Novartis Spinoff Sandoz Group Valued at $11.2 Billion in Trading Debut

04 Ottobre 2023 - 11:17AM

Dow Jones News

By Adria Calatayud

Generic-drug maker Sandoz Group was valued at around 10.3

billion Swiss francs ($11.18 billion) in its trading debut on the

SIX Swiss Exchange after it was spun off from Novartis.

At 0830 GMT, Sandoz's shares traded at CHF23.10, below the

CHF24.00 they hit at the opening bell. Novartis's shares slipped

3.85% to CHF88.40.

The market capitalization Sandoz achieved at the start of

trading was below the valuations estimated by some analysts.

Jefferies analysts said in a research note Tuesday that Sandoz

could be valued at between $12.3 billion and $16.2 billion, while

Deutsche Bank Research analysts said last month that its market cap

could range from $11 billion to $13 billion.

Sandoz's listing marks the end of an era for Novartis and is the

latest example of a pharmaceutical company offloading assets to

focus on innovative prescription medicines, following similar moves

from peers in recent years.

Novartis said its 2023 guidance remains unchanged after the

spinoff. It also intends to maintain a consistent approach to

capital-allocation priorities, including share buybacks and

dividend policy.

Sandoz generated $9.07 billion in net sales last year--most of

it from its generics business--and made a net profit of $848

million.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

October 04, 2023 05:02 ET (09:02 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

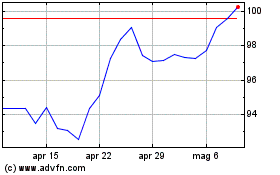

Grafico Azioni Novartis (NYSE:NVS)

Storico

Da Mar 2024 a Apr 2024

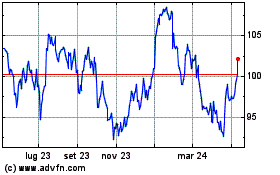

Grafico Azioni Novartis (NYSE:NVS)

Storico

Da Apr 2023 a Apr 2024