Regions Bank Announces Latest Innovation to Help Companies Streamline Cash Flow

13 Febbraio 2025 - 3:00PM

Business Wire

How this new solution from Regions, powered by Koxa, helps

businesses keep better track of their funds.

Regions Bank on Thursday announced its latest offering designed

to help Treasury Management clients better manage cash flow,

optimize liquidity, reduce risks and more clearly anticipate

business needs.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250213909498/en/

Regions Bank is announcing Regions

Embedded ERP Finance, the latest offering designed to help Treasury

Management clients better manage cash flow, optimize liquidity,

reduce risks and more clearly anticipate business needs. (Photo:

Business Wire)

The name of the solution is Regions Embedded ERP Finance.

The result is Regions’ clients now have the option of using this

tool, powered by Koxa, to seamlessly connect financial data to

their own enterprise resource planning (ERP) systems.

What does this mean?

Currently, business clients manually enter or upload financial

data from their Regions accounts into their own ERP systems that

they use to manage money, track sales, oversee inventory, manage

customer relationships and more.

What’s getting easier?

Now, with Regions Embedded ERP Finance, clients can immediately

access and review financial accounts and data in real-time within

their own ERP platforms. This means no manual uploading and, as a

result, quicker access to solid business-management data. By being

able to better leverage accurate, real-time information, the

service can help companies improve cash flow, determine appropriate

amounts of liquidity and create data-driven forecasts for future

financial management.

Here’s how it works:

- First, there’s greater accuracy and efficiency. Clients

can now create fully automated reports, like transactions and

balances, from bank accounts for reconciliation. For future

enhancements, Regions is currently developing an additional

capability designed to enable clients to initiate ACH and wire

payments for vendors, reimburse expenses, manage payroll, and more

– all from their Regions Bank account without leaving their

accounting software.

- There’s also full auditability. Clients can easily

manage account permissions and enhance their internal controls to

help mitigate fraud risk. This solution can track the user, IP

address and time stamp when each payment is submitted and approved,

helping ensure the accuracy of each transaction.

“Technology continues to enhance the speed at which businesses

operate, and this is another way Regions’ solutions can help

companies spend less time on day-to-day financial tasks and more

time focused on growing their business,” said Bryan Ford, head of

Regions Treasury Management. “Our Treasury Management division has

experienced record growth, and we believe that’s the result of a

positive client experience and consistent innovation. This is an

exciting next step in the evolution of open banking, and we are

proud to work with Koxa to make it available to clients. We look

forward to launching additional functionality over time as we

consistently work to connect clients with more advancements in

technology.”

Currently, Regions Embedded ERP Finance will connect with the

following systems:

- Workday

- Oracle NetSuite

- Microsoft Dynamics 365 Business Central

- Sage Intacct

Additional ERP platforms and capabilities are expected to be

added over time.

“Regions’ ERP-banking solution enables the bank’s clients to

better leverage the capabilities of their existing ERP systems.

Regions is constantly improving the client experience and investing

in its treasury platform, making them a perfect fit for Koxa,” said

Koxa Co-Founder and Chief Technology Officer Camellia George. “Over

the next several years, we expect API-based ERP-banking to be the

dominant banking channel for treasury teams. Regions now delivers

this next-generation experience.”

Regions Embedded ERP Finance is just the latest in a series of

new Treasury Management products and services from the bank.

Regions CashFlowIQSM, powered by BILL, provides advanced accounts

payable and accounts receivable capabilities to help businesses

securely pay bills, invoice customers, and receive payments

faster.

Additionally, Regions has launched other key Treasury Management

solutions that include:

- Visa Commercial Pay Mobile, which allows clients to make quick,

easy and secure payments from the convenience of a digital wallet.

Regions was the first financial institution to launch Visa

Commercial Pay Mobile. It joined Visa Commercial Pay Travel, which

Regions launched in 2022, to help clients facilitate on-the-go

business travel payments from a centralized travel-management

vendor.

- BillerXChange, which allows clients, ranging from health care

and professional services sectors to real estate, manufacturing,

distribution, wholesale industries and more, to manage the entire

lifecycle of accounts receivables from a single integrated

platform.

- Clients can also send real-time payments through the RTP®

network from The Clearing House. The real-time payments service is

part of Regions’ iTreasury platform, which offers a wide range of

competitive financial management options for businesses.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $157 billion in

assets, is a member of the S&P 500 Index and is one of the

nation’s largest full-service providers of consumer and commercial

banking, wealth management, and mortgage products and services.

Regions serves customers across the South, Midwest and Texas, and

through its subsidiary, Regions Bank, operates approximately 1,250

banking offices and more than 2,000 ATMs. Regions Bank is an Equal

Housing Lender and Member FDIC. Additional information about

Regions and its full line of products and services can be found at

www.regions.com.

About Koxa

Koxa’s Treasury Gateway platform connects banks to their

corporate treasury clients, letting clients bank directly from

inside their ERP. Koxa partners with banks to extend the

functionality of a bank's online treasury portal directly into the

user's ERP or accounting software. With Koxa, corporate accounting

teams can (i) submit, approve, and release payments, (ii) track

payment status and auto-reconcile settled payments, and (iii) pull

statement and other reporting data without having to leave their

ERP. Visit www.koxa.io for more information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213909498/en/

Media Contact: Jennifer Elmore Regions News Online:

regions.doingmoretoday.com

Regions Bank Regions Media Line: (205) 264-4551

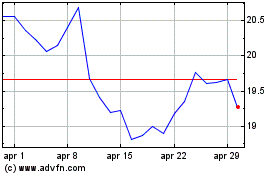

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Feb 2024 a Feb 2025