Regions Real Estate Capital Markets Now Servicing its Loan Assets

07 Maggio 2024 - 3:00PM

Business Wire

Establishing servicing signifies commitment to life-of-loan

customer service experience.

Regions Bank on Tuesday announced its Real Estate Capital

Markets division, a diversified multifamily and commercial real

estate lender, has now begun servicing the loans it has

originated.

“Already, clients recognize Regions Real Estate Capital Markets

as a source of customized financial guidance and solutions tailored

to meet the needs of the businesses we serve,” said Troy Marek,

head of Real Estate Capital Markets for Regions Bank. “Now, by

directly servicing Real Estate Capital Markets loans throughout

their lifespan, we’re offering a more seamless client experience

and valuable opportunities to work with customers on new and

evolving needs. This further differentiates Regions in the market,

and it sets the stage for additional growth moving forward.”

The Regions Real Estate Capital Markets servicing portfolio

includes loans previously originated by Regions’ Real Estate

Capital Markets Group as part of the following programs:

- Fannie Mae Delegated Underwriting and Servicing (DUS)

Conventional

- Fannie Mae Delegated Underwriting and Servicing (DUS) Small

Loans

- Freddie Mac Optigo® Small Balance Loans

- Freddie Mac Optigo® Conventional

- Commercial Mortgage Backed Securities (servicing only)

The loans in the servicing portfolio are financing or

refinancing assets categorized as multifamily, affordable housing,

workforce housing, senior housing, student housing, manufactured

home communities, and credit facilities.

“Throughout our work with clients, we never lose sight of the

fact that these financing solutions support important developments,

including housing communities that address the needs of many

people,” said Vartan Derbedrossian, fulfillment and servicing

manager for Regions Real Estate Capital Markets. “By expanding our

work to including servicing, we are further strengthening

life-of-loan relationships in ways that will help us meet even more

needs for clients moving forward.”

Regions Real Estate Capital Markets serves clients with a

comprehensive suite of agency financing solutions, meeting a range

of borrower needs. Solutions span agency options for acquisition,

refinance, bridge, and construction financing. The group’s loan

products serve borrowers and properties across all major

multifamily real estate asset types.

Regions Real Estate Capital Markets’ lending operations are

powered by SNAP™, a technology-driven platform that automates and

enhances customer relations across the life-of-loan process, from

loan origination through servicing. SNAP leverages tools including

real-time commercial property financing scenarios, seamless online

loan applications, and technology for tracking loan progress

through deal closure, and supporting servicing.

Regions Real Estate Capital Markets is a Morningstar rated

Commercial Mortgage Primary Servicer with a CS2 ranking and

Commercial Mortgage Special Servicer with a CS3 ranking, an S&P

Global rated Commercial Mortgage Loan Special Servicer with an

average ranking, as well as a Fitch rated Commercial Primary

Servicer with a CPS2 rating and Commercial Special Servicer with

CSS3+ rating.

Information on Regions Real Estate Capital Markets’

comprehensive multifamily and commercial real estate loan programs

can be found in the Real Estate Capital Markets section of

Regions.com.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $155 billion in

assets, is a member of the S&P 500 Index and is one of the

nation’s largest full-service providers of consumer and commercial

banking, wealth management, and mortgage products and services.

Regions serves customers across the South, Midwest and Texas, and

through its subsidiary, Regions Bank, operates approximately 1,250

banking offices and more than 2,000 ATMs. Regions Bank is an Equal

Housing Lender and Member FDIC. Additional information about

Regions and its full line of products and services can be found at

www.regions.com.

About Regions Real Estate Capital Markets Group

Regions Real Estate Capital Markets is a diversified commercial

real estate lender that keeps borrowers and brokers ahead of the

curve with comprehensive debt solutions encompassing agency

options. SNAP®, the lender’s proprietary technology platform,

supports origination and servicing while enhancing the customer

experience. For more details, visit Commercial Real Estate

Financing | Capital Markets | Regions Bank.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507342650/en/

Media Contact: Jennifer Elmore Regions Bank Regions News

Online: regions.doingmoretoday.com Regions Media Line: (205)

264-4551

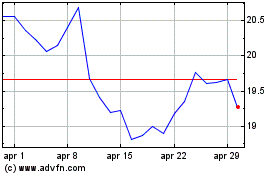

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Feb 2024 a Feb 2025