incorporated herein by reference to Annex G to the Proxy Statement filed herewith as Exhibit (a)(1)). |

|

|

| (c)(11) |

|

Discussion materials prepared by Wells Fargo Securities, LLC, dated April 25, 2024, for Martin Resource Management Corporation. |

|

|

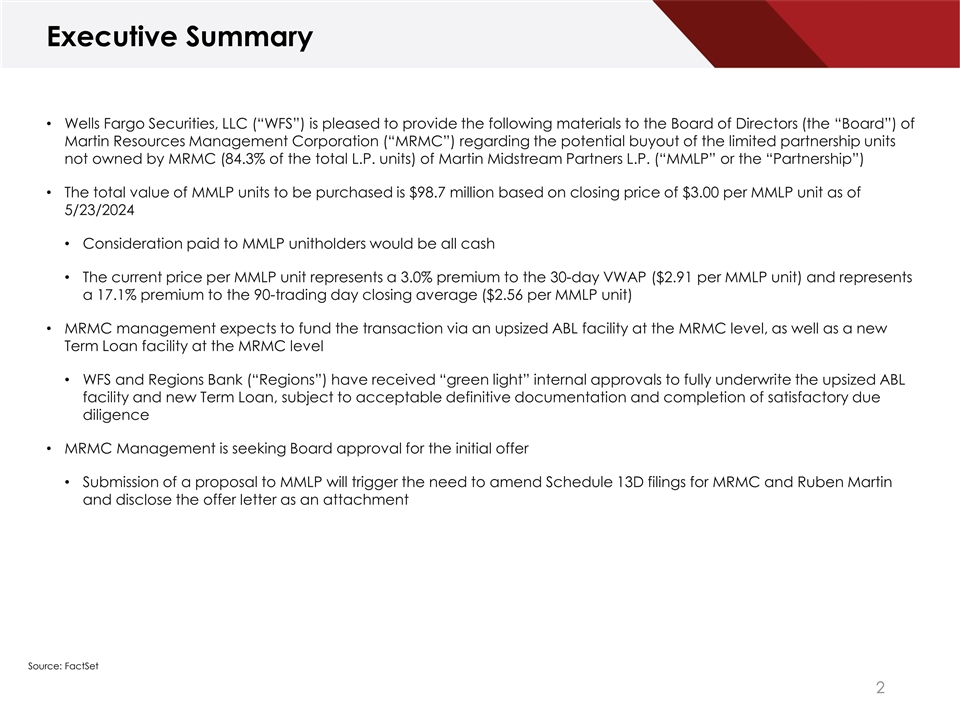

| (c)(12) |

|

Discussion materials prepared by Wells Fargo Securities, LLC, dated May 24, 2024, for Martin Resource Management Corporation. |

|

|

|

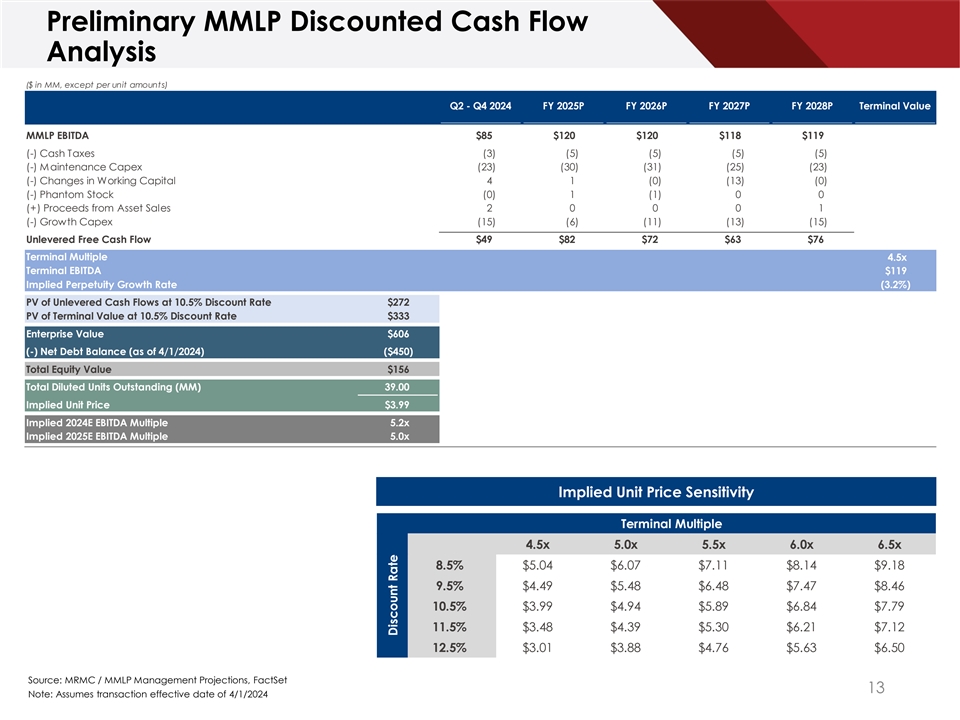

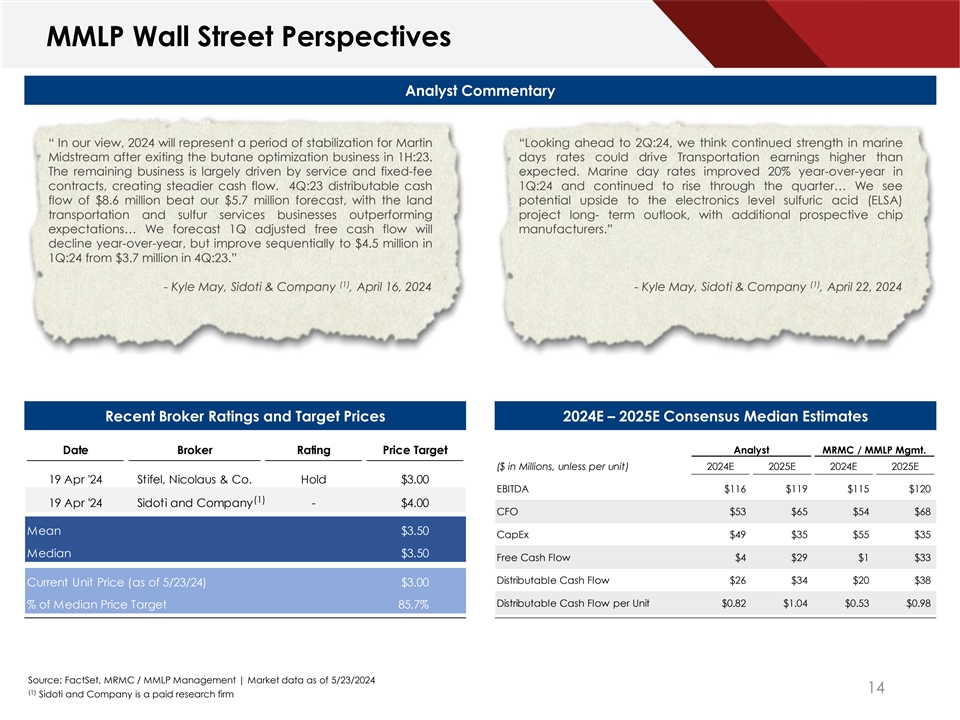

| (c)(13) |

|

Discussion materials prepared by Wells Fargo Securities, LLC, dated October 1, 2024, for Martin Resource Management Corporation. |

|

|

| (c)(14) |

|

Discussion materials prepared by Wells Fargo Securities, LLC, dated October 3, 2024, for Martin Resource Management Corporation. |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated as of October 3, 2024, by and among Martin Resource Management Corporation, MRMC Merger Sub LLC, Martin Midstream Partners L.P. and Martin Midstream GP LLC (incorporated herein by reference

to Annex A to the Proxy Statement filed herewith as Exhibit (a)(1)). |

|

|

| (d)(2) |

|

Support Agreement, dated as of October 3, 2024, by and between Martin Midstream Partners L.P., Martin Resource Management Corporation, Martin Resource LLC, Cross Oil Refining & Marketing, Inc. and Martin Product Sales

LLC (incorporated herein by reference to Annex B to the Proxy Statement filed herewith as Exhibit (a)(1)). |

|

|

| (d)(3) |

|

Support Agreement, dated as of October 3, 2024, by and between Martin Midstream Partners L.P. and Senterfitt Holdings Inc. (incorporated herein by reference to Annex C to the Proxy Statement filed herewith as Exhibit

(a)(1)). |

|

|

| (d)(4) |

|

Support Agreement, dated as of October 3, 2024, by and between Martin Midstream Partners L.P. and Robert D. Bondurant (incorporated herein by reference to Annex D to the Proxy Statement filed herewith as Exhibit

(a)(1)). |

|

|

| (d)(5) |

|

Support Agreement, dated as of October 3, 2024, by and between Martin Midstream Partners L.P. and Ruben S. Martin, III (incorporated herein by reference to Annex E to the Proxy Statement filed herewith as Exhibit

(a)(1)). |

|

|

| (f)(1) |

|

Third Amended and Restated Agreement of Limited Partnership of the Partnership, dated November

23, 2021 (filed as Exhibit 3.2 to the Partnership’s Current Report on Form 8-K, filed November 29, 2021, and incorporated herein by reference). |

|

|

| (f)(2) |

|

Delaware Code Title 6 § 17-212. |

|

|

| 107 |

|

Filing Fee Table. |

SIGNATURES

After due inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the

information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

| Dated as of October 25, 2024 |

|

|

|

MARTIN MIDSTREAM PARTNERS L.P. |

|

|

|

|

|

|

|

By: MARTIN MIDSTREAM GP, LLC |

|

|

|

|

its general partner |

|

|

|

|

|

|

|

|

By: |

|

/s/ Robert D. Bondurant |

|

|

|

|

Name: |

|

Robert D. Bondurant |

|

|

|

|

Title: |

|

President and Chief Executive Officer |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

MARTIN RESOURCE MANAGEMENT CORPORATION |

|

|

|

|

|

|

|

|

By: |

|

/s/ Sharon L. Taylor |

|

|

|

|

Name: |

|

Sharon L. Taylor |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

MMGP HOLDINGS LLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Robert D. Bondurant |

|

|

|

|

Name: |

|

Robert D. Bondurant |

|

|

|

|

Title: |

|

Chief Executive Officer |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

MARTIN MIDSTREAM GP, LLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Robert D. Bondurant |

|

|

|

|

Name: |

|

Robert D. Bondurant |

|

|

|

|

Title: |

|

Chief Executive Officer |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

MRMC MERGER SUB LLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Sharon L. Taylor |

|

|

|

|

Name: |

|

Sharon L. Taylor |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

MARTIN RESOURCE LLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Sharon L. Taylor |

|

|

|

|

Name: |

|

Sharon L. Taylor |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

CROSS OIL REFINING & MARKETING, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Sharon L. Taylor |

|

|

|

|

Name: |

|

Sharon L. Taylor |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

MARTIN PRODUCT SALES LLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Sharon L. Taylor |

|

|

|

|

Name: |

|

Sharon L. Taylor |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

| Dated as of October 25, 2024 |

|

|

|

SENTERFITT HOLDINGS INC. |

|

|

|

|

|

|

|

/s/ Ruben S. Martin, III |

|

|

|

|

Name: |

|

Ruben S. Martin, III |

|

|

|

|

Title: |

|

President |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

RUBEN S. MARTIN, III |

|

|

|

|

|

|

|

/s/ Ruben S. Martin, III |

|

|

|

|

Ruben S. Martin, III |

|

|

|

| Dated as of October 25, 2024 |

|

|

|

ROBERT D. BONDURANT |

|

|

|

|

|

|

|

/s/ Robert D. Bondurant |

|

|

|

|

Robert D. Bondurant |

Exhibit (b)(1)

October 25, 2024

Martin Resource Management Corporation

4200 B Stone Road

Kilgore, TX 75662

Attn: Sharon Taylor

| Re: |

$200,000,000 Senior Secured Credit Facility |

Dear Sharon:

You, Martin Resource

Management Corporation (“you” or the “Borrower”) have advised us, Regions Bank and Regions Capital Markets, a division of Regions Bank (“RCM” and, together with Regions Bank, “us,”

“we,” or “Regions”) that the Borrower desires to enter into a senior secured credit facility in an aggregate the principal amount of up to $200,000,000 (the “Senior Credit Facility”), as more fully

described in the Summary of Principal Terms and Conditions attached hereto as Annex I and by reference made a part hereof (the “Term Sheet;” and together with this letter, the “Commitment Letter”). Regions

understands that the proceeds of the Senior Credit Facility will be used to (i) consummate the acquisition (the “Acquisition”) pursuant to an acquisition agreement by and among the Borrower or certain of its subsidiaries and

the sellers (together with all exhibits, schedules, and disclosure letters thereto, collectively, the “Acquisition Agreement”) for the purchase of the equity interests of Martin Midstream Partners L.P. (the

“Target”) not already owned, directly or indirectly, by the Borrower, (ii) to pay transaction fees, costs and expenses related to the Senior Credit Facility and the Acquisition, and (iii) to fund the ongoing working

capital and general corporate needs of the Borrower and its subsidiaries. The date on which definitive credit documentation evidencing the Senior Credit Facility closes is referred to as the “Closing Date”. The Acquisition, the

entering into and funding of the Senior Credit Facility and all related transactions are hereinafter collectively referred to as the “Transaction”.

In connection with the foregoing, you have requested that: (i) Regions Bank agree to serve as the sole and exclusive administrative agent

(in such capacity, the “Administrative Agent”) for the Senior Credit Facility and provide a commitment to lend up to $200,000,000 of the Senior Credit Facility and (ii) RCM serve as lead arranger and book runner (in such

capacities, the “Lead Arranger”) for the Senior Credit Facility, and in such capacities to form a syndicate of financial institutions (together with Regions Bank, the “Lenders”) reasonably acceptable to you for the

Senior Credit Facility.

Subject to the terms and conditions in this Commitment Letter (including the Term Sheet), Regions Bank is pleased

to confirm its commitment to extend up to $200,000,000 of the Senior Credit Facility to you and its willingness to act as Administrative Agent for the Senior Credit Facility. RCM is also pleased to confirm its willingness to act as Lead Arranger for

the Senior Credit Facility.

Martin Resource Management Corporation

October 25, 2024

Page

2

| A. |

Terms and Conditions of the Senior Credit Facility |

The principal terms and conditions of the Senior Credit Facility shall include those set forth in the Term Sheet. In addition, the Lead

Arranger, on behalf of the Lenders, may require certain other customary terms and conditions found in a credit facility of this type, which may not be specifically listed in the Term Sheet.

| B. |

Syndication and Other Commitments |

The obligations of Regions and Regions Bank are not conditioned on the syndication of the Senior Credit Facility to any other Lenders,

provided that Wells Fargo Bank, National Association (or an affiliate thereof) (“Wells Fargo”) assumes $100,000,000 of Regions’ commitment to the Senior Credit Facility, and actually funds such commitment at closing.

Regions confirms that it has received a commitment letter from Wells Fargo for up to $100,000,000 of the Senior Credit Facility.

Certain fees payable to Regions in connection with its obligations hereunder are set forth in that certain letter agreement, dated the date

hereof, executed by Regions and acknowledged and agreed to by the Borrower (the “Fee Letter”). The obligations of Regions pursuant to this Commitment Letter are subject to the execution and delivery of the Fee Letter by the

Borrower, which Fee Letter constitutes an integral part of this Commitment Letter.

The undertakings and obligations of Regions under this Commitment Letter are subject to: (i) the preparation, execution and delivery of

mutually acceptable credit documentation, including a credit agreement incorporating substantially the terms and conditions outlined in this Commitment Letter; (ii) the absence of a material adverse change in the business, condition (financial

or otherwise), operations, liabilities (contingent or otherwise), properties or prospects of the Borrower and its subsidiaries or affiliates, taken as a whole as reflected in the respective consolidated financial statements of the Borrower as of

December 31, 2023; (iii) the accuracy of all representations that you or your affiliates make to Regions (including those in Section E below) and all information that the Borrower furnishes to Regions; (iv) the absence of

(x) any information or other matter being disclosed after the date hereof and (y) Regions becoming aware of any information, that, in either case is inconsistent in a material and adverse manner with any information or other material

disclosed to Regions; (v) the completion, and the Borrower’s reasonable cooperation in connection with, our legal, tax, accounting, business, financial, environmental and ERISA due diligence concerning the Borrower and its subsidiaries,

and Regions’ satisfaction in all material respects with the results thereof; (vi) the payment in full of all fees, expenses and other amounts payable hereunder and under the Fee Letter; (vii) the compliance by you with the provisions

of this Commitment Letter; (viii) an initial closing of the Senior Credit

Martin Resource Management Corporation

October 25, 2024

Page

3

Facility on or prior to December 31, 2024; (ix) Wells Fargo assumes $100,000,000 of Regions’ commitments for the Senior Credit Facility on the terms and conditions referred to herein

and in the Term Sheet, (x) internal credit approval of Regions Bank and (xi) the satisfaction of any other conditions set forth in the Term Sheet.

The Borrower represents, warrants and covenants to Regions that (i) all financial statements and other written information that has been

or will be made available to Regions by the Borrower or any of its representatives (or on your or their behalf) in connection with any aspect the transactions contemplated by this Commitment Letter (the “Information”), other than

any Projections, defined below, and information of a general economic or industry specific nature is or will be, when furnished, complete and correct in all material respects and does not or will not, when furnished, contain any untrue statement of

a material fact or omit to state a material fact necessary in order to make the statements contained therein not misleading; (ii) all financial projections concerning the Borrower and its subsidiaries and/or the Target and its subsidiaries that

have been or are hereafter made available to Regions or the Lenders by you or any of your representatives (or on your or their behalf) (the “Projections”) have been or will be prepared in good faith based upon assumptions believed

by you to be reasonable at the time such Projections were made. The Borrower agrees to supplement the Information and the Projections from time to time until the Closing Date so that the representations and warranties contained in this Section

E remain correct. In issuing this commitment and in arranging and syndicating the Senior Credit Facility, Regions shall be entitled to use and rely on the accuracy of the Information and the Projections without responsibility for independent

verification thereof. Each of the parties hereto represents and warrants that this Commitment Letter has been duly authorized by, and validly executed and delivered by, such party.

The Borrower authorizes Regions to use and share with its representatives all credit and other confidential or

non-public information regarding the Borrower to the extent permitted by applicable laws and regulations and for the purpose of performing its obligations under this Commitment Letter and the Senior Credit

Facility.

| F. |

Indemnities, Expenses, Etc. |

1. Indemnification. The Borrower agrees to indemnify and hold harmless Regions, each other Lender and each of their

respective affiliates, directors, officers, employees, agents, representatives, legal counsel, and consultants (each, an “Indemnified Person”) against, and to reimburse each Indemnified Person upon its demand for, any losses,

claims, damages, liabilities or other expenses of any kind or nature (“Losses”) incurred by such Indemnified Person or asserted against such Indemnified Person by any third party or by the Borrower or any of its subsidiaries,

insofar as such Losses arise out of or in any way relate to or result from this Commitment Letter, the Fee Letter, the financings and other transactions contemplated by this Commitment Letter (including, without limitation, the performance by any

Indemnified Person of its obligations hereunder) or the use of the proceeds of the Senior Credit Facility, including, without limitation, (i) all Losses arising out of any legal proceeding relating to any of the foregoing (whether or not such

Indemnified Person is a party thereto) and (ii) Losses that arise out of untrue statements made

Martin Resource Management Corporation

October 25, 2024

Page

4

or statements omitted to be made by the Borrower, or with the Borrower’s consent or in conformity with the Borrower’s actions or omissions), in each case whether or not such Indemnified

Person is a party to any such proceeding; provided that the Borrower shall not be liable pursuant to this indemnity for any Losses to the extent that a court having competent jurisdiction shall have determined by a final judgment (not subject to

further appeal) that such Loss resulted from the gross negligence or willful misconduct of such Indemnified Person. The Borrower also agrees that no Indemnified Person shall have any liability (whether direct or indirect, in contract or tort or

otherwise) to the Borrower or its subsidiaries or affiliates or to its respective equity holders or creditors arising out of, related to or in connection with any aspect of the transactions contemplated hereby, except to the extent of direct, as

opposed to special, indirect, consequential or punitive, damages determined in a final, non-appealable judgment by a court of competent jurisdiction to have resulted from such Indemnified Person’s gross

negligence or willful misconduct. Notwithstanding any other provision of this Commitment Letter, no Indemnified Person shall be liable for any damages arising from the use by others of information or other materials obtained through electronic

telecommunications or other information transmission systems, other than for direct or actual damages resulting from the gross negligence or willful misconduct of such Indemnified Person as determined by a final and nonappealable judgment of a court

of competent jurisdiction. The Borrower shall not, without the prior written consent of any Indemnified Person, effect any settlement of any pending or threatened proceeding in respect of which such Indemnified Person is a party and indemnity has

been sought hereunder by such Indemnified Person, unless such settlement includes an unconditional release of such Indemnified Person from all liability on claims that are the subject matter of such indemnity.

2. Expenses. In further consideration of the commitments and undertakings of Regions hereunder, and recognizing that in

connection herewith Regions will be incurring certain costs and expenses (including, without limitation, fees and disbursements of legal counsel, and costs and expenses for due diligence, syndication, transportation, duplication, mailings, messenger

services, dedicated web page on the internet for the transactions contemplated by this Commitment Letter, appraisal, audit, and insurance), the Borrower hereby agrees to pay (or cause to be paid), or to reimburse (or cause to be reimbursed) Regions

promptly after request for, all such reasonable and documented out-of-pocket costs and expenses (whether incurred before or after the date hereof), regardless of whether

any of the transactions contemplated hereby are consummated. The Borrower also agrees to pay all costs and expenses of Regions (including, without limitation, fees and disbursements of legal counsel) incurred in connection with the enforcement of

any of its rights and remedies hereunder.

1. Effectiveness. This Commitment Letter shall constitute a binding obligation of Regions for all purposes immediately upon

the acceptance hereof by the Borrower in the manner specified below. Notwithstanding any other provision of this Commitment Letter, the commitments and undertakings of Regions set forth herein shall not be or become effective for any purpose unless

and until this Commitment Letter and the Fee Letter shall have been accepted by the Borrower in the manner specified below.

Martin Resource Management Corporation

October 25, 2024

Page

5

2. Termination. Unless this Commitment Letter and the Fee Letter have

been executed by the Borrower and delivered to Regions prior to 5:00 p.m., central standard time, on October 31, 2024, all commitments and obligations of Regions under this Commitment Letter shall terminate on such date. If this Commitment

Letter and the Fee Letter are executed and delivered by the Borrower to Regions, in accordance with the preceding sentence, all commitments and undertakings of Regions hereunder shall terminate on the earliest of (a) December 31, 2024,

unless the definitive credit agreement and other legal documents related to the Senior Credit Facility have been executed and delivered on or prior to such date (it being agreed that the parties hereto will work diligently to achieve this

schedule) (b) the closing of the Acquisition without the use of the Senior Credit Facility and (c) the acceptance by you or any of your affiliates of an offer for all or any substantial part of the capital stock or property and assets of

the Target and its subsidiaries other than as part of the Transaction. In consideration of the time and resources that Regions will devote to the Senior Credit Facility, you agree that, until such expiration, you will not solicit, initiate,

entertain or permit, or enter into any discussions in respect of, any offering, placement or arrangement of any competing Senior Credit Facility or facilities for the Borrower and its subsidiaries of affiliates. The commitments and undertakings of

Regions may be terminated by Regions if the Borrower fails to perform its obligation under this Commitment Letter and the Fee Letter on a timely basis.

3. No Third-Party Beneficiaries. This Commitment Letter is solely for the benefit of the Borrower, Regions and the

Indemnified Persons; no provision hereof shall be deemed to confer rights on any other person or entity.

4. No

Assignment; Amendment. This Commitment Letter and the Fee Letter may not be assigned by the Borrower or Regions to any other person or entity; provided, that, without limiting the foregoing restriction, all of the obligations of the Borrower

hereunder and under the Fee Letter shall be binding upon the successors and assigns of the Borrower and Regions, respectively. No amendment, waiver or modification of any provision hereof shall in any event be effective unless in writing and signed

by the parties hereto and then only in the specific instance and for the specific purpose for which given. The section headings contained herein have been inserted as a matter of convenience of reference and are not part of this Commitment Letter.

5. Use of Name and Information. The Borrower agrees that any references to Regions or any of its affiliates made in

connection with the Senior Credit Facility are subject to the prior approval of Regions. Regions shall be permitted to use information related to the syndication and arrangement of the Senior Credit Facility in connection with marketing, press

releases or other transactional announcements or updates provided to investor or trade publications; including, but not limited to, the placement of “tombstone” advertisements in publications of its choice at its own expense.

6. GOVERNING LAW. THIS COMMITMENT LETTER AND THE FEE LETTER WILL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH

THE LAWS OF THE STATE OF GEORGIA WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS OF LAWS THEREOF.

Martin Resource Management Corporation

October 25, 2024

Page

6

7. WAIVER OF TRIAL BY JURY. TO THE EXTENT PERMITTED BY

APPLICABLE LAW, EACH OF THE BORROWER AND REGIONS WAIVES TRIAL BY JURY IN ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATED TO THIS COMMITMENT LETTER, THE FEE LETTER OR ANY OTHER DOCUMENTS CONTEMPLATED HEREBY. Each party hereto irrevocably and

unconditionally submits to the exclusive jurisdiction of any state court sitting in the City of Atlanta, State of Georgia or the United States District Court for the Northern District of Georgia for the purpose of any suit, action or proceeding

arising out of or relating to this Commitment Letter or the Fee Letter. Each party hereto irrevocably and unconditionally waives any objection to the laying of venue of any such suit, action or proceeding brought in any such court and any claim that

any such suit, action or proceeding has been brought in any such court and any claim that any such suit, action or proceeding has been brought in an inconvenient forum. A final judgment in any such suit, action or proceeding brought in any such

court may be enforced in any other courts to whose jurisdiction the Borrower or Regions are or may be subject, by suit upon judgment.

8. Survival. The obligations and agreements of the Borrower contained in the last paragraph of Section E, all of

Section F, and paragraphs 2, 6, 7, and 9 of this Section G shall survive the expiration and termination of this Commitment Letter.

9. Confidentiality. The Borrower will not disclose or permit disclosure of this Commitment Letter, the Fee Letter nor the

contents of the foregoing to any person or entity (including, without limitation, any lender other than Regions), either directly or indirectly, orally or in writing, except (i) to the Borrower’s officers, directors, accountants, agents

and legal counsel who are directly involved in the transactions contemplated hereby, in each case on a confidential basis, (ii) on a confidential basis to the board of directors and advisors of the seller and the Target in connection with their

consideration of the Transaction or (iii) as required by law (in which case the Borrower agrees to inform Regions promptly thereof); provided, however, it is understood and agreed that the Borrower may disclose this Commitment Letter (including

the Term Sheet) but not the Fee Letter after your acceptance of this Commitment Letter and the Fee Letter, in filings with the Securities and Exchange Commission and other applicable regulatory authorities and stock exchanges. Regions hereby

notifies the Borrower that pursuant to the requirements of the USA Patriot Act, Title III of Pub. L. 107-56 (signed into law October 26, 2001) (the “Patriot Act”), it and its affiliates

are required to obtain, verify and record information that identifies the Borrower, which information includes the name, address, tax identification number and other information regarding the Borrower that will allow Regions to identify the Borrower

in accordance with the Patriot Act. This notice is given in accordance with the requirements of the Patriot Act and is effective for Regions and its affiliates.

10. Counterparts. This Commitment Letter and the Fee Letter may be executed in any number of separate counterparts, each

of which shall collectively and separately constitute one agreement. Delivery by one or more parties hereto of an executed counterpart of this Commitment Letter or Fee Letter via facsimile, telecopy, DocuSign or other electronic method of

transmission pursuant to which the signature of such party can be seen (including Adobe Corporation’s Portable Document Format or PDF) shall have the same force and effect as the delivery of an original manually executed counterpart of this

Commitment Letter or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any Applicable Law,

Martin Resource Management Corporation

October 25, 2024

Page

7

including the Federal Electronic Signatures in Global and National Commerce Act, or any other similar state laws based on the Uniform Electronic Transactions Act. The words “execution,”

“signed,” “signature,” and words of like import in this Commitment Letter shall be deemed to include electronic signatures or the keeping of records in electronic form.

11. No Fiduciary Duty. The Borrower acknowledges and agrees that (i) the commitment to and syndication of the Senior

Credit Facility pursuant to this Commitment Letter are an arm’s-length commercial transaction between the Borrower, on the one hand, and Regions, on the other, and you are capable of evaluating and

understanding, and do understand and accept, the terms, risks and conditions of the transactions contemplated by this Commitment Letter, (ii) in connection with the transactions contemplated hereby and the process leading to such transactions,

Regions is and has been acting solely as a principal and is not the agent or fiduciary of the Borrower or its subsidiaries, affiliates, stockholders, creditors, employees or any other party, (iii) Regions has not assumed an advisory

responsibility or fiduciary duty in favor of the Borrower with respect to the transactions contemplated hereby or the process leading thereto (irrespective of whether Regions has advised or are currently advising the Borrower on other matters) and

Regions does not have any obligation to the Borrower except those expressly set forth in this Commitment Letter, (iv) Regions and its affiliates may be engaged in a broad range of transactions that involve interests that differ from those of

the Borrower and its affiliates, and Regions shall not have any obligation to disclose any of such interests by virtue of any fiduciary or advisory relationship as a consequence of this Commitment Letter, (v) Regions has not provided any legal,

accounting, regulatory or tax advice with respect to any of the transactions contemplated hereby and the Borrower has consulted its own legal, accounting, regulatory and tax advisors to the extent it deemed appropriate and (vi) Regions and its

affiliates may be engaged in a broad range of transactions that involve interests that differ from the Borrower’s and those of the Borrower’s affiliates and subsidiaries, and Regions has no obligation to disclose any of such interests to

the Borrower or its affiliates and subsidiaries. The Borrower waives and releases, to the fullest extent permitted by applicable law, any claims that it may have against Regions with respect to any breach or alleged breach of fiduciary duty as a

consequence of this Commitment Letter.

12. Entire Agreement. Upon acceptance by the Borrower as provided herein, this

Commitment Letter and the Fee Letter referenced herein shall supersede all understandings and agreements between the parties to this Commitment Letter in respect of the transactions contemplated hereby. Those matters that are not covered or made

clear herein or in the Term Sheet or the Fee Letter are subject to mutual agreement of the parties hereto and thereto.

Martin Resource Management Corporation

October 25, 2024

Page

8

We look forward to working with you on this important transaction.

|

|

|

| Very truly yours, |

|

| REGIONS BANK |

|

|

| By: |

|

/s/ Eric Morse |

| Name: |

|

Eric Morse |

| Title: |

|

Director |

|

| REGIONS CAPITAL MARKETS, A DIVISION OF REGIONS BANK |

|

|

| By: |

|

/s/ Ed Baran |

| Name: |

|

Ed Baran |

| Title: |

|

Director |

|

|

|

| ACCEPTED AND AGREED |

| this 25th day of October, 2024 |

|

| MARTIN RESOURCE MANAGEMENT CORPORATION |

|

|

| By: |

|

/s/ Sharon L. Taylor |

| Name: |

|

Sharon L. Taylor |

| Title: |

|

Executive Vice President and Chief Financial Officer |

Annex I

Term Sheet

[Attached]

|

|

|

|

|

| |

| MRMC Summary of Proposed

Terms |

| |

|

| Borrower |

|

Martin Resource Management Corporation and certain subsidiaries |

| |

|

| Facility |

|

$200MM Credit Facility including a Revolving Line of Credit of up to $200MM and a $20MM Term Loan. The

Revolving Line of Credit will be limited to $200MM less the outstanding balance of the Term Loan. |

| |

|

|

| Regions share of Facility |

|

$100MM |

|

|

| |

|

|

| Maturity |

|

June 27, 2027 |

|

|

| |

|

| Security |

|

All assets including 100% of MMLP partnership units. 84% of partnership units to be released as security

upon full repayment of the Term Loan. Subject to additional discussion either 1) Negative pledge on RE with option to perfect on RE assets subject to certain triggers tbd or 2) Mortgage on real property assets. |

| |

|

|

| Sublimits |

|

$22.5MM L/C sublimit |

|

|

| |

|

|

| |

|

FCCR |

|

Drawn Pricing |

| |

|

|

| Revolver Pricing |

|

Anytime Term Loan is outstanding and until such time that T3M Average EA > $40MM |

|

S+350bps |

| |

|

|

| |

|

<1.10x |

|

S+300bps |

| |

|

|

| |

|

≥ 1.10x, ≤1.50x |

|

S+250bps |

| |

|

|

| |

|

>1.50x |

|

S+225bps |

| |

|

|

| Term Loan Pricing |

|

S+600bps |

|

|

| |

|

| Term Loan Amortization |

|

4 Year Straight Line subject to mandatory prepayments from MMLP Distributions described below. |

| |

|

| Term Loan Payment Reserves |

|

To the extent that Proforma TTM FCCR is less than 1.1x, a borrowing base reserve will be

established as the lesser of $5MM or the remaining Term Loan principal balance due. For clarity, the Term Loan Payment Reserves would be excluded from the calculation of Minimum Excess Availability. |

| |

|

|

| Unused Line Fee |

|

37.5 bps |

|

|

| |

|

| Administrative Fee |

|

Annual fee on anniversary paid to the Agent $50,000 |

| |

|

| MMLP Distributions |

|

To the extent that

TTM MMLP leverage falls below 3.75x, a minimum of 75% of available distributions will be made to MRMC as long as the Term Loan (“TL” remains outstanding). Of the distributions, 70% will pay down the TL and 30% will pay down the revolver as

long as Average T3M Excess Availability (“EA”) is less than $45MM. When EA is greater than $45MM, 100% would be against the TL until paid in full.

MMLP Distributions made pursuant to a $10MM unrestricted distribution basket (basket that is not limited by MMLP leverage) would be used to pay down the

revolver and not the Term Loan. |

|

|

|

| |

|

| Reporting |

|

• Monthly financial statements, borrowing base certificates, and compliance certificates

• Annual projections and audited financial statements

• 1x field exam per year (up to 3 times reimbursed)

• 1x inventory appraisal per year (up to 2 times reimbursed) |

| |

|

| Borrowing Base |

|

• 90% of eligible investment grade A/R; plus

• 90% of eligible non-IG A/R (reverting to 85% one year

after closing); plus • 90% of eligible MMLP A/R supported by Letters of Credit; plus

• 80% of book value of Eligible Petroleum Inventory; plus

• Lesser of (a) 70% of book value and (b) 85% of NOLV percentage of book value of Eligible Asphalt

Inventory; plus • Lesser of (a) 70% of book value and (b) 85% of NOLV percentage of book value

of Eligible Lubricant Inventory; plus • Eligible

in-transit (crude oil) which is eligible up to an aggregate limit of $15MM; plus

• Prepaid Inventory which is delivered within 7 days of the prepayment at an advance rate

consistent with the type of inventory above not to exceed $5MM in total; plus

• 95% of restricted cash (capped at $5MM); less

• LC reserves offset by Eligible Addback for Unused Trade Letters of Credit; less

• Other Reserves established by lender

Eligible Add-Back for Unused Trade Letters of

Credit: the aggregate maximum amount of Trade Letters of Credit minus any amounts drawn under such Trade Letters of Credit minus any other liabilities then existing which may be satisfied by a drawing under any such Trade Letters of Credit for the

purchase of the Eligible Petroleum for which title has passed to a Loan Party as of the Borrowing Base Date minus any other liabilities which may be owed by such Loan Party to the beneficiary of any such Trade Letter of Credit and which may be

satisfied by any such Trade Letter of Credit. |

| |

|

| Minimum Opening Excess Availability |

|

$30MM if the transaction is closed prior to December 20, 2024. $25MM if the transaction is closed between

December 20 and December 31 2024 |

| |

|

| Financial Covenants |

|

Minimum Excess Availability of 10% of the Borrowing Base at all times using a

5-day moving average |

2

|

|

|

| |

|

| |