Ethereum Taker Buy/Sell Ratio Is Rising Again — What It Means For ETH Price

29 Settembre 2024 - 2:30PM

NEWSBTC

The Ethereum price recovery has been quite impressive in recent

weeks, and an analyst has suggested that this might only be the

beginning of a good run for the altcoin. Is The Ethereum Market

Preparing For A Rally? A pseudonymous analyst has shared — via a

CryptoQuant Quicktake post — an interesting on-chain insight into

the price action of Ethereum. The relevant indicator here is the

“taker buy/sell ratio,” which measures the taker buy and taker sell

volumes for a particular cryptocurrency. When the value of this

ratio is higher than 1, it implies that the taker buy volume is

greater than the taker sell volume. This is often taken as a

bullish signal, which indicates that investors are willing to pay a

higher price for a particular asset. Related Reading: Here’s Who

Has Been Driving The Bitcoin Price Recovery Above $65,000 On the

flip side, a taker buy/sell ratio that is less than 1 suggests the

buy volume for a cryptocurrency is greater than the sell volume.

This typically signals a bearish sentiment amongst investors, as

there are more sellers ready to sell their assets at a lower price.

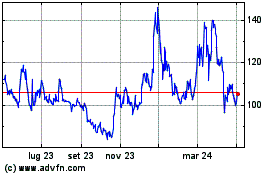

As shown in the highlighted chart, the 30-day simple moving average

(SMA) of the Ethereum taker buy/sell ratio has consistently

remained below the 1 threshold over the past few months. This

indicates that ETH sellers have been overwhelming buyers, resulting

in an increased token supply in the open market. However, the

30-day SMA of this metric has been on a resurgence since the price

of Ethereum found its support just above the $2,100 level. The

Ethereum taker buy/sell ratio recently reached a new high since

mid-June, indicating that the bearish pressure might be waning. The

CryptoQuant analyst noted that if the taker buy/sell ratio

continues on its upward trajectory, it could mean that the Ethereum

bulls are taking over the market. Ultimately, this level of

aggressive buying activity could set the stage for a price rally

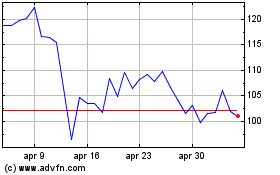

for the altcoin. ETH Price Overview As of this writing, the Ether

token is valued at $2,677, reflecting a 0.8% decline in the past 24

hours. Despite experiencing a slight correction in the past day,

the altcoin’s price is still up by more than 3% on the weekly

timeframe. Related Reading: Maker Price Heats Up, Soars 12% In A

Week — Is $1,850 The Next Stop? Thanks to the price rally over the

past week, more Ethereum investors seem to be returning to profit.

According to data from IntoTheBlock, the percentage of ETH

addresses “in the money” went from 59% to 69%, with more than 80%

of the ETH supply now in profit. Featured image created by Dall.E,

chart from TradingView

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Nov 2023 a Nov 2024