Centrica Pretax Profit Falls Sharply in 2017

22 Febbraio 2018 - 9:38AM

Dow Jones News

By Maryam Cockar

British Gas owner Centrica PLC (CNA.LN) said Thursday that

pretax profit fell sharply in 2017 after incurring several charges,

and after 2016 profit benefited from a tax credit in 2016.

The utility company said that pretax profit was 142 million

pounds compared with GBP2.19 billion a year earlier. Stripping out

exceptional items, adjusted pretax profit declined to GBP901

million from GBP1.17 billion, it said.

Centrica said that revenue rose to GBP28.02 billion from GBP27.1

billion a year earlier.

The FTSE 100-listed company maintained its final dividend at

8.40 pence a share, bringing the full-year dividend to 12

pence.

The company said its GBP750 million cost-efficiency program was

delivered three years early and so it has increased the program

target by GBP500 million to GBP1.25 billion a year by 2020.

"The combination of political and regulatory intervention in the

U.K. energy market, concerns over the loss of energy customers in

the U.K., and the performance issue in North America have created

material uncertainty around Centrica and, although we delivered on

our financial targets for the year, this resulted in a very poor

shareholder experience. We regret this deeply, and I am determined

to restore shareholder value and confidence," Chief Executive Iain

Conn said.

Mr. Conn said Centrica is committed to delivering attractive

returns and growth over the medium term.

Centrica also said it will buy its 4% senior notes due 2023 and

up to $250 million of its 5.375% senior notes due 2043 in order to

improve the efficiency of its balance sheet structure.

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

February 22, 2018 03:23 ET (08:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

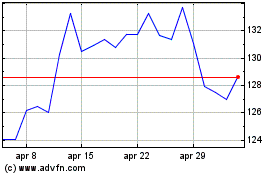

Grafico Azioni Centrica (LSE:CNA)

Storico

Da Mar 2024 a Apr 2024

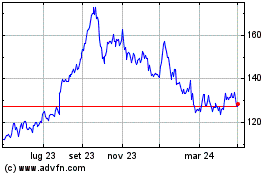

Grafico Azioni Centrica (LSE:CNA)

Storico

Da Apr 2023 a Apr 2024