Bayer Agrees to New Review of Monsanto Purchase

27 Febbraio 2020 - 11:44AM

Dow Jones News

By Ruth Bender

BERLIN -- Bayer AG said it would strengthen external oversight

of its due diligence in deal making in its latest concession to

shareholders after its 2018 acquisition of Monsanto swamped it with

a tide of lawsuits and sent its stock crashing.

Bayer said Thursday that it would allow an independent expert to

review its rules for scrutinizing major deals and would publish the

results on its website in late March.

The concessions come a day after the German chemical and

pharmaceutical company said Chairman Werner Wenning was stepping

down earlier than planned and would be replaced by Norbert

Winkeljohann in April.

Bayer has also agreed to a new review of how it evaluated risks

in its $63 billion purchase of Monsanto, which shareholders have

criticized as overly risky after the acquisition plunged the

company into a major legal battle over Roundup weedkiller, which

thousands of Americans allege causes cancer.

The moves highlight Bayer's efforts to appease investors ahead

of its shareholder meeting in April. By then, many shareholders

expect Bayer to deliver progress on resolving the lawsuits. The

company has been exploring a comprehensive settlement.

There was no sign of such progress on Thursday, as Bayer

reported another rise in the number of plaintiffs. As of Feb. 6, it

faced a total of 48,600 plaintiffs, up from 42,700 reported three

months ago. Bayer argues that the weedkiller is safe and has

appealed verdicts in the three cases it has lost so far.

Bayer has been negotiating with plaintiff attorneys since last

summer to try to reach a deal to settle the claims. Bayer lost

three jury verdicts in the U.S. last year and has since come under

pressure from investors to find a way to put to rest the legal

fight that has been dragging down its share price and prompted

shareholders to withdraw confidence in Chief Executive Werner

Baumann at the group's annual meeting last year.

Shareholders have accused Mr. Baumann and Mr. Wenning of

underestimating the risks of the Monsanto purchase. Christian

Strenger, an individual shareholder in Bayer and a German expert on

corporate governance, filed a motion at last year's meeting for a

special audit of whether directors acted dutifully in handling the

Monsanto litigation risks.

The motion failed to obtain a majority but Bayer nevertheless

agreed to take some of the recommendations on board in an attempt

to assuage investors ahead of the shareholder meeting. Some

analysts expect the meeting to deliver another rebuke for Mr.

Baumann if Bayer can't show it is making progress on settling the

lawsuits.

Bayer said it hired an independent lawyer to review the legal

advice it commissioned before the Monsanto acquisition about the

legal risks of the deal. The lawyer and mass-torts expert James B.

Irwin concluded that the legal opinions, on which Bayer based its

decision to purchase Monsanto, appropriately analyzed the risks.

Bayer will also publish this report on its website.

Bayer last year had already hired external lawyers to examine

whether Bayer's management acted dutifully in their due diligence

of the deal. Bayer Thursday said those reports, which found no

breach of duty, would also be published in a more detailed

form.

Mr. Baumann reiterated Thursday that Bayer would agree to a

settlement only if it can bring a "reasonable conclusion" to the

entire legal battle, meaning it must also include a solution to

prevent lawsuits against Bayer in the future, a key sticking point

in settlement talks.

"We will pursue the three appeals through all judicial instances

if necessary," Mr. Baumann said in a statement.

One issue Bayer and plaintiff lawyers have been sparring over is

how many plaintiffs in total would be eligible for compensation in

a settlement, according to people familiar with the negotiations.

Some lawyers have estimated the total amount of plaintiffs at some

100,000, a figure Bayer dismissed as speculative and not reflecting

the actual number of served cases.

Separately, the Monsanto purchase helped Bayer post a rise in

profit and sales for its latest quarter, broadly meeting analyst

forecasts and helping the group reach its full year goals.

Net profit in the quarter swung to EUR1.41 billion ($1.54

billion) after a loss of nearly EUR4 billion in the same period

last year, helped by the integration of Monsanto and a recovery in

crops science. Sales in the quarter rose 3.8% to 10.26 billion in

the fourth quarter, driven by the group's blockbuster drugs, blood

thinner Xarelto and eye treatment Eylea and Latin American crops

science business.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

February 27, 2020 05:29 ET (10:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

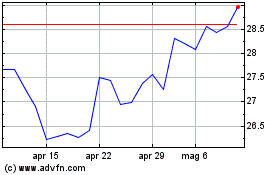

Grafico Azioni Bayer (TG:BAYN)

Storico

Da Apr 2024 a Mag 2024

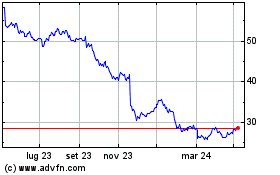

Grafico Azioni Bayer (TG:BAYN)

Storico

Da Mag 2023 a Mag 2024