Wereldhave was assigned Long-Term Issuer Default Rating and senior unsecured rating of ‘BBB’ from Fitch Ratings

22 Maggio 2024 - 6:58AM

Wereldhave was assigned Long-Term Issuer Default Rating and senior

unsecured rating of ‘BBB’ from Fitch Ratings

Wereldhave N.V. (“Wereldhave”) is pleased to announce that Fitch

Ratings has assigned a Long-Term Issuer Default Rating (IDR) and

senior unsecured rating of ‘BBB’ to Wereldhave. The Outlook on the

IDR is Stable. This public rating reflects the company's

strengthened financial position and solid operational

performance.

Enhanced balance sheet Wereldhave's balance

sheet has shown significant improvement, supported by the strategic

acquisition of Polderplein and the related successful share issue

in December 2023. These actions have strengthened the company's

financial profile and reduced leverage.

Performance of Full Service Centers The

transformation of Wereldhave's shopping centers into Full Service

Centers continues to yield positive results. These centers,

offering a mix of retail, leisure, and essential services, have

demonstrated robust performance and resilience in the current

market environment.

The rating results in immediate financial benefits for

Wereldhave, particularly through annualized interest savings due to

rating triggers. At current debt levels, savings will initially

amount to approximately € 400,000 annually. Dennis de Vreede, CFO

at Wereldhave, commented: “We are very pleased with this credit

rating. Although Wereldhave does not seek access immediately to the

Debt Capital Markets at this time, it remains a potential avenue

going forward. Following successful access to the equity and USPP

markets in 2023, Wereldhave now has even more DCM opportunities

thanks to this investment grade rating.”

- PR 22-05-2024 - Wereldhave was assigned Long-Term Issuer

Default Rating and senior unsecured rating of ‘BBB’ from Fitch

Ratings

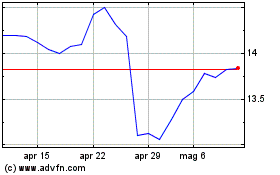

Grafico Azioni Wereldhave NV (EU:WHA)

Storico

Da Feb 2025 a Mar 2025

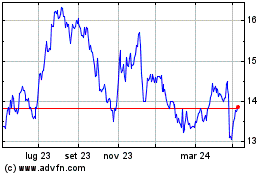

Grafico Azioni Wereldhave NV (EU:WHA)

Storico

Da Mar 2024 a Mar 2025