HASI Prices Private Offering of $700 Million of 6.375% Green Senior Unsecured Notes due 2034

25 Giugno 2024 - 1:00PM

Business Wire

Hannon Armstrong Sustainable Infrastructure Capital, Inc.

(“HASI,” “our,” or the “Company”) (NYSE: HASI), a leading investor

in climate solutions, today announced that it has priced its

private offering of $700 million in aggregate principal amount of

6.375% green senior unsecured notes due 2034 (the “Notes”). At

issuance, the Notes will be guaranteed by Hannon Armstrong

Sustainable Infrastructure, L.P., Hannon Armstrong Capital, LLC,

HAT Holdings I LLC, HAT Holdings II LLC, HAC Holdings I LLC and HAC

Holdings II LLC. The settlement of the Notes is expected to occur

on July 1, 2024, subject to customary closing conditions. The Notes

will have certain registration rights.

The Company estimates that the net proceeds from the offering of

the Notes will be approximately $688 million, after deducting the

initial purchasers’ discounts and estimated offering expenses. The

Company intends to utilize the net proceeds from the offering of

the Notes to temporarily repay a portion of the outstanding

borrowings under its unsecured credit facility and to repurchase

for cash certain of its 6.00% Senior Notes due 2025 (the “2025

Notes”) as described below. The Company will use cash equal to the

net proceeds from the offering to acquire, invest in or refinance,

in whole or in part, new and/or existing eligible green projects.

These eligible green projects may include projects with

disbursements made during the twelve months preceding the issue

date of the Notes and those with disbursements to be made two years

following the issue date. Prior to the full investment of such net

proceeds, the Company intends to invest an amount equal to such net

proceeds in interest-bearing accounts and short-term,

interest-bearing securities and/or such net proceeds may be

temporarily used to repay certain indebtedness.

The Notes and the related guarantees are being offered only to

persons reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”), and non-U.S. persons outside the United

States pursuant to Regulation S under the Securities Act. The Notes

and the related guarantees have not been registered under the

Securities Act or any state securities laws and may not be offered

or sold in the United States absent an effective registration

statement or an applicable exemption from the registration

requirements of the Securities Act or any state securities

laws.

This press release shall not constitute an offer to sell, or the

solicitation of an offer to buy, these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction. This press release shall not constitute a

notice of redemption for the 2025 Notes.

About HASI

HASI (NYSE: HASI) is a leading climate positive investment firm

that actively partners with clients to deploy real assets that

facilitate the energy transition. With more than $12 billion in

managed assets, our vision is that every investment improves our

climate future.

Forward-Looking Statements

Some of the information in this press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. When used in this

press release, words such as “believe,” “expect,” “anticipate,”

“estimate,” “plan,” “continue,” “intend,” “should,” “may,”

“target,” or similar expressions are intended to identify such

forward-looking statements. Forward-looking statements are subject

to significant risks and uncertainties. Investors are cautioned

against placing undue reliance on such statements. Actual results

may differ materially from those set forth in the forward-looking

statements. Factors that could cause actual results to differ

materially from those described in the forward-looking statements

include those discussed under the caption “Risk Factors” included

in the Company’s Annual Report on Form 10-K (as supplemented by our

Form 10-K/A) for the Company’s fiscal year ended December 31, 2023,

which were filed with the U.S. Securities and Exchange Commission

(“SEC”), as well as in other reports that the Company files with

the SEC.

Forward-looking statements are based on beliefs, assumptions and

expectations as of the date of this press release. The Company

disclaims any obligation to publicly release the results of any

revisions to these forward-looking statements reflecting new

estimates, events or circumstances after the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240625066722/en/

Investors: Aaron Chew investors@hasi.com 240-343-7526

Media: Conor Fryer media@hasi.com 443-321-5754

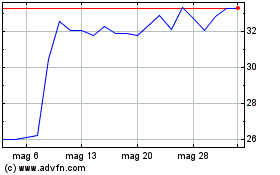

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni HA Sustainable Infrastru... (NYSE:HASI)

Storico

Da Feb 2024 a Feb 2025