HASI Extends and Upsizes Bank Facilities to $1.625 Billion, Further Strengthening Diversified Funding Platform

17 Aprile 2024 - 10:30PM

Business Wire

Hannon Armstrong Sustainable Infrastructure Capital, Inc.

("HASI," "we", "our", or the "Company") (NYSE: HASI), a leading

investor in climate solutions, today announced that it has amended

and extended its corporate unsecured credit facilities with a

syndicate of banks. The committed capacity under the Company’s

CarbonCount®-Based Revolving Credit Facility has increased from

$915 million to $1.25 billion, outstanding amounts under the

CarbonCount®-Based Term Loan Facility are $250 million, and the

CarbonCount® Green Commercial Paper Note Program (the “CarbonCount

Green CP Program”) has increased from $100 million to $125 million,

totaling $1.625 billion across the three facilities.

The revolving line of credit has been extended by four years

maturing in 2028, the term loan A has been extended for three years

maturing in 2027, and the green CP program has been extended for

two years maturing in 2026. The applicable margins remain unchanged

for all three bank facilities at 187.5 bps for the revolving line

of credit, 212.5 bps for term loan A, and 140 bps for the green CP

program. Each facility provides for interest rate reductions if

HASI achieves certain levels of its CarbonCount metric on an annual

basis. The CarbonCount Green CP Program was the first fully green

commercial paper program in the United States when launched in

2021.

“The upsize and term extension of our credit facilities

simultaneously addresses a majority of our 2025 maturities and

enhances the flexibility of our diversified funding platform,” said

Marc Pangburn, Chief Financial Officer, HASI. “A well-balanced

platform of bank borrowings, unsecured debt, and project debt

allows us to maintain an opportunistic approach to debt

financing.”

The revolving line of credit and term loan A includes a 14 bank

syndicate led by J.P. Morgan as administrative agent,

sustainability structuring agent, and lead left arranger. BofA

Securities, Inc. is the dealer and green structuring advisor for

the CarbonCount Green CP Program.

Measuring the Climate Impact of Every Investment

Consistent with our investment thesis and sustainability

investment policy, HASI only invests in assets that are neutral to

negative on incremental carbon emissions or have some other

tangible environmental benefit, such as reducing water consumption.

We track and report on the impact of all investments utilizing

CarbonCount, a proprietary scoring tool for evaluating real assets

to determine the efficiency by which each dollar of invested

capital avoids annual carbon dioxide equivalent emissions (CO2e).

This first-of-its-kind methodology promotes transparency in project

finance by creating a simple and comparable metric for

infrastructure projects to be evaluated in terms of how much

capital investment is mitigating climate change.

About HASI

HASI (NYSE: HASI) is a leading climate positive investment firm

that actively partners with clients to deploy real assets that

facilitate the energy transition. With more than $12 billion in

managed assets, our vision is that every investment improves our

climate future. For more information, please visit hasi.com.

Forward Looking Statements

Some of the information in this press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. When used in this

press release, words such as "believe," "expect," "anticipate,"

"estimate," "plan," "continue," "intend," "should," "may,"

"target," or similar expressions, are intended to identify such

forward-looking statements.

Forward-looking statements are subject to significant risks and

uncertainties. Investors are cautioned against placing undue

reliance on such statements. Forward-looking statements are not

predictions of future events. Actual results may differ materially

from those set forth in the forward-looking statements. Factors

that could cause actual results to differ materially from those

described in the forward-looking statements include those discussed

under the caption "Risk Factors" included in the Company's Annual

Report on Form 10-K (as supplemented by our Form 10-K/A) for the

Company's fiscal year ended December 31, 2023, which was filed with

the SEC, as well as in other reports that the Company files with

the SEC.

Forward-looking statements are based on beliefs, assumptions and

expectations as of the date of this press release. The Company

disclaims any obligation to publicly release the results of any

revisions to these forward-looking statements reflecting new

estimates, events or circumstances after the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240417822484/en/

Investor Inquiries Neha Gaddam investors@hasi.com

410-571-6189

Media Inquiries Conor Fryer media@hasi.com

443-321-5754

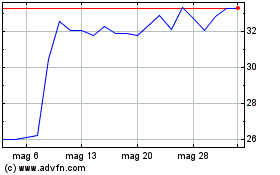

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Feb 2024 a Feb 2025