American Tower Corporation Declares Quarterly Distribution

23 Maggio 2024 - 10:15PM

Business Wire

American Tower Corporation (NYSE: AMT) announced that its Board

of Directors (the “Board”) declared a quarterly cash distribution

of $1.62 per share on shares of the Company’s common stock. The

distribution is payable on July 12, 2024 to the stockholders of

record at the close of business on June 14, 2024.

About American Tower

American Tower, one of the largest global REITs, is a leading

independent owner, operator and developer of multitenant

communications real estate with a portfolio of over 224,000

communications sites and a highly interconnected footprint of U.S.

data center facilities. For more information about American Tower,

please visit the “Earnings Materials” and “Investor Presentations”

sections of our investor relations hub at

www.americantower.com.

Cautionary Language Regarding Forward-Looking

Statements

This press release contains “forward-looking statements”

concerning the Company’s goals, beliefs, expectations, strategies,

objectives, plans, future operating results and underlying

assumptions and other statements that are not necessarily based on

historical facts. Actual results may differ materially from those

indicated in the Company’s forward-looking statements as a result

of various factors, including those factors set forth under the

caption “Risk Factors” in Item 1A of its most recent annual report

on Form 10-K, and other risks described in documents the Company

subsequently files from time to time with the Securities and

Exchange Commission. The Company undertakes no obligation to update

the information contained in this press release to reflect

subsequently occurring events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240523474198/en/

Adam Smith Senior Vice President, Investor Relations and

FP&A Telephone: (617) 375-7500

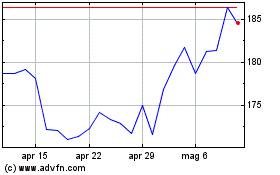

Grafico Azioni American Tower (NYSE:AMT)

Storico

Da Gen 2025 a Feb 2025

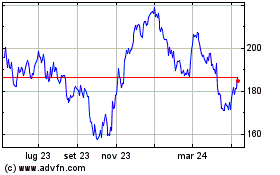

Grafico Azioni American Tower (NYSE:AMT)

Storico

Da Feb 2024 a Feb 2025