Analyst Predicts $200k Bitcoin On Incoming ‘Massive Supply Shock’

20 Novembre 2024 - 8:30PM

NEWSBTC

Crypto Rover, a prominent crypto analyst, has identified critical

indicators in the market dynamics of Bitcoin, such as a decline in

exchange reserves and a favorable chart pattern that suggests a

price target of $200,000. Related Reading: Poland Could Lead With

Bitcoin Reserve, Presidential Hopeful Says His analysis is

consistent with Bernstein’s long-term projection, which serves to

bolster the notion that Bitcoin may experience substantial growth

in the years ahead. These predictions have investors and analysts

alike anxiously anticipating Bitcoin’s next significant move, as

the market is currently in flux. Decreasing Exchange Reserves May

Indicate A Supply Shock The consistent decline in Bitcoin reserves

on exchanges is one of the most noteworthy trends identified by

Crypto Rover. Despite the increasing price of Bitcoin, an

increasing number of investors are transitioning their holdings to

private wallets. For the first time in #Bitcoin history, the

balance of $BTC on exchanges is dropping during a bull run. This

cycle is different. A MASSIVE SUPPLY SHOCK IS COMING.🚨

pic.twitter.com/Yw5ZSJ4l0z — Crypto Rover (@rovercrc) November 18,

2024 This transition underscores an increasing preference for

security over liquidity, particularly in light of persistent

concerns regarding cyberattacks and breaches. As the quantity of

Bitcoin on exchanges declines, there could be an upcoming

disturbance. Less coins for trading suggest that demand would soon

exceed supply, which would cause prices to rise significantly. This

tendency questions the conventional market dynamics, which usually

show reserves rising in bull markets. Bernstein’s $200K Target And

Rover’s Bull Flag A bull flag pattern is forming on the price

charts of Bitcoin, as revealed by Rover’s technical analysis. This

pattern frequently indicates the continuance of an upward trend.

Rover predicts that Bitcoin may shortly surpass the $200,000

threshold if it surpasses critical resistance levels, as indicated

by this pattern. Bernstein analysts further align with this

positive sentiment as they reaffirm their Bitcoin price target to

reach $200,000 in 2025. Bernstein’s price objective of $100,000 is

increasingly plausible, and the long-term forecast of achieving

$200,000 by 2025 is gathering momentum, given that Bitcoin is

already trading at approximately $92,000. 🚀 Daily Crypto Movers

Nov. 19 •Bitcoin to $200K as Bernstein predicts a 2025 bull run 📈

•MicroStrategy adds 4.6B BTC at 88K avg 🎯 •Goldman Sachs launches

tokenized products 🌐 Learn more⤵️#Bitcoin #CryptoNews #KuCoin —

KuCoin (@kucoincom) November 19, 2024 They attribute this potential

increase to a variety of factors, such as the favorable political

and regulatory conditions for Bitcoin, which are notably prevalent

under a pro-crypto U.S. administration. Related Reading: Solana

Market Cap Hits Milestone: $400 Price Target Gains Traction Market

Outlook And Investor Strategy Strong technical indicators combined

with declining exchange reserves point to Bitcoin about to undergo

a major comeback, which would be advantageous for investors. Little

changes in demand could cause significant price swings as liquidity

drops. This creates risks as well as possibilities, hence a careful

plan and timing are especially important. Bernstein also points out

as a major influence the larger political terrain. Under the

direction of incoming President Donald Trump especially, they hope

that an atmosphere better suited for Bitcoin’s growth would help to

drive its expansion even further. Featured image from Pexels, chart

from TradingView

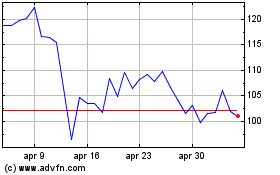

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Ott 2024 a Nov 2024

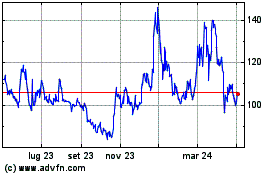

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Nov 2023 a Nov 2024