Bitcoin Network Activity Is Declining — Impact On Price?

16 Febbraio 2025 - 2:30PM

NEWSBTC

A sluggish Bitcoin price performance has not been the only

disappointing theme for the largest crypto market so far in 2025.

According to the latest on-chain data, the Bitcoin network

fundamentals have been dwindling since the final quarter of last

year. Bitcoin’s Active Addresses And Transaction Count On A

Decline? In a Quicktake post on the CryptoQuant platform, a crypto

analyst with the pseudonym Yonsei_dent explained how recent price

stagnation is tied to declining network activity. One of the

relevant on-chain indicators here is the Active Addresses (AA)

metric, which measures the number of wallet addresses involved in a

transaction within a specific period. Related Reading: $1,000

Solana? Analyst Says “It’s Written”, Predicts When Breakout Will

Happen Usually, the Active Addresses metric is used to evaluate

investor sentiment on a particular blockchain. According to

Yonsei_dent, the number of active addresses on the Bitcoin network

is steadily declining, suggesting a “potential weakness in investor

participation.” Additionally, a “death cross” recently formed

between the AA’s 30-day moving average (30DMA) and its 365-day

moving average (365DMA). For context, a “death cross” in technical

analysis refers to a bearish signal marked by a short-term moving

average crossing below a longer-term moving average. This death

cross signals a bearish momentum is forming and that a prolonged

downward trend (for both price and network activity) might be on

the horizon. Yonsei_dent added: While the two metrics have been

fluctuating in a tight range, the 365DMA remains in a downward

trend, suggesting a prolonged slowdown in network engagement.

Furthermore, another on-chain metric spotlighted by the Quicktake

analyst is Transaction Count, which measures the number of unique

transactions on the network within a specific period. According to

data from CryptoQuant, the number of unique transactions on the

Bitcoin network has been declining since Q4 2024. Yonsei_dent

associated this worrying trend with the global macroeconomic

uncertainty and increasing risk aversion that has plagued the

market since US President Donald Trump took the Oval Office. What

Next For BTC Price? As inferred earlier, the declining network

activity does not exactly bode well for the Bitcoin price action.

Periods of low transaction activity have often coincided with

prolonged sideways movement and sometimes price corrections. This

trend might explain the price performance of the premier

cryptocurrency in 2025. The Bitcoin price has struggled to maintain

any serious bullish momentum to push new highs. Related Reading:

XRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball

Analyst Says As of this writing, the price of Bitcoin sits just

above $97,700, reflecting a measly 0.3% increase in the past 24

hours. The coin’s weekly record is not any better, as the market

leader has increased by barely 1% in the last seven days. Featured

image from iStock, chart from TradingView

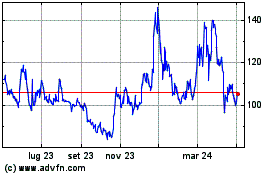

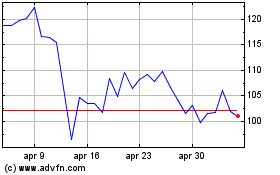

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Feb 2024 a Feb 2025