UniCredit Says Bad-Loan Coverage Meets ECB Guidelines

16 Gennaio 2019 - 8:47AM

Dow Jones News

By Nathan Allen

UniCredit SpA (UCG.MI) said Wednesday that its exposure to bad

loans complies with guidelines set out by the European Central

Bank, which were reported in Italian media yesterday but

unconfirmed by the ECB.

The Italian lender said it reduced its nonperforming-exposure

portfolio by more than 36 billion euros between the third quarter

of 2016 and the third quarter of 2018, bringing its core bank NPE

ratio down to 4.3%.

"Consequently, UniCredit considers its NPE coverage fully

adequate," the bank said.

Shares in Italian banks fell sharply Tuesday after newspaper Il

Sole 24 Ore reported that the ECB told its supervised Italian

lenders they must fully cover their exposure to all existing and

future nonperforming loans by 2026.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

January 16, 2019 02:32 ET (07:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

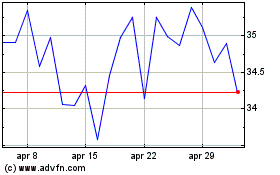

Grafico Azioni Unicredit (BIT:UCG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Unicredit (BIT:UCG)

Storico

Da Apr 2023 a Apr 2024