Big Tech Earnings Under Radar This Week for S&P 500 Investors

30 Gennaio 2023 - 12:25PM

Finscreener.org

Investors should expect the stock

market to remain volatile in the upcoming week, given the plethora

of big-tech earnings on the cards. Some of the largest companies in

the world, including Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOG), Amazon (NASDAQ:

AMZN),

ExxonMobil (NYSE:

XOM),

Starbucks (NASDAQ:

SBUX),

and Ford

(NYSE:

F), are expected to report earnings for the quarter

ending in December 2022.

Last week, tech giants such

as Microsoft (NASDAQ:

MSFT) and Intel (NASDAQ:

INTC) reported quarterly results, which underwhelmed

investors. While Microsoft reported its slowest revenue growth in

the last six years, Intel missed revenue and earnings forecasts by

a wide margin.

However,

Tesla (NASDAQ: TSLA)

surprised Wall Street forecasts, and the stock has already surged

by 46% in the past month. Tesla stated while lower automobile

prices drove profit margins lower, demand for its portfolio of

battery-powered vehicles gained significant momentum.

During the earnings call, CEO

Elon Musk confirmed, “Thus far in January we’ve seen the strongest

orders year-to-date than ever in our history. We’re currently

seeing orders of almost twice the rate of production.”

Analysts expect a tough

macroeconomic environment to negatively impact big tech earnings in

Q4 as companies continue to wrestle with tepid sales and rising

interest rates. In the last year, interest rate hikes have driven

valuations of tech companies lower, who increased balance sheet

debt to finance their expansion plans aggressively in the past

decade. Investors are worried that the rising cost of debt to hurt

the profit margins of companies across sectors in the next 12

months.

The adjusted earnings per share

for Meta Platforms (NASDAQ:

META) are forecast to

fall by 38% year over year to $2.25 on the back of lower ad sales

and losses attributed to the metaverse business. Comparatively,

Amazon’s earnings might nosedive by 83% year over year to $0.21

despite a 6% growth in revenue, while Wall Street forecasts

AlphabetU+02019s earnings to fall by 13.4% in Q4.

The jobs market remains in the spotlight

One macro indicator which will be

closely watched is the U.S. Labor Department’s JOLTS (Job Openings

and Labor Turnover Survey) report for the month of December. The

JOLTS report will be published on Wednesday, and its tracks job

openings, hires, resignations, and separations for the last month.

Payroll provider ADP will also publish its NEP or National

Employment Report, which tracks private-sector payroll growth for

January.

Next, the stage is set for the

nonfarm payrolls report, which will be published by the Labor

Department on Friday. Economists forecast the U.S. economy to add

185,000 jobs in January, lower than the 223,000 additions in

December. It will also mark the slowest growth since the loss of

306,000 jobs back in December 2020. The unemployment rate might

rise to 3.6% compared to a multi-decade of 3.5% right

now.

Central banks and policy meetings

The policymakers at the Federal

Reserve will conduct a two-day meeting of the FOMC (Federal Open

Market Committee) while deciding on the decision of interest rate

hikes this Wednesday.

Market participants expect the

Fed to raise interest rates by 25 basis points, increasing

benchmark rates to 4.5%-4.75%.

An Investopedia report states,

“The

European Central Bank (ECB) and the Bank of England (BoE) will hold policy meetings on Thursday. ECB

policymakers are expected to raise interest rates by 50 bps in

their ongoing effort to tame record-high inflation in the

eurozone, which hit a recent peak of 10.6% in October.

BoE officials are also expected to hike rates by 50 bps, as the

U.K. grapples with an economic slowdown and the highest inflation

rate in over 40 years.”

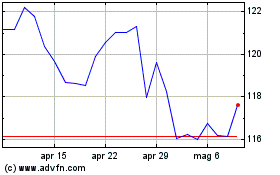

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Apr 2024 a Mag 2024

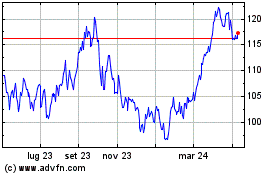

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Mag 2023 a Mag 2024