LONDON MARKETS: U.K. Stocks Inch Higher After Mixed Jobs Report

15 Maggio 2018 - 12:44PM

Dow Jones News

By Sara Sjolin, MarketWatch

Vodafone slumps after news of CEO's planned departure

U.K. stocks inched higher on Tuesday after a mixed jobs report

that was seen as easing pressure on the Bank of England to raise

interest rates.

What are markets doing?

The FTSE 100 index was up 0.2% at 7,727.95, on track for its

highest close since late January, according to FactSet data.

The pound traded at $1.3546, compared with $1.3556 late Monday

in New York. Sterling has lost almost 5% against the dollar over

the past month as expectations of an imminent rate hike dwindled

following dovish comments from BOE Gov. Mark Carney and a string of

disappointing data. A weaker pound tends to boost the FTSE 100 as

index's components make the bulk of their earnings overseas, with a

softening sterling making those goods and services relatively more

attractive.

What is driving the market?

All eyes were on the U.K. jobs data. The unemployment rate

remained at a 42-year low of 4.2% in March, while wages without

bonuses advanced 2.9%, up from 2.8% in February. However, earnings

including bonuses slipped to 2.6% from 2.8%.

Carney said last week at the central bank's quarterly inflation

report news conference that interest rates will rise over the next

three years, if the economy evolves as the bank forecasts. The

comments were seen as adding extra weight to the macroeconomic data

coming out of the U.K.

What are strategists saying?

-- "Today's labor market report illustrates the conundrum faced

by the Bank of England. A strong labor market should push wage

pressures higher in the months ahead, requiring the Bank to hike

rates in order to ward off future inflation pressures," said Dean

Turner, economist at UBS Wealth Management, in a note.

"But, all the while that the data shows a struggling consumer,

it is difficult to have confidence that the time for tighter

monetary policy is now. In our view, this points to the bank

keeping rates on hold for a little while longer," he added.

-- "Today's data adds further weight to our view that pay growth

is moderating, not firming. Since the [BOE] has tended to attach

more weight to wage growth than the unemployment rate as a signal

of slack in the labor market, it is consistent with our view that

the [BOE] will not hike this year," said Daniel Vernazza, chief

U.K. economist at UniCredit, in a note.

Stock movers

Shares of Vodafone Group PLC (VOD.LN) (VOD.LN) dropped 2.7%

after the telecom giant said its chief executive Vittorio Colao

will step down

(http://www.marketwatch.com/story/vodafone-cfo-to-succeed-ceo-colao-in-october-2018-05-15)

and be succeeded by Chief Financial Officer Nick Read, effective

Oct. 1.

EasyJet PLC (EZJ.LN) rose 1.9% after the budget airline said its

pretax loss for the first half of fiscal 2018 narrowed

(http://www.marketwatch.com/story/easyjet-first-half-loss-narrows-on-higher-revenue-2018-05-15),

driven by record revenue a reduction in capacity by other

airlines.

Outside the FTSE 100, shares of CYBG PLC (CYBG.LN) slid 5.4%

after the bank reported disappointing earnings and said the U.K.

environment remains challenging.

(END) Dow Jones Newswires

May 15, 2018 06:29 ET (10:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

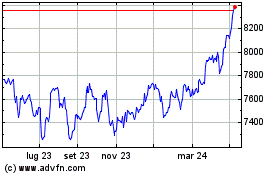

Grafico Indice FTSE 100

Da Apr 2024 a Mag 2024

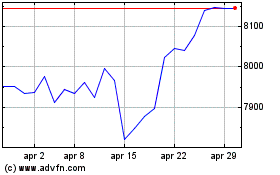

Grafico Indice FTSE 100

Da Mag 2023 a Mag 2024