RM Secured Direct Lending PLC Net Asset Value(s) (1217D)

17 Febbraio 2020 - 8:00AM

UK Regulatory

TIDMRMDL TIDMRMDZ TIDMTTM

RNS Number : 1217D

RM Secured Direct Lending PLC

17 February 2020

RM Secured Direct Lending Plc and RM ZDP PLC

("RMDL" or the "Company")

LEI: 213800RBRIYICC2QC958

Net Asset Value

RMDL announces that its unaudited net asset value per ordinary

share as at 31 January 2020, on a cum income basis, was 98.31

pence (31 December 2019: 97.79 pence).

RM ZDP PLC announces that the unaudited accrued capital entitlement

per ZDP share as at 31 January 2020 was 106.47 pence (31 December

2019: 106.18 pence).

NAV

The NAV total return for the month was 0.51%. This takes the

1 year NAV total return to 8% and the cumulative NAV total return

since IPO to 18.4%.

The Ordinary Share NAV as at 31(st) January 2020 was 98.31 pence

per share, which is 0.52 pence higher than at 31(st) December

2019, comprising interest income net of expenses of 0.60 pence

per share and a decrease in portfolio valuations of 0.08 pence

per share which includes all credit and currency movements.

Portfolio Activity

As at the 31(st) January, the Company's portfolio consisted of

34 debt investments with a weighted average yield of 8.58%, spread

across 13 sectors, with a percentage split between fixed and

floating rate of 55% to 45%. The Investment Manager is focused

on reducing interest rate risk by keeping the tenors on fixed

rate investments generally shorter dated.

The portfolio has the following breakdown: 59 % in bilateral

private loans; 36% in club or syndicated private loans; and 5

% in more liquid corporate debt. Consequently, private debt investments

represent 95 % of the portfolio.

The transaction highlights for the month are as follows:

* six further drawdowns to Loans previously documented

with two borrowers. These loans relate to Social

Infrastructure and Energy Efficiency (Student

Accommodation & Receivables Finance).

* Two partial repayments of Loans.

In addition to this the Investment Manager is finalising Due

Diligence and documentation for a Loan secured against a Hotel

which formed part of the pipeline for the capital raise conducted

in Q4 2019. This will conclude the pipeline for this sector and

the manager will continue to focus on sourcing Social Infrastructure

assets such as Healthcare and Childcare opportunities secured

on business assets and real estate.

The Company also announces that the Monthly Report for the period

to 31 January 2020 is now available to be viewed on the Company

website:

https://rmdl.co.uk/investor-centre/monthly-factsheets/

END

For further information, please contact:

RM Capital Markets Limited - Investment Manager

James Robson

Pietro Nicholls

Tel: 0131 603 7060

International Fund Management - AIFM

Chris Hickling

Shaun Robert

Tel: 01481 737600

Tulchan Group - Financial PR

James Macey White

Elizabeth Snow

Tel: 0207 353 4200

PraxisIFM Fund Services (UK) Limited - Administrator and Company

Secretary

Brian Smith

Ciara McKillop

Tel: 020 7653 9690

Nplus1 Singer Advisory LLP - Financial Adviser and Broker

James Maxwell

Lauren Kettle

Tel: 020 7496 3000

About RM Secured Direct Lending

RM Secured Direct Lending Plc ("RMDL" or the "Company") is a

closed-ended investment trust established to invest in a portfolio

of secured debt instruments.

The Company aims to generate attractive and regular dividends

through loans sourced or originated by the Investment Manager

with a degree of inflation protection through index-linked returns

where appropriate. Loans in which the Company invests are predominantly

secured against assets such as real estate or plant and machinery

and/or income streams such as account receivables.

For more information, please see

https://rmdl.co.uk/investor-centre/monthly-factsheets/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVGPURPPUPUGMC

(END) Dow Jones Newswires

February 17, 2020 02:00 ET (07:00 GMT)

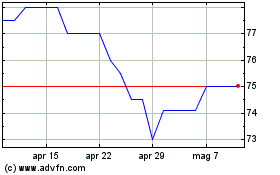

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Mag 2023 a Mag 2024