Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

30 Ottobre 2023 - 10:28PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-275173

FINAL TERM SHEET

Dated

October 30, 2023

6.200% Notes due 2028

6.875% Notes due 2033

|

|

|

| Issuer: |

|

Altria Group, Inc. |

|

|

| Guarantor: |

|

Philip Morris USA Inc. |

|

|

| Aggregate Principal Amount: |

|

2028 Notes: $500,000,000 2033 Notes:

$500,000,000 |

|

|

| Maturity Date: |

|

2028 Notes: November 1, 2028 2033 Notes:

November 1, 2033 |

|

|

| Coupon: |

|

2028 Notes: 6.200% 2033 Notes:

6.875% |

|

|

| Interest Payment Dates: |

|

2028 Notes: Semi-annually on May 1 and November 1, commencing May 1, 2024

2033 Notes: Semi-annually on May 1 and November 1, commencing May 1, 2024 |

|

|

| Price to Public: |

|

2028 Notes: 99.801% of principal amount 2033

Notes: 99.736% of principal amount |

|

|

| Benchmark Treasury: |

|

2028 Notes: 4.875% UST due October 31, 2028

2033 Notes: 3.875% UST due August 15, 2033 |

|

|

| Benchmark Treasury Yield: |

|

2028 Notes: 4.797% 2033 Notes:

4.862% |

|

|

| Spread to Benchmark Treasury: |

|

2028 Notes: +145 bps 2033 Notes: +205

bps |

|

|

| Yield to Maturity: |

|

2028 Notes: 6.247% 2033 Notes:

6.912% |

|

|

| Optional Redemption: |

|

2028 Notes: Make-whole call at T+25 bps prior to October 1, 2028; par call on or after

October 1, 2028

2033 Notes: Make-whole call at T+35 bps prior to August 1, 2033; par call on or after August 1,

2033 |

|

|

|

|

|

| Trade Date: |

|

October 30, 2023 |

|

|

| Settlement Date (T+2): |

|

November 1, 2023 |

|

|

| CUSIP / ISIN: |

|

2028 Notes: CUSIP: 02209S BQ5

ISIN: US02209SBQ57

2033 Notes: CUSIP: 02209S BR3

ISIN: US02209SBR31 |

|

|

| Listing: |

|

None. |

|

|

| Joint Book-Running Managers: |

|

Barclays Capital Inc. Citigroup Global Markets

Inc. Mizuho Securities USA LLC |

|

|

| Senior Co-Managers: |

|

Deutsche Bank Securities Inc. Goldman

Sachs & Co. LLC J.P. Morgan Securities LLC Morgan

Stanley & Co. LLC PNC Capital Markets LLC Santander

Investment Securities Inc. Scotia Capital (USA) Inc. U.S.

Bancorp Investments, Inc. Wells Fargo Securities, LLC |

|

|

| Co-Managers: |

|

Academy Securities, Inc. CastleOak Securities,

L.P. Seelaus & Co., Inc. |

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement each with the SEC for the offering to which

this communication relates. Before you invest, you should read the prospectus in that registration statement, that preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the issuer

and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the

preliminary prospectus supplement upon your request by calling Barclays Capital Inc. toll free at 1-888-603-5847; Citigroup

Global Markets Inc. toll free at 1-800-831-9146; or Mizuho Securities USA LLC toll free at 1-866-271-7403.

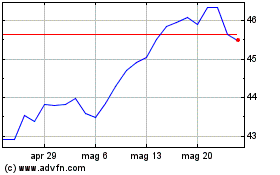

Grafico Azioni Altria (NYSE:MO)

Storico

Da Apr 2024 a Mag 2024

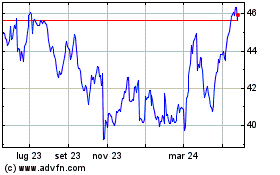

Grafico Azioni Altria (NYSE:MO)

Storico

Da Mag 2023 a Mag 2024